![]()

I had three naked put trades close on April 16 and each produced a different result.

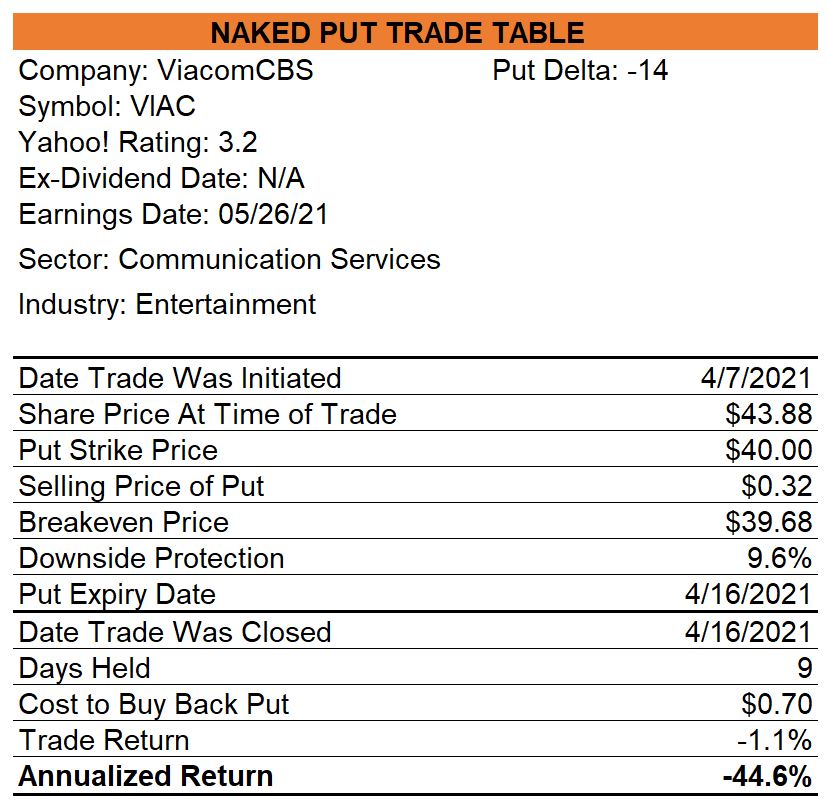

ViacomCBS (VIAC)

On April 07, I sold Apri-16 $40.00 puts for $0.32. Late in the trading session on Friday, VIAC was trading below $40.00 and I didn’t want to be assigned the shares so I bought the puts back for $0.70 resulting in a 1.1% loss (44.6% annualized). With a low delta of -14, this trade had a low probability of a loss but a low probability is not a zero probability.

