![]()

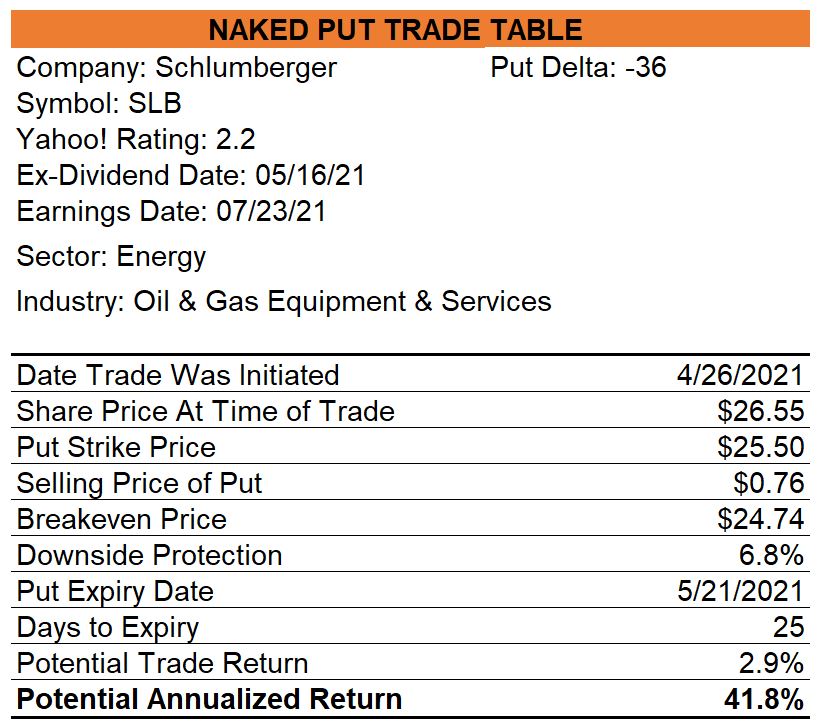

I noted in an earlier post how I established a covered call trade with Schlumberger May-21 $26.00 calls. Today, I set up what I refer to as a “partial covered strangle” by selling May-21 $25.50 puts. I use the word “partial” because I did not sell the same number of puts as calls. For this particular strangle, I sold 30% as many puts as calls. In a similar manner, I established a partial covered straddle (same strike prices for puts and calls) with Newmont Mining. These multi-leg option trades are my measured way of getting more premium out of the market.

0 Comments