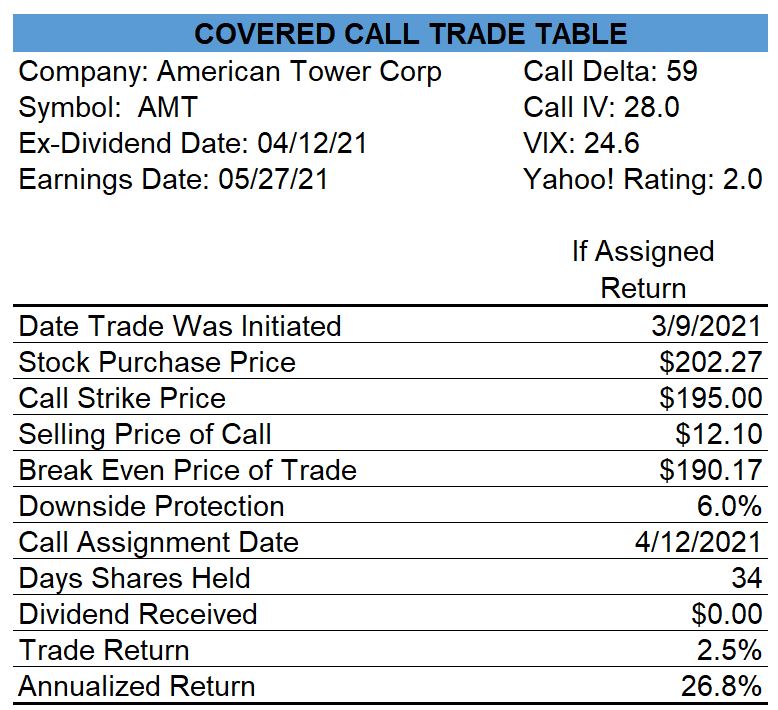

American Tower

Today, with no surprise to me, my American Tower shares were assigned early as the holder of the calls wanted to capture the dividend and today the shares went ex-dividend. Shares of AMT closed on Friday at $239.15 which represents an 18.2% increase in the 34 days since I opened the trade on March 09. This trade produced a 27% annualized return but it would have produced a higher return had I sold OTM calls instead of ITM ones. When I opened this trade, my Market Meter was Neutral so I was cautious with my strike prices and, as it turns out, I may have been too cautious with this trade.

