December 10

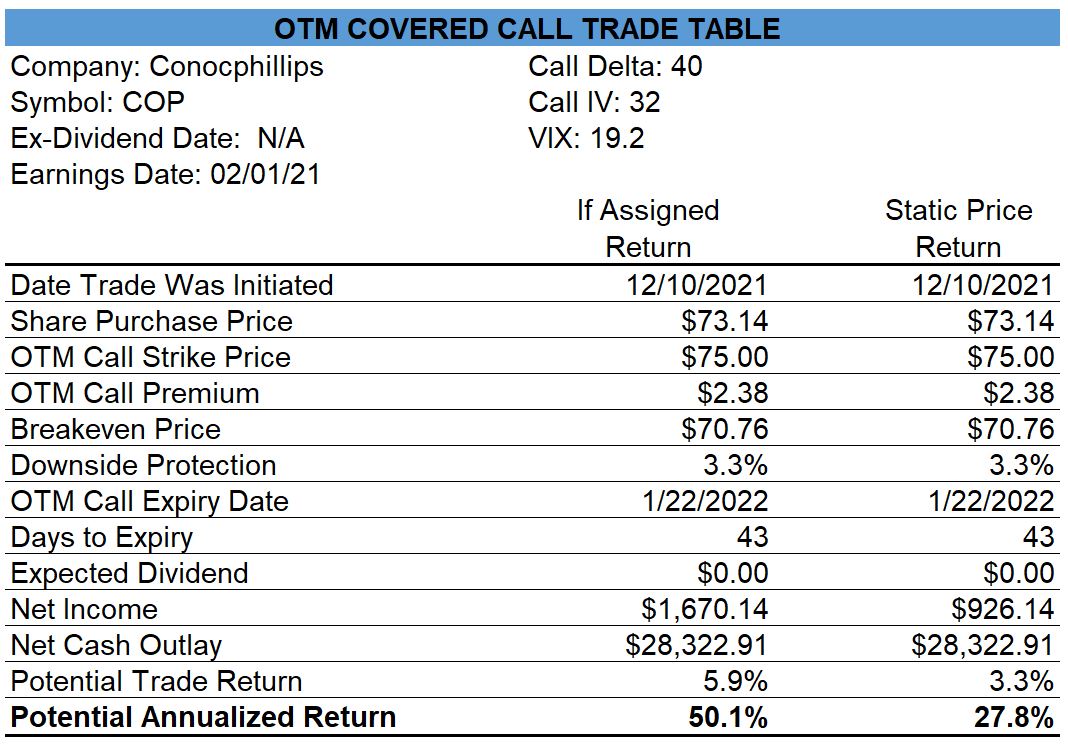

Conocophillips (COP) – Sold Covered Calls

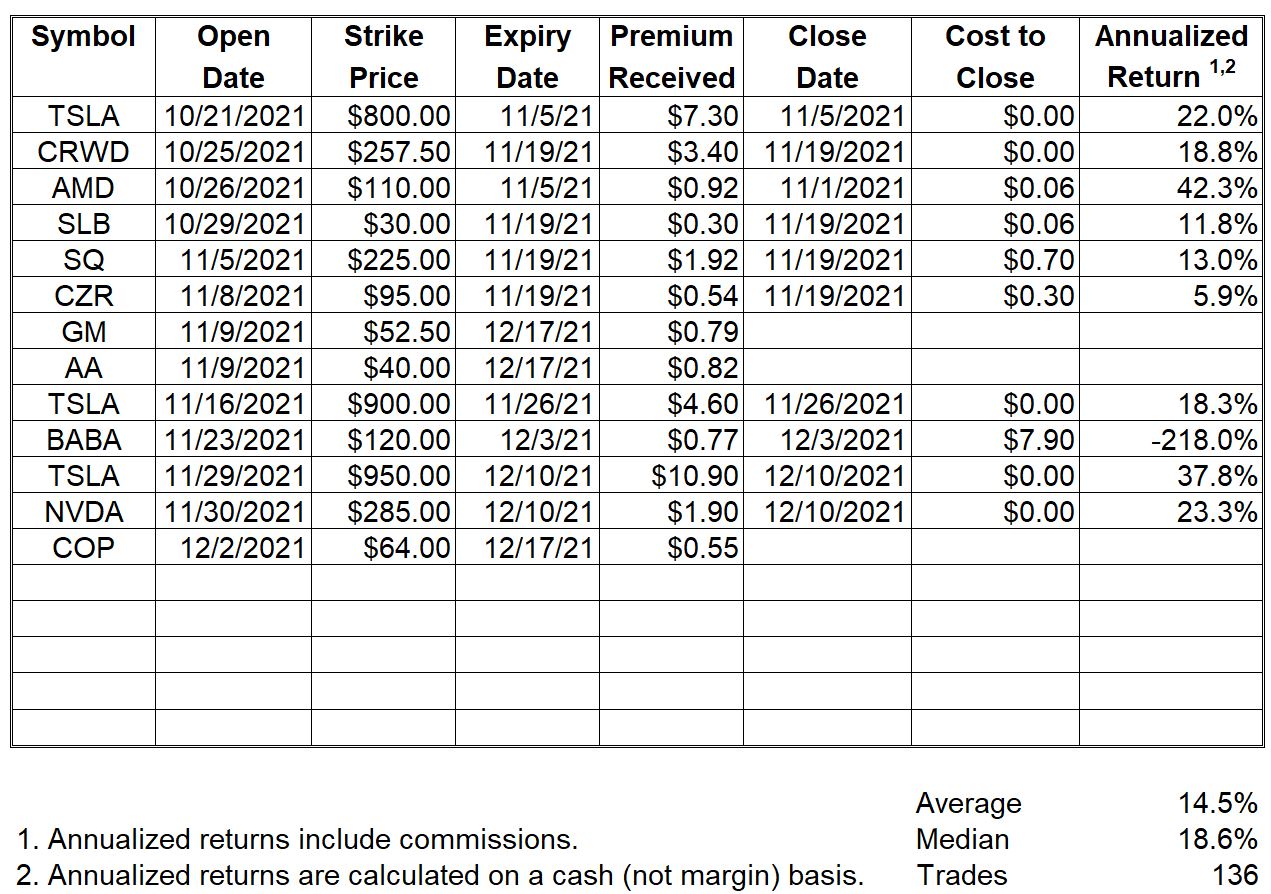

Closed Naked Puts

Sometimes wild price swings work in my favour and sometimes they don’t. On the option expiry date of December 03 for my BABA puts, the share price dropped by more than 8% so I had to buy the puts back to avoid being assigned the shares. On the next trading day, the price of BABA shares jumped back up by more than 