December 12

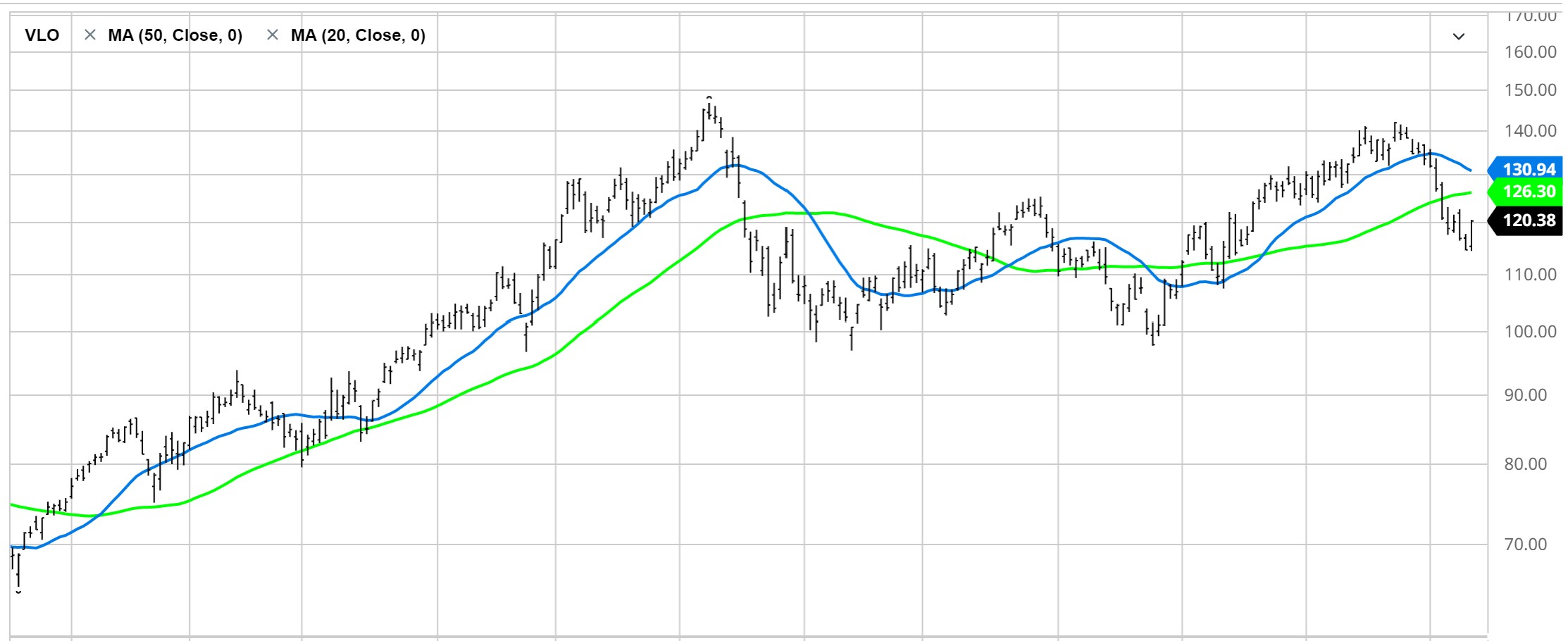

Valero Energy (VLO) – Shares Purchased

For the first time in many months, I purchased shares of a company. The position size is 4.25% of my account and I set an 8% trailing stop.

