I have many new followers on Twitter/X and a common question I get is "Why do you allocate to only one strategy at a time rather than allocate evenly across them?" In developing my weekly trading system, I formulated a method of selecting one strategy to allocate to...

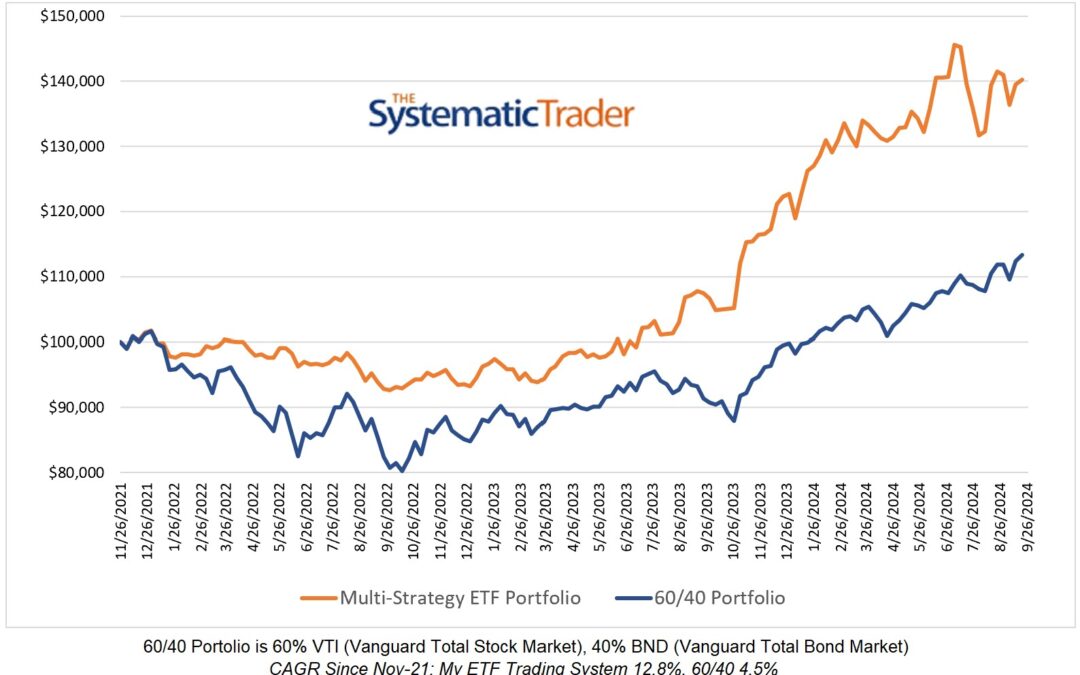

Investing Update for the Week Ending October 18, 2024

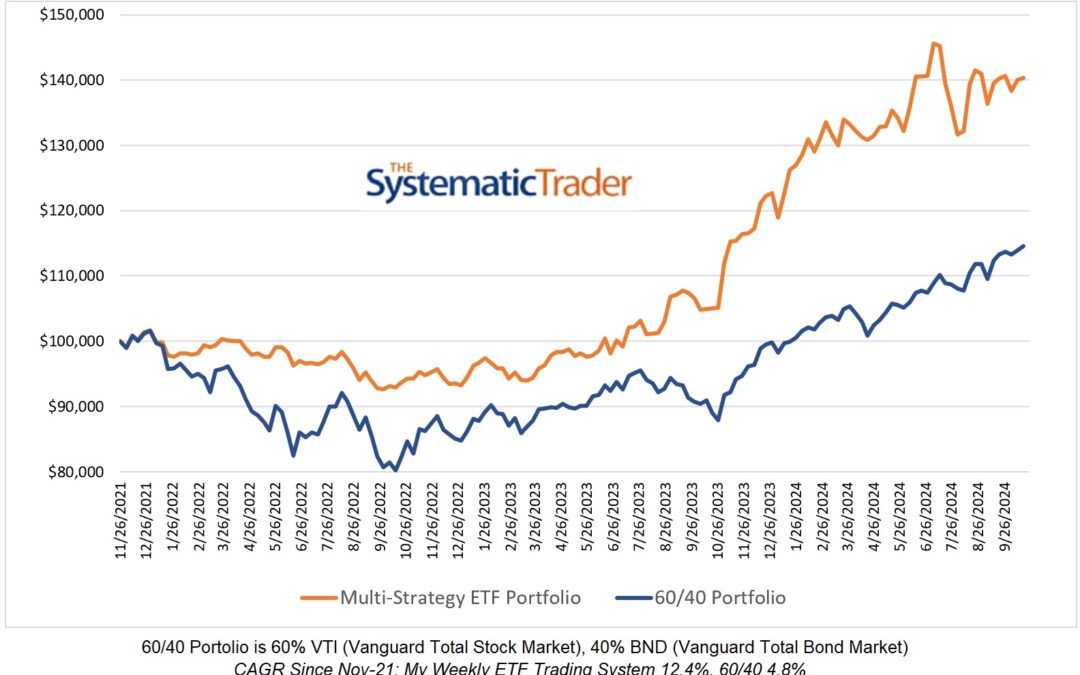

It was a barely positive week for my weekly trading system which remains 100% allocated to