Tactical asset allocation (TAA) is most often based on the investor trading once-per-month and that once occurs on the last trading day of each month. There may be an inherent problem in the selection of the same day each month on which to rebalance the portfolio and this is referred to as timing luck.

Fortunately, Walter at Allocate Smartly and Corey Hoffstein at Newfound Research wrote about timing luck as it pertains to TAA so there is no need for me to reinvent the wheel.

The Allocate Smartly post is here and the Newfound Research post is here. If you are a TAA investor, I strongly suggest you read both articles and consider the timing luck issue if you are making allocation adjustments only at month end.

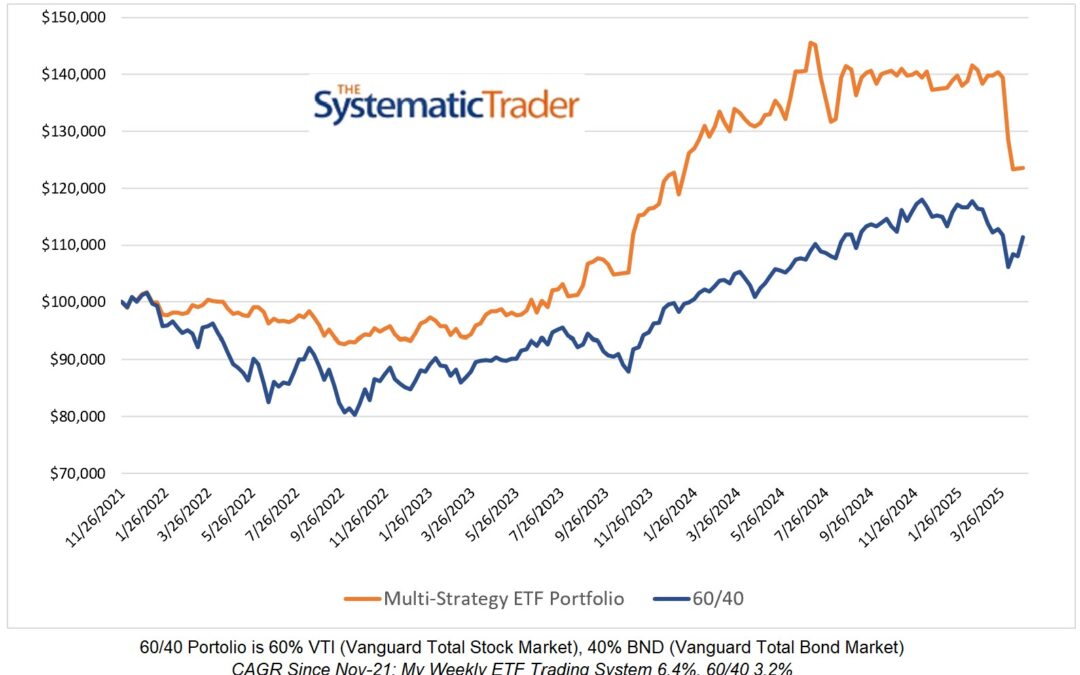

The take away from both articles is that trading on the same day each month, be it the last trading day, the eleventh trading day, etc, introduces the risk that the performance results are due, in part, to the day selected to trade. To remove timing luck from a TAA, both articles present the solution that the investor divide their TAA portfolio into equal weights and rebalance each segment on a different day of the month. The assumption is that the rebalancing days are equally spaced apart.

I have decided to take the advice of Water, Corey and other professionals that I have spoken to. I divided my portfolio into four equal segments and, going forward, will adjust the weights of the ETF’s on a weekly basis. Segment 1 which is 25% of my portfolio will be adjusted on the last trading day of week 1 (which was last week in my case). Segment 2 which is 25% of my portfolio will be adjusted on the last trading day of Week 2. Repeat for segments 3 and 4. On the fifth week, the process repeats starting with segment 1.

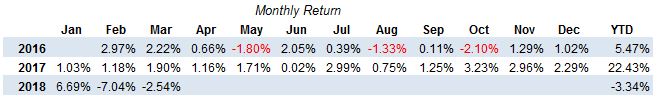

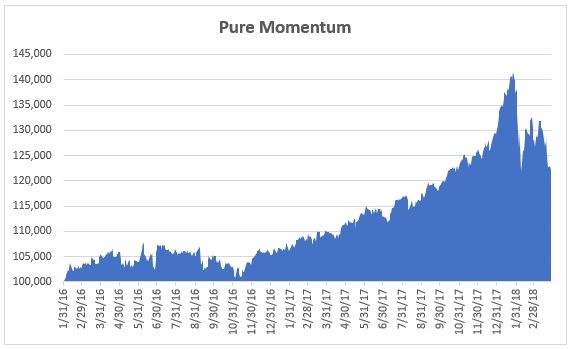

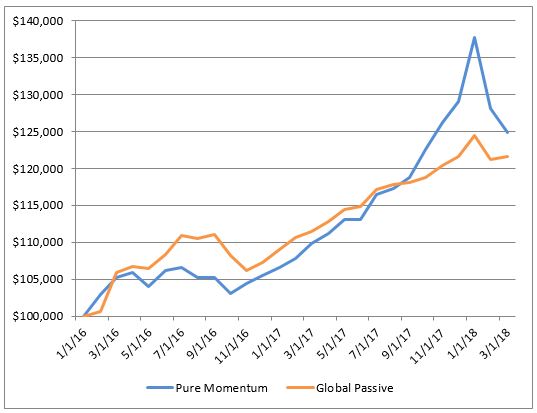

As for my portfolio, it slipped by 2.54% in March resulting in a year-to-date loss of 3.34%.

Could tou make the negative returns red? Could you update also the GtP ratio?