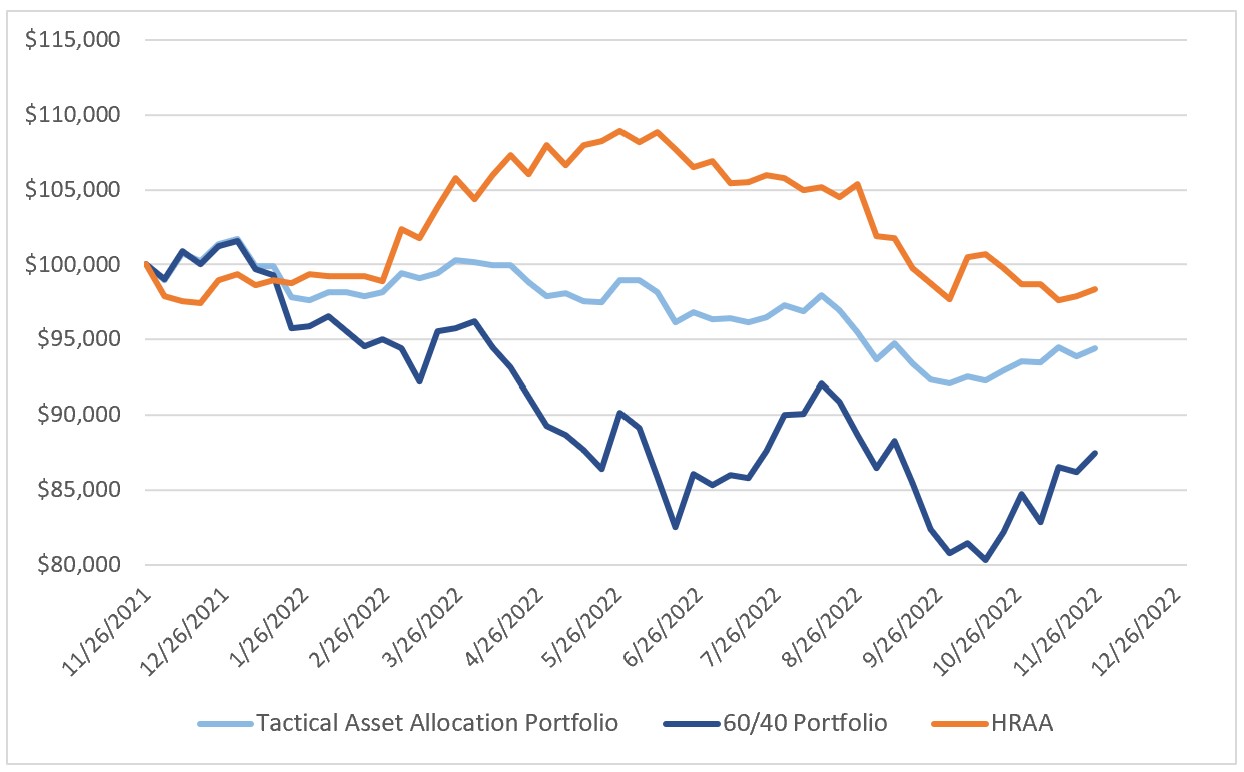

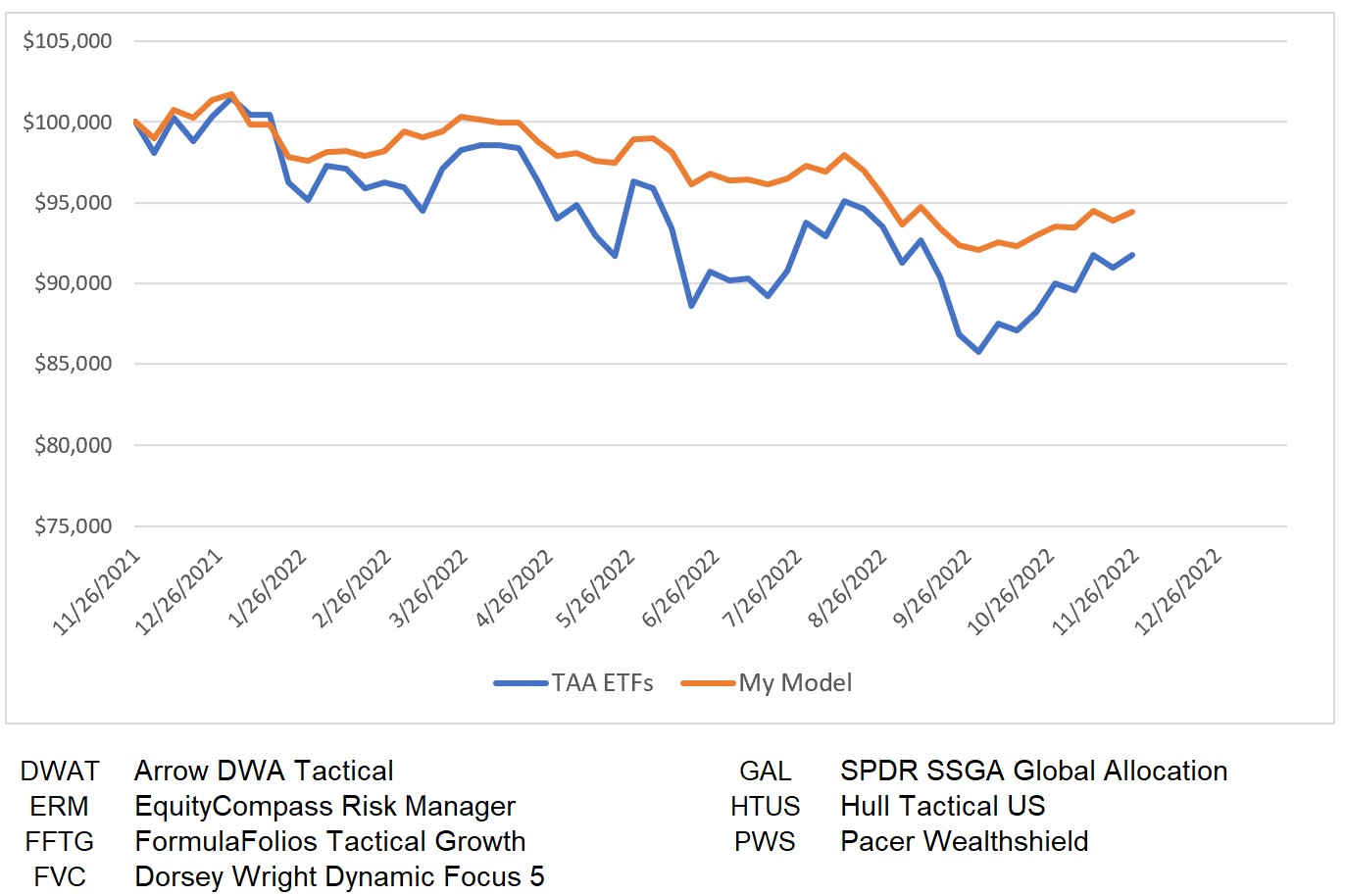

It has been a year since I began posting the weekly tactical asset allocations of my models. A one-year period is far too short of a timeframe to base a performance comparison on so I have little to say about the chart below which compares my TAA model performance to the average of a number of TAA ETFs. Eyeballing both lines, one can make two obvious observations: 1. my model has slightly outperformed the TAA ETFs, and 2. my model has a much smoother equity curve.

