OptionStrat is a new free site for analyzing almost every imaginable option trade in near real-time. Fortunately, the site allows the user to enter an option trade to analyze and then share a link to same which I will do below.

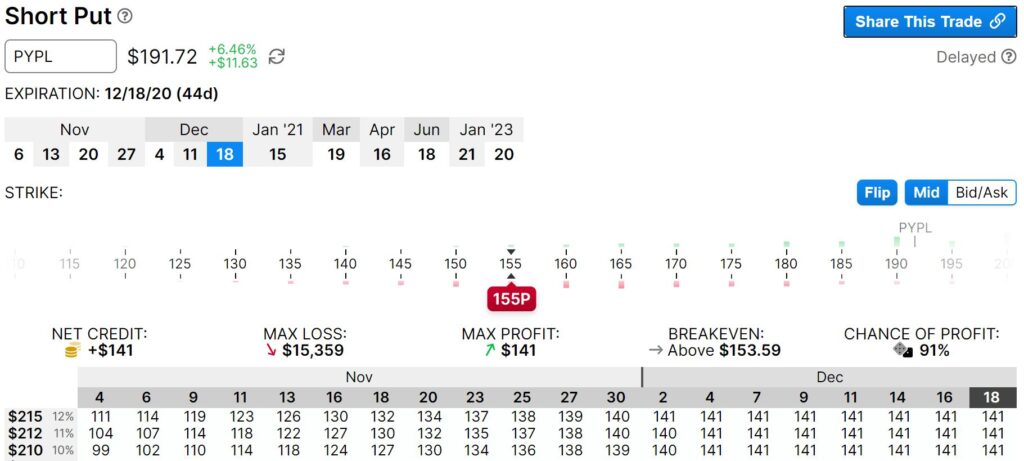

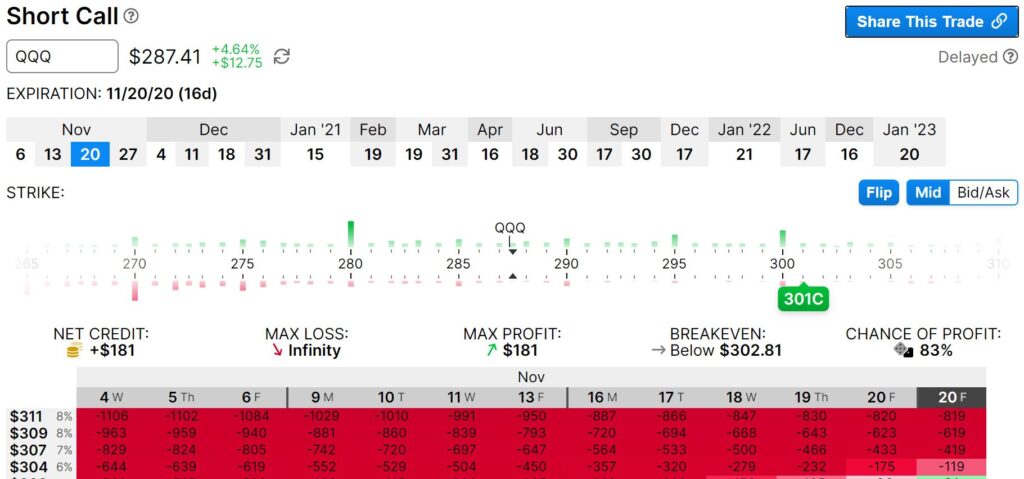

Today, I sold two options: a PYPL Dec-18 155 put and a QQQ Nov-20 301 call. Prior to selling both options, I set them up on OptionStrat.

If you click on the link above, you will be taken to OptionStrat and will see the following:

The PYPL put had a delta of -0.11 and OptionStrat shows the naked put trade as having a 91% probability of profit (POP).

Clicking on the above link will reveal the following table on OptionStrat:

The QQQ call had a delta of 0.22 and OptionStrat shows a POP of 83%.

If you wish to see the traditional style option profit/loss graph, you can do so by clicking on a button the below the table.

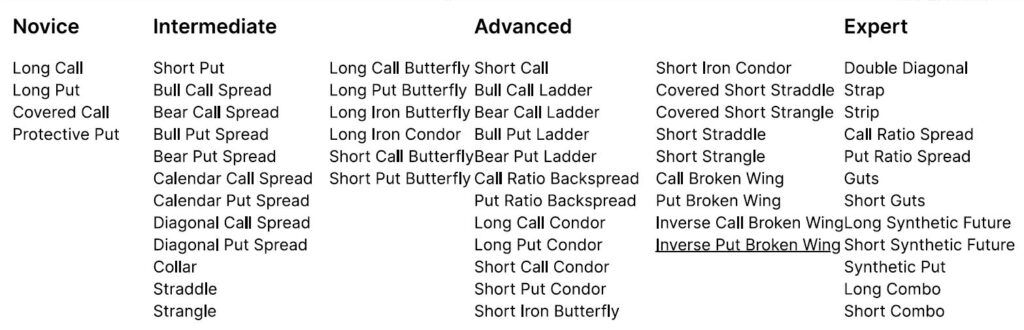

The image below shows the current exhaustive list of option strategies which can be set up on OptionStrat:

Rather than me writing a review of what OptionStrat can do, I suggest that you head over to that site and try it out. FYI, I did email a question to the site administrator and received a response the same day so I would suggest that you not hesitate to click on the Contact link if need info.

All the best in trading and in life.

0 Comments