December 13

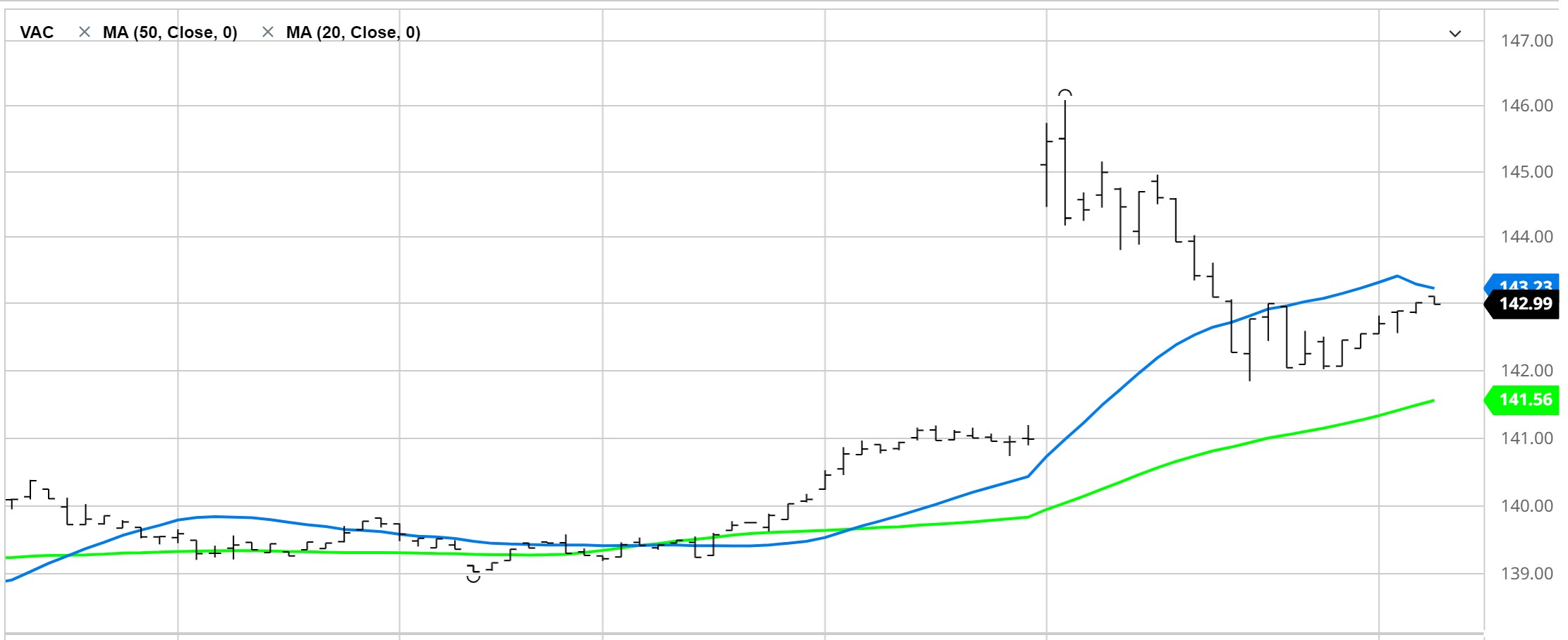

Marriott Vacations (VAC) – Shares Purchased

The position size is 5.65% of my account and I set a 7% trailing stop.

