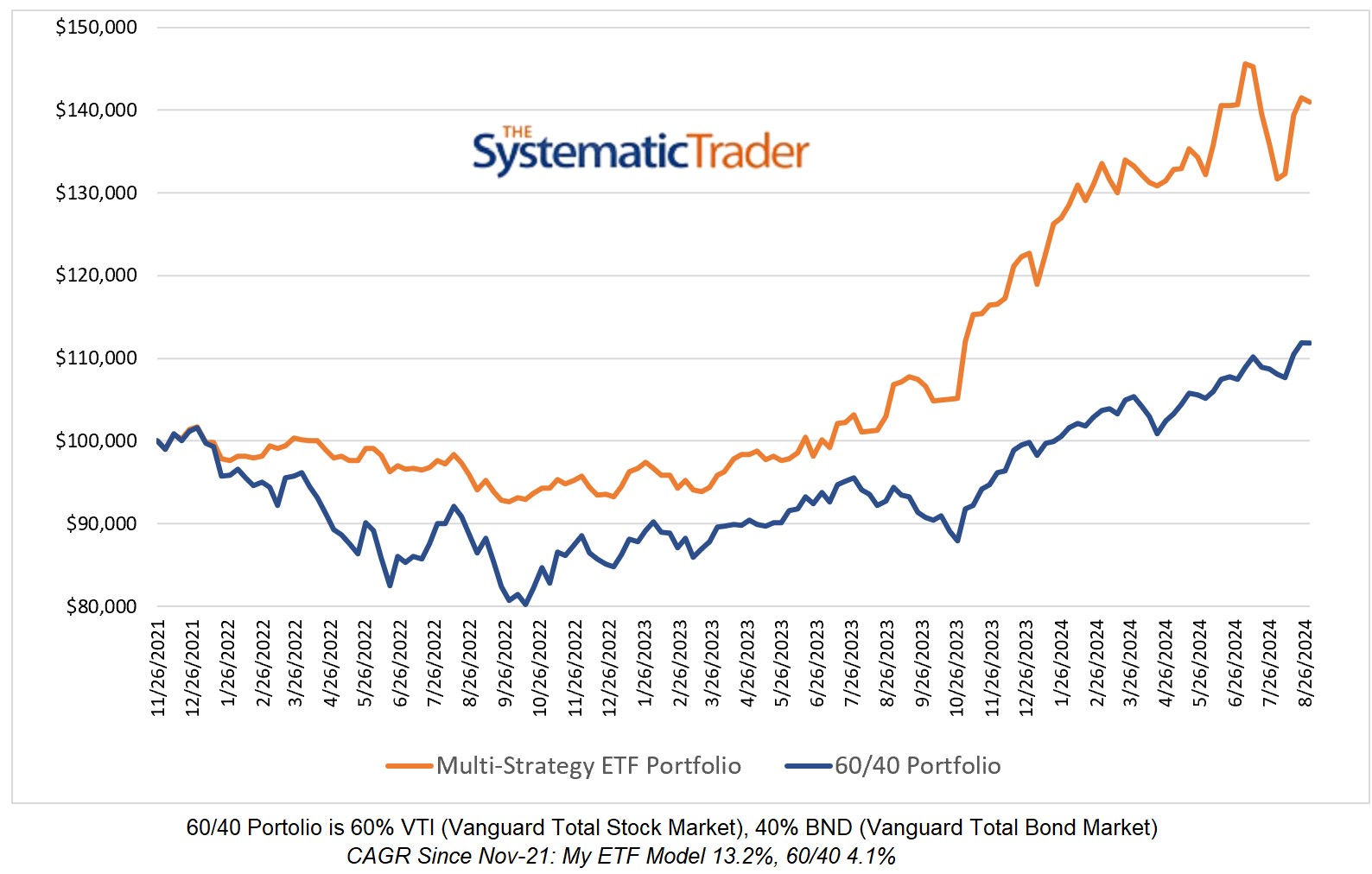

My Personal Weekly Dynamic Asset Allocations

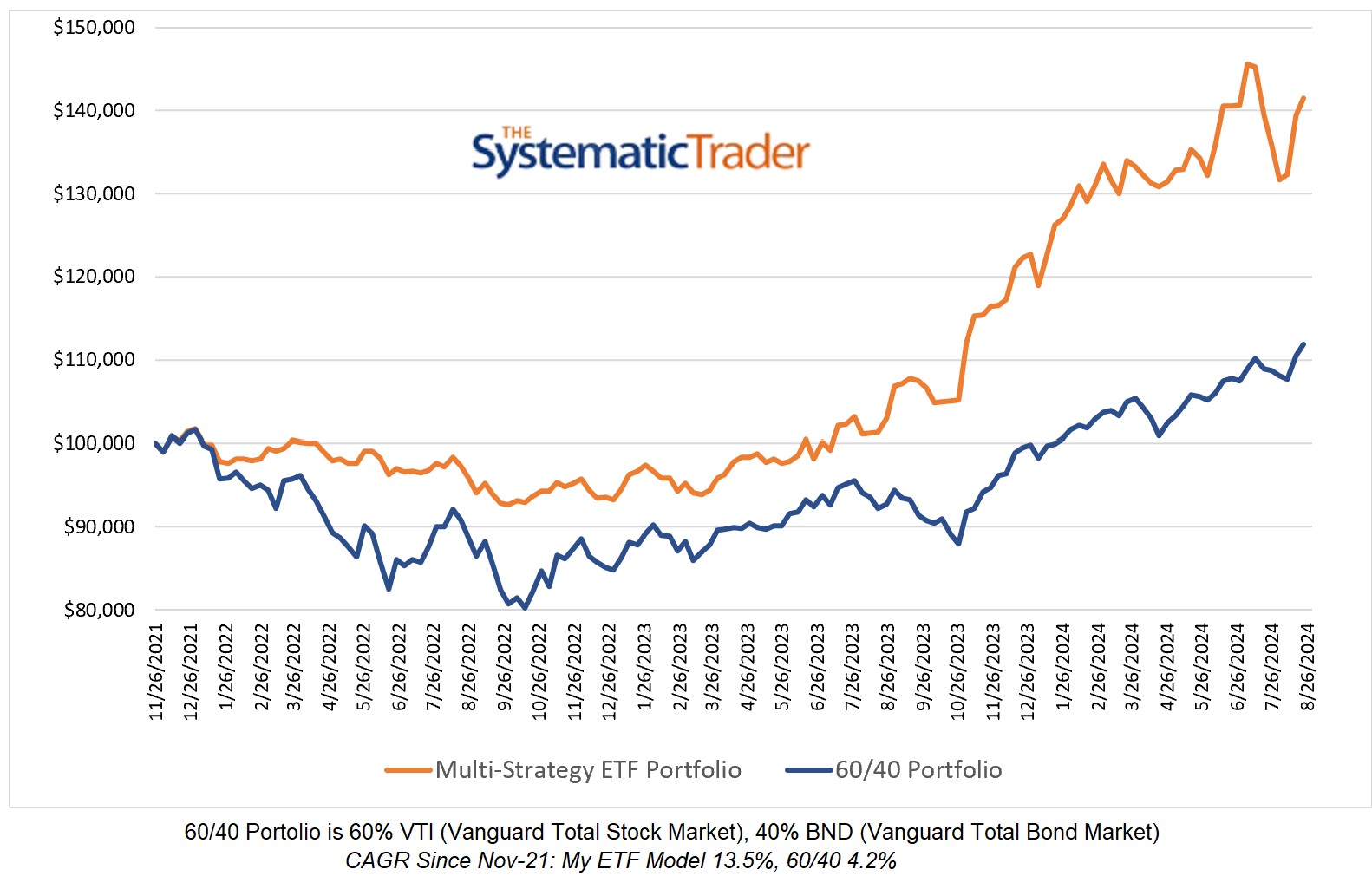

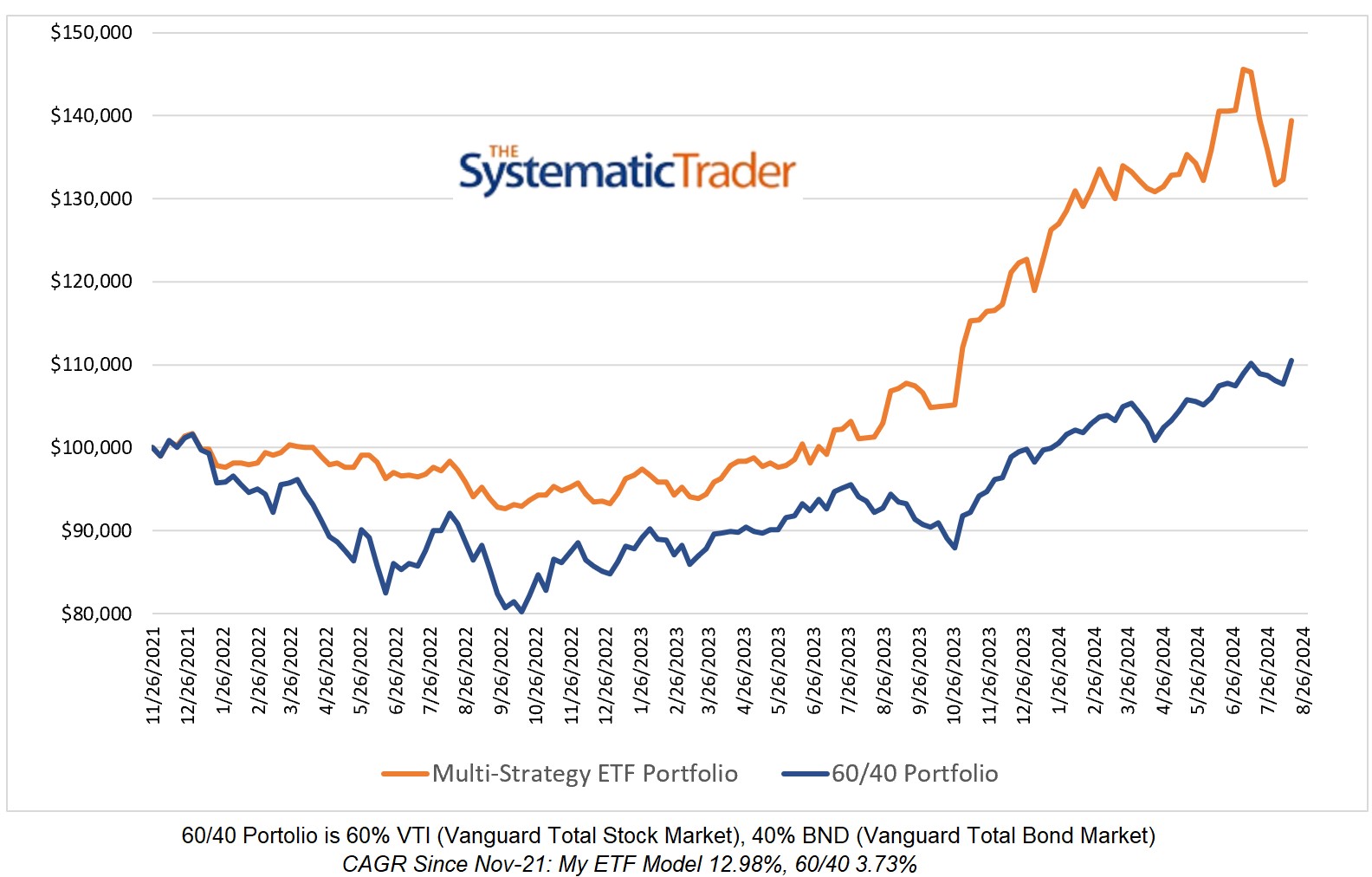

