![]()

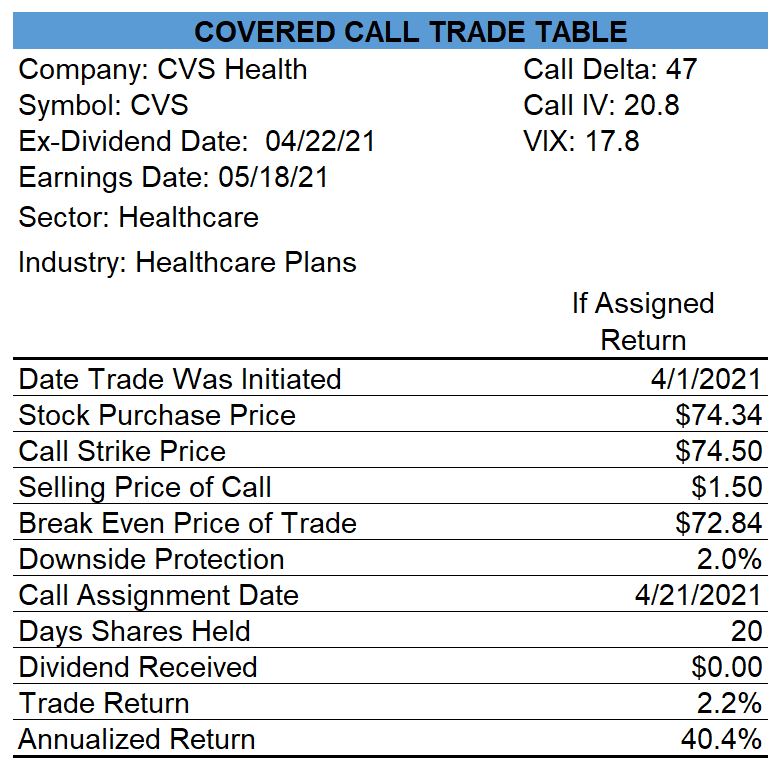

On April 01, I set up a covered call trade with CVS shares by purchasing the shares at $74.34 and then selling slightly OTM Apr-30 $74.50 calls. CVS had an ex-dividend date of April 22 and on April 21 the holder of the calls exercised their right to call the shares away from me in order to receive the $0.50 dividend. As the trade produced an annualized return of 40.4%, I am pleased with the result.

Since I began posting here about my covered call trades, I have closed 21 of them and have a median annualized return of 35.9% after commissions.

0 Comments