I had eight covered call trades for which the call options expired yesterday and six of the stocks closed higher than the strike price so those stocks will be assigned to the holders of the calls. For the two stocks that closed below the strike, one was FTCH and it was only 0.8% below the strike and the other was QCOM which was only 1.3% below the strike. FTCH isn’t currently passing any of my screeners so it will be sold next week. If the price holds steady, the FTCH trade will generate an annualized return north of 60%. QCOM has been passing one of my screeners so I will likely sell May 21 calls on it on Tuesday. If I closed my QCOM trade on this coming Tuesday (that is the earliest I can as the call options have to settle), the annualized return for the trade would be over 80%.

The average annualized return for all eight trades was 53%. Yes, it was a great month for me from a trading perspective.

If you have been reading my posts for any period of time, you likely recognize that I have an appreciation for the saying “A rising tide lifts all boats”. The price chart for the S&P 500 below illustrates that the broad US equity market has performed very well recently and that favoured my covered call trades. As my Market Meter has been neutral since January 22, I have been selecting call strike prices that were ITM or not very far OTM. We now know with the benefit of hindsight that my Market Meter did not forecast the stock market strength. That’s fine. There is no such thing as a perfect market strength forecasting tool. That said, I believe in following trade-creation and trade-management processes and I believe that it is important over the long run to incorporate a tool that provides me with guidance on which strike prices to select.

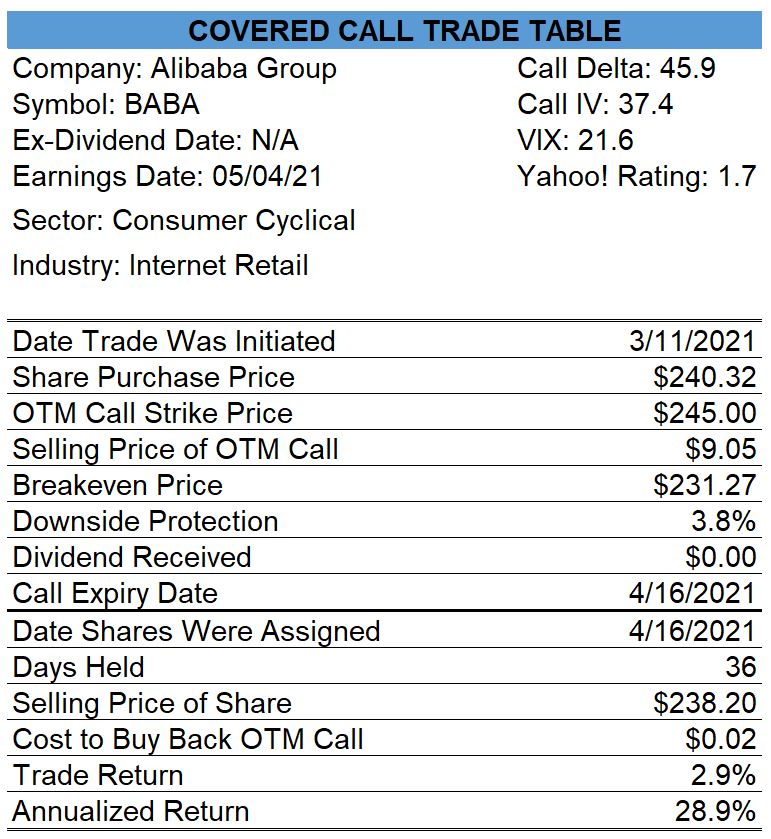

Alibaba Group

My covered call trade with Alibaba Group produced a 29% annualized return.