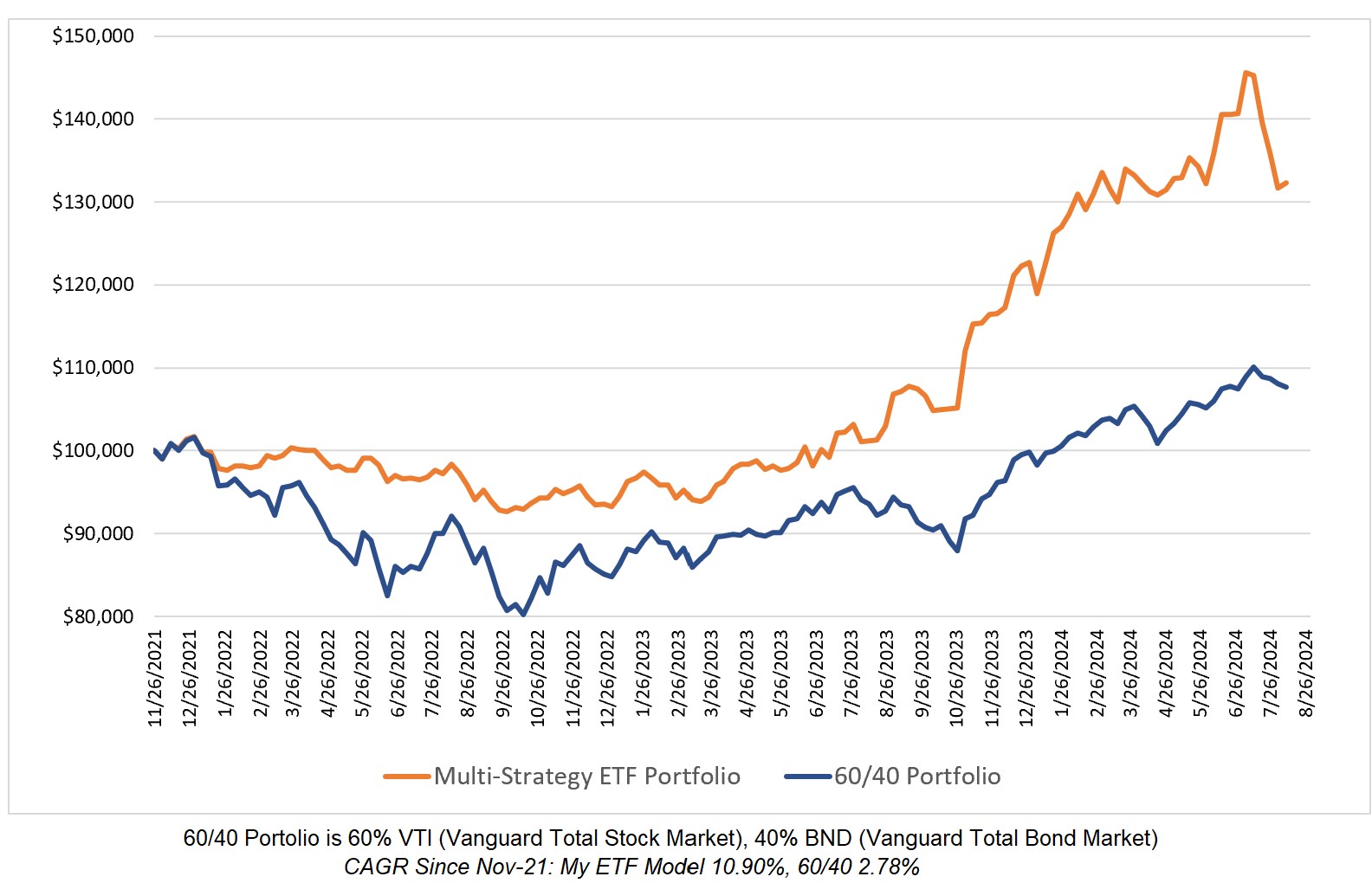

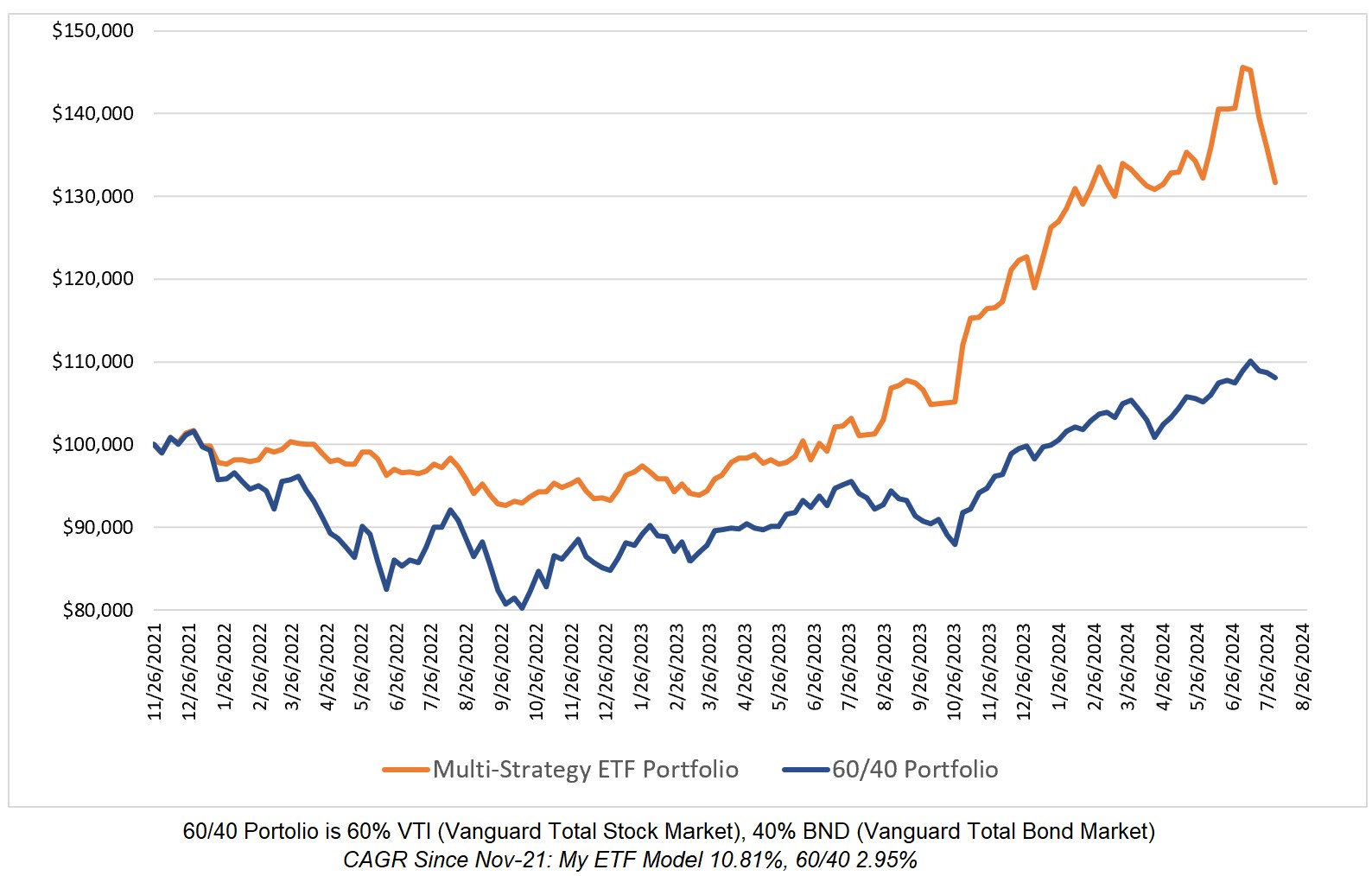

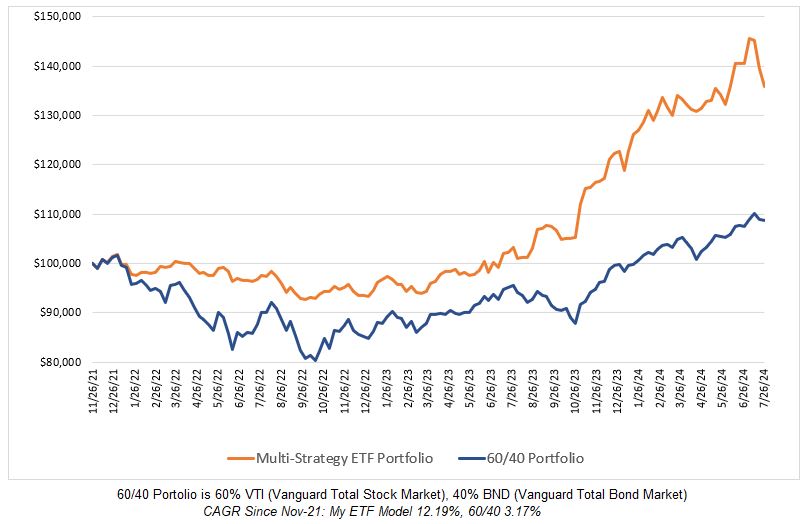

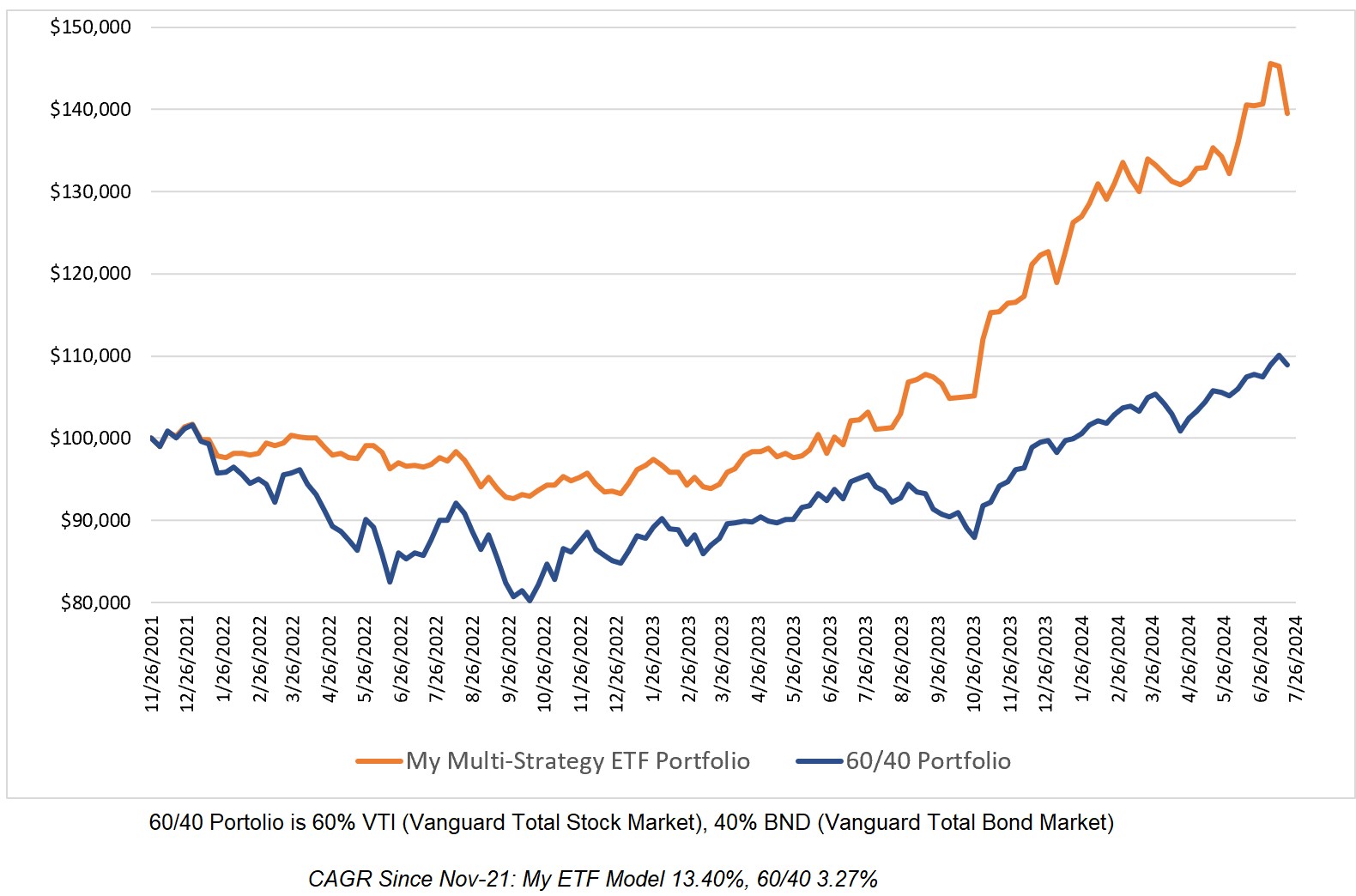

