December 21

Nvidia (NVDA) – Purchased Shares

This was a Tier 1 trade but was a small position given the large ATR.

December 22

Air Lease Corp (AL) – Shares Purchased

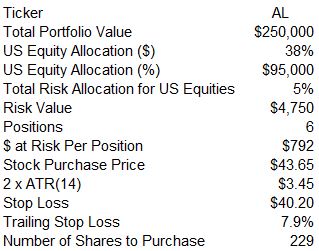

Risk-Based Position Sizing

I have been asked to demonstrate how I determine the number of shares to purchase so I will provide the details below based on a portfolio size of $250,000.

The first step in my calculation is determining the percentage of my portfolio to allocate to US equities. I use a number of momentum strategies (aka tactical asset allocation) to arrive at allocations for each asset class. Currently, my allocation to US equities is 38%, and thus for my example $95,000 is allocated to US stocks.

The next step is a calculation of the risk value for my US equity holdings which is a personal choice and I am going to use a risk allocation of 5% in my example. I will assume that I will hold stocks in a maximum of six companies. $95,000 x 5% = $4,750. The dollar value of risk per stock position is $4,750 / 6 = $792. I divide $792 by 2 x ATR(14) to calculate the number of shares to purchase. ATR(14) is the average true range of the stock price over the past 14 days. 2xATR(14) is a common value to use when setting a stop loss. The stop loss is generally Purchase Price – 2xATR(14) which in my example is $43.65 – $3.45 = $40.20.

After the purchase is complete, I could set a hard stop loss of $40.20 or a trailing stop loss of 8%. My choice is to select the latter.

If the concept of ATR is new to you, here is a helpful article on the StockCharts site.

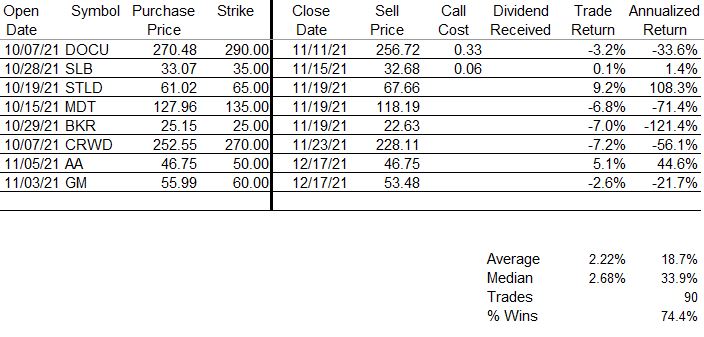

Covered Calls Update

The table below provides trade details for my recently closed covered calls as well as a summary of covered call trades that I completed in 2021.

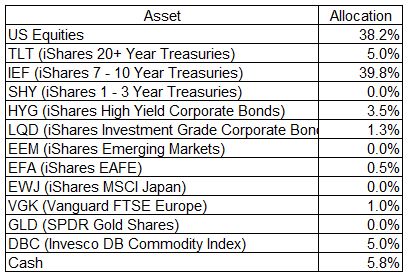

Asset Class Allocations for ETF Investing

My tactical asset allocation model currently has allocations as provided in the table below.

Open Trades

My open trades can always be viewed here.

0 Comments