If you think that the market commentary you read was written by a person, you aren’t paying attention. I used ChatGPT to write the following three paragraphs.

Last week, the U.S. stock markets showed a mixed performance, with the Dow Jones Industrial Average and the S&P 500 both recording gains, while the Nasdaq Composite fell slightly. The Dow rose by 1.4%, while the S&P 500 gained 0.8%, as positive economic data and earnings reports helped boost investor sentiment. On the other hand, the Nasdaq dipped by 0.6%, as concerns over rising interest rates and inflation weighed on tech stocks. Some of the notable gainers for the week included energy and financial stocks, while technology and healthcare stocks saw some declines.

The international stock markets had a mostly positive performance, as investors responded positively to a series of strong economic data releases and corporate earnings reports. In Europe, the major indices, including the FTSE 100 in the UK, the CAC 40 in France, and the DAX in Germany, all recorded gains, as investors focused on signs of a strong economic recovery from the pandemic. Meanwhile, in Asia, the Japanese Nikkei and the Hong Kong Hang Seng both rose, as optimism over the global economic outlook helped to offset concerns over rising inflation and interest rates. However, some emerging markets, including Brazil and India, saw some weakness, as concerns over Covid-19 outbreaks and their impact on economic growth weighed on investor sentiment.

The U.S. Treasuries market had a mixed performance, with yields on government bonds fluctuating throughout the week. The benchmark 10-year Treasury note yield initially rose above 1.6% early in the week, as investors continued to assess the potential impact of rising inflation and interest rates on the economy. However, yields retreated later in the week, as investors responded to a series of weaker-than-expected economic data releases and comments from Federal Reserve officials suggesting that the central bank is not in a hurry to tighten monetary policy. The 10-year yield ended the week at around 1.7%, up slightly from the previous week. Overall, the market continues to be driven by a range of economic and geopolitical factors, as investors look for signals on the direction of monetary policy and the broader economic outlook.

Edit: I realized after publishing this post that the commentaries are inaccurate since ChatGPT has a cut-off date of September 2021. The commentaries above are likely for the last week that the AI was trained on.

