Selling put options for income certainly doesn’t rank up there with all the excitement recently in short squeezes and cryptocurrencies but, then again, it shouldn’t. If you arrived at my site looking for excitement, you are going to be beyond disappointed!

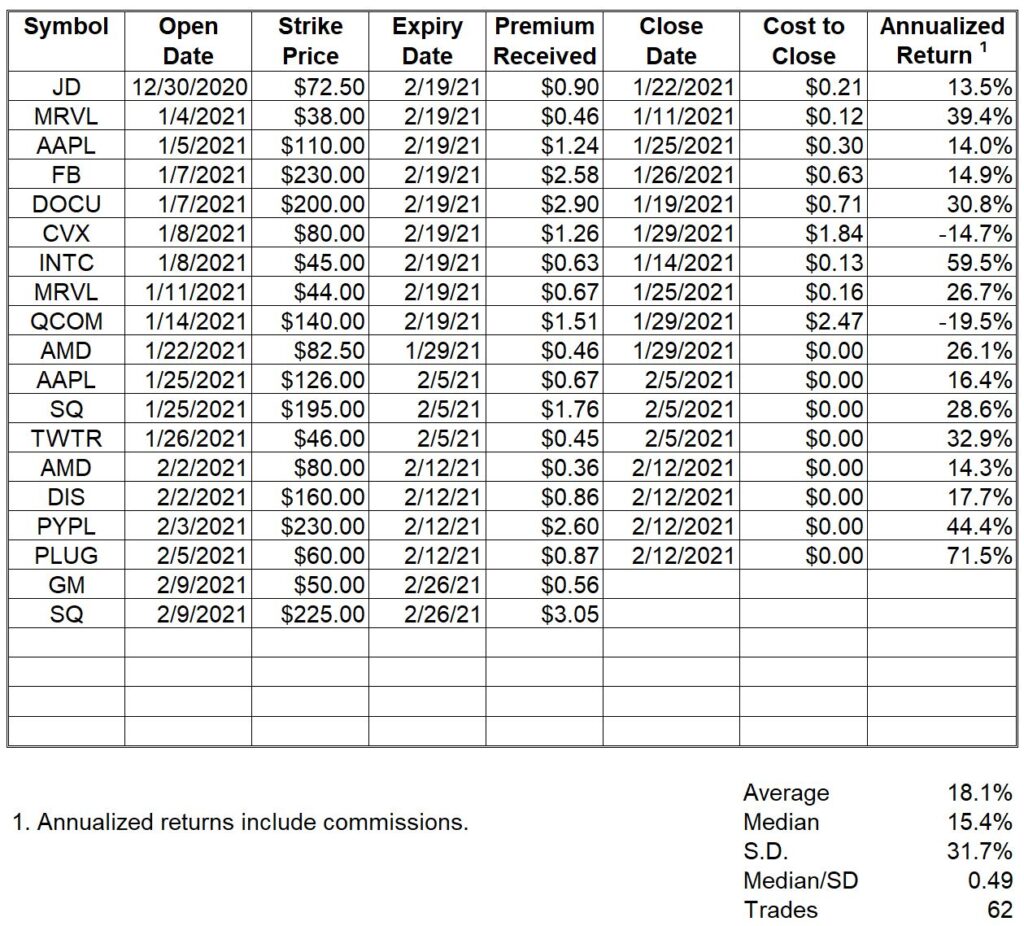

Selling relatively short-dated naked put options on US stocks using the holdings in my investment account as collateral is a means of generating extra income and so far, so good as the table below shows.

On February 12, four of the naked put options I sold earlier expired worthless leaving me with two open trades.

A trade statistic that I consider is Median Return / Standard Deviation of Returns. This is an indicator of the quality of the trades and, as a trader, you want the value of this calculation to be high given that you want a high median return and a low standard deviation. As of right now, the standard deviation for my naked put trades is 31.7% giving me a value of 0.49 for this calculation. My goal is to improve that by both increasing the median return and lowering the standard deviation.

All the best in trading and in life.

0 Comments