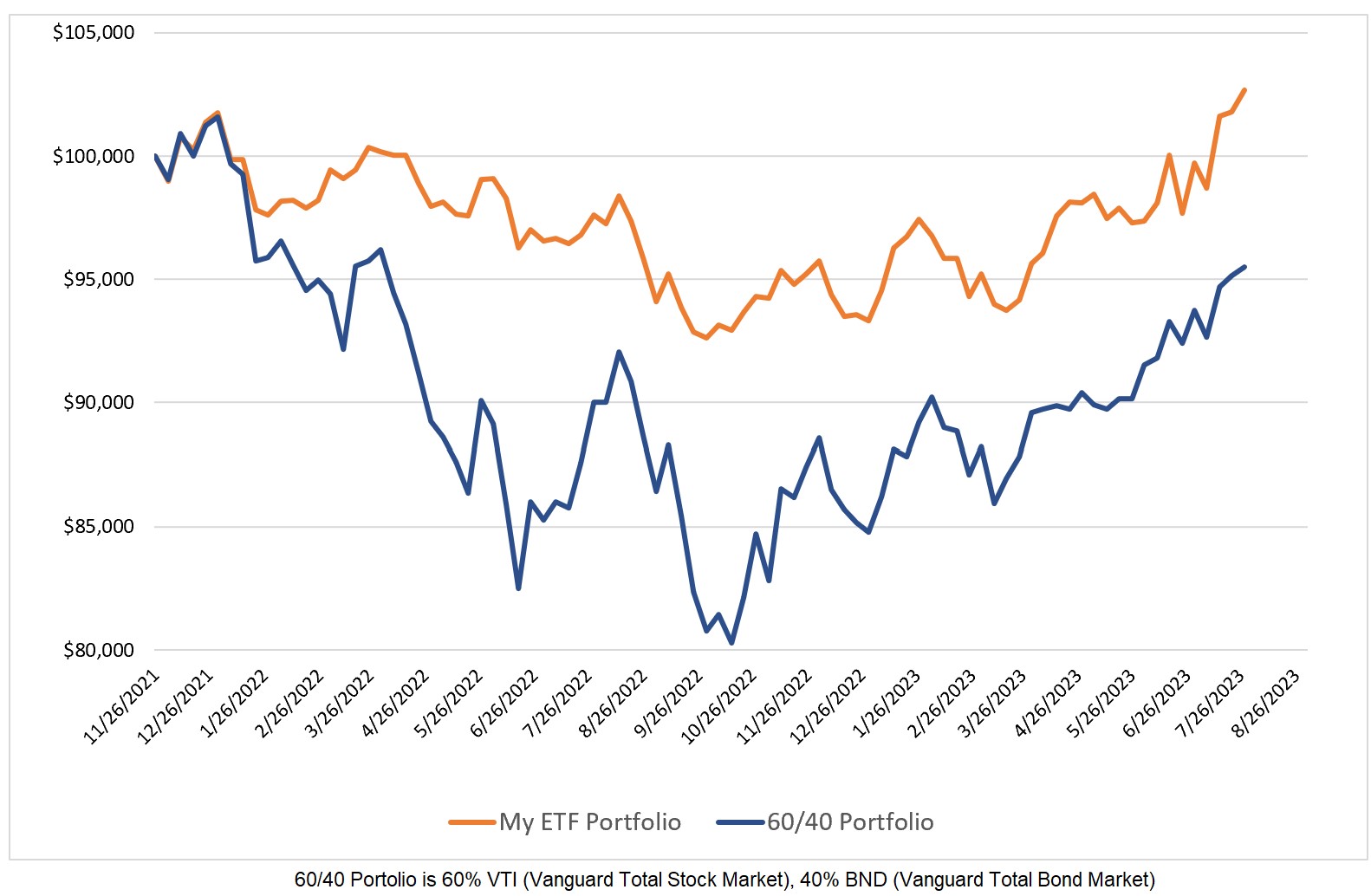

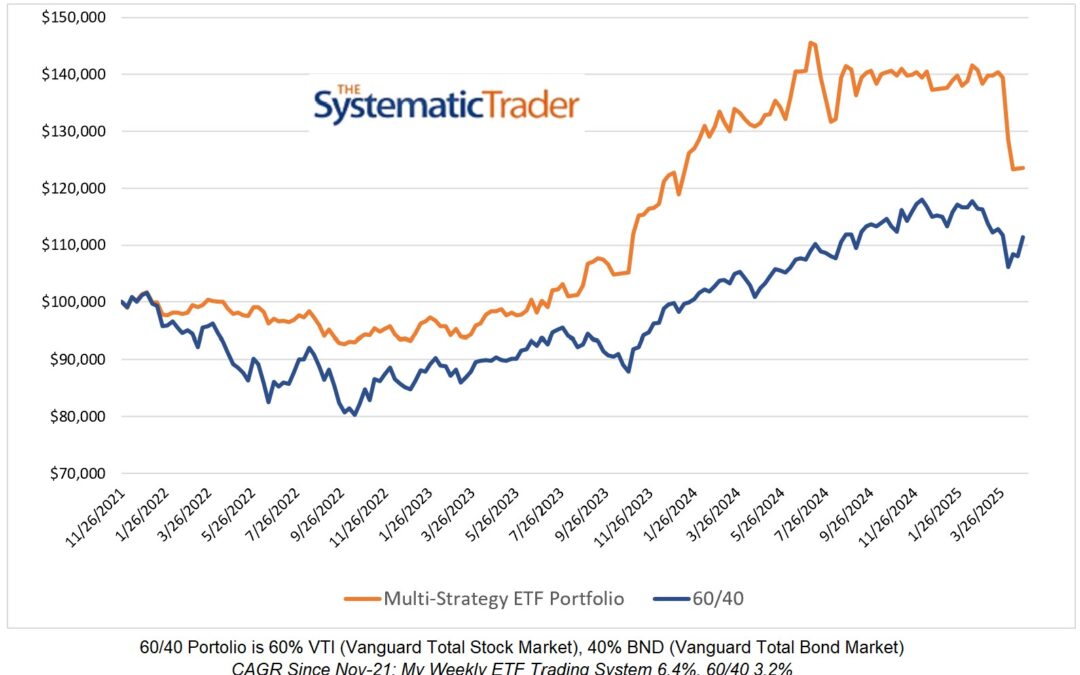

