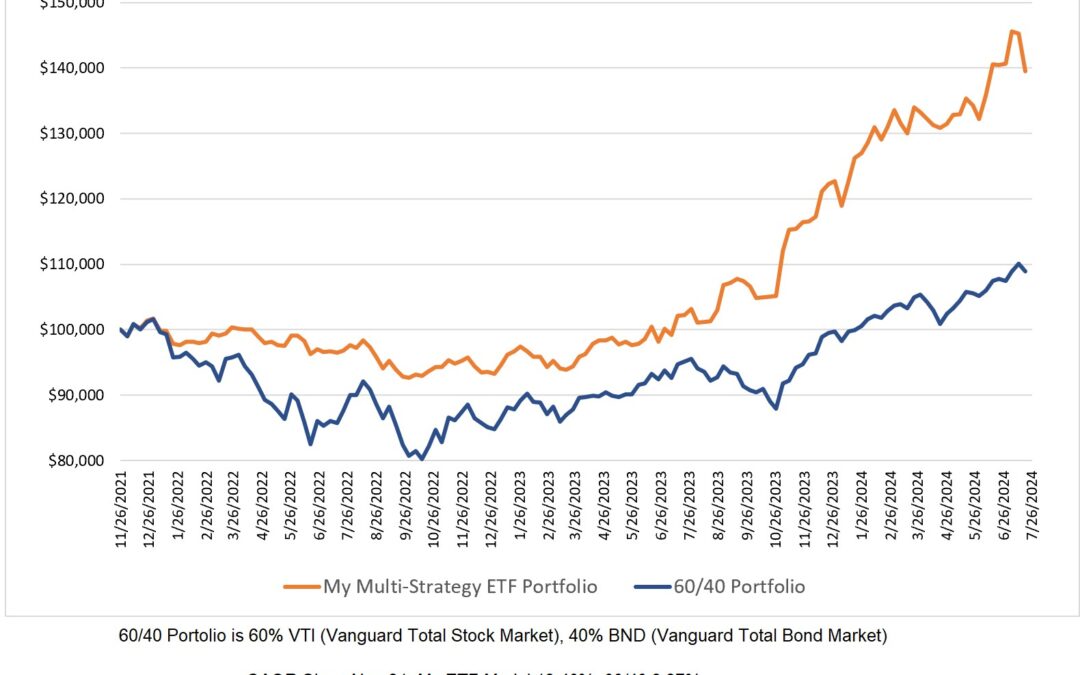

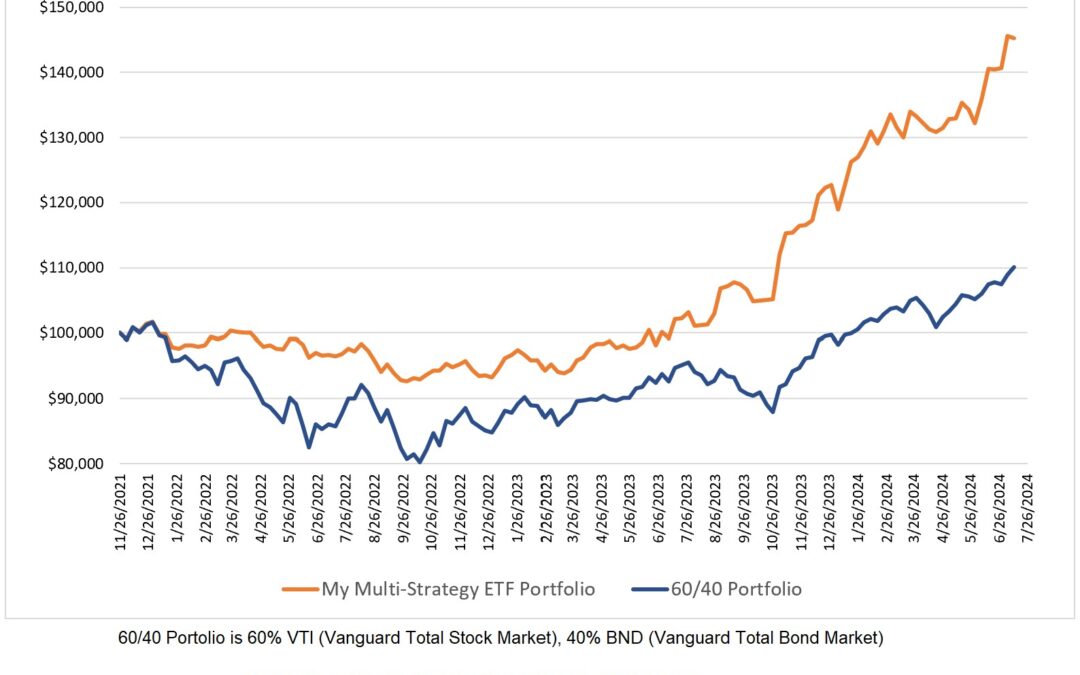

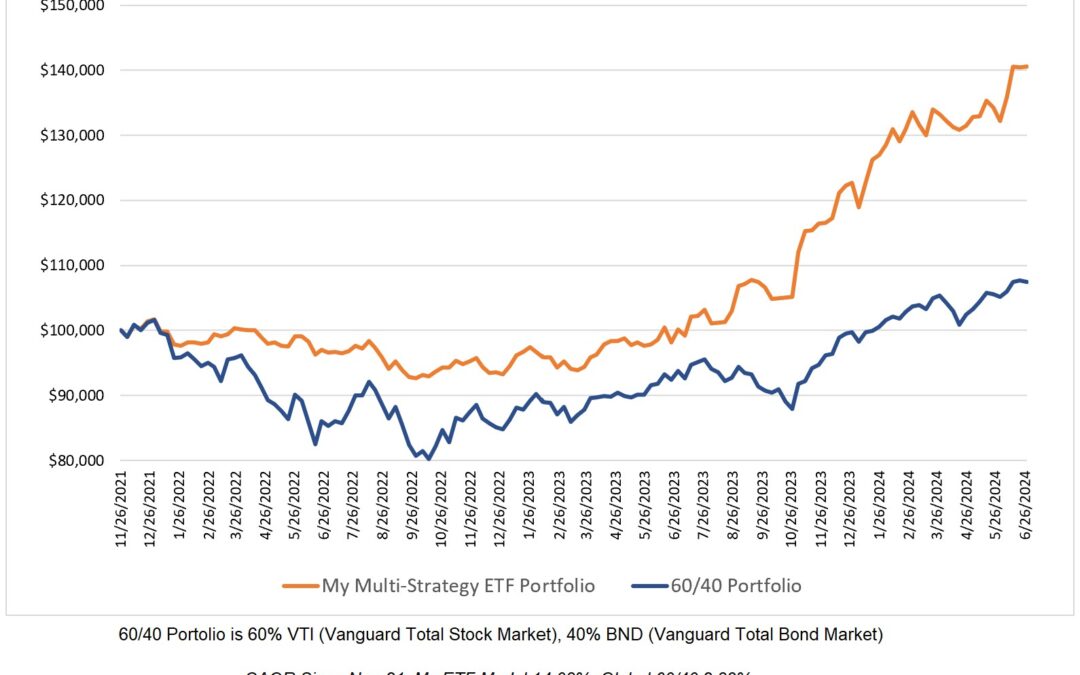

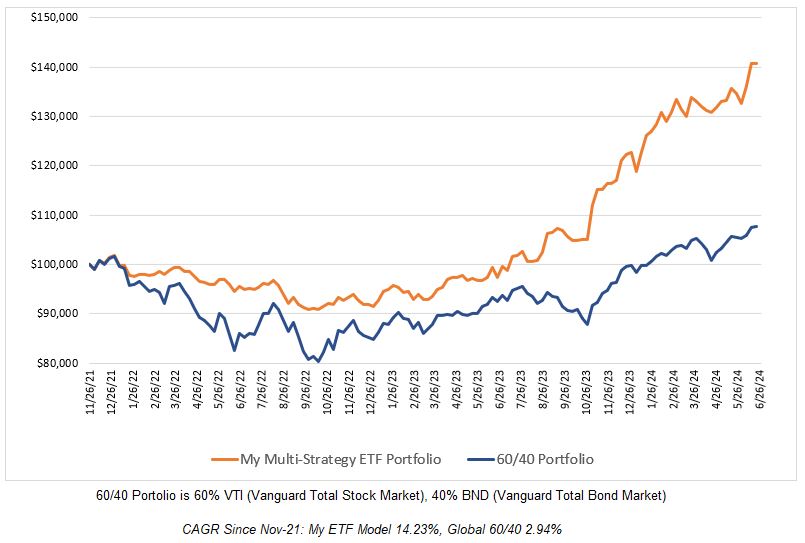

Comparison With Professionally Managed Money

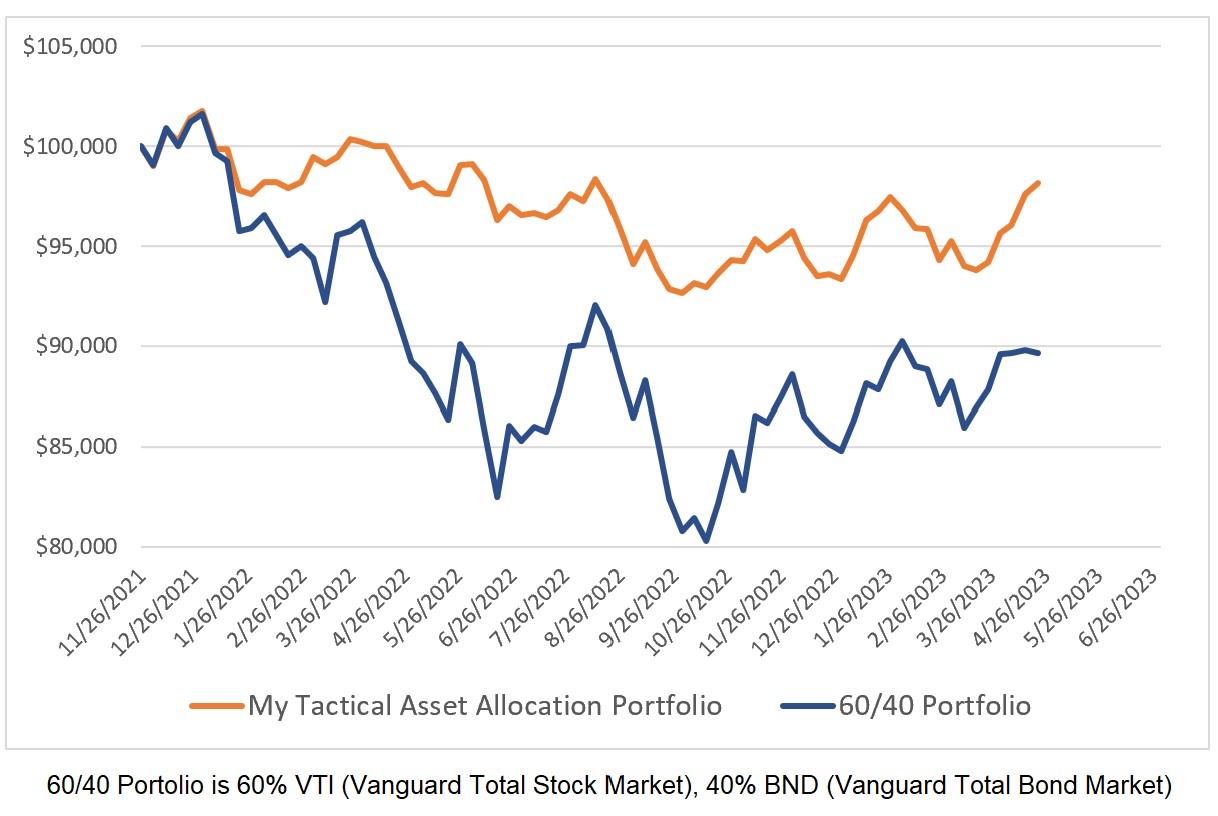

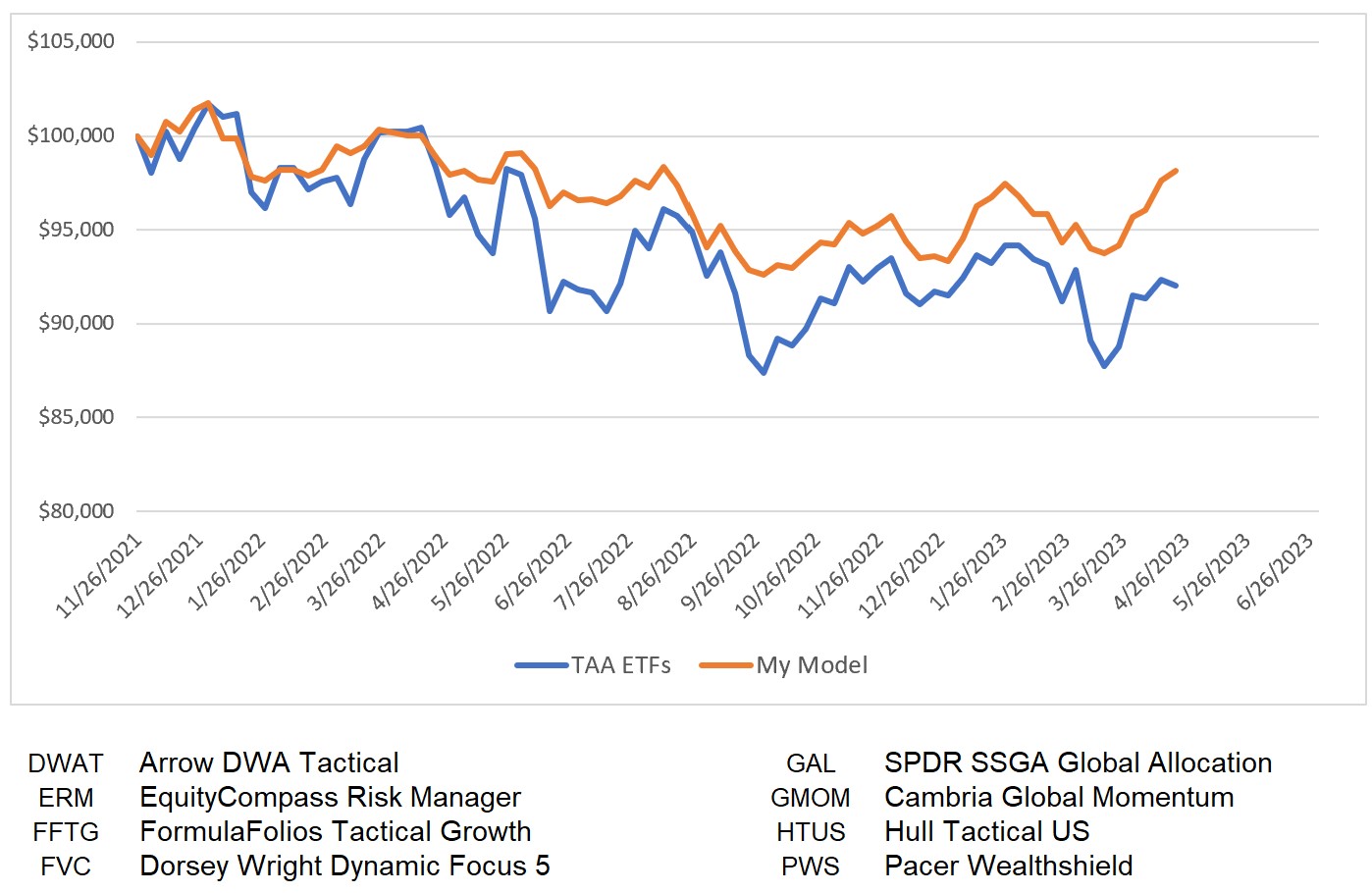

I compare the performance of my weekly ETF allocations to both the 60/40 portfolio (see chart above) and to an equal-weighted portfolio of eight tactical asset allocation ETFs. The results so far are positive as my investing model has outperformed both portfolios.

Market Meter

My Market Meter reading continues to be above zero and that usually means my investing strategy will produce a positive return in the next month.

Based on the performance of my current active investing system, the 28-day return when my Market Meter is positive is 2.0% versus 1.0% when it is negative. This is based on the historical performance from Sep-18 to the present.

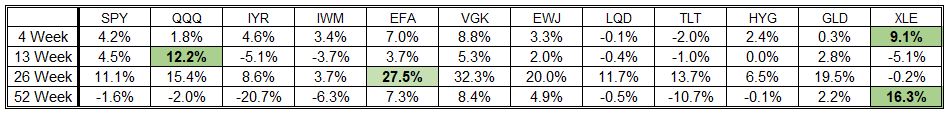

ETF Price Performance for the Past 52 Weeks

The energy ETF continues to have the best return in the 4-week and 52-week periods.