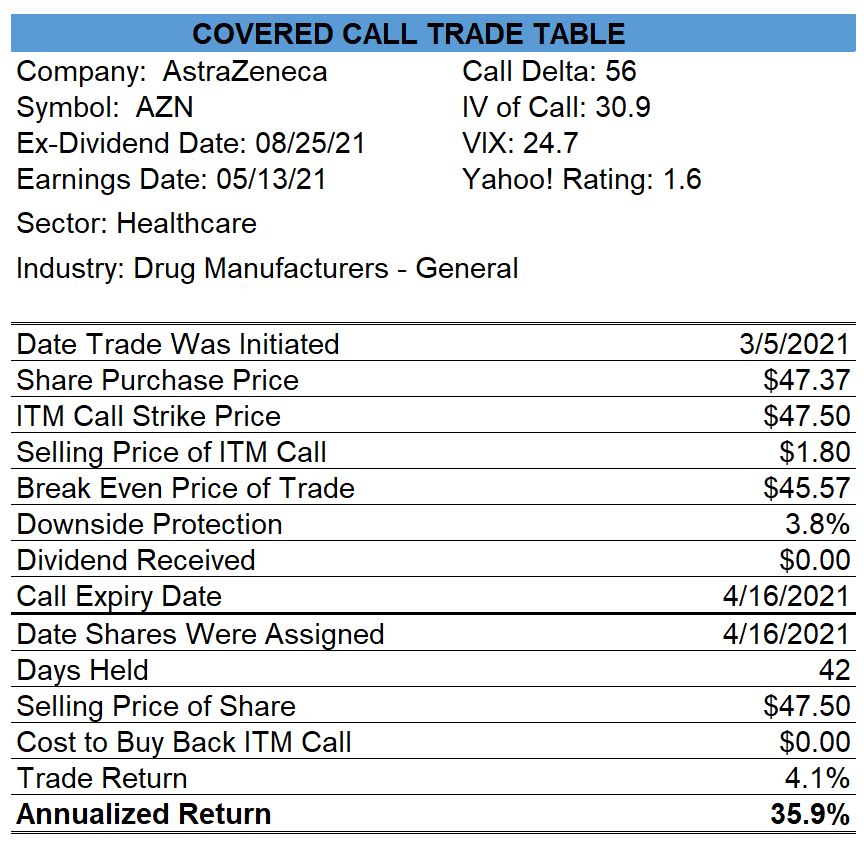

AstraZeneca

My covered call trade with AstraZeneca produced a 36% annualized return.

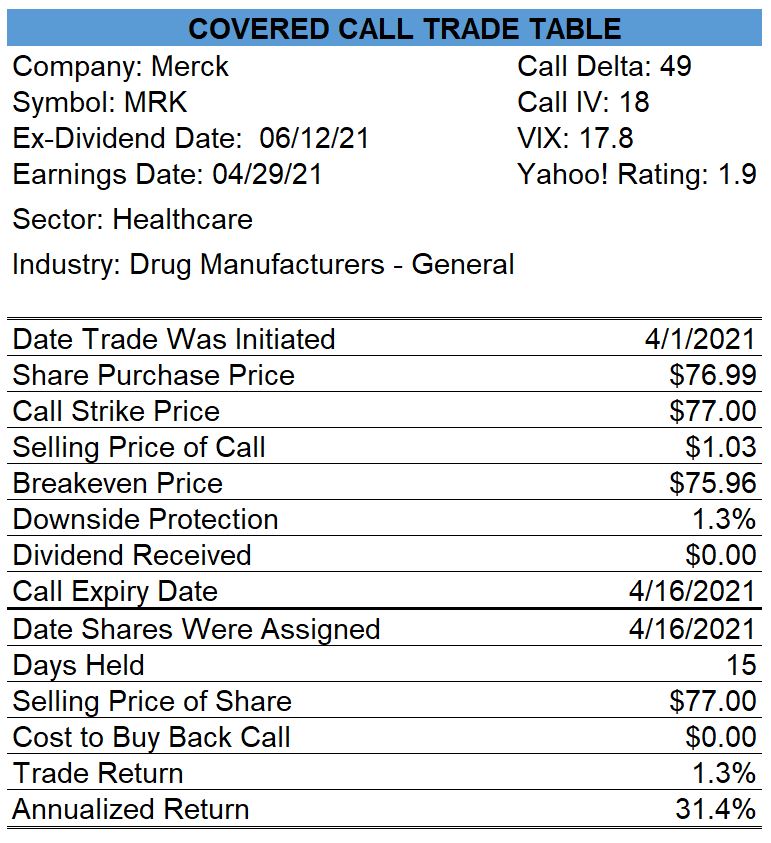

Merck

My covered call trade with Merck produced a 31% annualized return.