QQQ. If you enjoy listening to podcasts about trading, I'm going to suggest the most recent AlphaMind Podcast episode with guest Greg Newman. Greg has some great insights into...

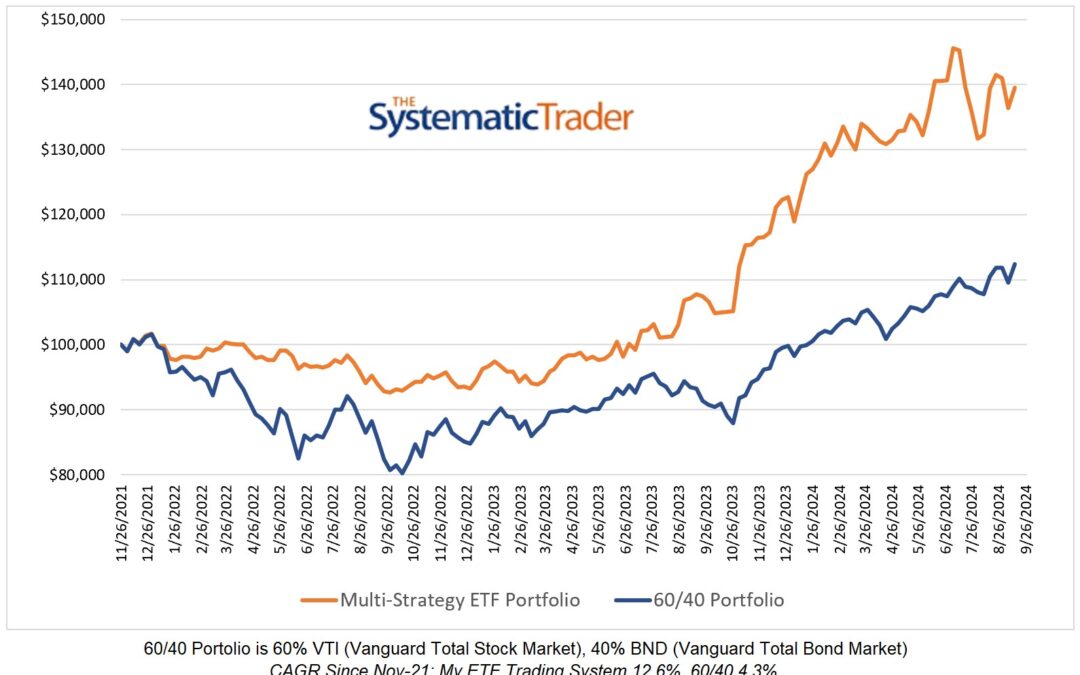

Investing Update for the Week Ending October 11, 2024

It was a positive week for both my ETF trading strategy which gained 1.24% and the 60/40 model which gained 0.53%. There is no change in my model's holdings as it remains 100% allocated to QQQ. Posts are not trading advice.

