“In investing, what is comfortable is rarely profitable.” Robert Arnott

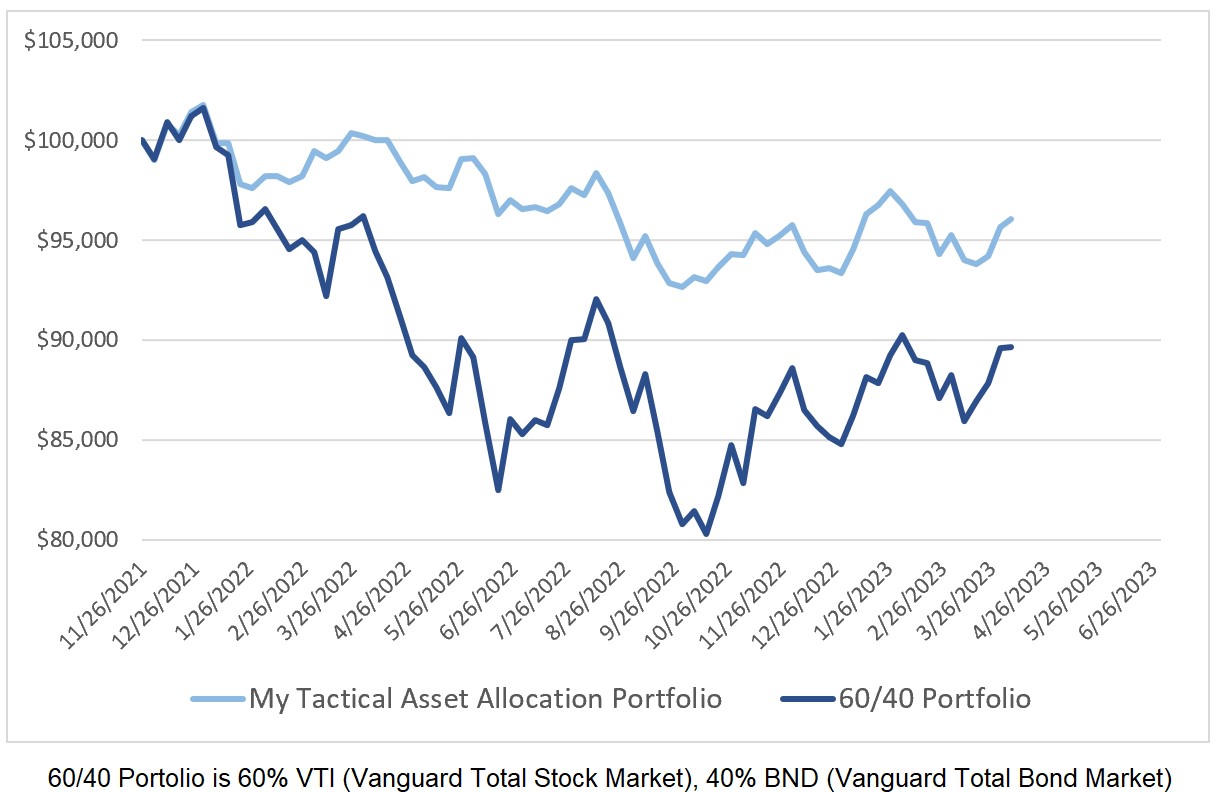

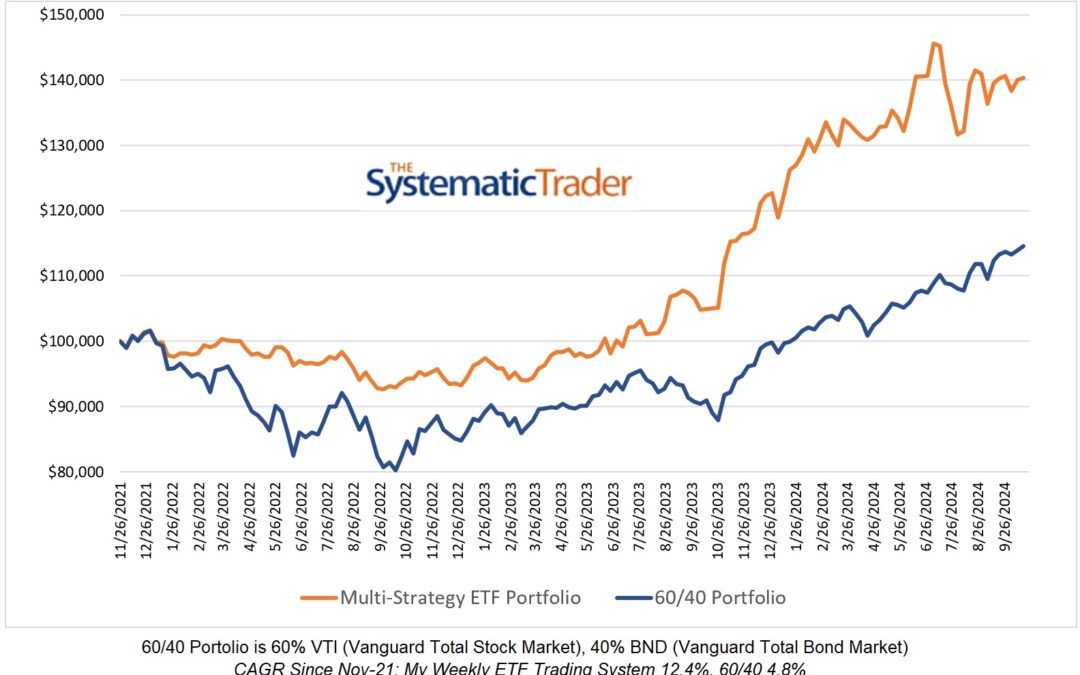

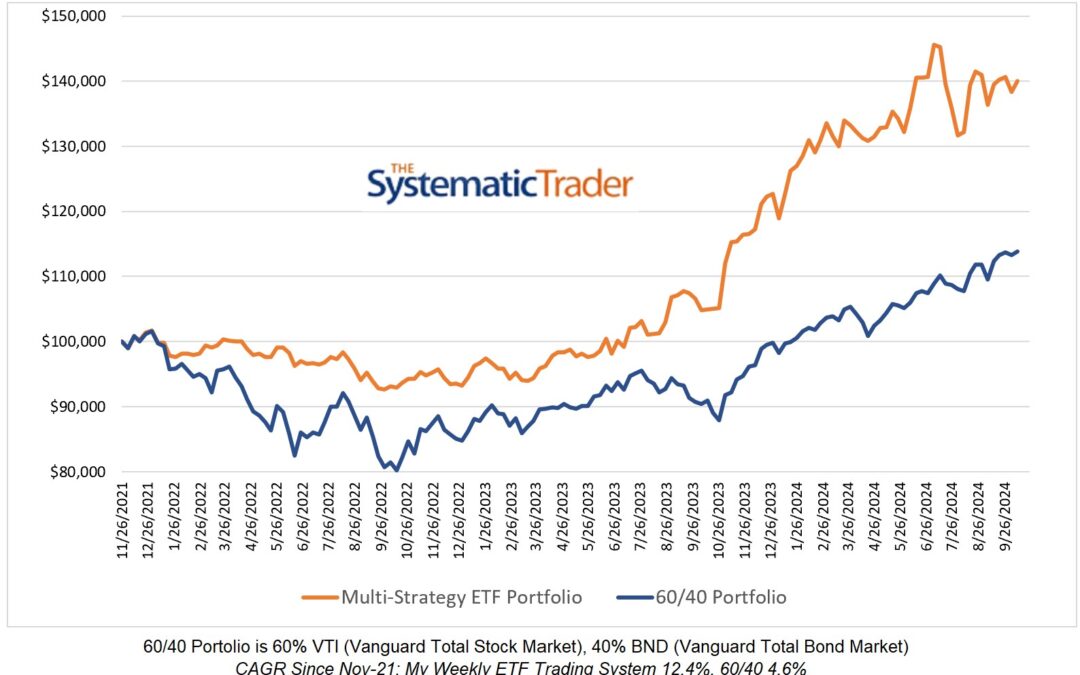

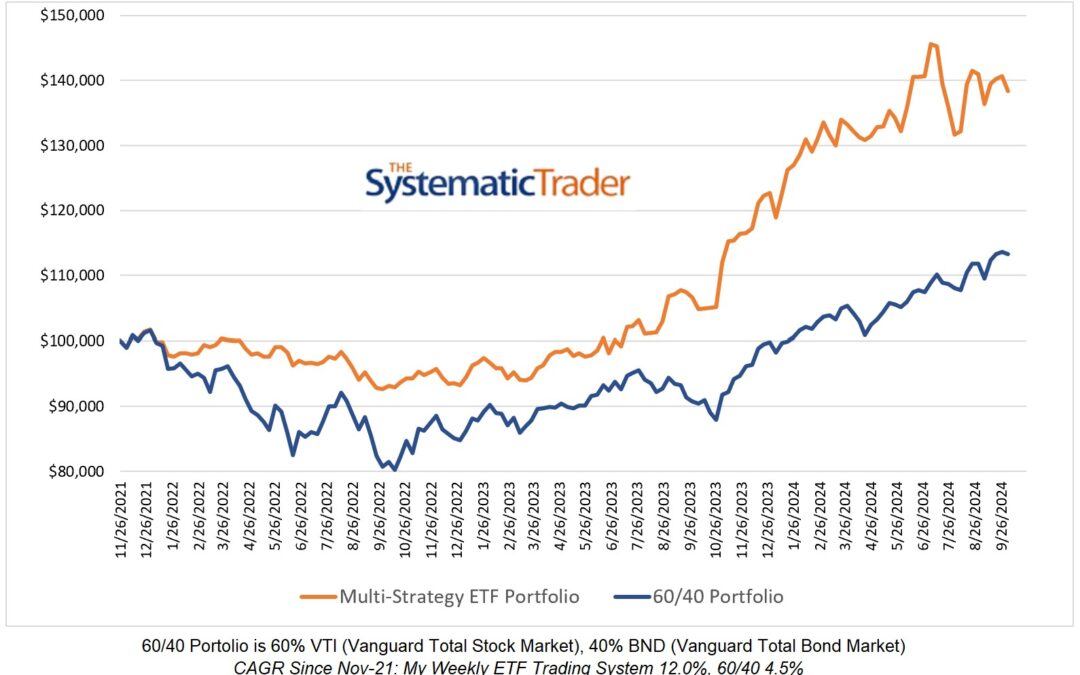

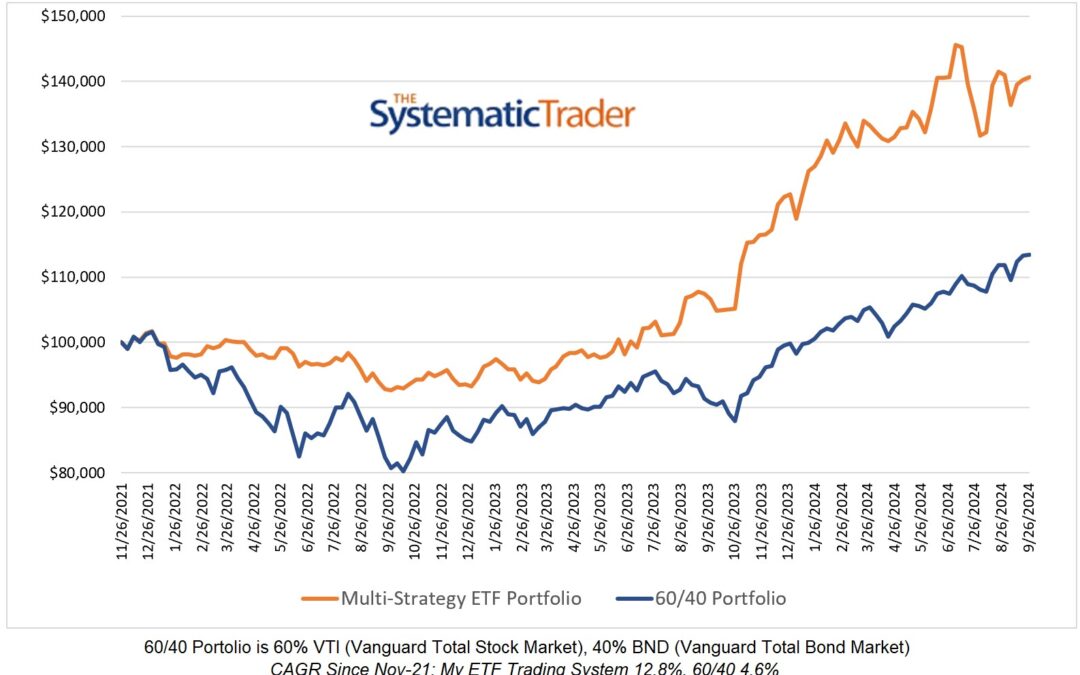

I like that quote by Rob Arnott but I think he meant something more specific than “rarely profitable”. For example, investing in CDs or GICs can be both comfortable and profitable. I believe what Arnott meant is that if you never feel uncomfortable with your investment holdings then you will never beat the market (let’s assume that the 60/40 portfolio is “the market”) over a long period of time. As an investor who uses systematic strategies to select ETFs and the allocations to each, I recognize that my personal biases can lead me to question the allocations. Those biases emanate largely from financial media and even social media. For instance, if I come across many articles from trusted sources in financial media stating that US equities are very overvalued and due for a correction, it may feel uncomfortable to increase my allocations to US equities based on my models. If you are new to tactical asset allocation, you will experience unease with the model’s allocations at times. I have been using multiple TAA strategies for long enough to not allow my biases to override the models.