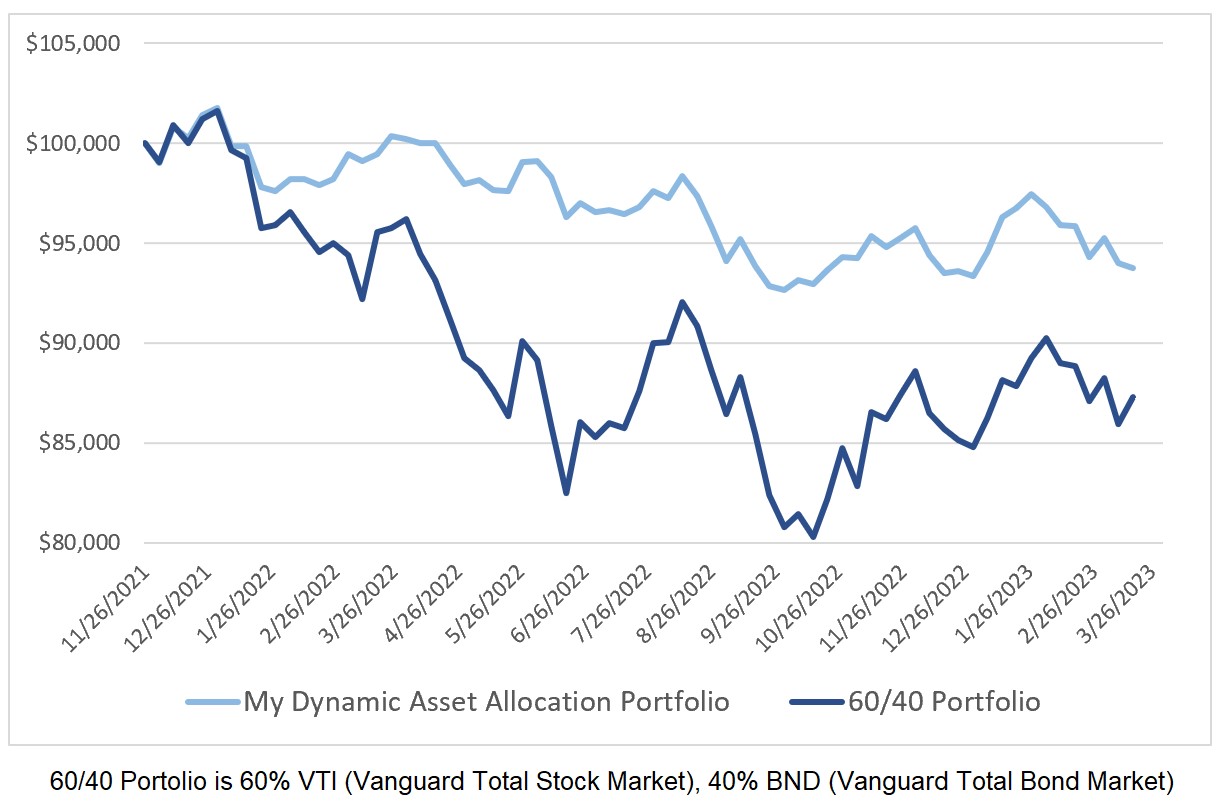

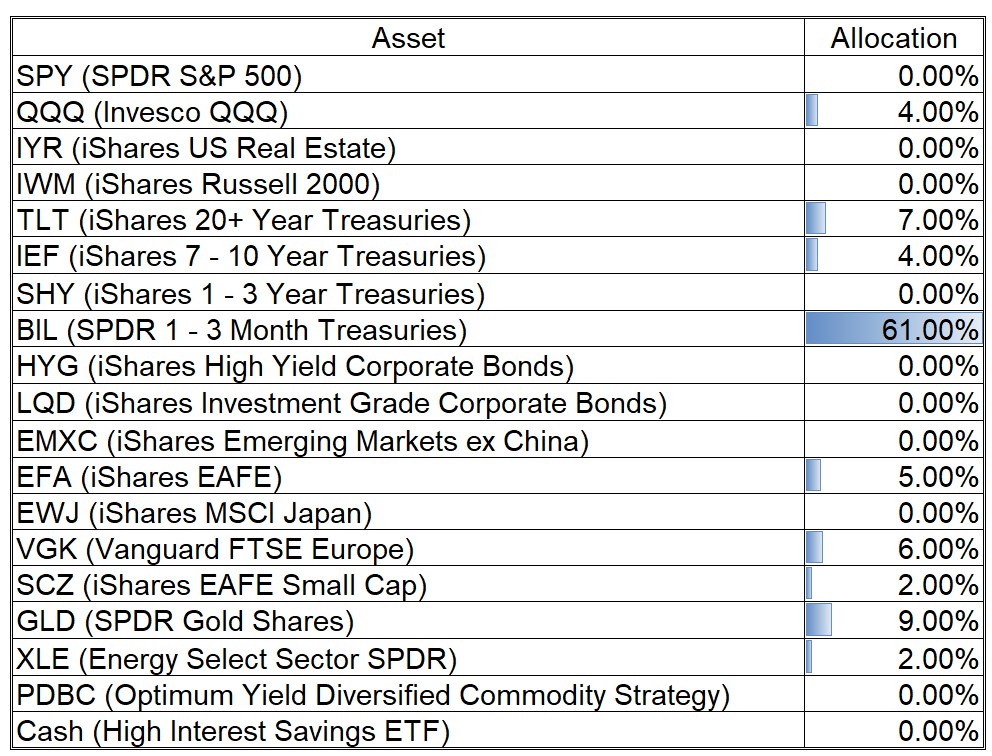

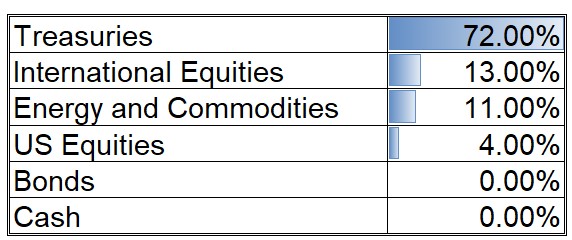

My Dynamic Asset Allocations

U.S. Treasuries continue to dominate my asset allocations with a current 72% weighting.

0 Comments