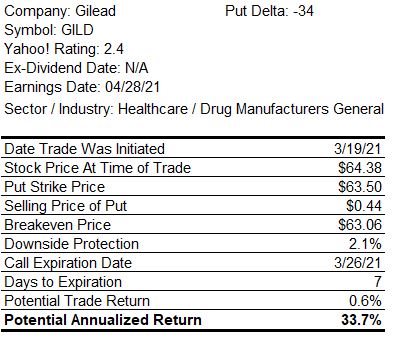

Gilead has been passing one of my covered call screens for the past week so I decided to sell short-dated naked puts on it. I sold Mar-26 $63.50 puts at a price of $0.44 each. If the price of Gilead closes above $63.50 on March 26 then I will have earned 33.7% annualized on the trade. Should Gilead close below $63.50 on the put expiry date then the shares will be assigned to me and I will follow that by selling covered calls.

0 Comments