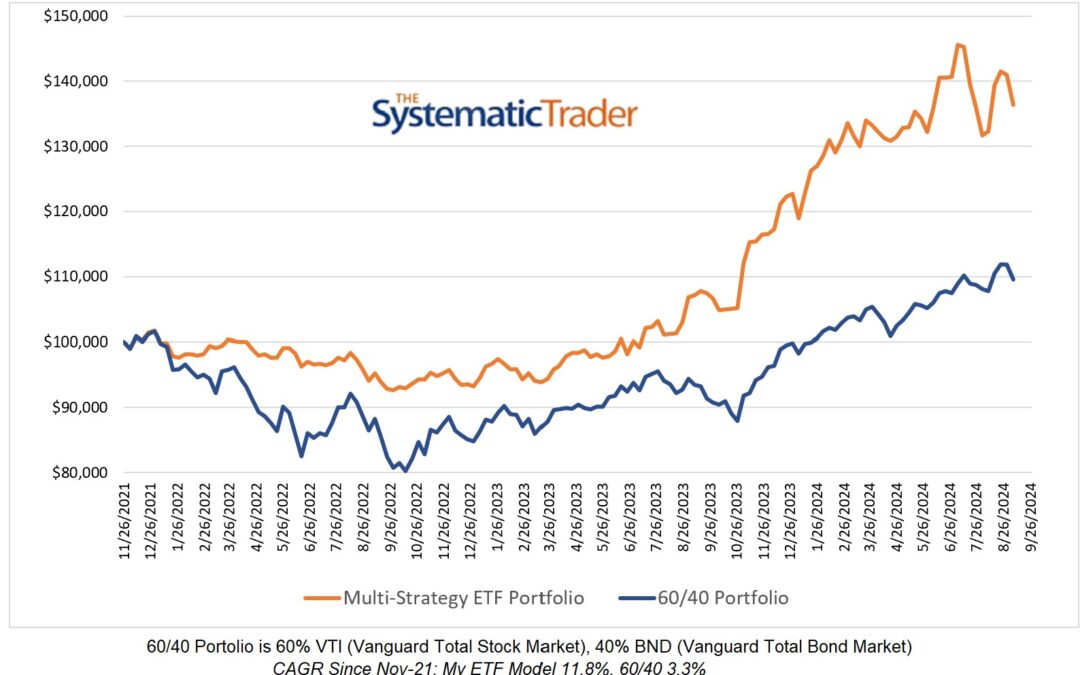

Investing Update for the Week Ending October 04, 2024

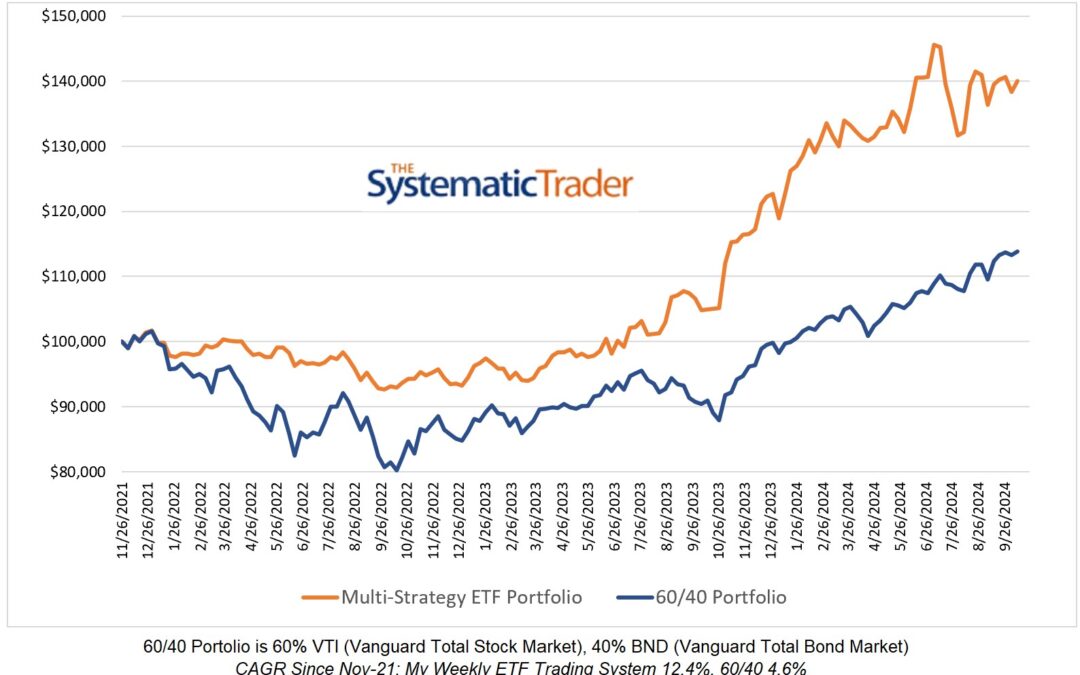

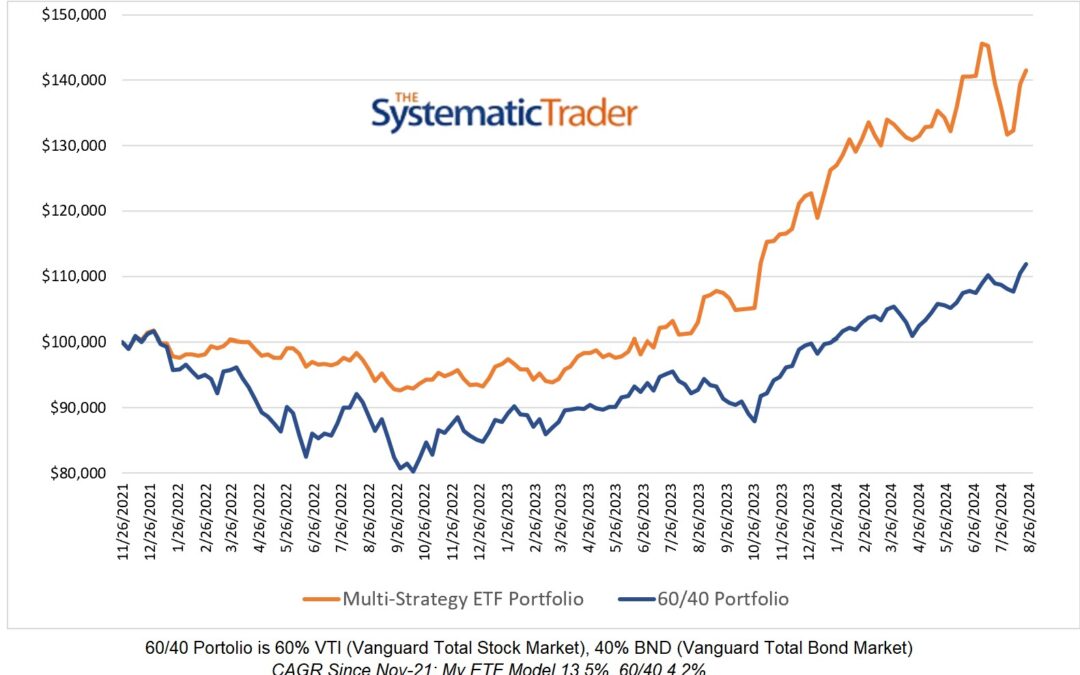

It was a negative week for both my ETF trading system and the 60/40 model. My trading system had the larger loss but has nonetheless outperformed the 60/40 rather well since its inception here on my site. My ETF system is now in familiar territory as it is 100%...

