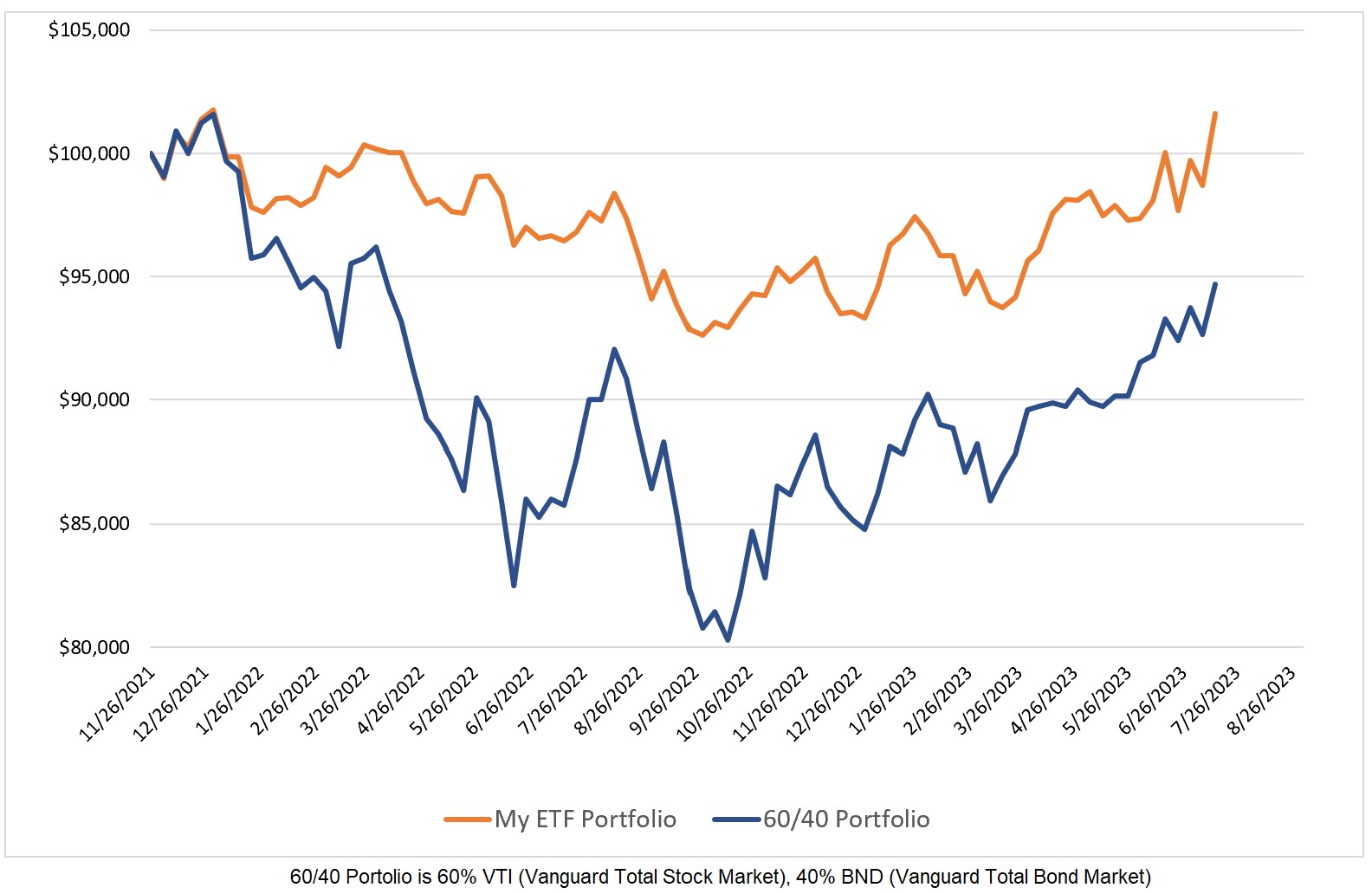

This past week was the best yet for my ETF portfolio as it gained 2.95%. My portfolio is now beating the 60/40 model on a 4.26% annualized basis and, as you can easily see in the chart above, is doing so with much lower volatility. The standard deviation of my portfolio’s weekly returns is 1.04% compared to 1.89% for the 60/40 model. Higher returns with lower volatility is my goal and, so far, my model is achieving that quite well.

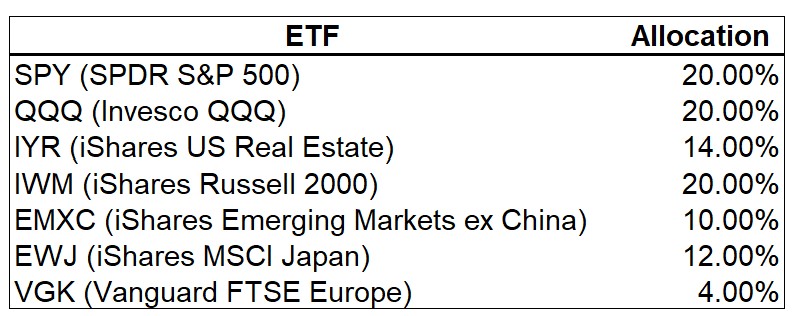

My ETF Allocations

My model continues to be 100% invested in equity ETFs with only minor changes this week.

0 Comments