![]()

I have to say at the outset that opening a covered call trade today felt uncomfortable. For me, it feels like the stock market has had an excellent run and is about to roll over. That being said, as a systematic trader I have to follow my processes.

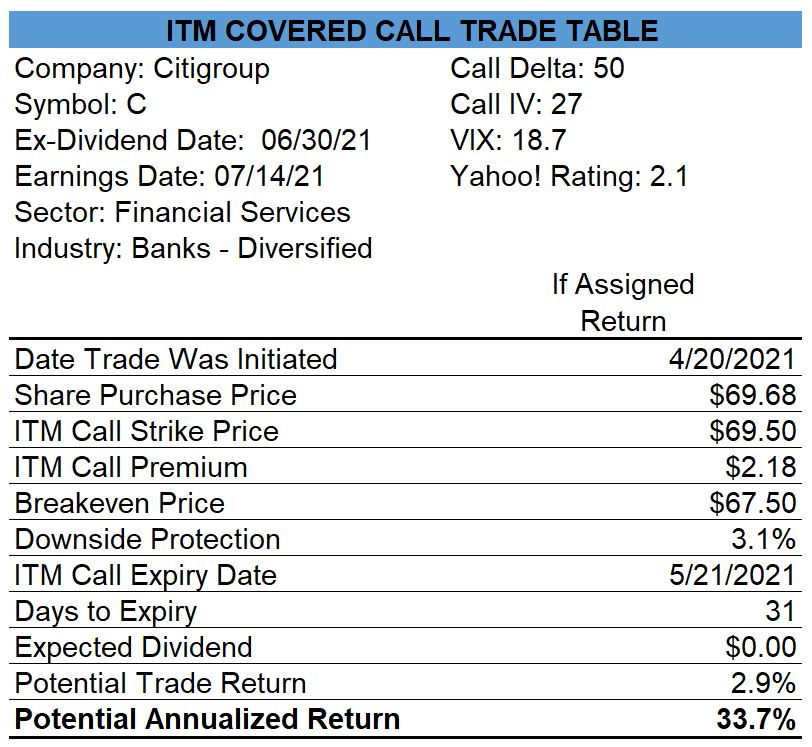

Today, I bought Citigroup shares at $69.68 and sold ITM May-21 $69.50 calls for $2.18 which sets up a potential annualized return of 34%. I decided to sell ITM rather than OTM as my Market Timer is currently providing a low reading of 2.5.

