August 11

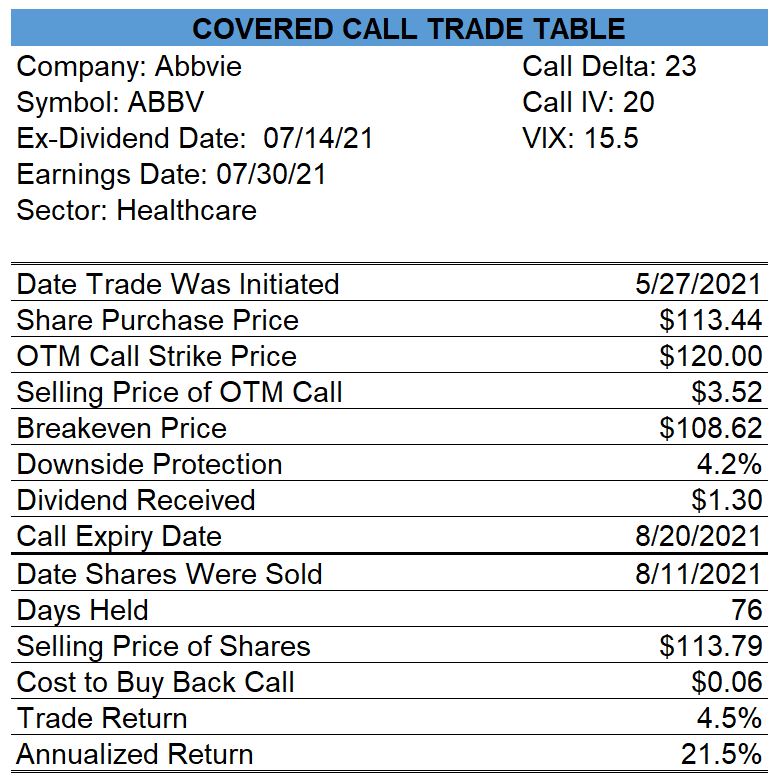

Abbvie (ABBV) – Closed Covered Call

I bought back the Aug-21 $120.00 calls for $0.06 and sold the shares.

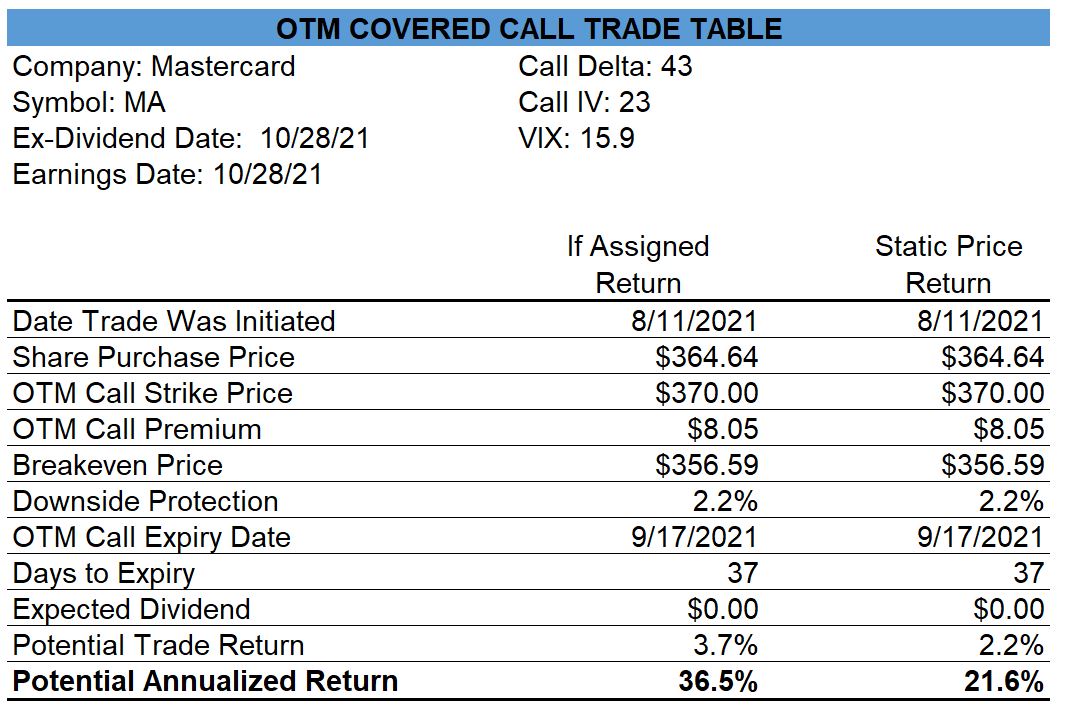

Mastercard (MA) – Opened Covered Calls

I bought Mastercard shares and then sold Sep-17 $370.00 calls for $8.05. Since my Market Meter now has a reading of 0 (Neutral), I have selected a higher delta call.

