Successful trading isn’t easy nor is it supposed to be but the difficult part of trading may not be what most new traders originally anticipate it would be. Sticking to an investment strategy is likely the most difficult part of trading. Why? All investment strategies suffer from drawdowns, they all underperform for a period of time relative to their benchmark or other strategies, some strategies are boring, you can’t easily determine if strategies that trade infrequently are broken, you will often wonder if you should tweak the rules, you will read about backtests of new strategies that are much better than your strategy, etc.

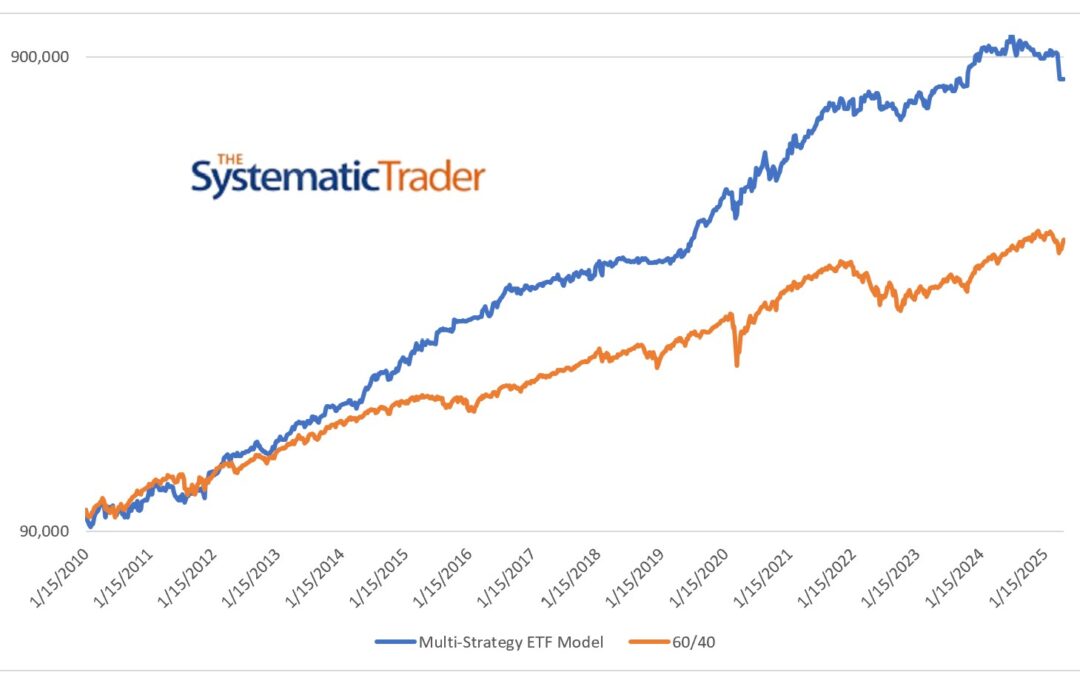

There are innumerable strategies that will provide returns with satisfactory risk profiles. Meb Faber has written extensively about some of those strategies and how, in the long run, many of them provide very similar returns. The key point is that the strategies provide similar compound annual returns in the long run. For the strategy chosen by a new trader, there absolutely will be varying levels of performance in the short term and those variances will cause most traders to abandon their strategy and try the new flavor of the month.

Many DIY investors are likely to tune in to the financial media on a daily basis. The financial media has the wonderful benefit of hindsight and plays that card extraordinarily well. The next time the stock market is off by more than 1% during the day, watch any of the financial media outlets and they will have talking heads on explaining why the market is going down. Likewise for a strong positive day. The media play on the public’s tendency to seek confirmation bias – the market is going up so they, the financial media, have to convince the viewers that they understand why it is going up and appear as if they positioned their investments to take advantage of the market move.

This daily explaining of why the market just moved as it did creates the illusion that there are “investing professionals” who know what is going to happen next in the markets. The truth is that nobody knows what will happen next. Nobody. For your own interest, the next time a talking head impresses you with her market analysis, look up the performance of her fund(s) if she is a fund manager. I’m willing to bet you that will not be as impressed as you were based on her market commentary.

