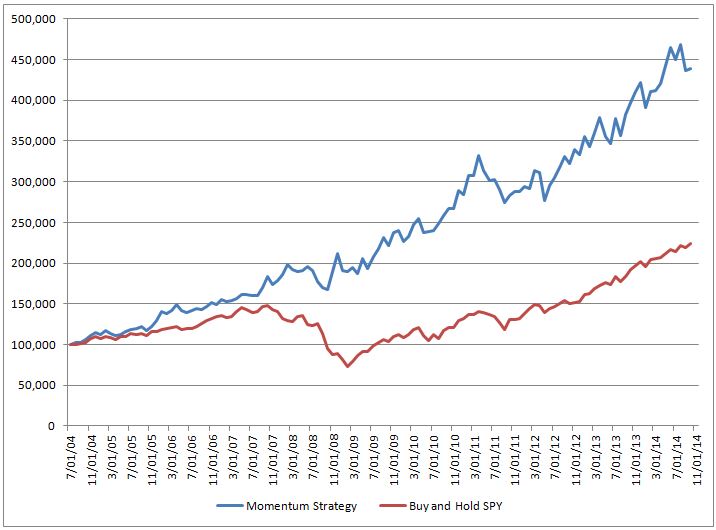

Although I practice systematic trading based on strategies that generate short holding periods I keep an open mind towards other styles of trading. One particular style of trading that has caught my attention recently is ETF momentum systems that require work on only one day per month. Using information from a paper written by Adam Butler, Michael Philbrick, Rodrigo Gordillo, and David Varadi titled Adaptive Asset Allocation: A Primer plus rules from Gary Antonacci’s soon-to-be-released book, Dual Momentum Investing: An Innovative Strategy For Higher Returns With Lower Risk, I created my own ETF momentum strategy. The chart below is based on reallocating (if necessary) at the beginning of each month to five ETFs based on the prior six-month price performance of the ETFs.

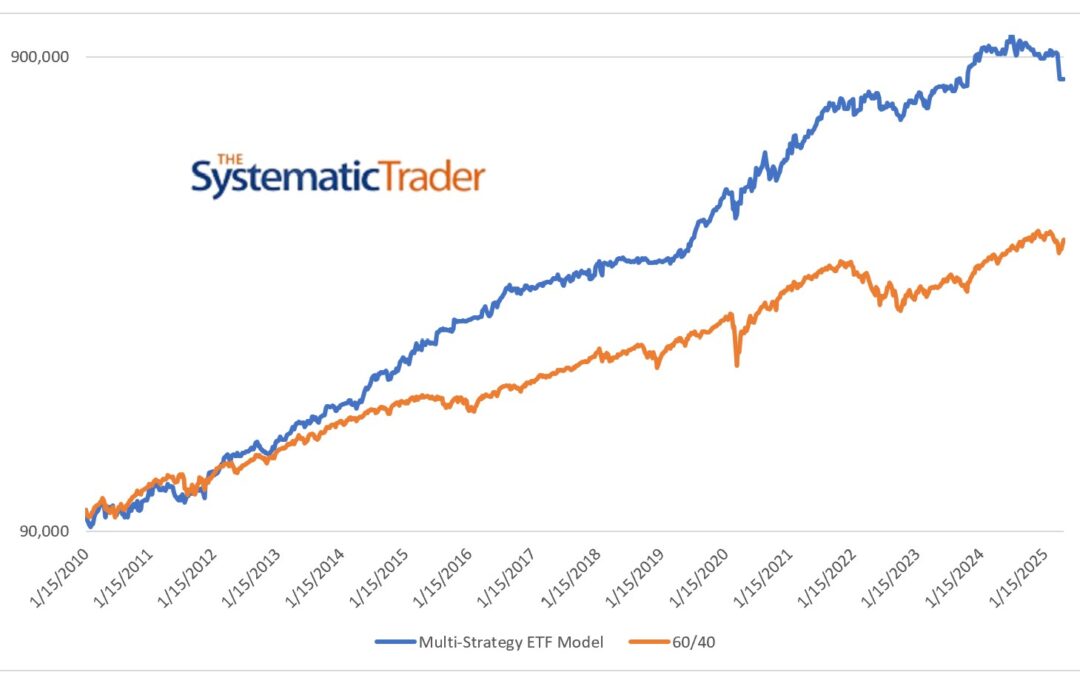

My model has a compound annual growth rate (CAGR) of 14.7% before fees and 89% of the twelve-month periods have a positive return.

My model has a compound annual growth rate (CAGR) of 14.7% before fees and 89% of the twelve-month periods have a positive return.

The caveat about this type of system is its partial reliance on bond prices increasing as interest rates fall which they have for the past thirty years. I believe this concern is warranted but Antonacci provides a means of taking falling bond prices into account.

If this type of investing is of interest to you I would encourage you to download the paper and order the book. Create your own model and, who knows, you may design a system that’s even better than mine. One parameter that you may want to vary is the look-back period for prior price performance. The common periods are 3 months, 6 months, and 12 months.

FJP

Hi,

Thank you very much for the links,

This looks very interesting.

Could you please give more details / clarification regarding this paragraph :

The caveat about this type of system is its partial reliance on bond prices increasing as interest rates fall which they have for the past thirty years. I believe this concern is warranted but Antonacci provides a means of taking falling bond prices into account.

