June 07

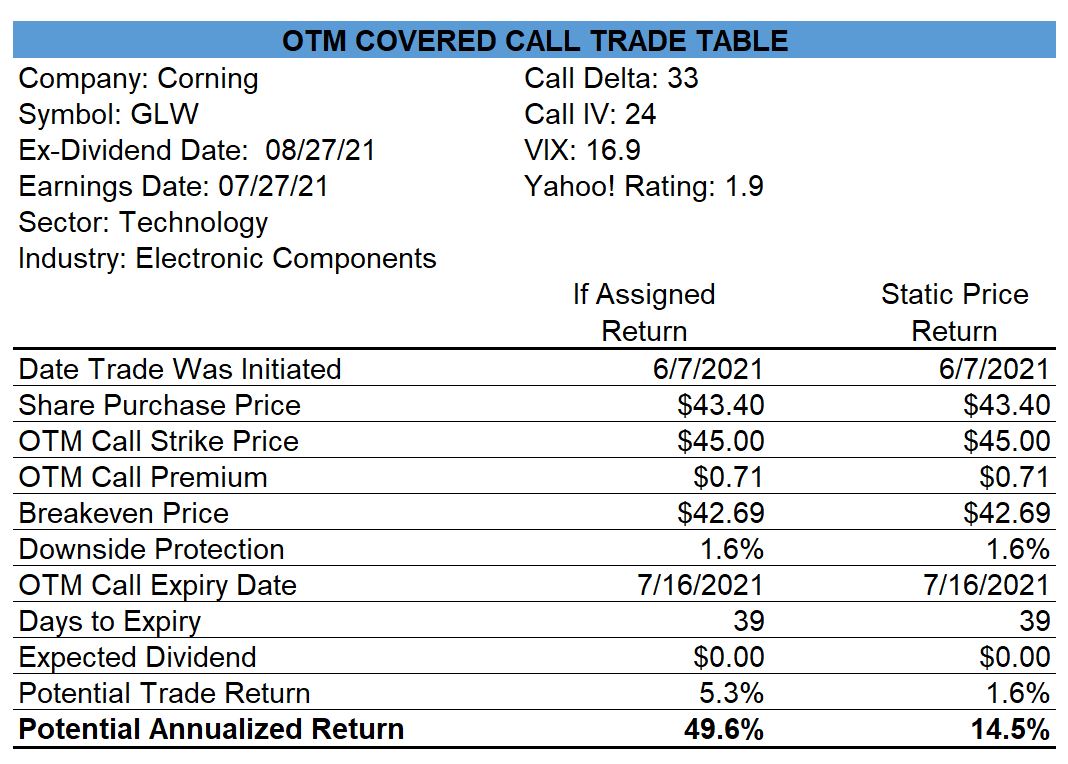

Corning

I am leaning towards selecting covered call strike prices as close to 5% OTM as I can get with the strikes that are available and have good liquidity. With that in mind, I purchased shares of Corning at $43.40 and sold OTM Jul-16 $45.00 calls.

