The style of investing I use is most commonly known as Tactical Asset Allocation (TAA). The majority of investors who employ this style of investing with liquid ETF’s probably reallocate at the end of each month. Personally, I reallocate three times each month for a more robust investing methodology.

Very recently, as a means of producing additional investment income, I added a new component to my methodology which involves selling options on the more liquid ETF’s that I hold. I sell cash secured puts and covered calls. The rationale behind this component of my strategy is that the ETF’s I hold are most likely to rise in price in the very near term or, at the very least, not decline meaningfully. That being the case, properly selected puts with 30 to 50 days to expiry remaining should expire worthless more often than not.

Covered calls are a little different in that the ETF’s I hold should increase in price in the next 30 days or so and calls sold at a similar delta as the puts I sold are more likely to be exercised (i.e. the ETF units would be called away by the purchaser if the price of the ETF is above the strike price on expiry day).

At this point, I won’t get into how I select the puts and calls to sell other than to say I pick appropriate days to sell the options. In my opinion, not every day is a great day to sell either a put or a call.

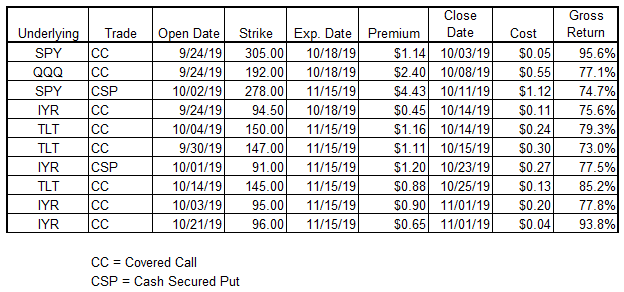

The table below illustrates the small number of option trades that I have closed so far. Please note I do have open trades and some of them are in losing positions. If I closed out the losing positions at the time of writing this post I would have an overall positive result (i.e. my option selling would have produced positive income).

If you have some knowledge of option strategies you would recognize that selling a put and a call with the same expiration date is a short strangle. At a most basic level, that is what I am doing. A common short strangle approach used by options traders is to sell 30 delta puts and calls in equal numbers on the underlying stock or ETF and buy them back when a profit of 50% or 75% is achieved. Looking at the Gross Return column in the table above you will note that the lowest gross return so far was 75.6% so that gives you a very good indication of the profit return which will trigger me to close out the option.

In the future, I plan to provide updated tables for my closed option trades and time will tell if my selling puts and calls on the ETF’s I hold will prove to be a sustainable means of producing additional income within my investment portfolio.

All the best.

0 Comments