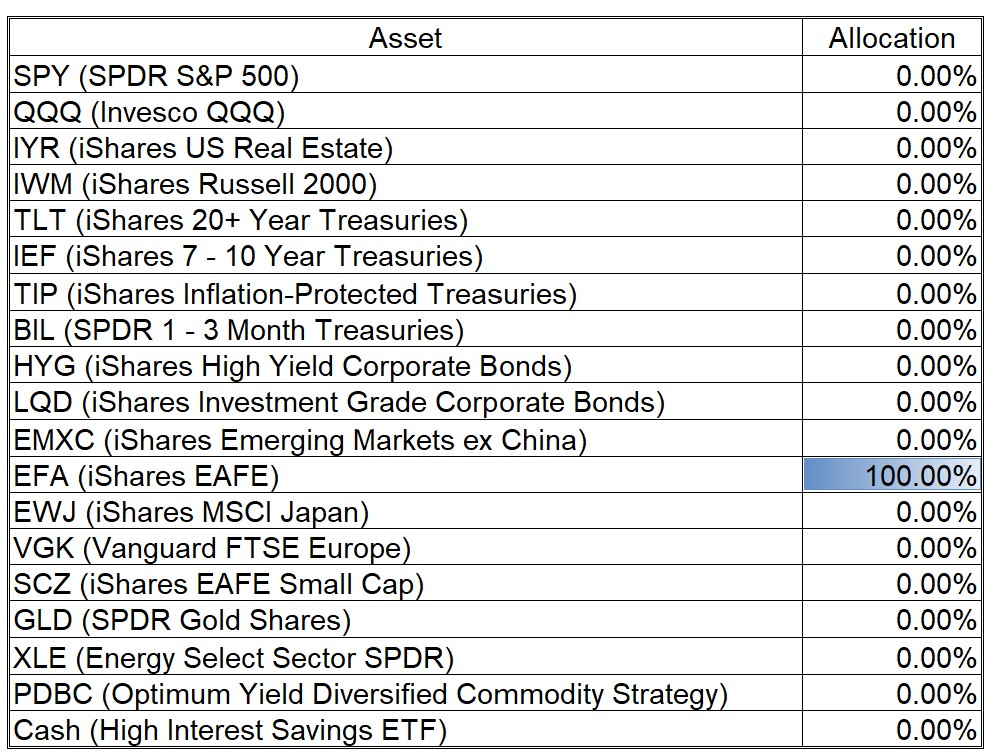

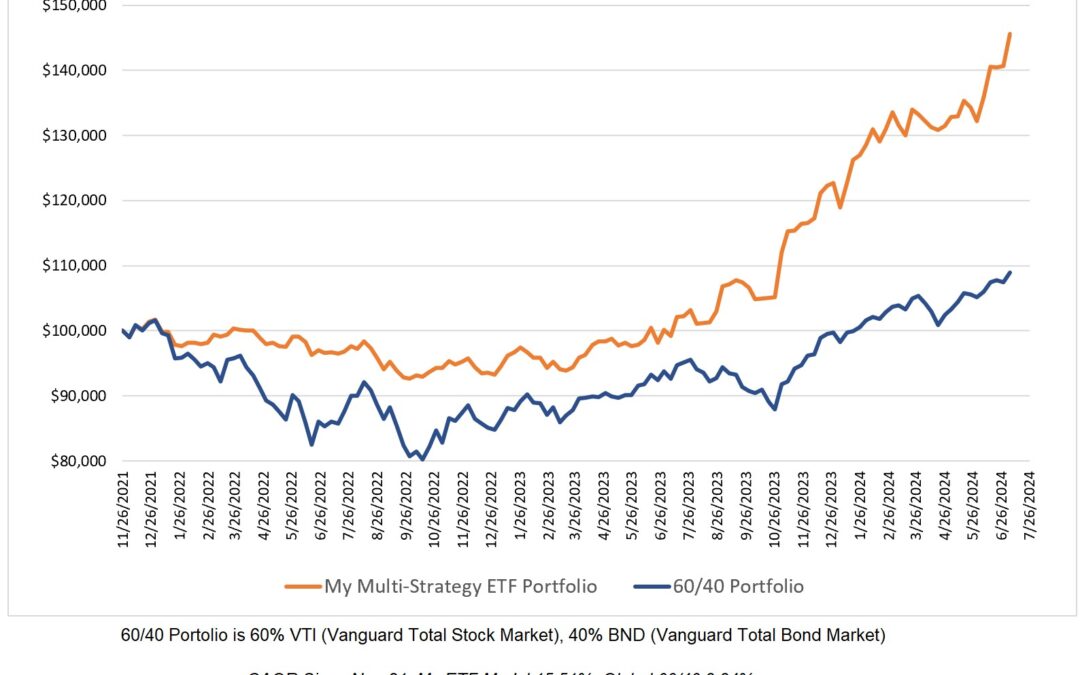

ETF Allocations

There are no changes in the ETF allocations this week.

0 Comments