With all the chatter on Twitter lately about jaw-dropping gains in the prices of Tesla and Bitcoin, writing a post about selling put options feels excruciatingly boring! It’s as though I am in a community of one.

Mind you, there is a small portion of my investment portfolio that is certainly exciting but my posts here are a means of me keeping myself honest about the value (or lack thereof) of generating income through collecting put premiums every month.

I know that I sound like a broken record (for those of you old enough to remember what happens when you have a deep scratch on a vinyl record) when I say that the US equity markets continue to provide excellent opportunities for selling put options on stocks.

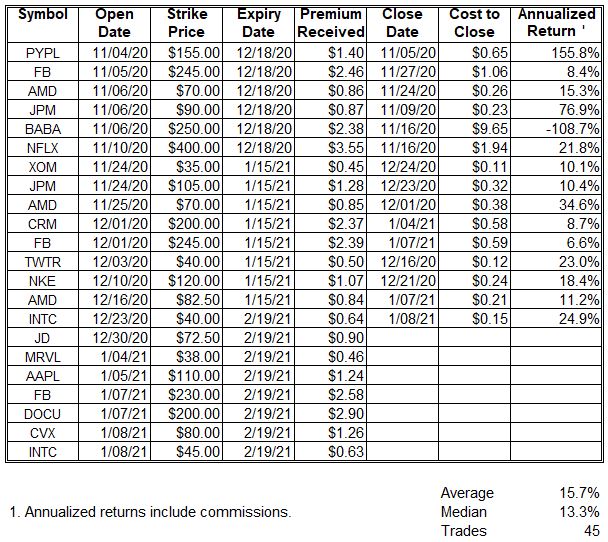

Since I began posting my put option trades here on my humble blog last year, I have closed 45 trades and have a median annualized return after commissions of 13.3%. If you trade on one of the ultra-low commission online brokerages, your returns should be better than mine. I pay higher fees than I would if I switched to Interactive Brokers but I may get better fills.

For those of you who aren’t fully familiar with naked put options, I am using the holdings in one of my investment accounts as collateral for these trades. I am not tying up any capital by selling put options. I could have 100% of my account invested in ETF’s and still sell naked puts using the ETF’s as collateral. You could consider selling naked puts as a side hustle. Essentially I am selling insurance in that I am assuming risk and am being paid to do that.

All the best in life and trading.

0 Comments