August 12

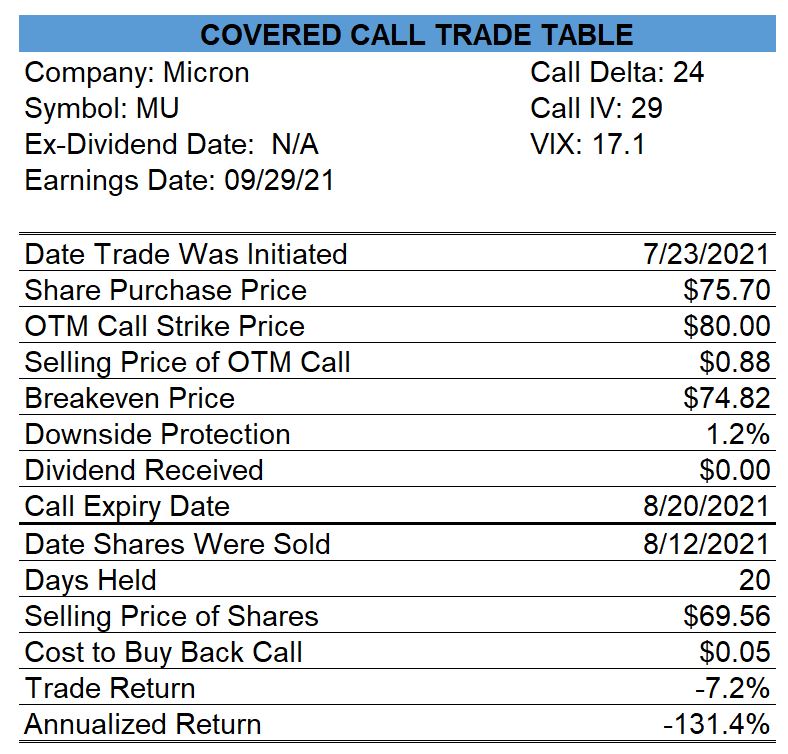

Shares of Micron declined sharply so I bought back the calls and sold my shares resulting in a losing trade.

