If you perform a Google search on the phrase “best trading advice” you will get over 200 million results. That’s a lot of advice for a trader! I thought I would share some advice that sounds simple but is actually very comprehensive.

I believe it was Australian trader Nick Radge that I heard in a podcast say “You should do more of what you are good at and less of what you are not good at.”. Nick wasn’t the first to make this statement but I heard it at a time that was instrumental in my development as a trader so it stuck with me. That statement in conjunction with 1. the belief that if you can’t measure it then you can’t improve it and 2. a practice of continuous improvement (kaizen) are at the core of my development.

In order to determine which of your trading strategies are good and which aren’t you obviously need data and the more the better. Herein lies a challenge for traders who have long holding periods. The longer your average holding period the less data you will have to analyze and the less opportunity to improve. Most of my stock trading strategies fall into the mean reversion category and thus have average holding periods between two and five days. Contrast that with a trend follower whose average holding period is months. A trader with short holding periods will generate more data than one with long holding periods and will therefore have the ability to more quickly determine which strategies are working and which ones aren’t. This is crucial and leads to consideration of position sizing. As Dr. Howard Bandy has repeatedly said “The correct position size for a trading system that is broken is zero.”. A trader must have a sufficient number of closed trades in order to continuously perform statistical analysis and thereby determine if a system is worth trading. Furthermore, following the methods outlined by Kenneth Grant one can determine if more capital should be allocated to a particular trading system.

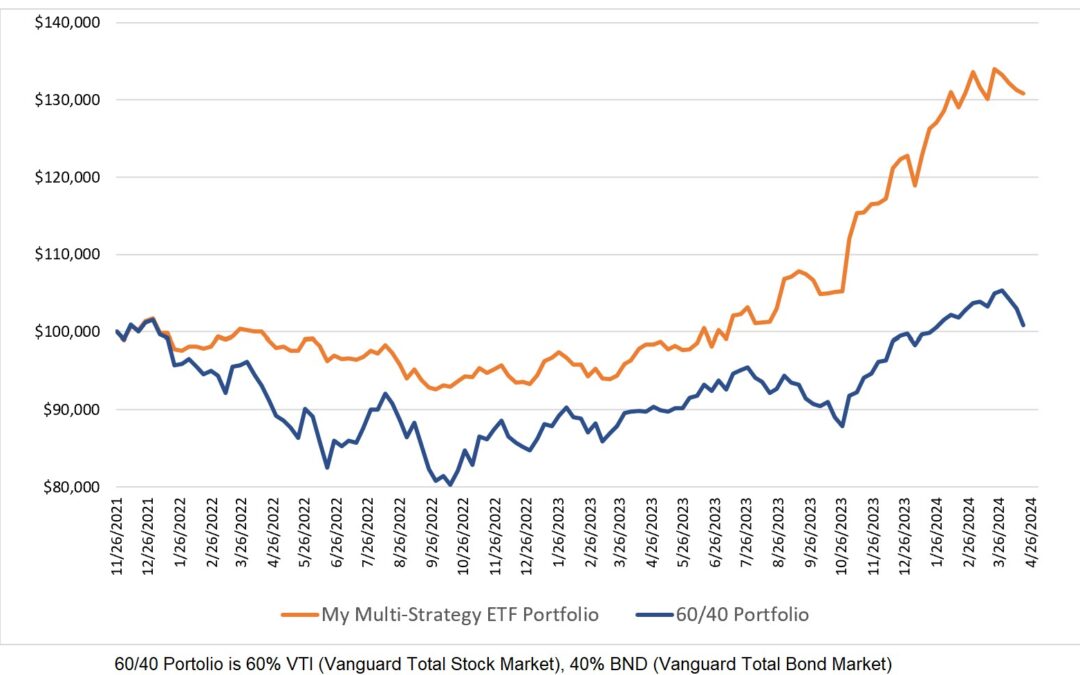

In a spreadsheet, I record every trading signal generated by each of my various strategies. Analysis of the strategies has led me to stop trading some strategies this year. Also, I have made refinements in my position sizes for some strategies based on the analysis so I am doing more of what I am good at and less of what I am not so good at.

0 Comments