Thanks,

Itay

Any trading system which includes bonds or bond ETF’s and for which the starting point is the early 1980’s or later benefits from falling interest rates since bond prices go up as interest rates go down and interest rates in the US having been falling since the early 1980’s. With interest rates as low as they are now, going forward interest rates could go a little lower, stay low or go up. If interest rates go up then bond prices will go down and, depending how a trading system is designed, the bond or bond ETF portion of the system could drag down returns.

This type of drag could happen with a relative momentum system which, by definition, selects the top X ETF’s over the look back period. For example, an ETF trading system based on relative momentum could select the top 4 ETF’s based on trailing returns for the previous 12 months. The issue is that this type of system could select a bond ETF as one of the top 4 even if it had a negative trailing 12 month return. An absolute or dual momentum system gets around this by having as one its rules that no ETF that has a negative return over the look back period will be selected.

For example, if a system selects 4 ETF’s each month but one of the 4 was TLT and it had a trailing 12 month return of -2% then an absolute or dual momentum trading system would not purchase TLT but would instead go to cash or buy a short term bond fund such as SHY provided SHY had a positive 12 month trailing return.

Hi Fred,

Thank you very much for the explanation.

When I read about dual momentum I saw that when there is no etf with

A larger return then the risk free asset (SHY), it will be chosen instead.

I was wondering if you go to cash if even SHY has negative return and you

Answered it, so there might be some probability that some or even all the

the portfolio will not be invested in any etf, just cash.

Still, I am wondering if there can be any other kind of protection /insurance

From large drawdown / extreme bear regimes, since these types of investments

should protect the value of the portfolio before trying to make a good profit.

Maybe using some hedge ?

Thanks,

Itay

Itay:

An ETF momentum system by design has built-in mechanisms to prevent a major decline. Diversification across asset classes as well as the purchase of ETF’s that have a positive momentum will result in a lower draw down than a buy-and-hold strategy would experience.

My trading system will have a draw down. There is no way around that. Such is the case for every momentum system but the size of the maximum draw down depends on the assets traded (e.g. stocks only or ETF’s). The more protection a trading system has in place to limit the maximum draw down the lower the return will be. Each investor has to select a trading strategy that suits him/her and the maximum draw down which can be expected is a very important factor to consider.

If you plan to design your own ETF momentum system, you should read the posts on Mebane Faber’s blog to get a feel for the maximum draw downs some of the momentum systems he follows have incurred. Also, you could sign up for a one month subscription at ETFReplay.com and experiment with different ETF combinations.

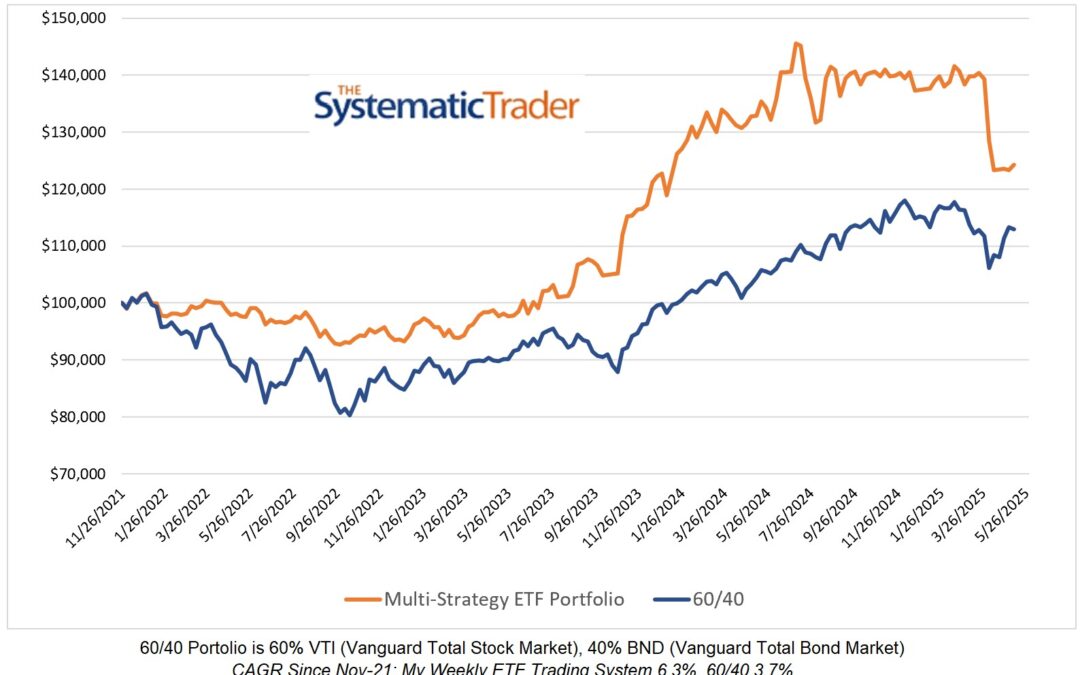

You can see the equity curve for my system at the following link: https://thesystematictrader.com/2015/01/04/larry-swedroe-doesnt-like-tactical-asset-allocation/ You will note that my system did not have a draw down anywhere close to equities in 2008 for example.

I hope this answer helps.

Fred

Hi Fred,

I have been a portfolio asset allocator for some time, diversification and like to benefit from negative correlation. I was introduced to Gary Antonacci Dual Momentum strategy. I found your internet site and really like your February performance rank. It would be nice to see your portfolio asset allocation each month based on momentum. Thanks for your innovative site.

I appreciate your comments.

I have set up a subscription service on Collective2.com for investors who wish to follow my trading system. For that reason, I do not publish the trades on this site.

Great to see that you create own ETF.