December 14

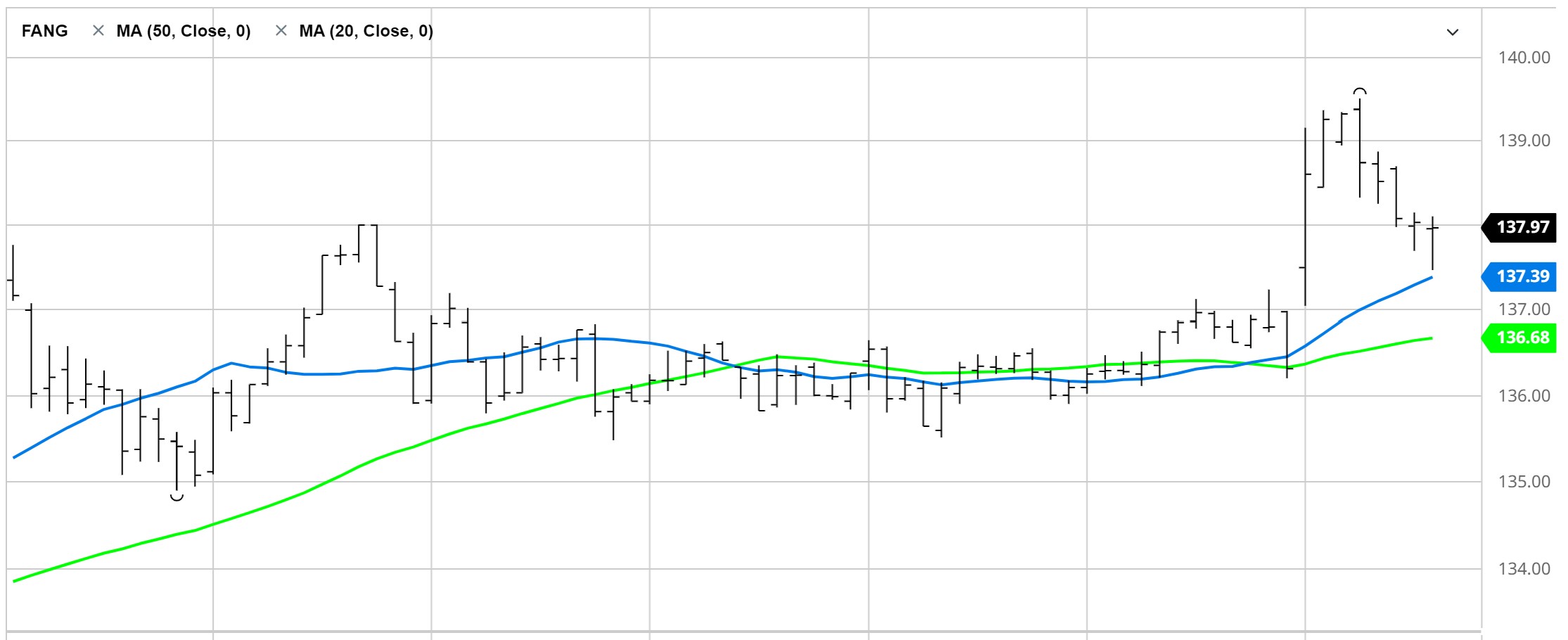

Diamondback Energy (FANG) – Shares Purchased

The position size is 4.1% of my account and I set an 8% trailing stop.

Account Risk

Should all three stocks that I hold fall in price and the sell stops be triggered, the damage to my account would be a 1.1% loss. This risk associated with holding individual stocks is something that I monitor.

Expired Covered Calls

The SPY Dec-16 $410.00 and XLE Dec-16 $100.00 calls that I sold expired out of the money so I will not have my shares called away.