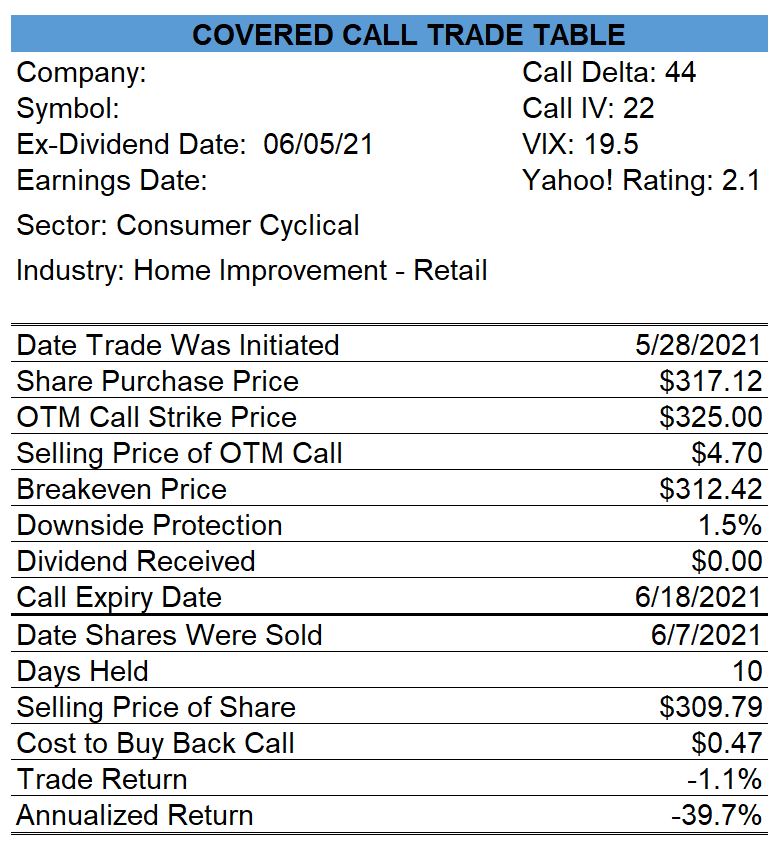

Home Depot

The share price of Home Depot fell since my purchase on May 28 and the Jun-18 $325.00 calls I had sold were down to 10% of the price I sold them for so I bought the calls back and sold my shares at a loss to close the trade.

June 10

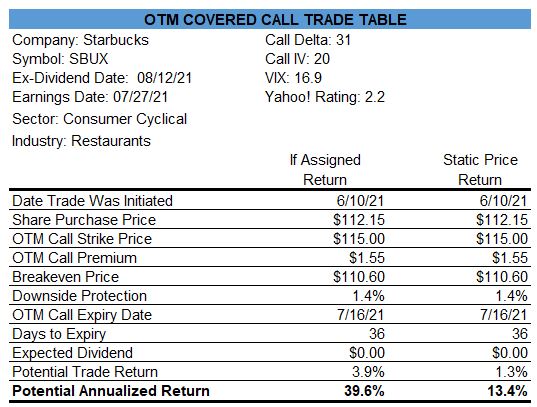

Starbucks

Starbucks met my screener so I purchased shares at $112.15 and then sold OTM Jul-16 $115.00 calls for $1.55.

Partial Covered Strangles

I have open covered call trades on both Abbott Laboratories (ABT) and Gilead Sciences (GILD). Earlier in the week, I sold naked puts on both stocks to establish what I refer to as partial covered strangles since I sold fewer puts than calls.

As always you can view my open trades on the Open Trades page.

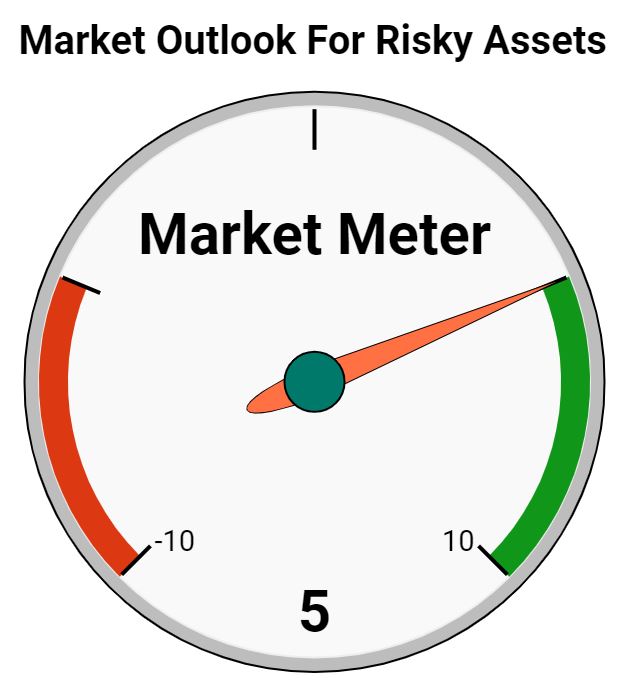

Market Meter

My Market Meter has moved up to a score of 5.

For reasons unknown to me, emails of my posts aren’t going out until Monday night even though I publish them on the weekend. For this post, I will include trades made on June 14.