10% to close above my strike price of $122.00. The difference between the trade closing profitably versus a 6% loss was one day.

My TSLA and NVDA puts closed out of the money and, therefore, I kept the full premium on both sales.

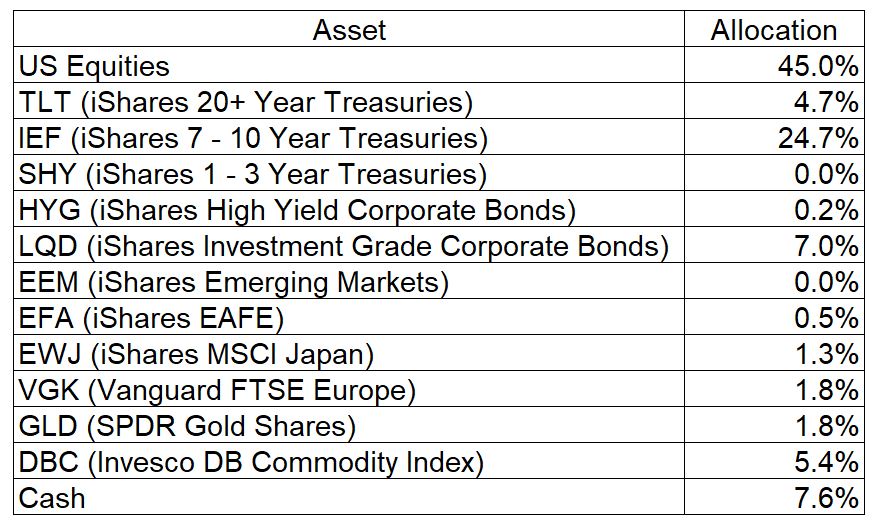

Asset Class Allocations for ETF Investing

My tactical asset allocation model currently has allocations as provided in the table below.

Open Trades

My open trades can always be viewed here.

0 Comments