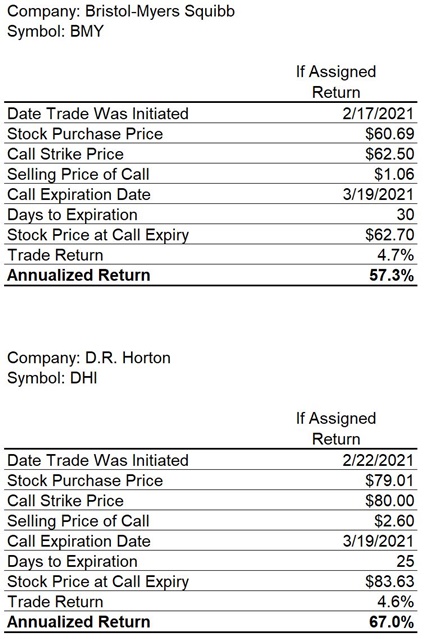

I had two covered call trades close on March 26 and both produced the maximum possible profit as both were initiated OTM and closed ITM. That is when the calls were sold the stock prices were below the strikes but when the calls expired the stock prices were above the strikes.

On February 17, I sold Mar-19 $62.50 BMY calls based on a stock purchase price of $60.69. Shares of BMY traded at $62.70 at the close on Friday so the shares will be assigned to the holder of the calls and the trade generated an annualized return of 57.3%. The 4.7% return on this trade compares favourably against a decline in SPY of 2.0% over the holding period.

On February 22, I sold Mar-19 $80.00 DHI calls based on a stock purchase price of $79.01. Shares of DHI traded at $83.63 at the close on Friday so the shares will be assigned and the trade generated an annualized return of 67.0%. The 4.6% return on this trade was well above the 0.6% price increase in SPY over the same holding period.

BMY continues to pass one of my covered call screens and it has an upcoming dividend so I plan to enter another covered call trade with BMY well before the ex-dividend date of March 31.

0 Comments