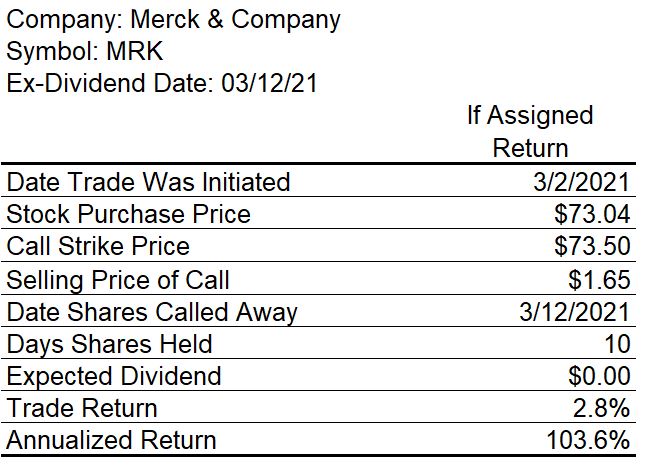

On March 02, I purchased shares of Merck at $73.04 and immediately sold Apr-01 $73.50 calls for $1.65 each. Tomorrow, March 12, is the ex-dividend day for Merck which led me late in today’s trading session to look at the likelihood of those shares being called away tomorrow morning.

On March 02, I purchased shares of Merck at $73.04 and immediately sold Apr-01 $73.50 calls for $1.65 each. Tomorrow, March 12, is the ex-dividend day for Merck which led me late in today’s trading session to look at the likelihood of those shares being called away tomorrow morning.

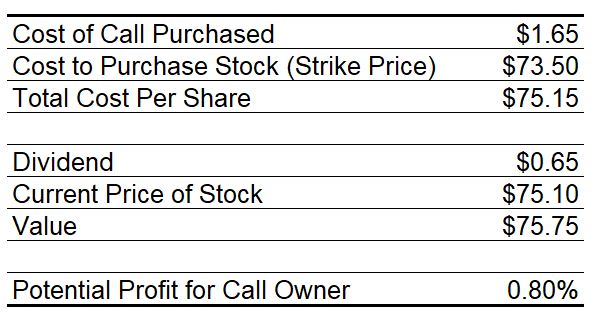

The owner of the $73.50 calls has the potential to earn 0.80% before commissions if the share price of MRK holds between this afternoon and when the share transfer is completed. The share transfer process normally takes two days.

Based on the above analysis, I expect the call owner to exercise early assignment and, therefore, I have to decide if I should buy back the calls and sell new ones at a higher strike and perhaps a different expiration. What would your decision process be?

The first step in my decision process is to determine whether MRK still passes any of my covered call screens. If it does then I should consider rolling up and possibly out. If MRK doesn’t pass any of my screens then I am willing to let the shares be called away. As it turns out, MRK did not pass any of my screens today so I decided to not roll the call.

The next consideration for me is to determine my return on this trade if the shares are called away tomorrow. As the table below illustrates, this trade will generate a very healthy annualized return if my shares are called away early.

0 Comments