![]()

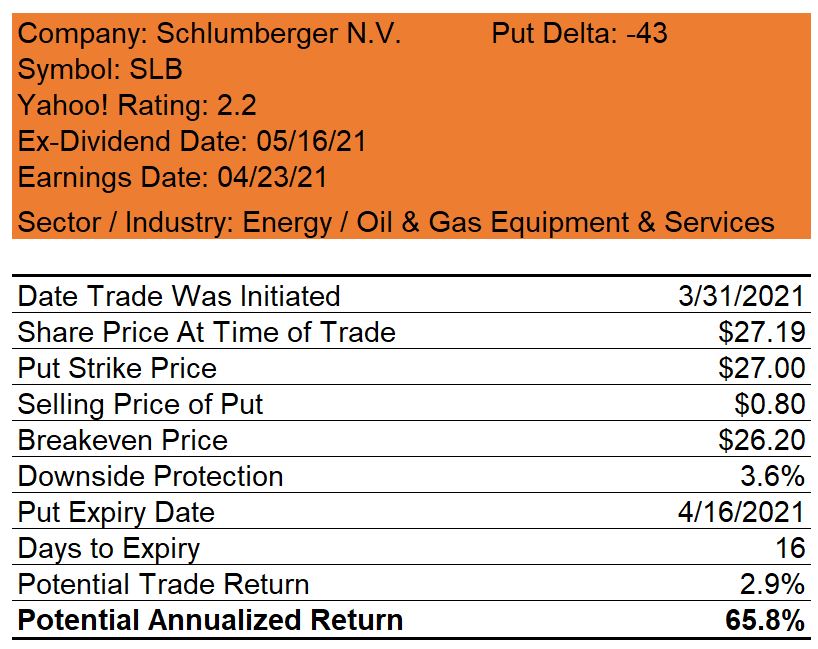

Schlumberger has been passing one of my covered call screens lately so I decided to sell Apr-16 $27.00 naked puts. As the strike price was just below the share price at the time of the sale, the premium I received was significant enough to provide an annualized return of 65.8% if the shares are not assigned to me. If the price of Schlumberger shares falls below the strike price on April 16 then I will receive the shares and proceed to sell May-21 covered calls with a plan to capture the May quarterly dividend.

0 Comments