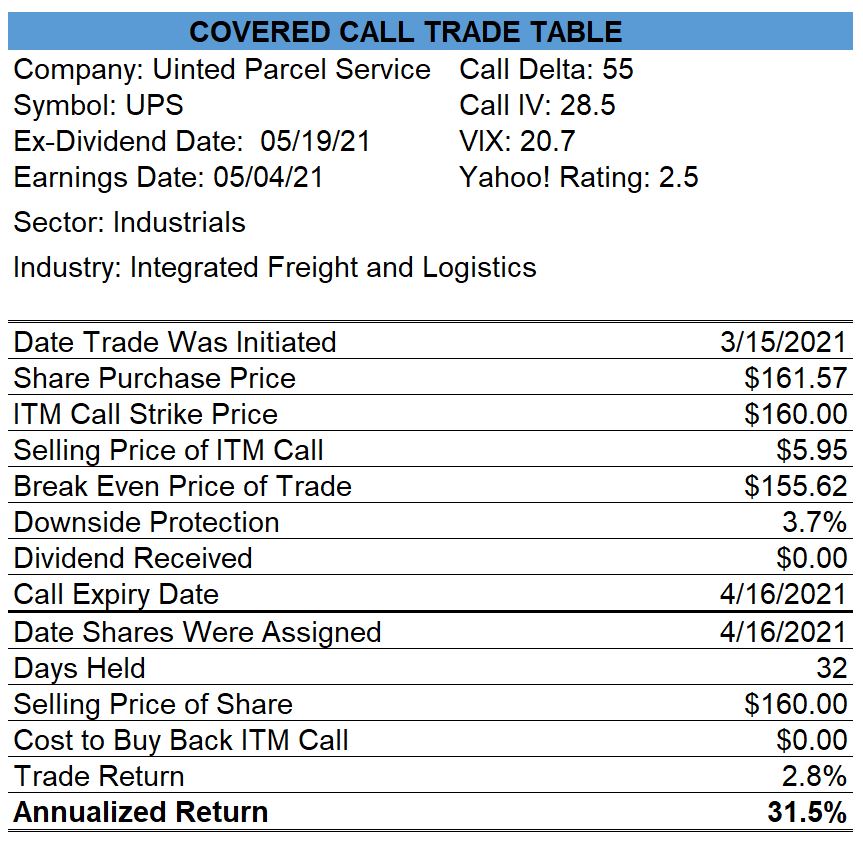

UPS

My covered call trade with UPS produced a 31% annualized return.

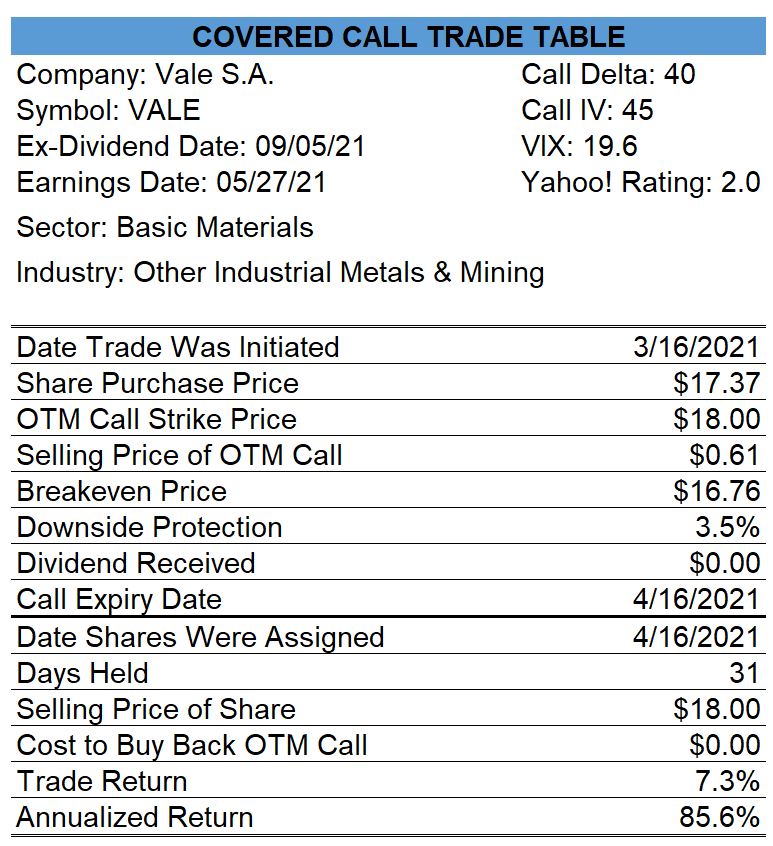

Vale

My covered call trade with VALE produced an 86% annualized return.