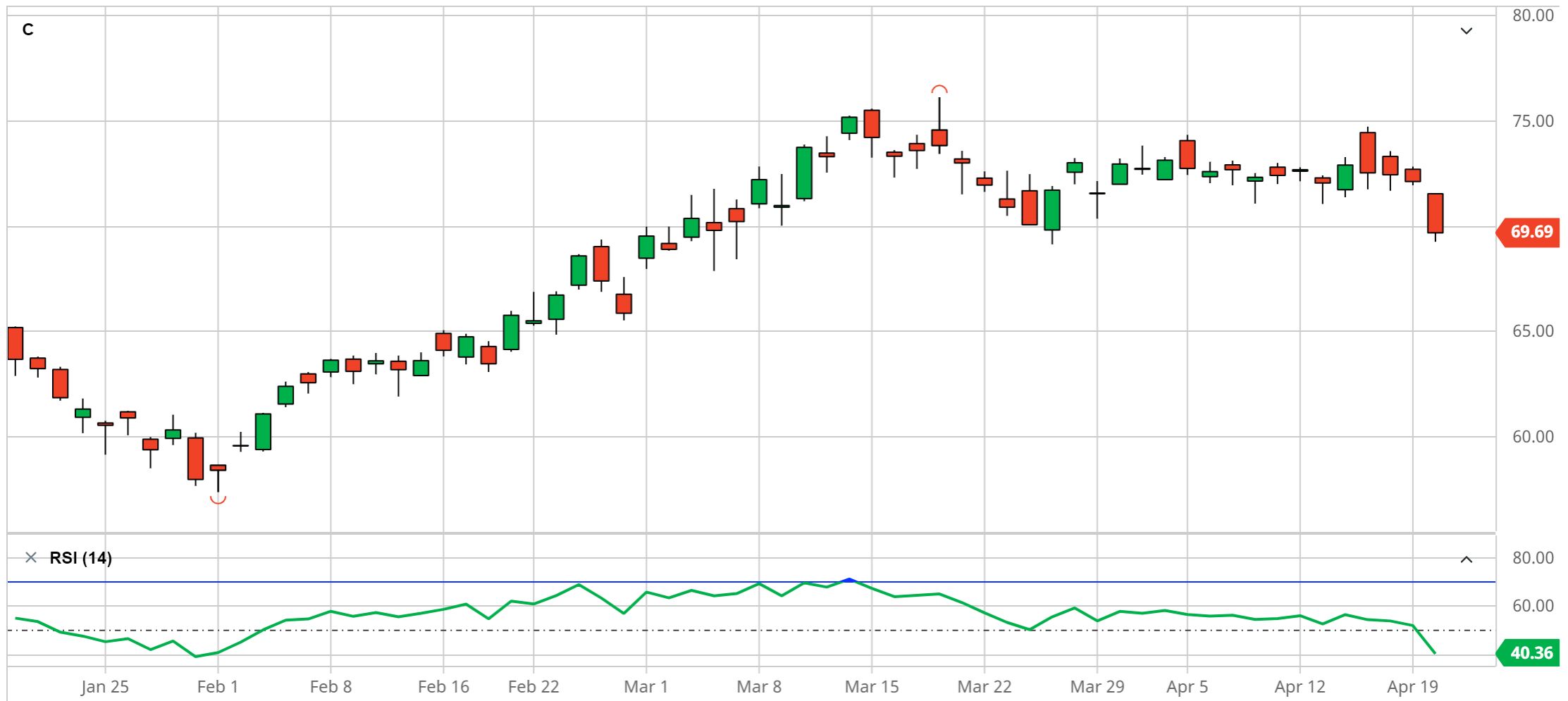

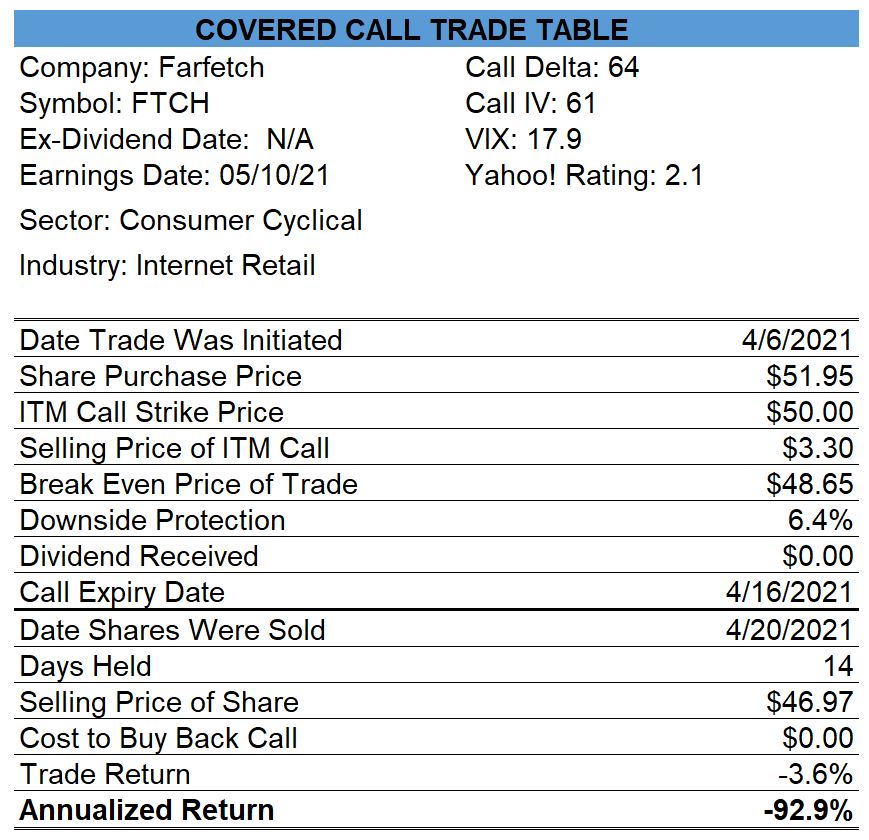

Farfetch

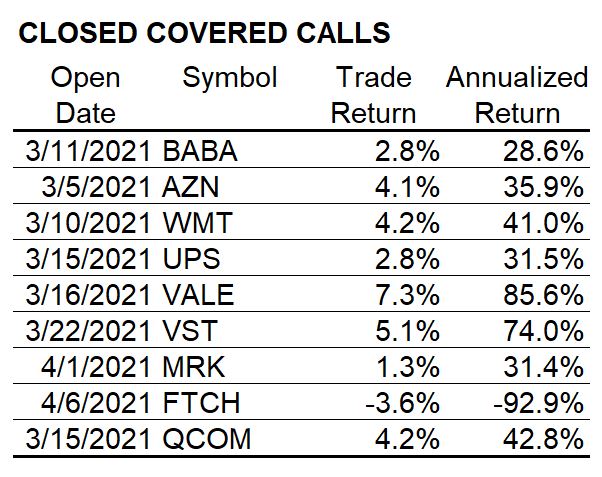

Today, I sold my Farfetch shares to close out my unprofitable covered call trade in that stock with a 3.6% loss.

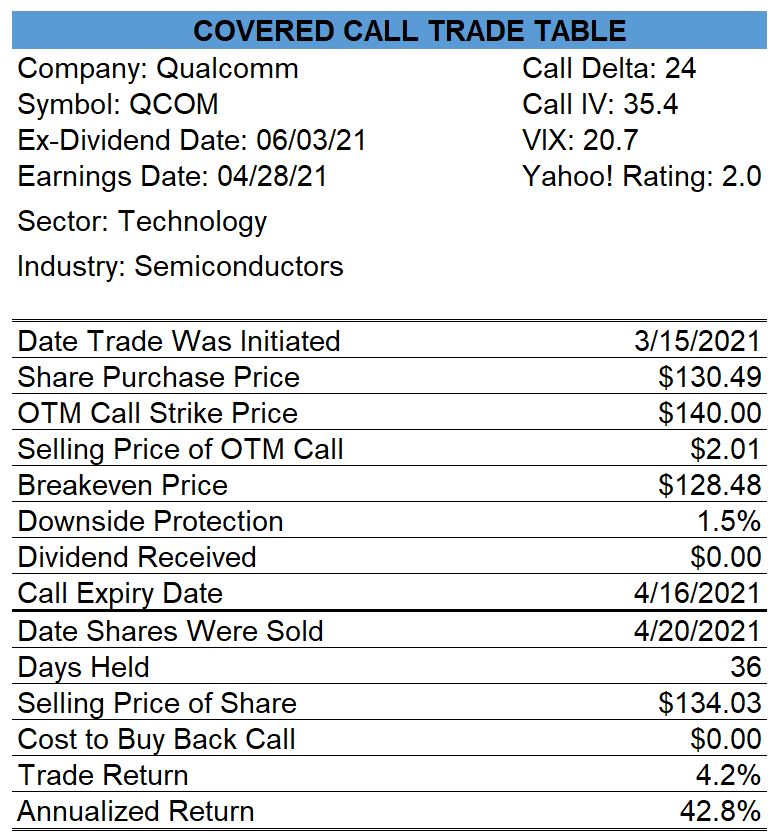

Qualcomm

Today, I sold my Qualcomm shares for $130.49 resulting in a profitable trade with a 4.2% profit.

April 16 Covered Call Trade Summary

I had nine covered call trades based on April 16 expiry dates and even with the Farfetch losing trade, the average annualized return including commissions was 30.9%. It would be wonderful if my CC trades provide these results every month but my trade results are, in large part, dependent on the movement of the broad market over which I have no control and little foresight.

0 Comments