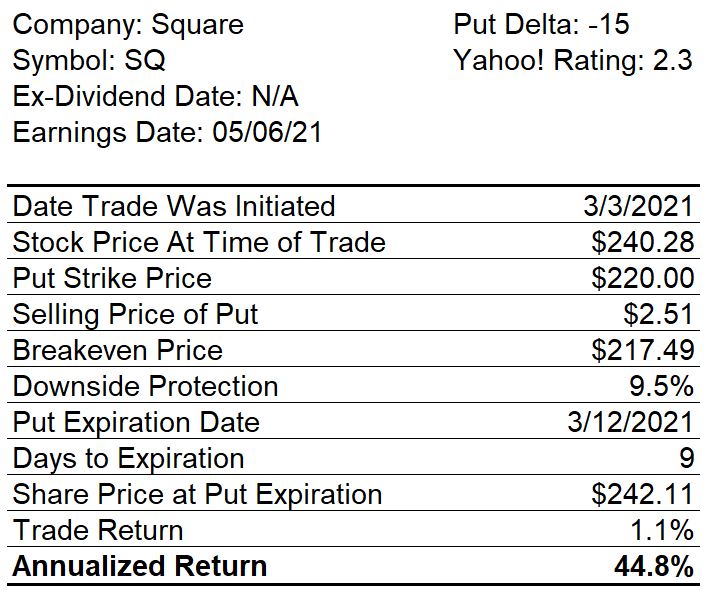

On March 03, I sold naked Mar-12 $220.00 puts on Square at a price of $2.51. As the price of Square closed on Friday well above the strike price of $220.00, the puts have expired and I will not be assigned the shares. This option trade generated an annualized return of 44.8%.

I also sold Mar-19 $230.00 SQ puts on March 02 for a premium of $3.55. If the price of Square is above $230.00 at the close on March 19, this trade will generate an annualized return of 32%.

One other open option trade I have is for Mar-19 $212.50 Boeing naked puts. Shares of Boeing are now at $269.00 so these puts should expire worthless and generate an annualized return of 29%.

0 Comments