June 14

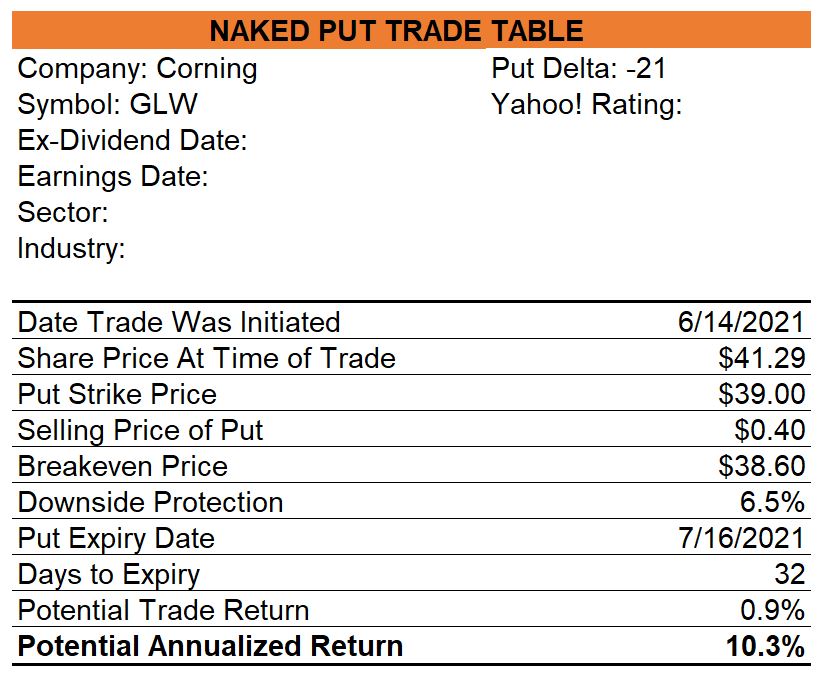

Corning (GLW) – Partial Covered Strangle

The price of Corning dropped by 4.3% and I had an open covered call so I sold some Jul-17 $39.00 naked puts for $0.40. I sold fewer puts than the calls I sold previously.

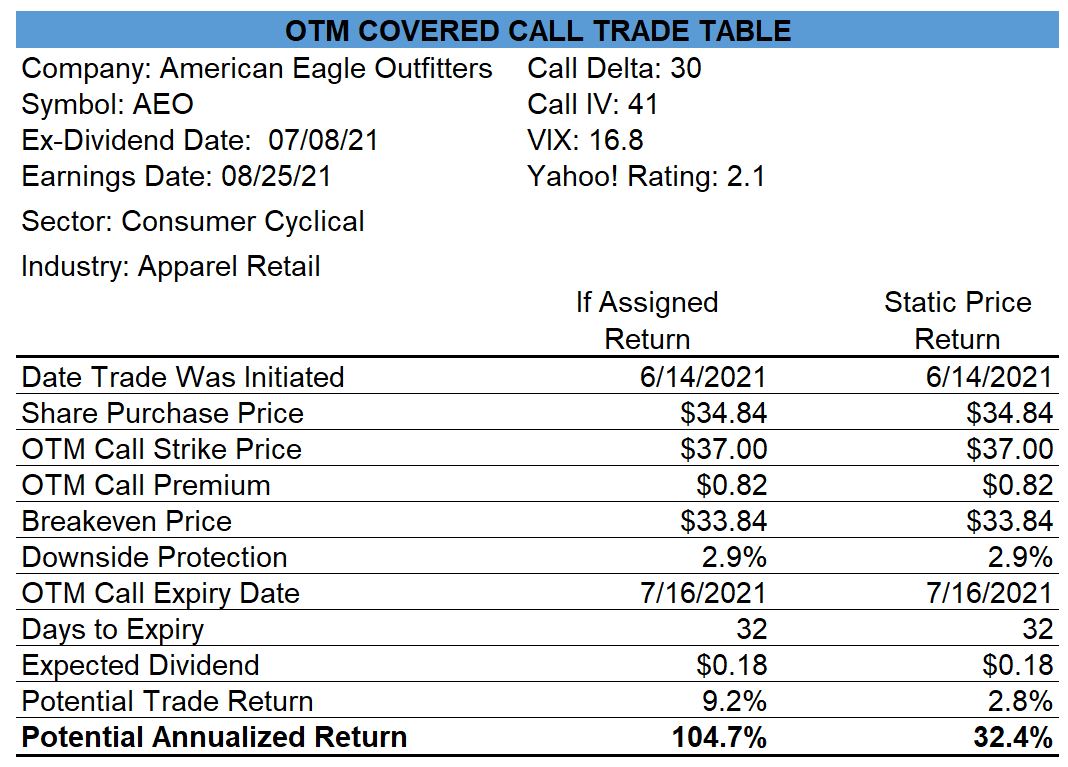

American Eagle Outfitters (AEO) – Covered Call Opened

I bought shares of AEO and sold OTM Jul-17 $37.00 calls for $0.82.

0 Comments