Micron (MU) – Closed Covered Call

August 13

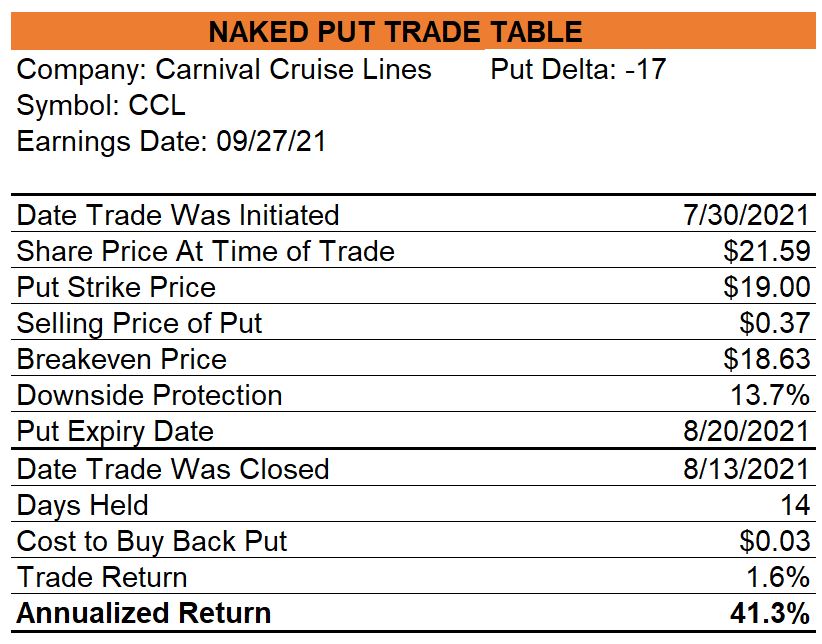

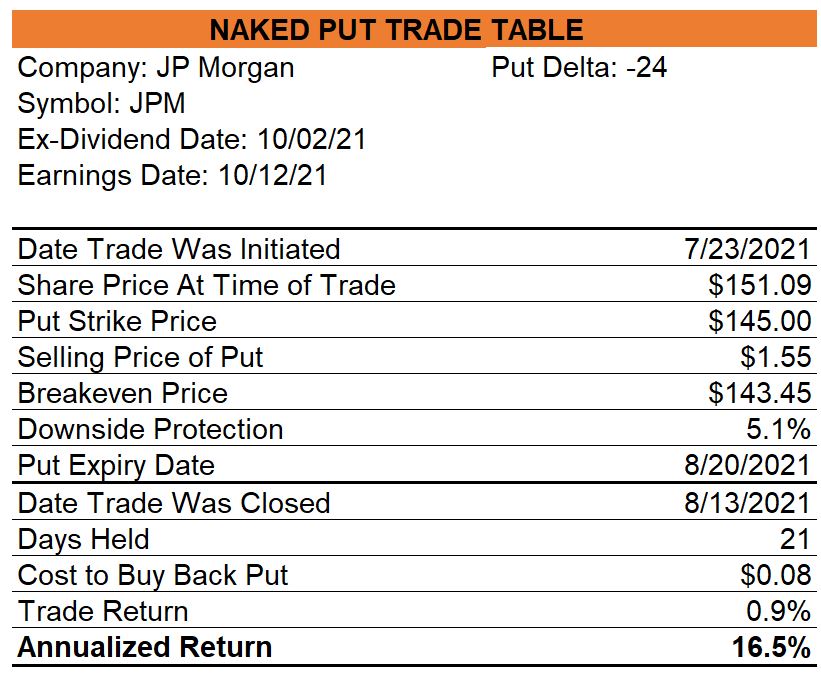

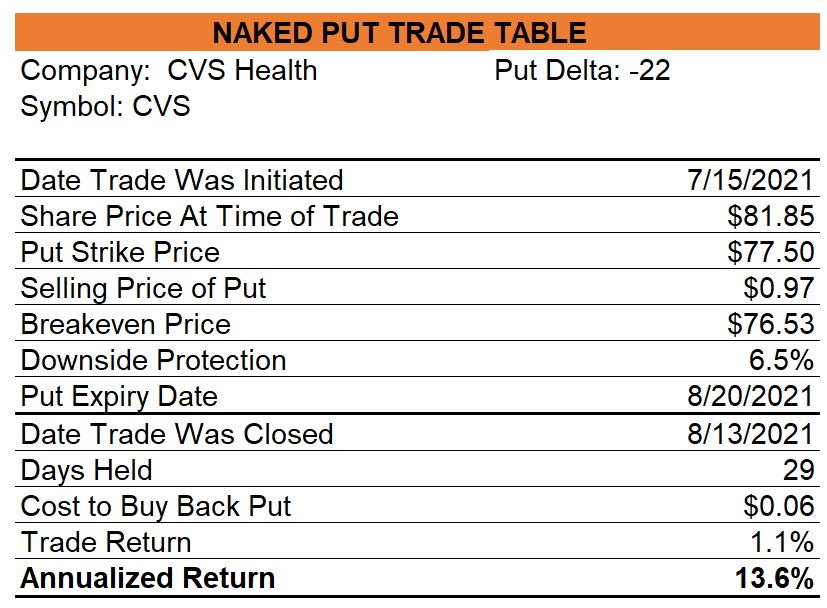

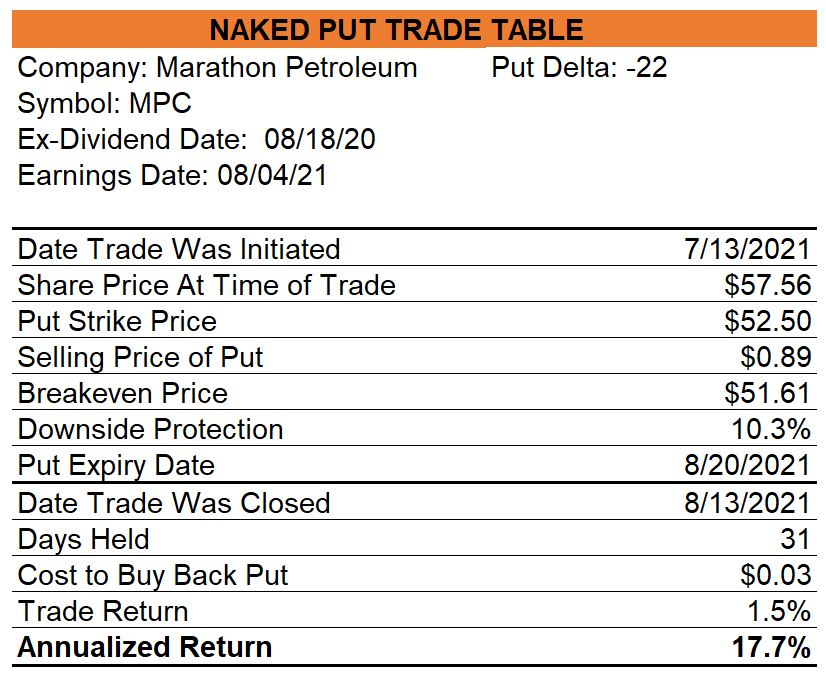

I bought back the puts I had sold in Carnival Cruise Lines, JP Morgan and CVS resulting in annualized profits of 41.3%, 16.5% and 13.6%.

Carnival Cruise Lines (CCL) – Closed Naked Put