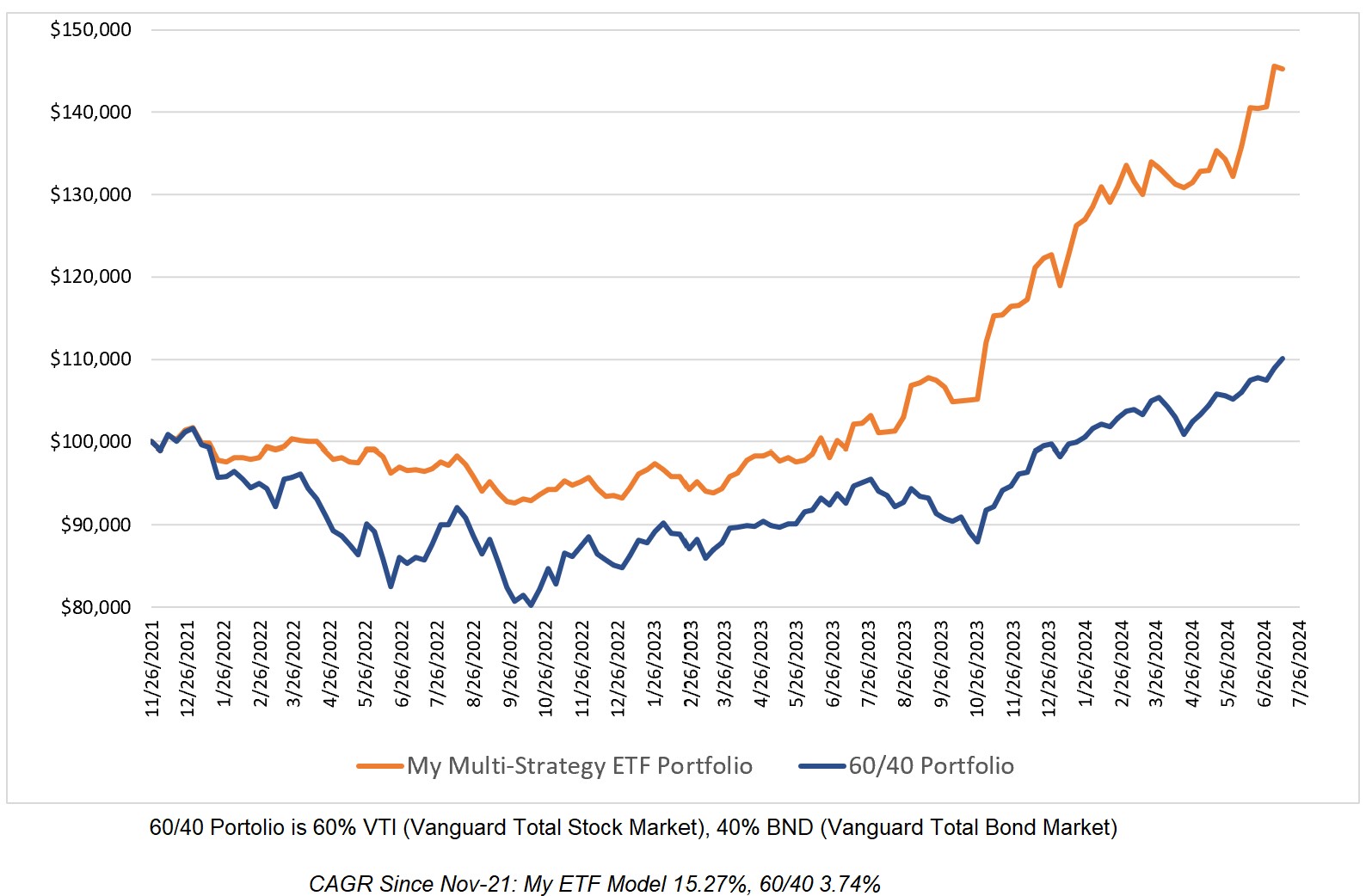

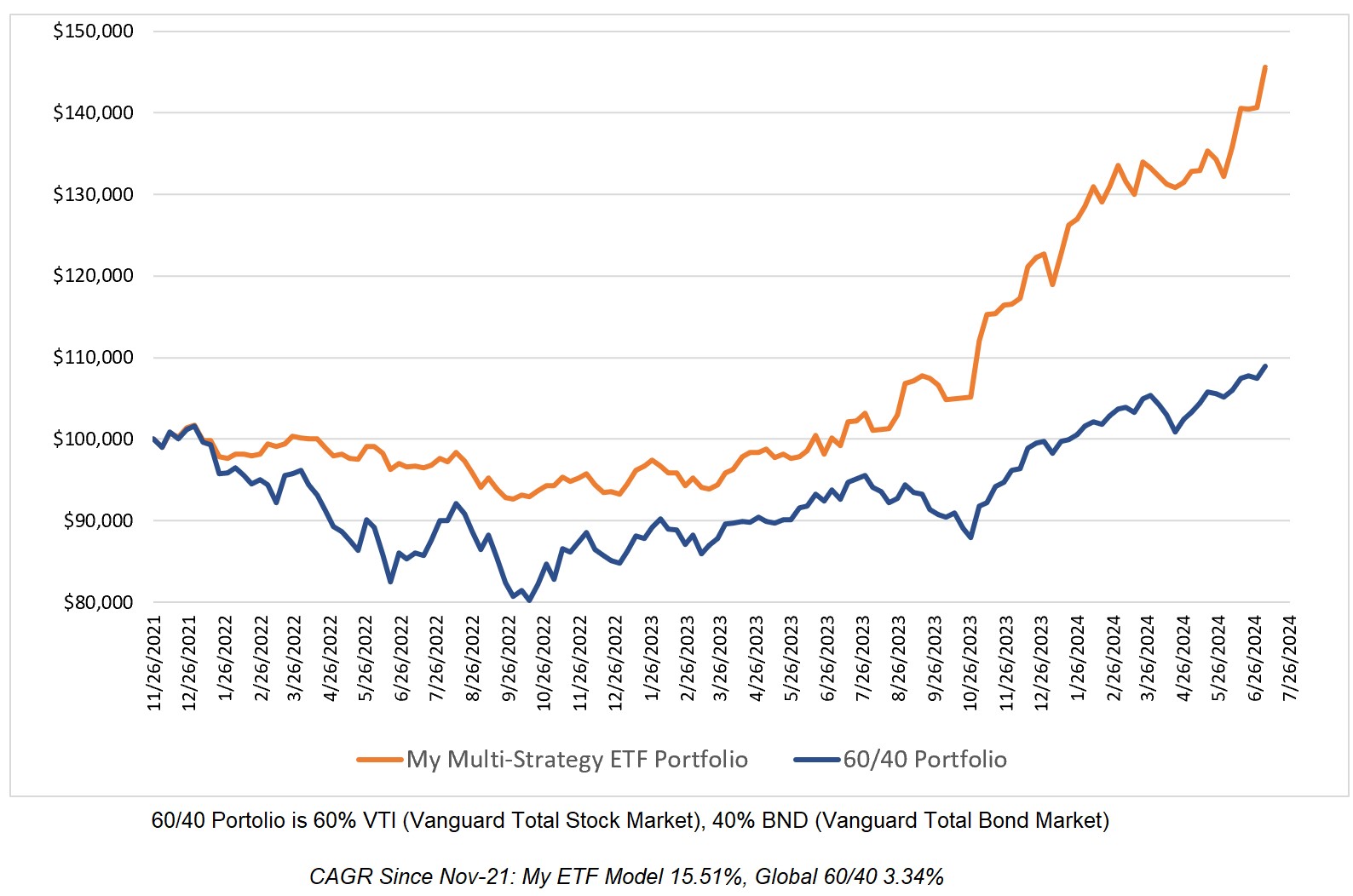

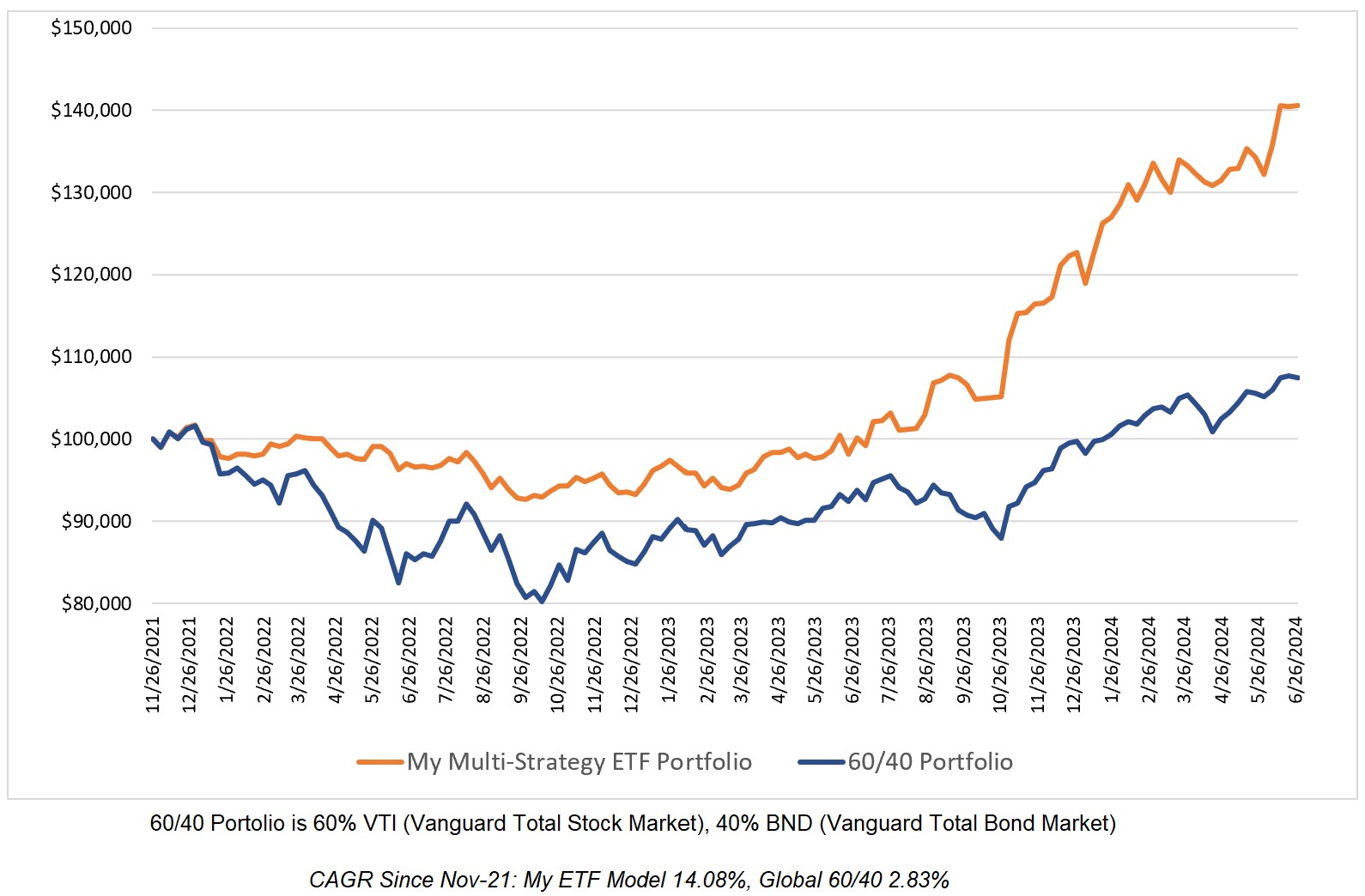

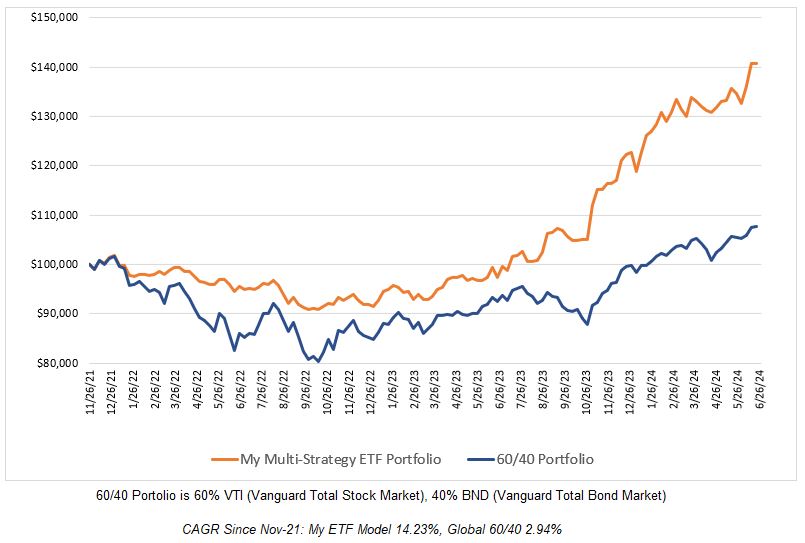