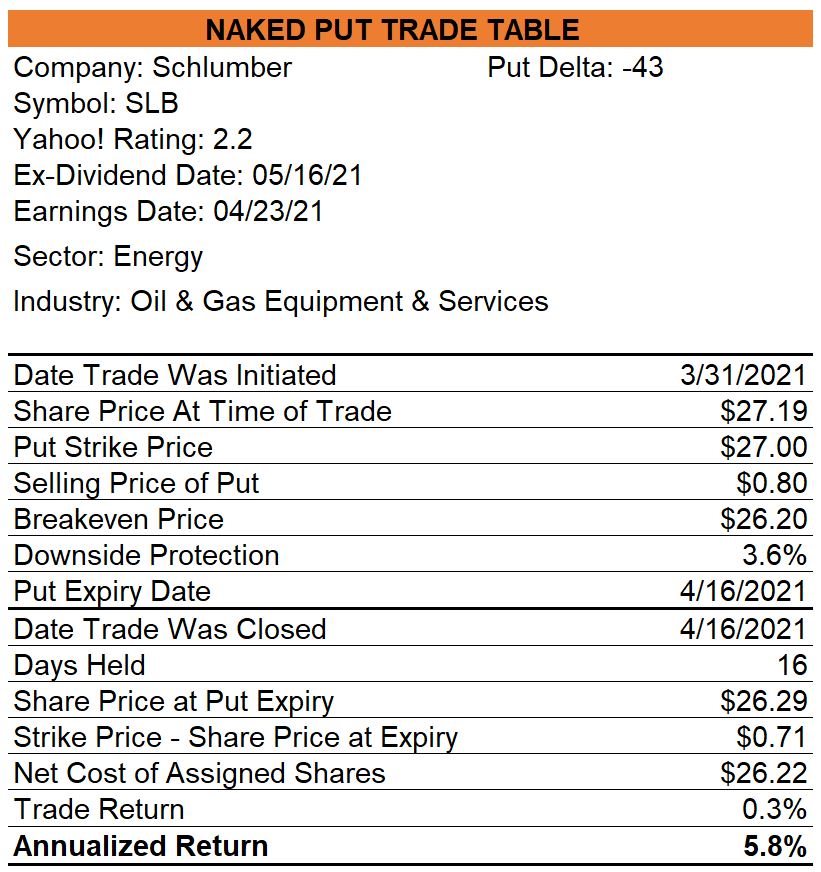

Schlumberger (SLB)

On March 31, I sold Apr-16 $27.00 puts for $0.80. My intent was to be assigned the shares when the puts expired since SLB had been passing one of my covered call screeners and rather than purchase the shares outright, I wanted to sell puts until I was assigned the shares and then sell covered calls. This is known as “The Wheel” strategy. Shares of SLB closed the Friday session below the put strike so I will be assigned the shares on Tuesday. My net share cost will be $26.22 which is ever so slightly below the Friday close.

The astute reader will note that there is a risk with me initiating a covered call trade and that risk that goes against what is, for some, a cardinal CC rule. Do you see anything in the table that would make you hesitate to initiate a covered call with SLB? The earnings date is April 23 and I generally do not hold a stock in a CC trade through an earnings report. I am going to make an exception for this trade.

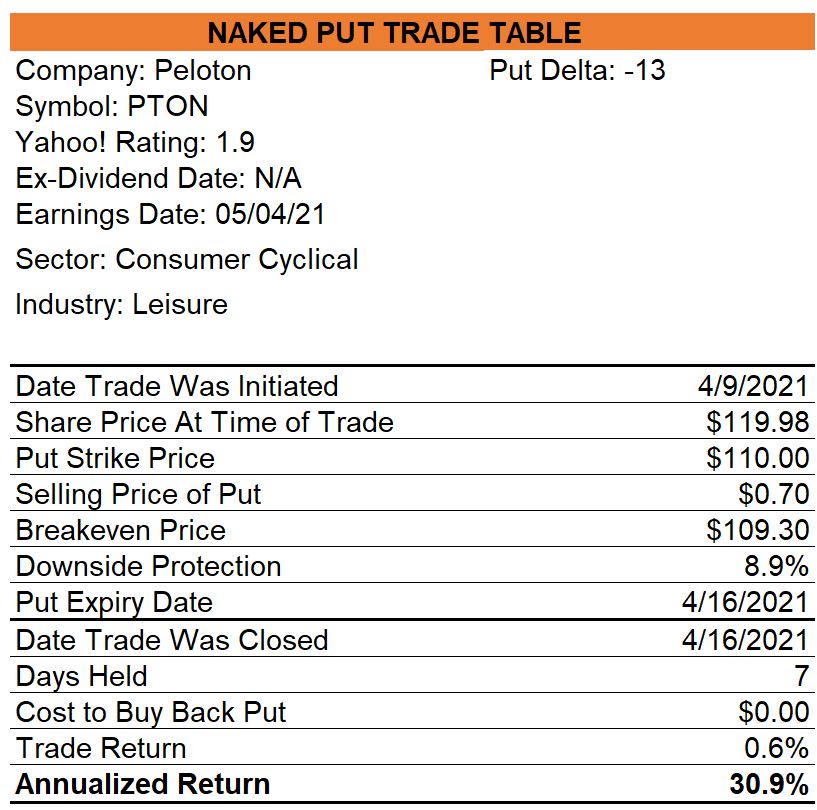

Peloton (PTON)

On April 09, I sold Apr-16 $110.00 puts. PTON closed the trading session on Friday at $116.21 so the shares will not be assigned to me and I keep the premium.

0 Comments