JP Morgan (JPM) – Closed Naked Put

CVS Health (CVS) – Closed Naked Put

Marathon Petroleum (MPC) – Closed Covered Call

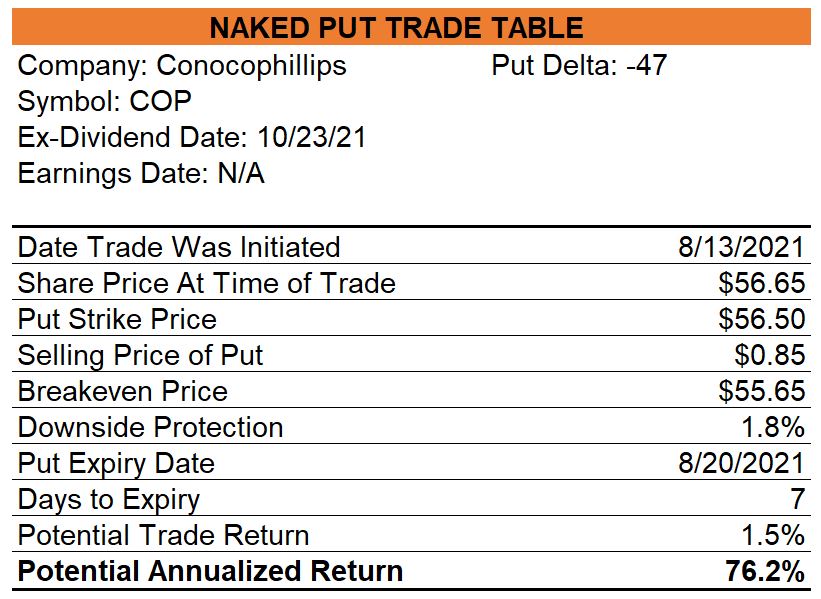

Conocophillips (COP) – Opened Covered Call

Conocophillips passed my covered call screen so I decided to sell Aug-20 $56.50 puts. If the shares close ITM and the shares are assigned to me, I would then sell calls.

