(For the fun of it, I used ChatGPT to create this post using this guide. The image below was generated by Dall-E using a prompt from ChatGPT.)

Unlock the power of Tactical Asset Allocation and take control of your financial future

Unlock the power of Tactical Asset Allocation and take control of your financial future

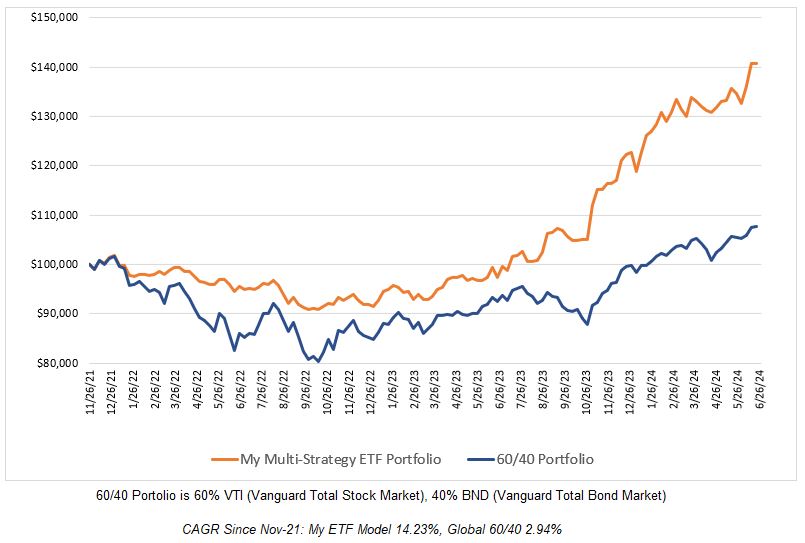

When it comes to investing, there are many strategies one can implement. The strategy I use, Tactical Asset Allocation, is a powerful investment strategy that can help investors by optimizing their portfolios for changing market conditions. In this post, I will cover most of what you need to know about Tactical Asset Allocation, including the basics, benefits, implementation tips, and risk management. Whether you’re a seasoned investor or a beginner, this post will provide you with the knowledge and tools to build a successful investment portfolio. So, let’s dive in and learn why Tactical Asset Allocation is the strategy every investor needs to know.

Understanding the Basics of Tactical Asset Allocation

Tactical Asset Allocation (TAA) is an investment strategy that aims to optimize portfolio performance by actively shifting asset allocations based on changing prices of the ETFs used. Unlike traditional buy-and-hold investment strategies, which maintain a fixed allocation to individual ETFs over time, TAA strategies use a variety of quantitative factors to make tactical adjustments to a portfolio’s asset mix. The objective is to maximize returns while minimizing risk by identifying market trends.

Benefits of Tactical Asset Allocation for Long-Term Investors

The benefits of TAA are numerous, particularly for long-term investors seeking to build and maintain a diversified investment portfolio. Some of the key benefits include:

- Improved risk-adjusted returns: TAA strategies can potentially improve risk-adjusted returns by adjusting asset allocations in response to changing market conditions. This can help investors to minimize downside risk and capitalize on opportunities for upside potential.

- Diversification: By actively managing asset allocations, TAA can help investors to diversify across a range of asset classes and investment strategies. This can potentially reduce overall portfolio risk and enhance returns over the long term.

- Flexibility: TAA strategies can be customized to meet a variety of investment objectives, risk tolerances, and time horizons. This flexibility allows investors to adjust their portfolios as market conditions change, while still staying true to their investment goals.

- Better alignment with investor preferences: TAA strategies can help investors to better align their investment portfolios with their personal preferences, including ethical or social values, while still achieving their desired risk and return profiles.

Top Tactical Asset Allocation Strategies to Consider

There are four main TAA strategies that investors can use, each with its own set of advantages and risks.

- Relative Strength: This strategy involves selecting ETFs that have displayed price strength relative to their peers.

- Mean Reversion: This strategy involves selecting ETFs that have underperformed in the short term, but are expected to revert to their long-term averages.

- Trend Following: This strategy involves selecting ETFs that are trending upward or downward based on technical analysis or other quantitative indicators.

- Risk Parity: This strategy involves allocating to ETFs based on their risk level, with the objective of achieving a balanced portfolio that minimizes overall portfolio risk.

How to Implement Tactical Asset Allocation in Your Investment Portfolio

Implementing TAA in an investment portfolio involves several key steps, including:

- Defining investment objectives and risk tolerances

- Developing a clear understanding of market trends and conditions

- Selecting a TAA strategy that aligns with your investment objectives

- Building a diversified investment portfolio that includes a mix of ETFs covering a wide range of asset classes

- Monitoring and adjusting the portfolio on an ongoing basis to ensure that it remains aligned with your investment goals and objectives.