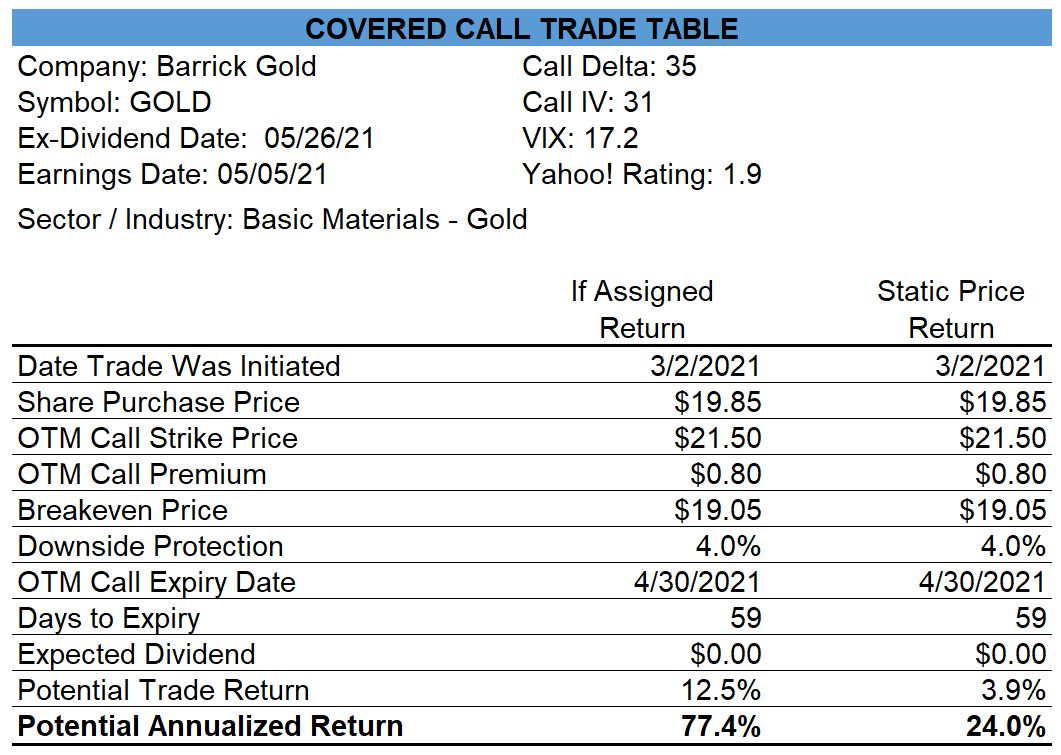

Barrick Gold

I bought back the Apr-16 $22.00 Barrick Gold calls that I had sold on March 02 today. I sold them for $0.48 and was able to buy them back for $0.05. As Barrick Gold passed one of my screeners today and it has a supposed earnings report date of May 05, I decided to sell Apr-30 $21.50 calls for $0.32. The table below includes all the info for both sets of calls that I sold.

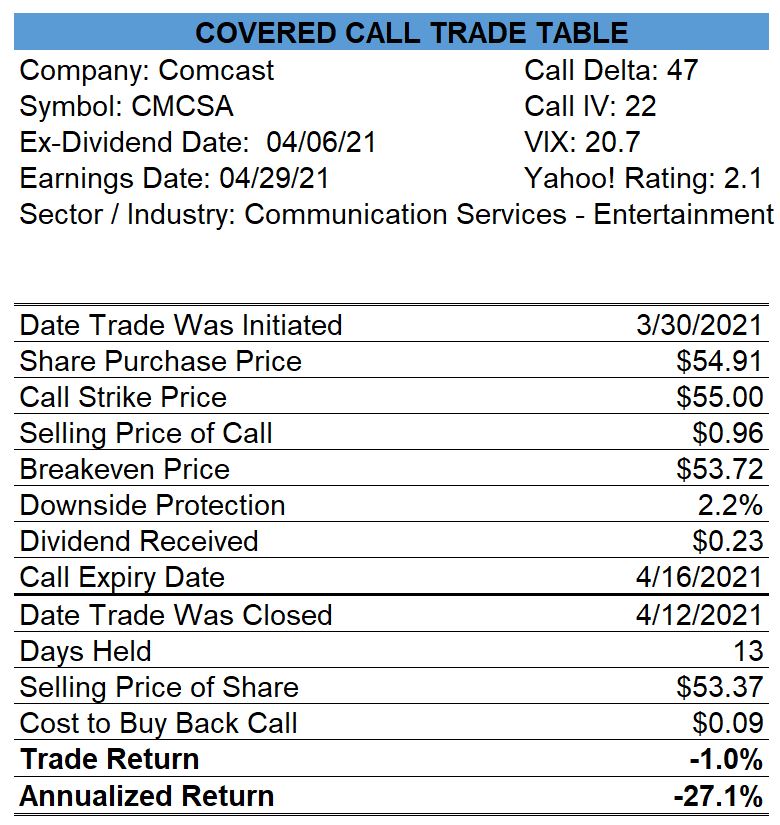

Comcast

Shares of Comcast haven’t performed well since I opened a covered call trade on March 30 so I bought back the APR-16 $55.00 calls today for $0.09 and sold the shares for $53.37. I lost 1% or 27% annualized on this trade.

Recall what I said about being too cautious with the strike price I selected for the AMT trade? Had I not been so cautious with this trade and selected a higher strike, I would have lost more than I did. I have no control over the outcome of a trade but I do have control over the process. In my opinion, as long as I follow my processes for initiating and managing trades then the outcome over the long run will be fine.

0 Comments