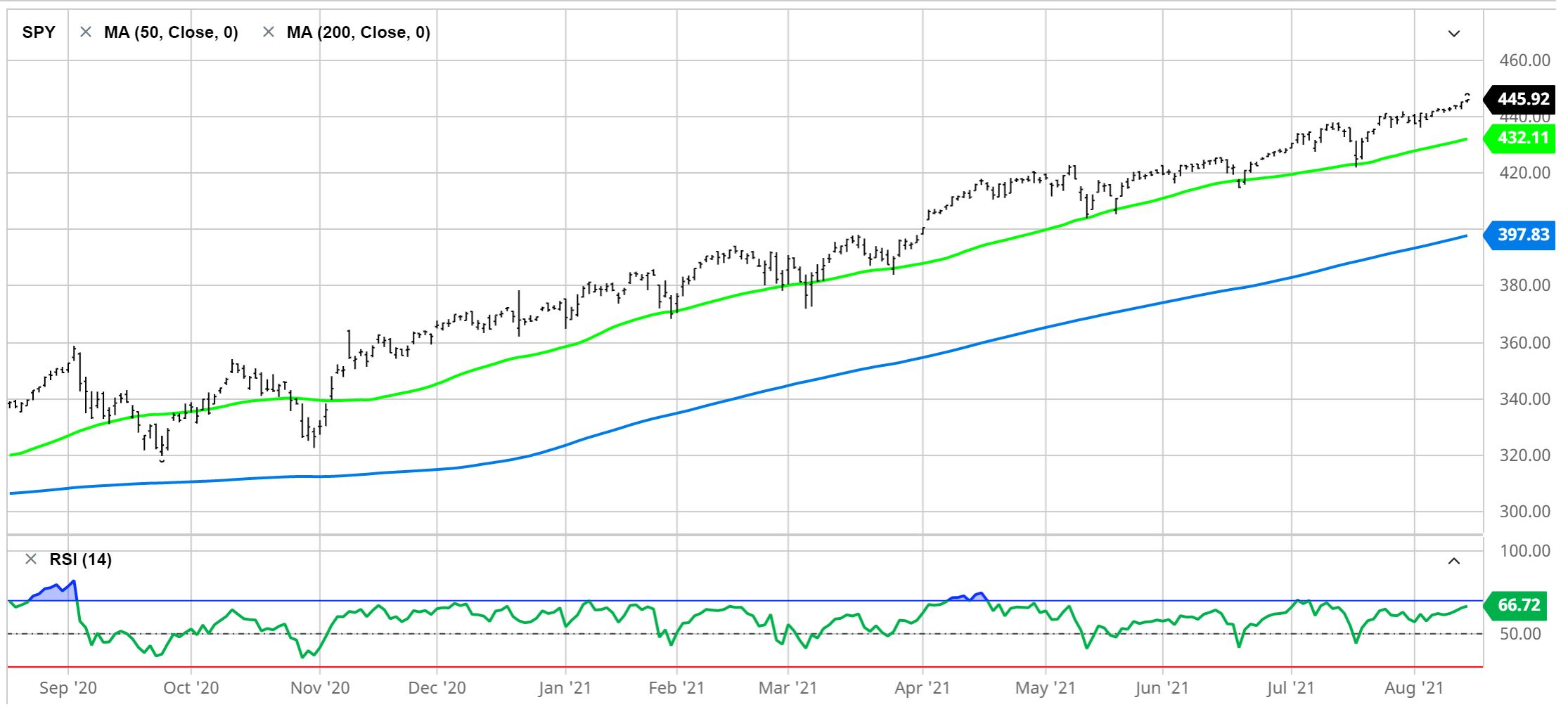

Market Timer

With the continued strength of the US equity market, my market meter is just about useless this year. I’m starting to lean towards relying on the 50-day and 200-day moving averages of SPY for formulating Bullish, Neutral or Bearish short-term outlooks.

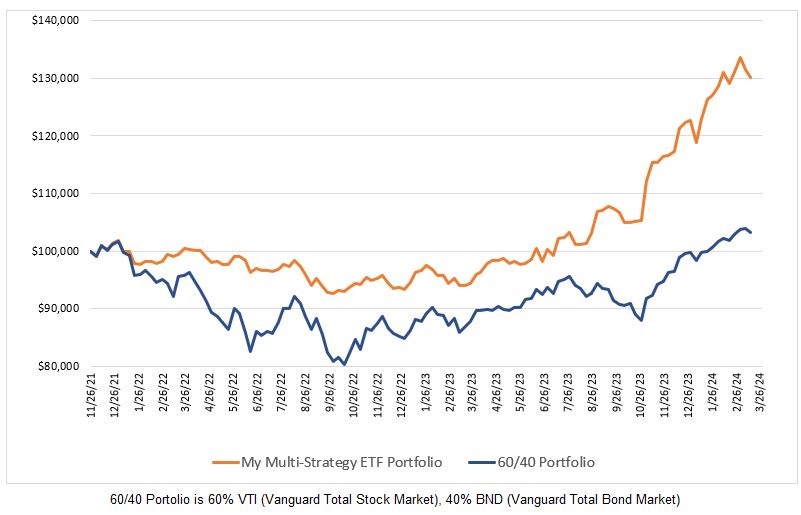

I have said many times recently that the strength of the US equity market has made selling covered calls and naked puts an easy gig. The chart below should illustrate exactly that.

All the best in trading and in life.

0 Comments