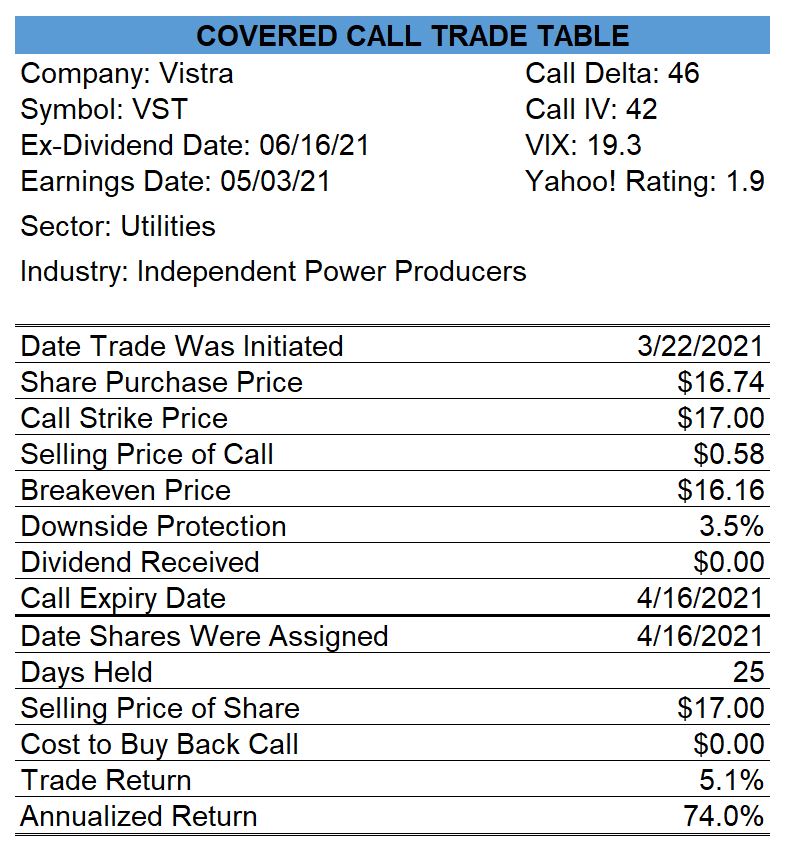

Vistra

My covered call trade with VST produced a 74% annualized return.

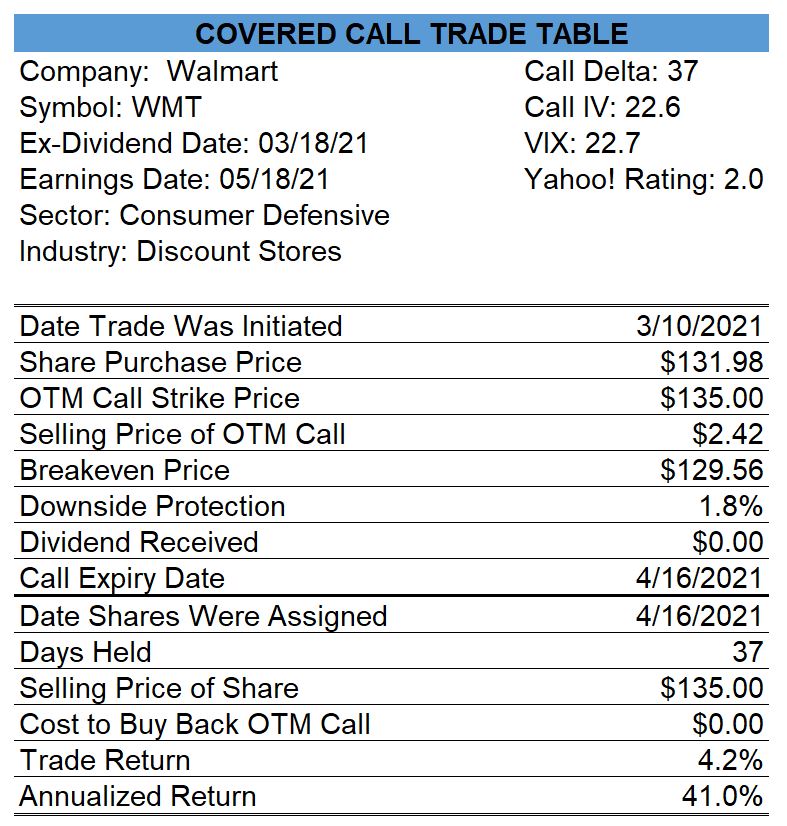

Walmart

My covered call trade with Walmart produced a 41% annualized return.

0 Comments