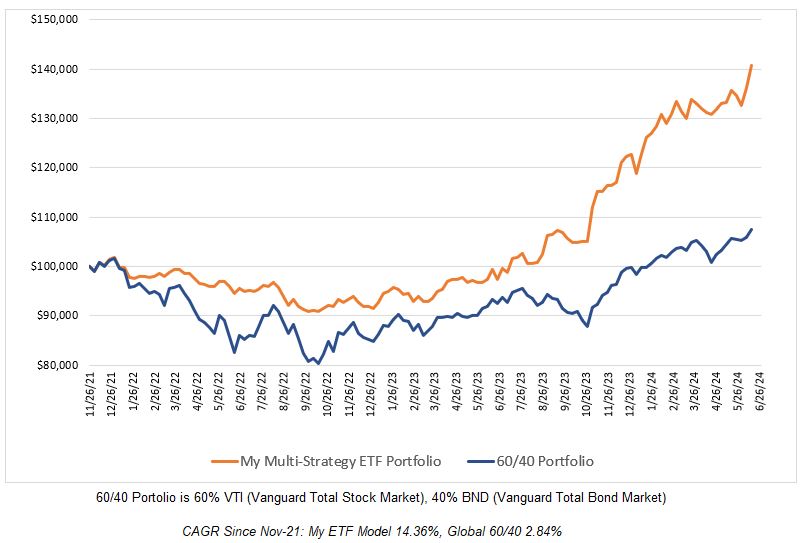

Suggestions for ETF Allocations to Outperform the 60/40 Portfolio

Latest Posts

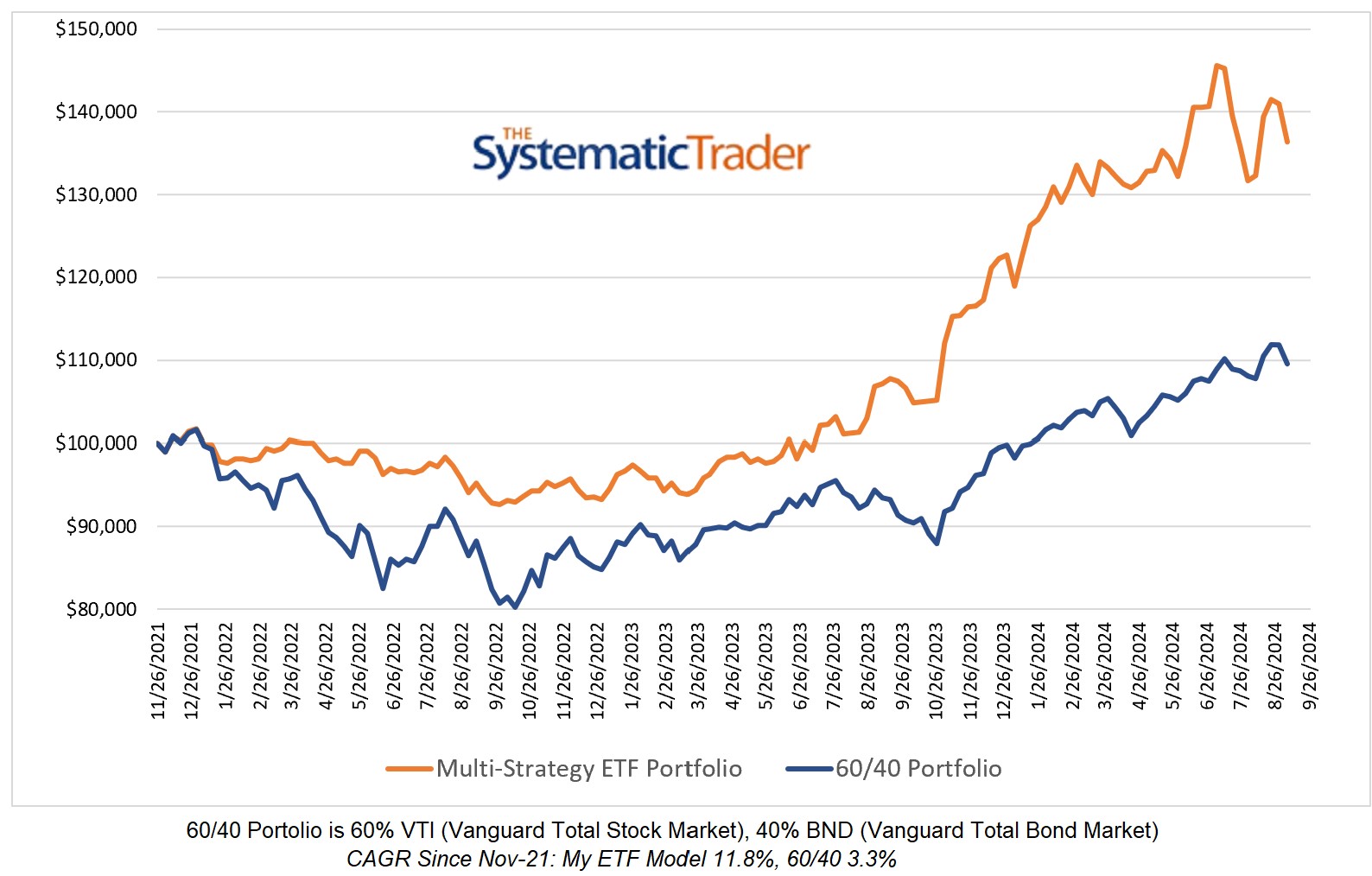

Why I Allocate to Only One Strategy at a Time

I have many new followers on Twitter/X and a common question I get is "Why do you allocate to only one strategy at a time rather than allocate evenly across them?" In developing my weekly trading system, I formulated a method of selecting one strategy to allocate to...

