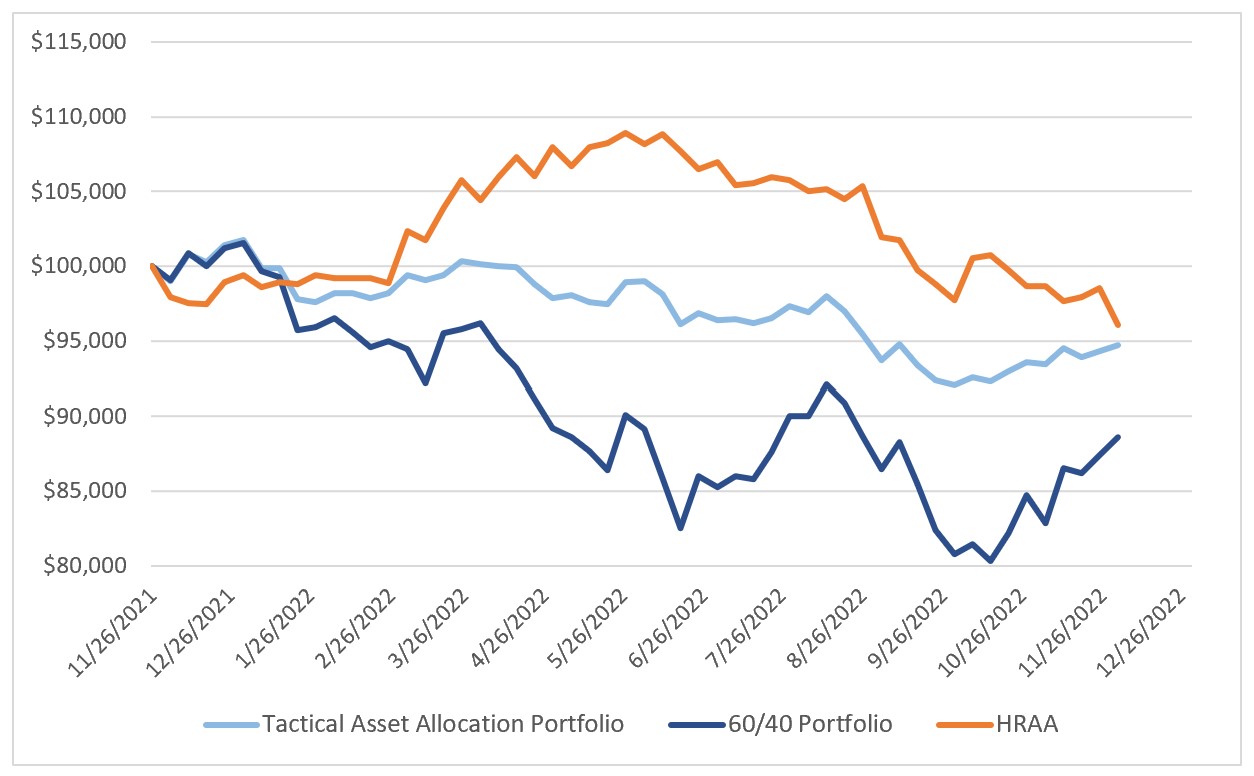

When I look at the chart above, I like the much smoother equity curve of my model versus the traditional 60/40 of the professionally managed Horizons Resolve Adaptive Asset Allocation ETF. In the period covering just over one year, my model and HRAA arrived at the same total performance but HRAA had a much wider price swing.

Covered Calls

With SPY closing out the week at $406.91, My Dec-02 $407.00 SPY calls expired out of the money so I keep the premium and my shares.

My Dec-16 $100.00 XLE calls remain well out of the money with XLE currently at $90.31

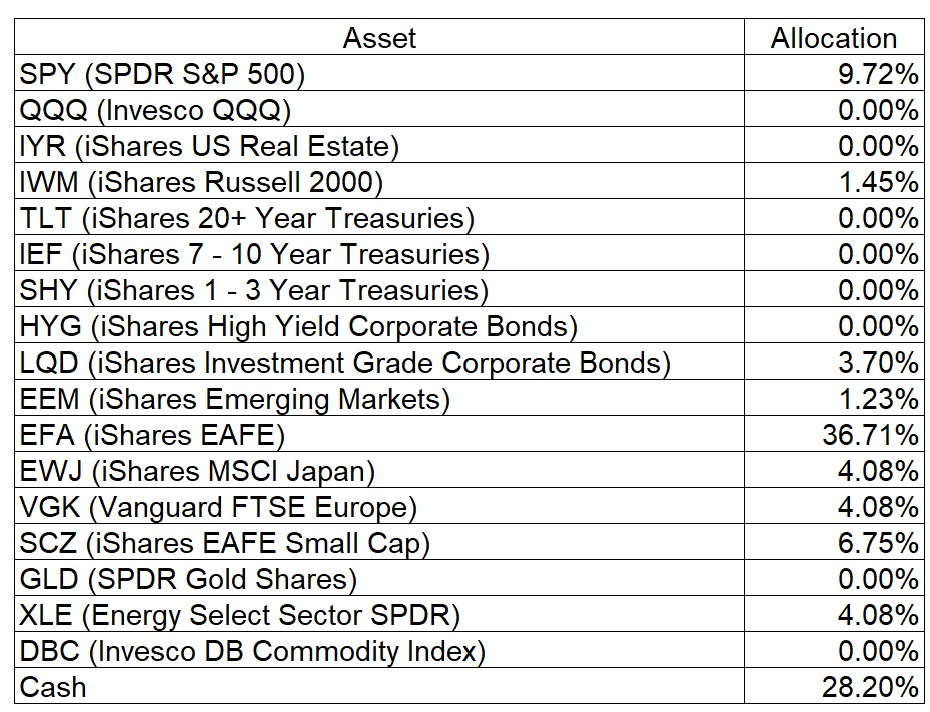

My Tactical Asset Model Allocations

My model continues to deploy cash into equity ETFs, particularly international ones. The international equity ETF allocation is now 52.8% compared to only 11.2% for US equity ETFs.

0 Comments