With the prices of many asset classes increasing recently, it was expected that the cash allocation in my models would fall as allocations were made to various asset classes. As you will see in the table further down in this post, allocations were made this week to both bond and equity ETFs.

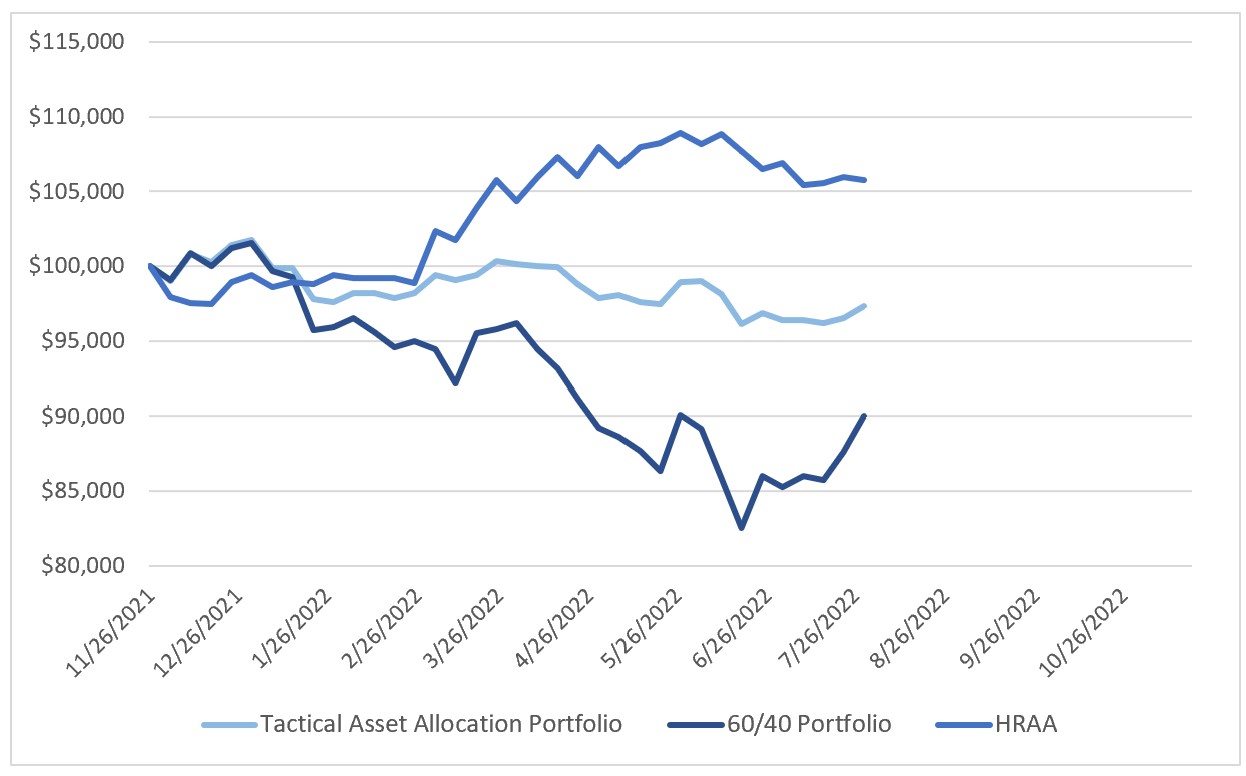

I have added the Horizons ReSolve Adaptive Asset Allocation (HRAA) ETF to my weekly chart which shows the performance of a 60/40 portfolio, my tactical asset allocation portfolio and now HRAA. As far as I know, HRAA is the only adaptive asset allocation ETF of its kind. For me, it is very important to know how my investing methodology stacks up against a professionally managed ETF with a similar approach.

July 29

Cenovus Energy (CVE – Shares Purchased)

I purchased CVE at $19.12. The value of the long CVE position was 3% of my portfolio and the stop I will use results in this trade presenting a 0.34% risk.

Tactical Asset Allocations

Open Trades

The only US stock I currently hold is CVE.

0 Comments