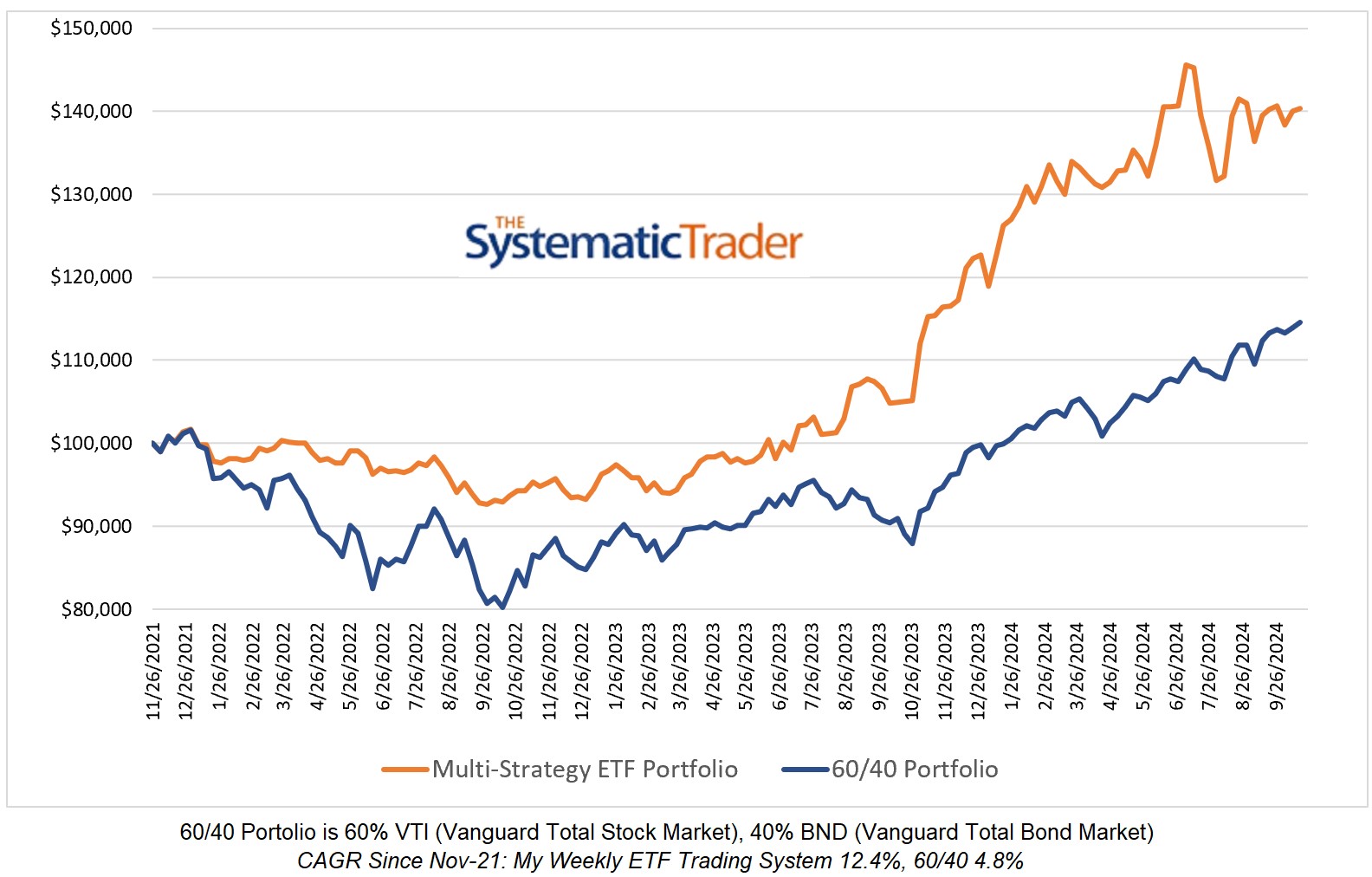

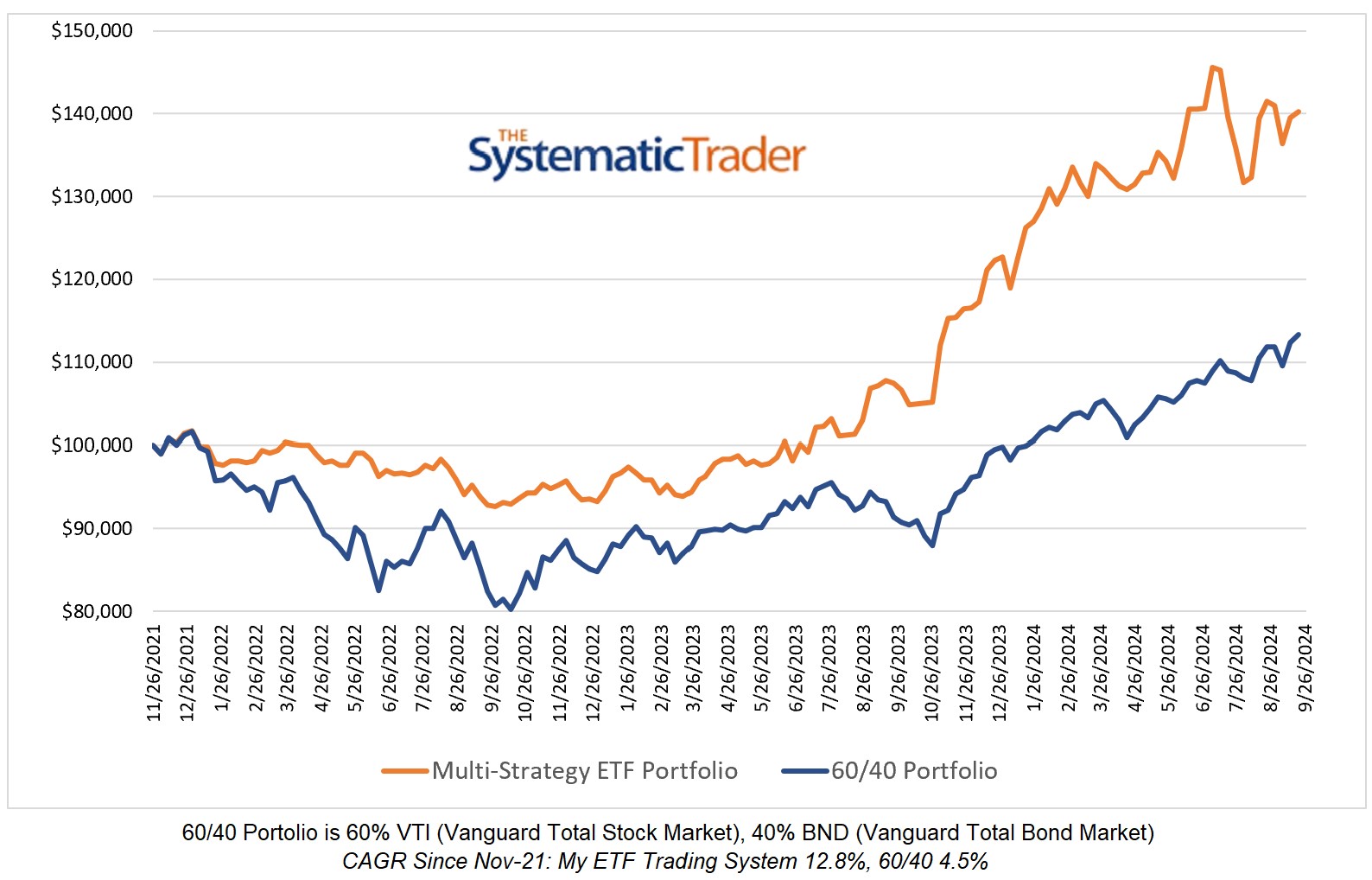

Investing Update for the Week Ending October 18, 2024

It was a barely positive week for my weekly trading system which remains 100% allocated to QQQ. If you enjoy listening to podcasts about trading, I'm going to suggest the most recent AlphaMind Podcast episode with guest Greg Newman. Greg has some great insights into...