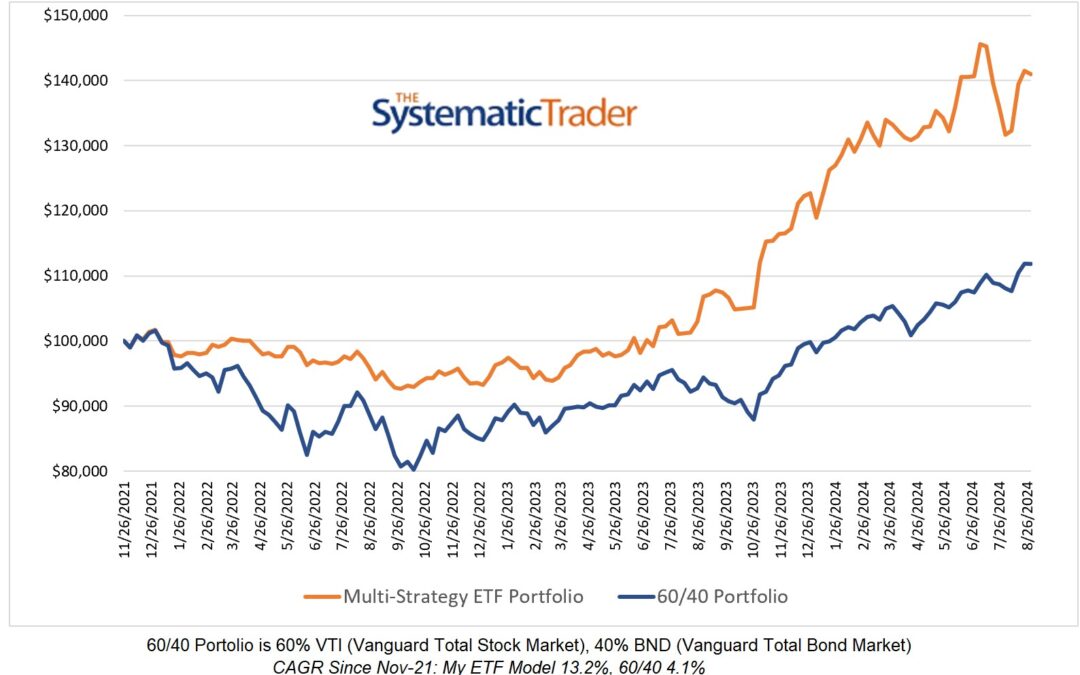

Investing Update for the Week Ending September 27, 2024

Both my ETF trading system and the 60/40 portfolio model achieved very modest gains this week. My trading system is now allocated to six ETFs as listed in the table below.

Investing Update for the Week Ending September 20, 2024

It was a positive week for both my multi-strategy ETF trading system and the 60/40 as both notched small gains. The 60/40 model has been performing well lately and is at an All-Time High since I began posting in 2021. There is one change in the ETFs my system is...