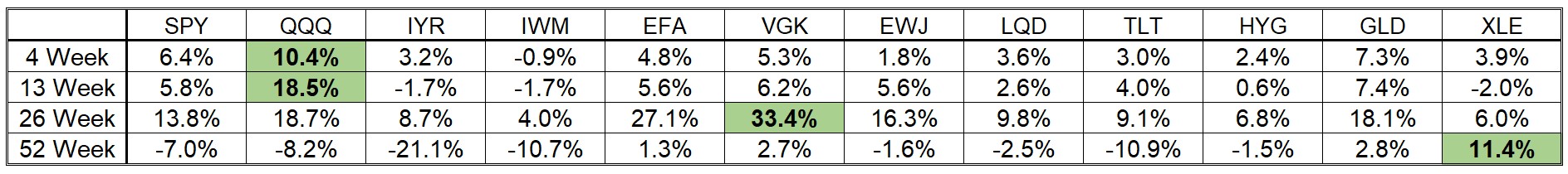

ETF Performance

The table below provides the past performance over the past year for a select group of ETFs that I use.

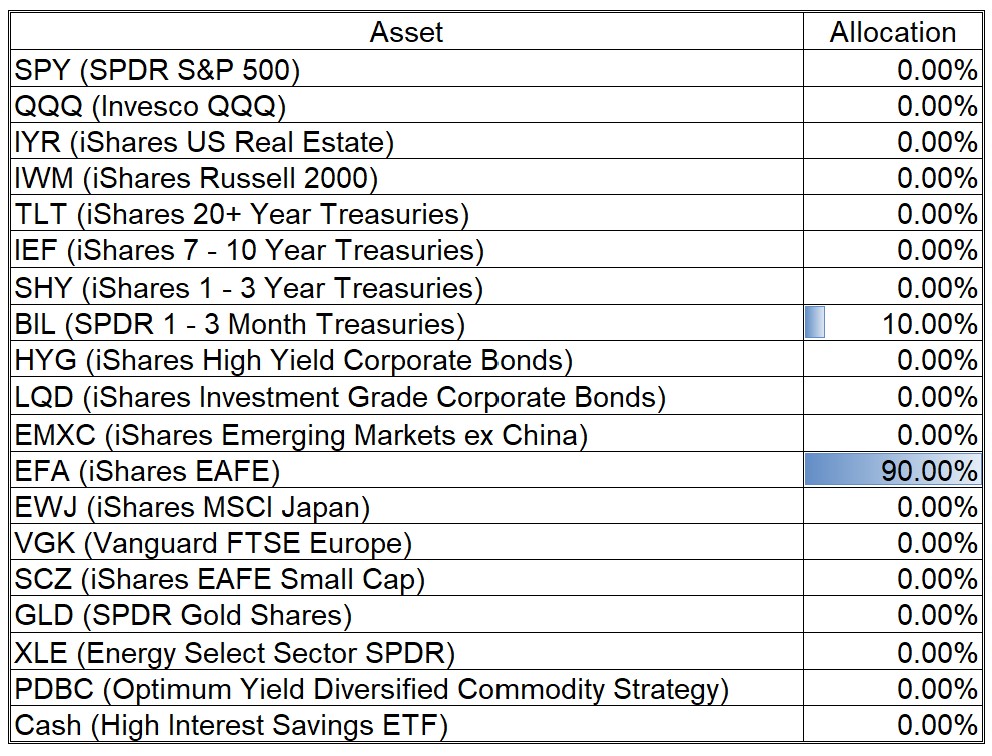

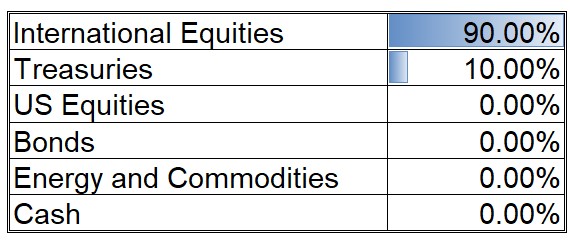

Tactical Asset Allocations for My Models

The move away from Treasuries and into equities continues this week with a current allocation of 90% to EFA and 10% to BIL.

0 Comments