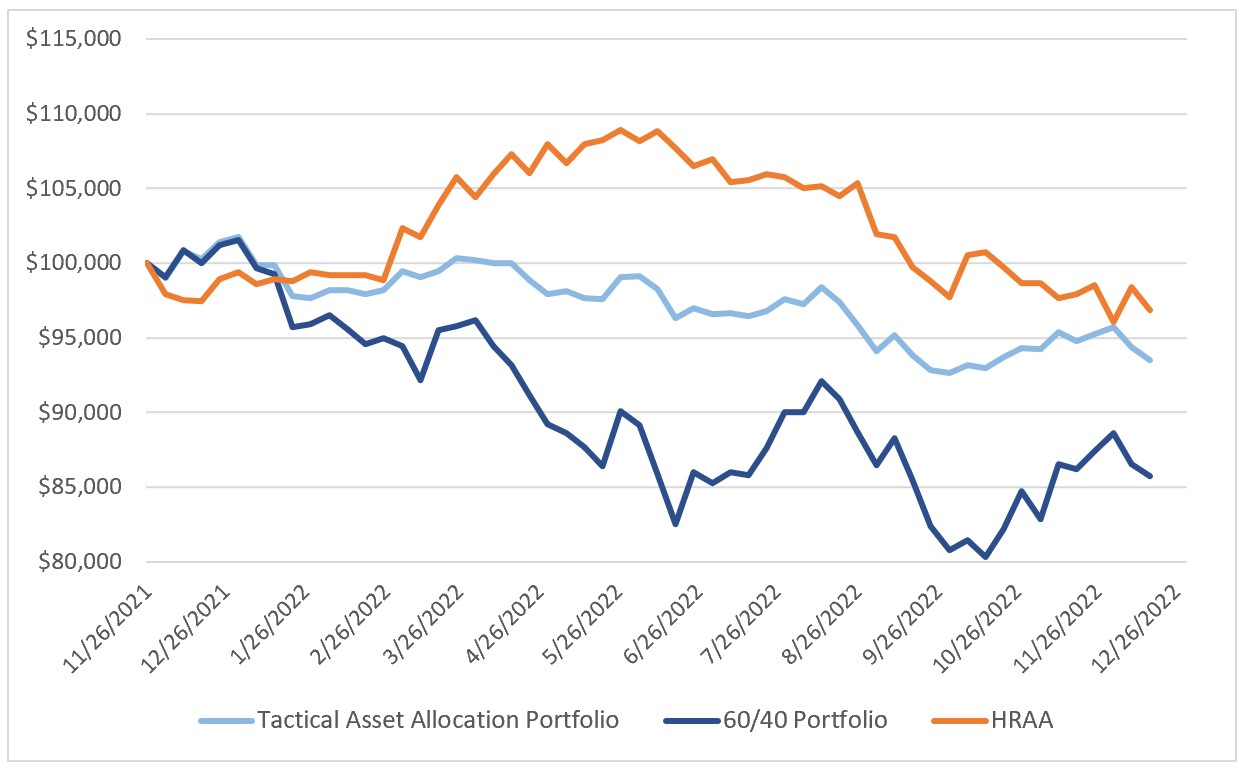

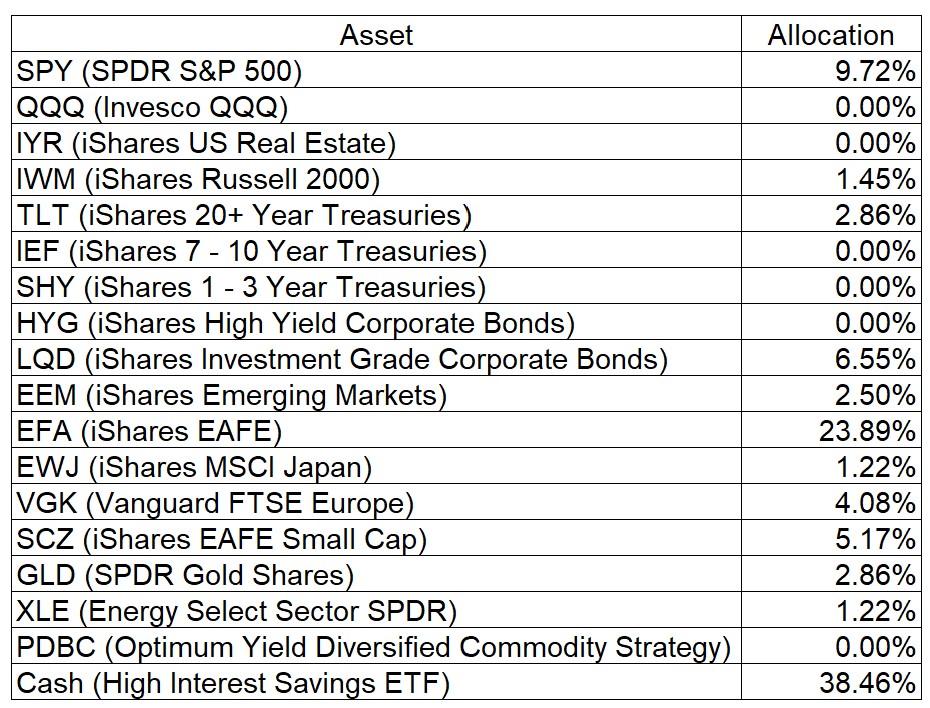

My Tactical Asset Model Allocations

With falling ETF prices this past week, my model has an increased allocation to cash compared to the previous week. International equities continue to have a much higher allocation than US equities.

0 Comments