November 22

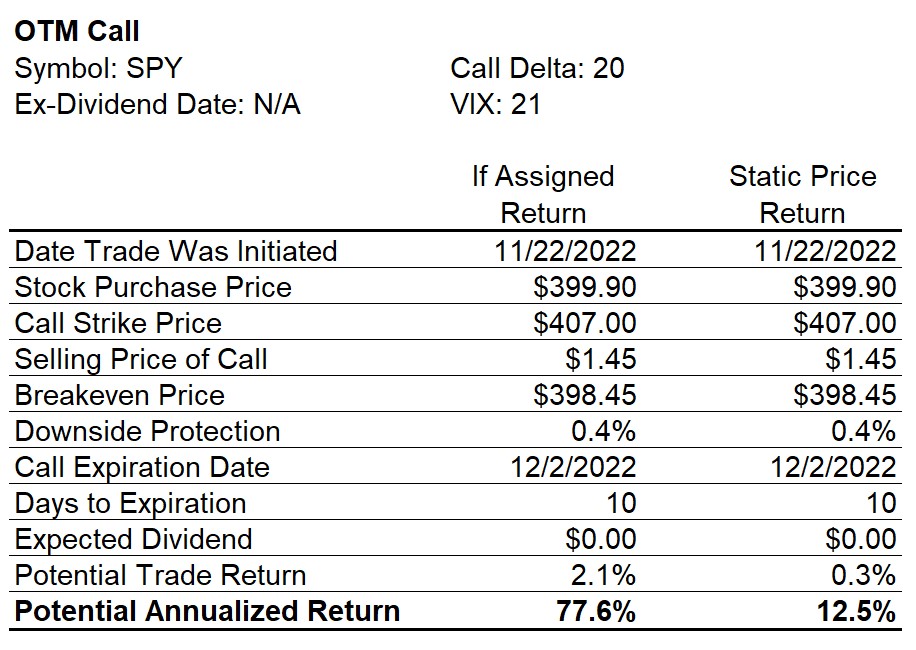

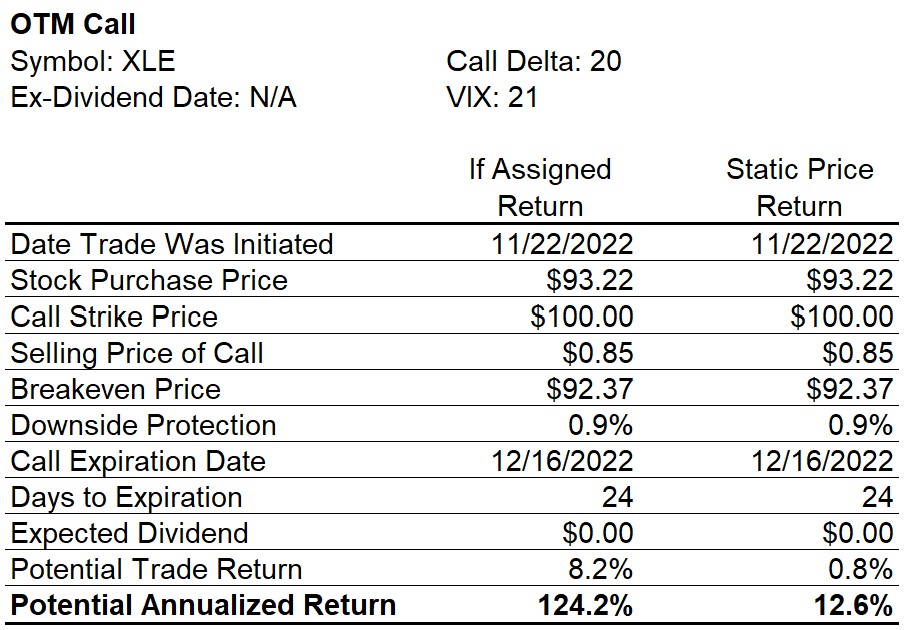

I currently hold units of SPY and XLE. Both ETFs were up in price today by more than 1% so I chose to sell 20-delta calls on portions of my holdings of both. I sold Dec-02 $407.00 SPY calls for $1.45 (these have 10 days to expiry) and Dec-16 $100.00 XLE calls for $0.85 (these have 24 days to expiry). SPY closed at $399.90 today and XLE closed at $93.22.

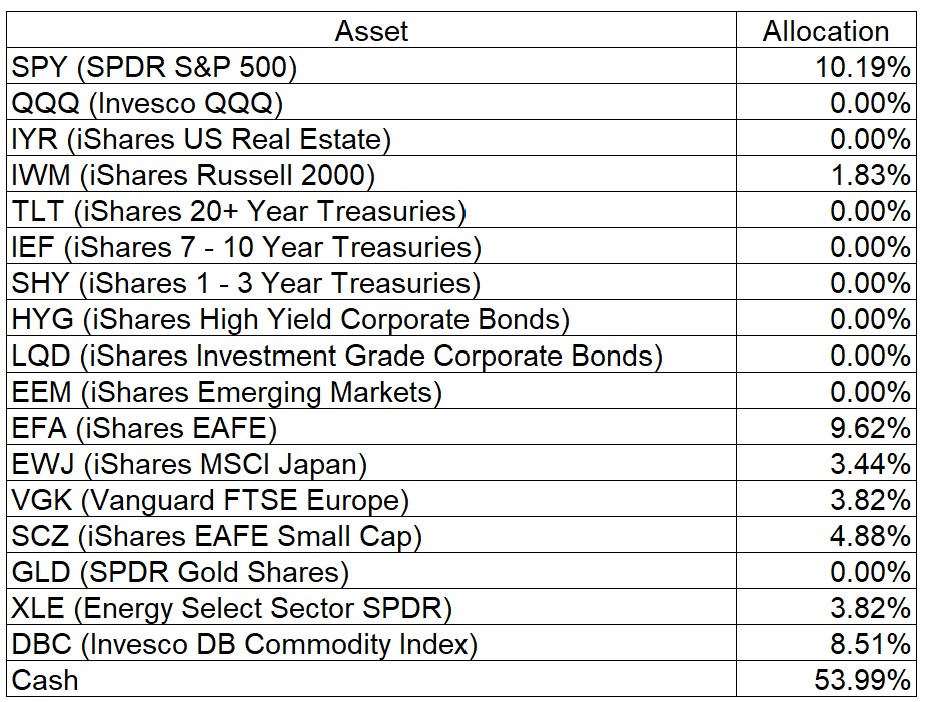

My Tactical Asset Allocation Model Weights

It is interesting to note that the international equity allocation of 21.76% is much higher than the 12.02% allocation to US equities.

0 Comments