Risks and Challenges of Tactical Asset Allocation and How to Mitigate Them

Like any investment strategy, TAA involves certain risks and challenges that investors should be aware of. Some of the key risks include:

- Poor performance during extended periods of market stability

- Over-reliance on historical data or quantitative models

- Difficulty in accurately predicting market trends and conditions

- Higher transaction costs and tax implications associated with more frequent portfolio turnover To mitigate these risks, investors should carefully consider their investment objectives, risk tolerances, and time horizons, as well as the potential costs and benefits of TAA.

How Beneficial is Tactical Asset Allocation?

- During the financial crisis of 2008, TAA strategies helped to mitigate losses for investors. For example, one study found that a TAA strategy that included a combination of U.S. and international stocks, bonds, and commodities had an annualized return of 9.9% between 2003 and 2012, compared to just 5.8% for a static 60/40 stock/bond portfolio. During the market downturn in 2008, the TAA strategy lost just 5.8% compared to a loss of 30.1% for the static portfolio.

- In 2020, the COVID-19 pandemic led to significant market volatility and uncertainty. However, investors who employed TAA strategies were able to navigate these conditions and potentially generate higher returns than a buy-and-hold approach. For example, one study found that a TAA strategy that used momentum and trend-following signals outperformed the S&P 500 by over 18% during the first eight months of 2020.

- A long-term study of TAA strategies by Mebane Faber found that these strategies consistently outperformed a buy-and-hold approach over multiple market cycles. For example, from 1973 to 2016, a TAA strategy that used a combination of momentum, trend-following, and mean reversion signals outperformed a static 60/40 stock/bond portfolio by an annualized rate of 2.7%. This outperformance was even more significant during market downturns, with the TAA strategy losing just 0.7% during the 2008 financial crisis compared to a loss of 21.1% for the static portfolio. [Original Source] (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=962461)

Tactical Asset Allocation FAQ

Q: What is Tactical Asset Allocation? A: Tactical Asset Allocation (TAA) is an investment strategy where an investor actively adjusts their portfolio’s asset allocation based on short-term market conditions and economic outlook.

Q: What is the difference between Tactical Asset Allocation and Strategic Asset Allocation? A: Strategic Asset Allocation (SAA) is a long-term investment strategy that involves creating a portfolio with a fixed mix of asset classes based on an investor’s risk tolerance and financial goals. TAA, on the other hand, involves making changes to the portfolio’s asset allocation based on short-term market conditions.

Q: What are the benefits of Tactical Asset Allocation? A: TAA can potentially help investors avoid losses during market downturns, capture gains during upswings, and potentially generate higher returns than a buy-and-hold approach.

Q: What are the risks of Tactical Asset Allocation? A: TAA strategies can involve higher trading costs and taxes, and there is a risk that the investor’s allocations lead to losses.

Q: How do investors implement Tactical Asset Allocation? A: Investors can implement TAA strategies by using a variety of techniques, such as technical analysis, economic forecasting, and quantitative models. Some common TAA techniques include momentum investing, mean reversion, and trend-following.

Q: How do investors evaluate the success of a Tactical Asset Allocation strategy? A: Investors can evaluate the success of a TAA strategy by comparing the performance of their portfolio to a benchmark index or to a buy-and-hold approach. Other metrics, such as the Sharpe ratio or maximum drawdown, can also be used to evaluate the risk-adjusted performance of a TAA strategy.

Q: Is Tactical Asset Allocation suitable for all investors? A: TAA may not be suitable for all investors, as it requires a high level of market knowledge and active management. Additionally, TAA strategies may involve higher risk and trading costs than a buy-and-hold approach. Investors should consider their risk tolerance and investment goals before implementing a TAA strategy.

Conclusion

Tactical Asset Allocation is a powerful investment strategy that every investor should consider. By actively adjusting your portfolio’s asset allocation based on ETF price changes, you can potentially avoid losses, capture gains, and potentially generate higher returns than a buy-and-hold approach. However, it is important to keep in mind that TAA strategies involve risks such as higher trading costs and taxes, and there is a risk that your allocations will lead to losses. With that said, by combining a sound investment plan with TAA strategies and carefully monitoring your portfolio’s performance, you can potentially achieve your financial goals and enjoy a more secure financial future. So why wait? Start implementing Tactical Asset Allocation in your investment strategy today and take control of your financial future.

Don’t let market volatility and economic uncertainty derail your investment strategy. Discover how Tactical Asset Allocation can help you navigate changing market conditions and potentially generate higher returns. Subscribe to my posts to follow my weekly ETF allocations.

0 Comments