Investing Update for the Week Ending September 13, 2024

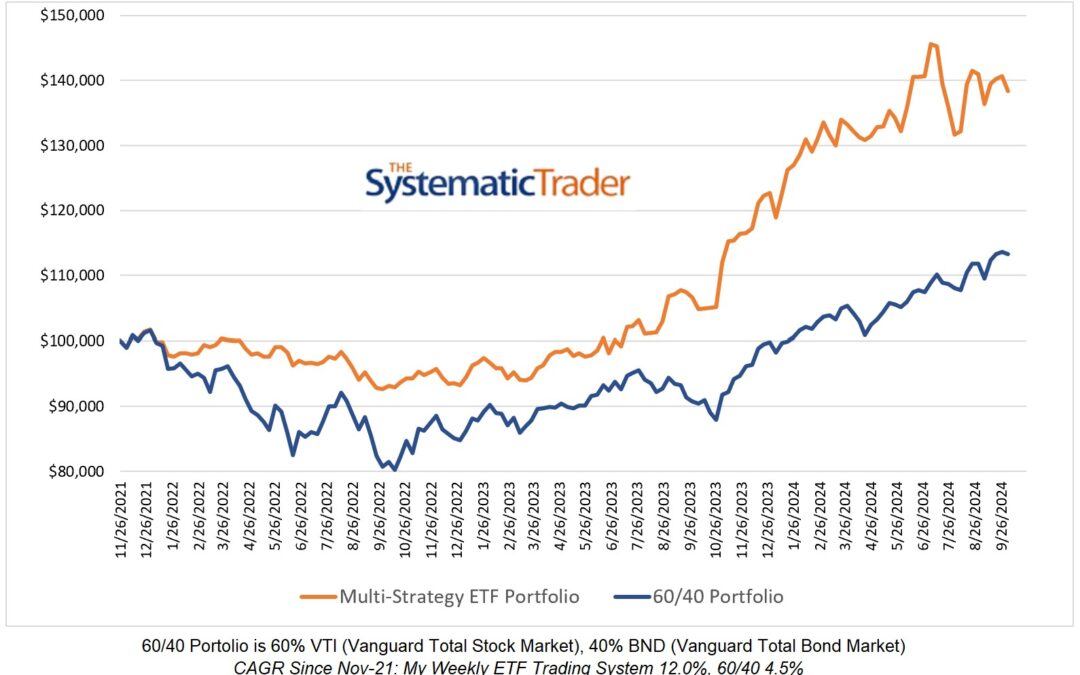

Both my ETF trading system and the 60/40 model posted solid gains this week. There is one change in my system's holdings this week as IWM replaces LQD. Disclaimer: Posts are not trading advice.

Investing Update for the Week Ending September 06, 2024

Well, that was an unpleasant week for many of us as far as investment returns are concerned. My multi-strategy ETF model lost 3.25% while the 60/40 lost 2.08%. Asset class momentum as I measure it has shifted away from US equities as seen in my model's new allocation...

Investing Update for the Week Ending August 30, 2024

My ETF momentum-style trading system declined slightly this week while the 60/40 remained essentially flat. The allocations are a little more international now than they have been in a long time.

Investing Update for the Week Ending August 23, 2024

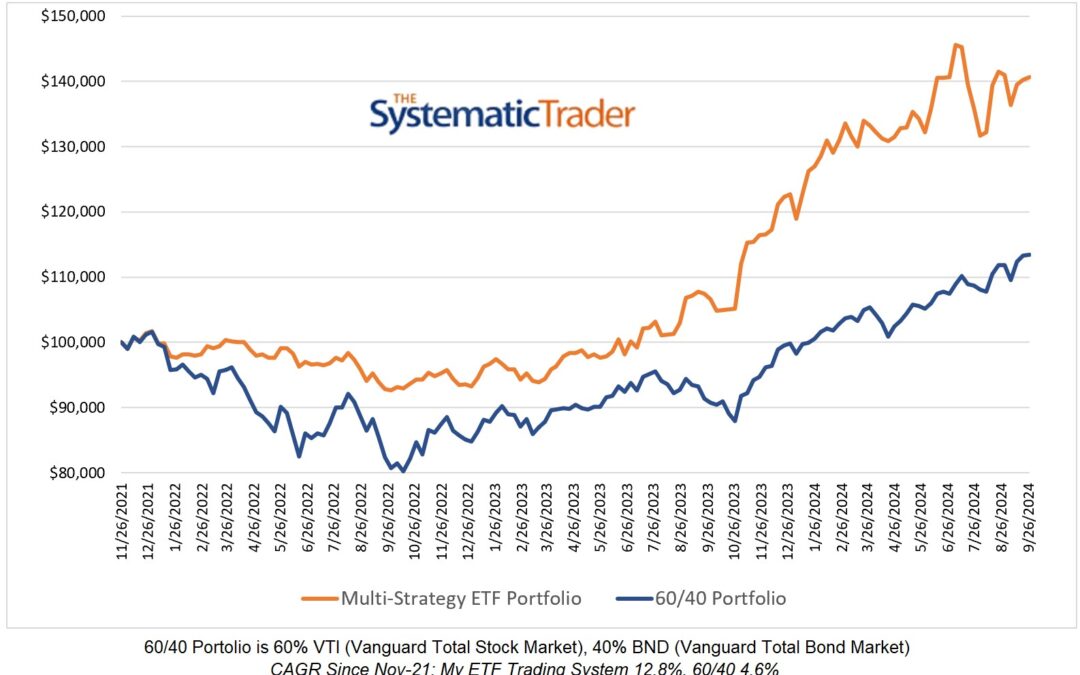

My multi-strategy ETF system had a 1.45% gain this week vs 1.24% for the 60/40. This brings my system's one-year return to 37.4% vs 20.7% for the 60/40. Those are both well above their long-term averages. My weekly trading system's allocations are now evenly split...