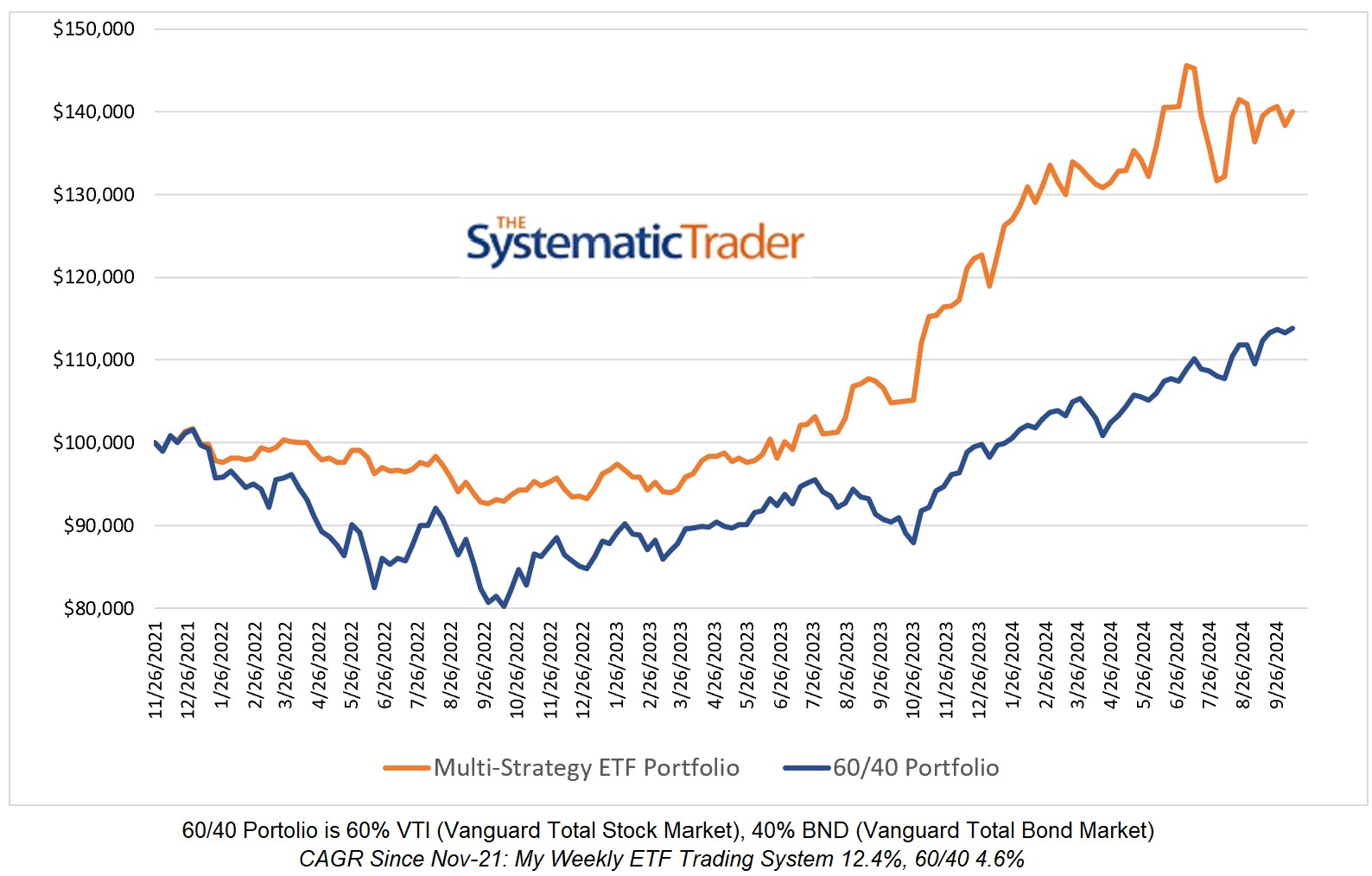

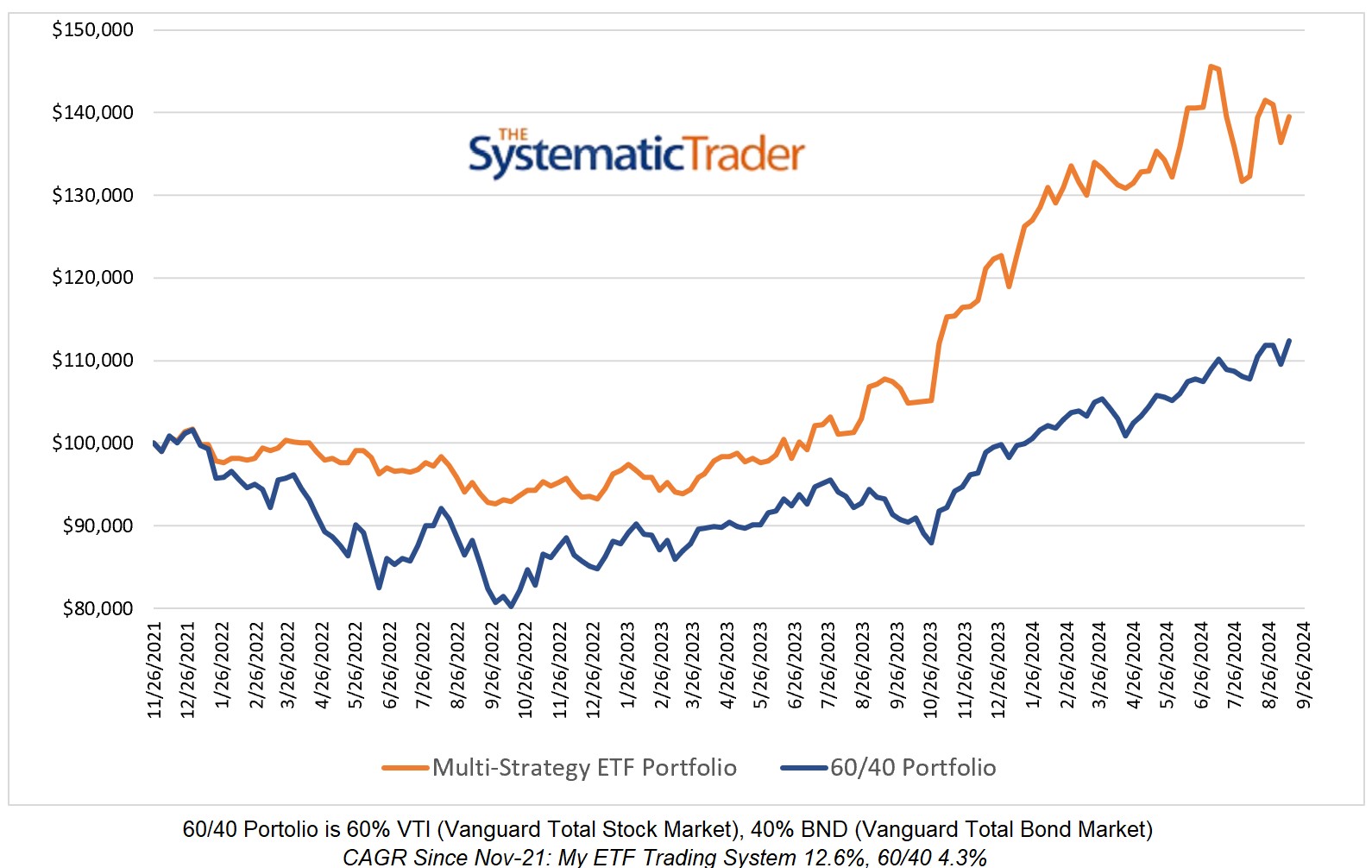

Investing Update for the Week Ending October 11, 2024

It was a positive week for both my ETF trading strategy which gained 1.24% and the 60/40 model which gained 0.53%. There is no change in my model's holdings as it remains 100% allocated to QQQ. Posts are not trading advice.