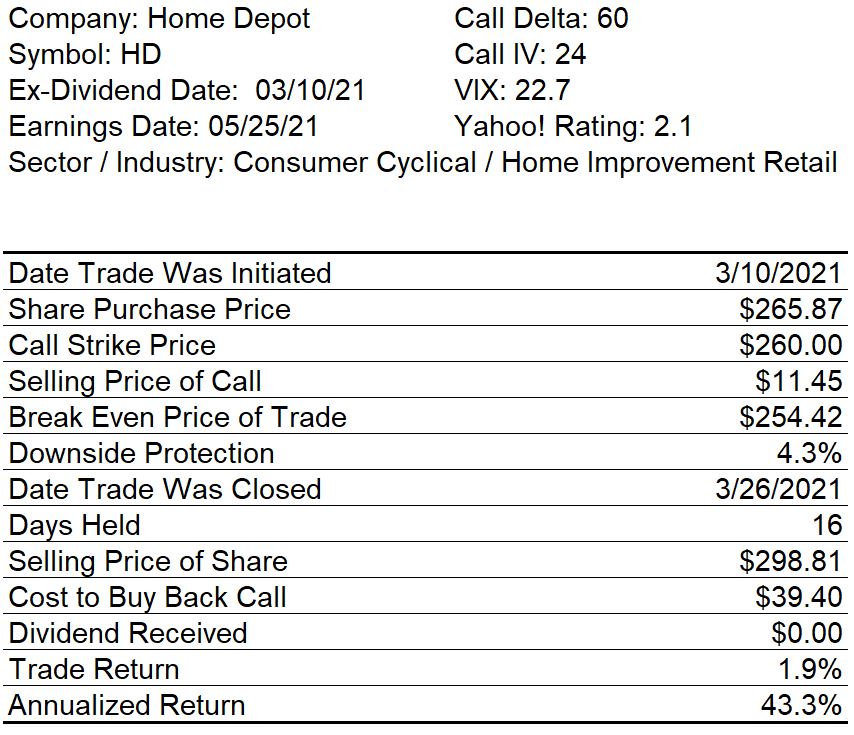

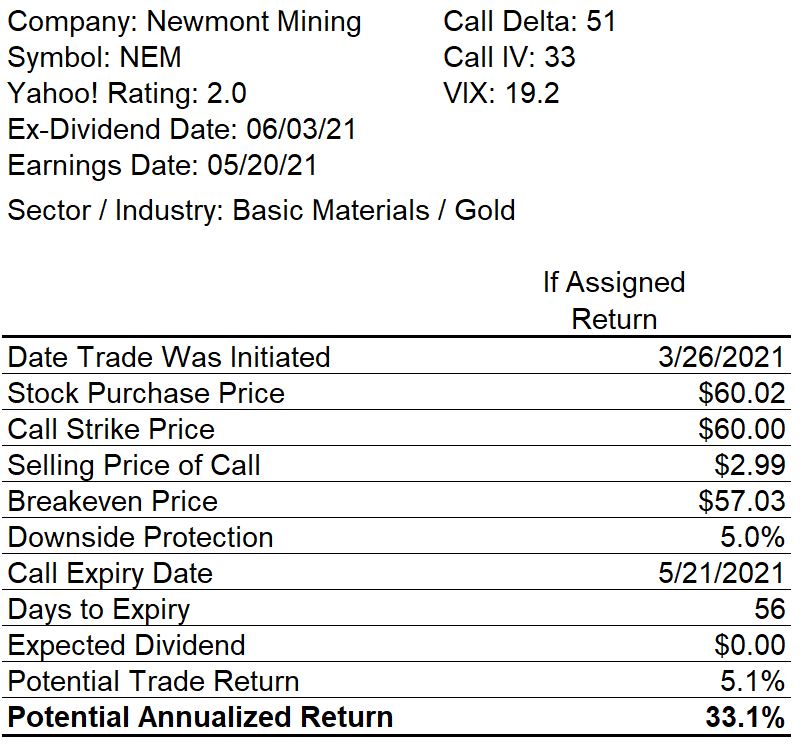

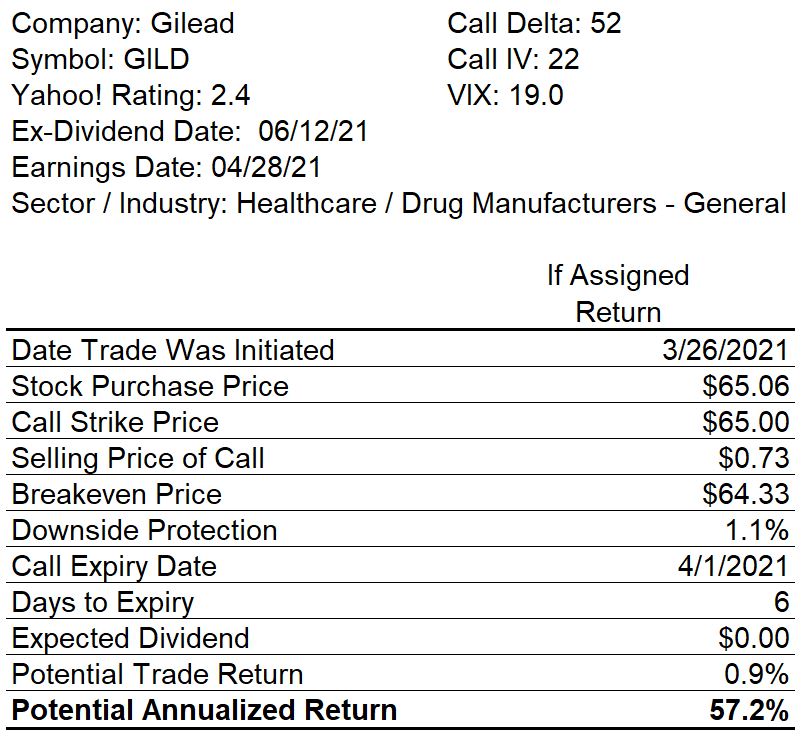

Yesterday, I saw an opportunity to close my Home Depot Apr-16 $260.00 covered call trade early and achieve a higher annualized return than would be achieved if I held the calls until expiry so I closed the trade for an annualized return after commissions of 43.3%. The cash which became available from closing the HD trade went, in part, to opening new covered call trades in Newmont Mining (May-21 $60.00) and Gilead Sciences (Apr-01 $65.00). The two new trades were essentially at-the-money (ATM) and have maximum annualized return potentials of 33.1% (NEM) and 57.2% (GILD).

Home Depot

Newmont Mining

Gilead Sciences

0 Comments