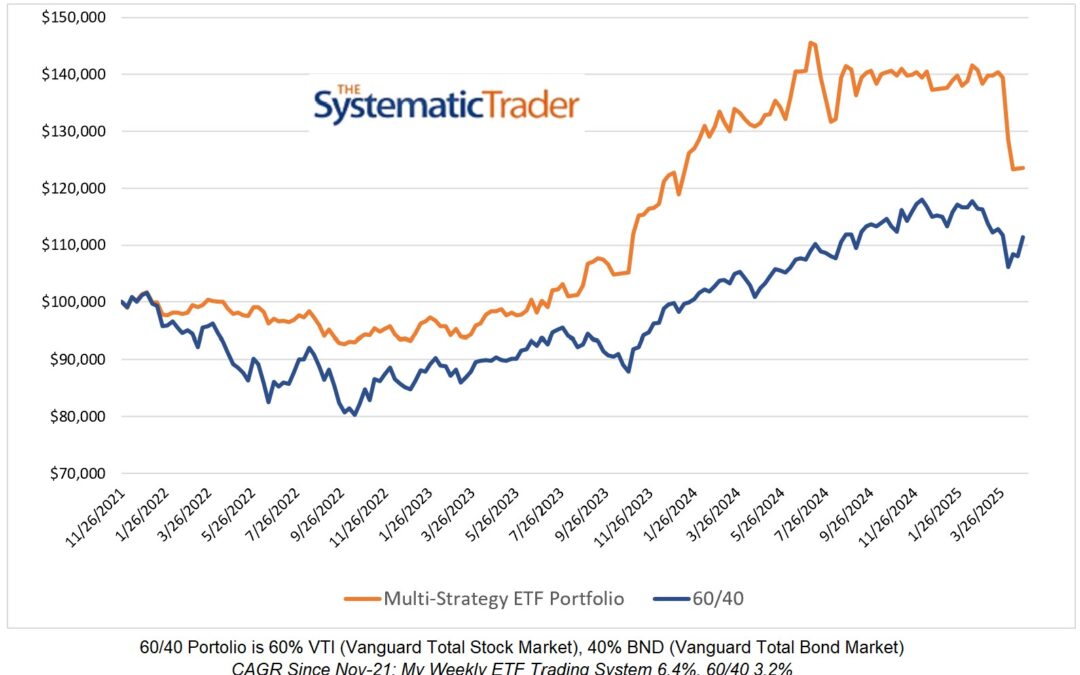

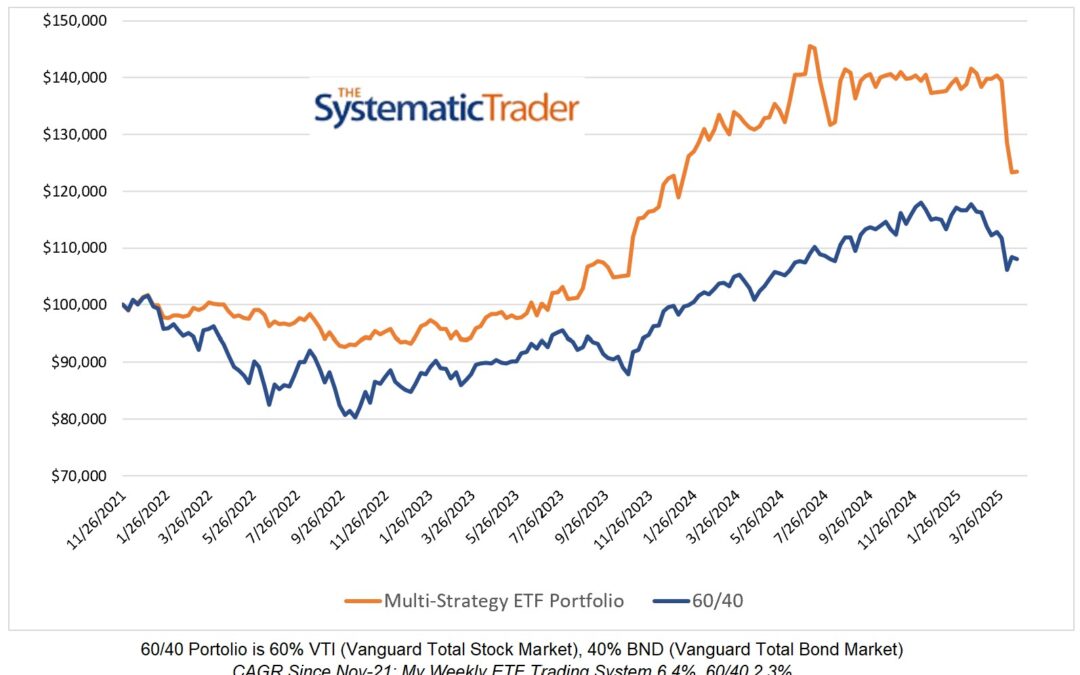

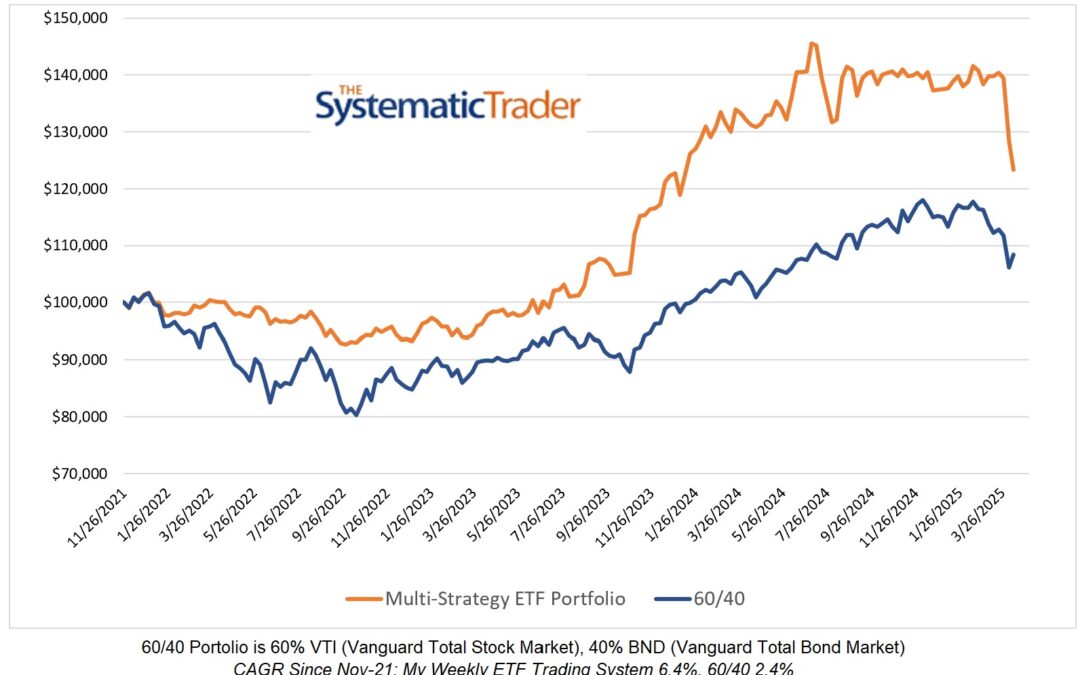

The psychological stress of a draw down may be the most difficult part of trading. My way of dealing with a draw down is to stop looking at my equity curve. That approach was discussed by Andrea Unger recently on the Better System Trader podcast when he advised listeners to stop looking at a draw down as the best way to cope with it. I recently incurred an 11.4% draw down in a little over two weeks. Of course, that wasn’t pleasant but since I trade at the end of the month only and do not use stop losses, my trading strategy did not call for me to take action. Looking at the draw down each day would have been painful so I ignored it. Fortunately, my equity curve bounced back to recover much of the draw down.

Another method of coping with draw downs and underperformance is to focus on process over outcome. Experienced traders recognize that they have zero influence over the outcome of a trade but they have complete control over the process. Strings of consecutive losses can and will happen to all traders. Expect it and understand that it is normal. However, you have to stick to the process of executing your trades and following your trading plan.

Successful trading isn’t easy but it sure is worth the effort.

I like this sentence, “…coping with draw downs and underperformance is to focus on process over outcome.” When I really analyze my trading results, this is where I always fall down. We get myopic on the results each and every time, rather than understanding and believing in the system and then letting that system do the work. If the strategy is sound, then over time you should be ahead.

My style of trading is simple but it isn’t easy. That is true for other types of investing as well – the psychological side of trading is what defeats most traders. Also, it is very difficult to differentiate between a system experiencing a normal period of underperformance and a system beginning to fail because it is no longer in sync with the market. One must have a high degree of confidence, not faith, in a system to stick with it when it underperforms per a period of time measured in years. Every style of trading has periods of poor performance and that is when many traders switch to a style of trading that is currently more favourable.