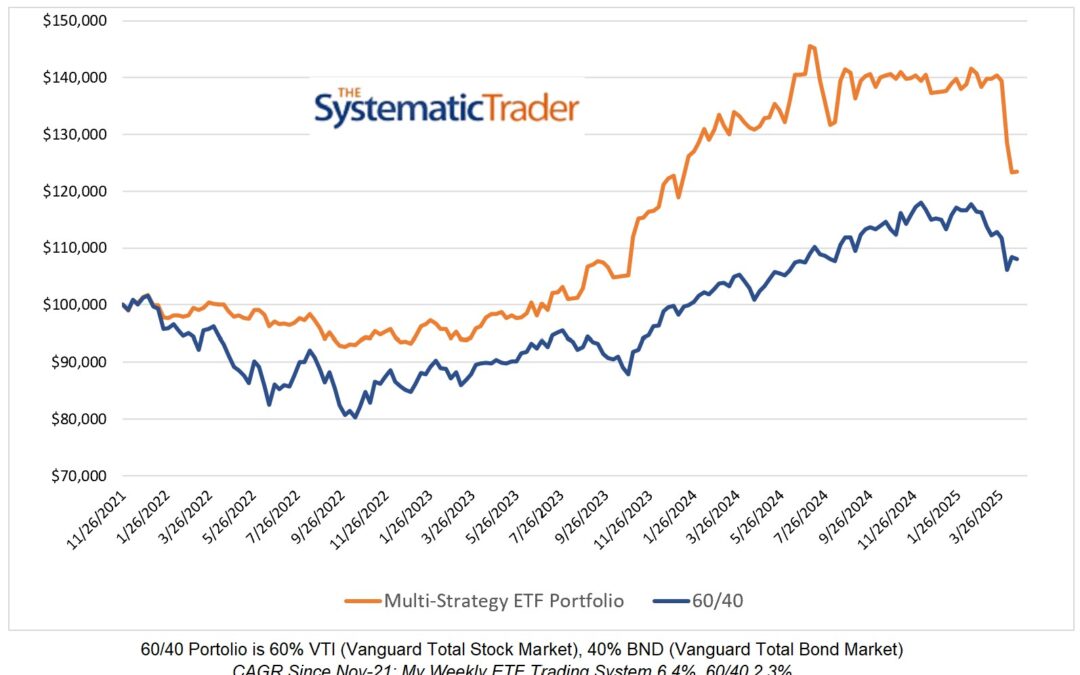

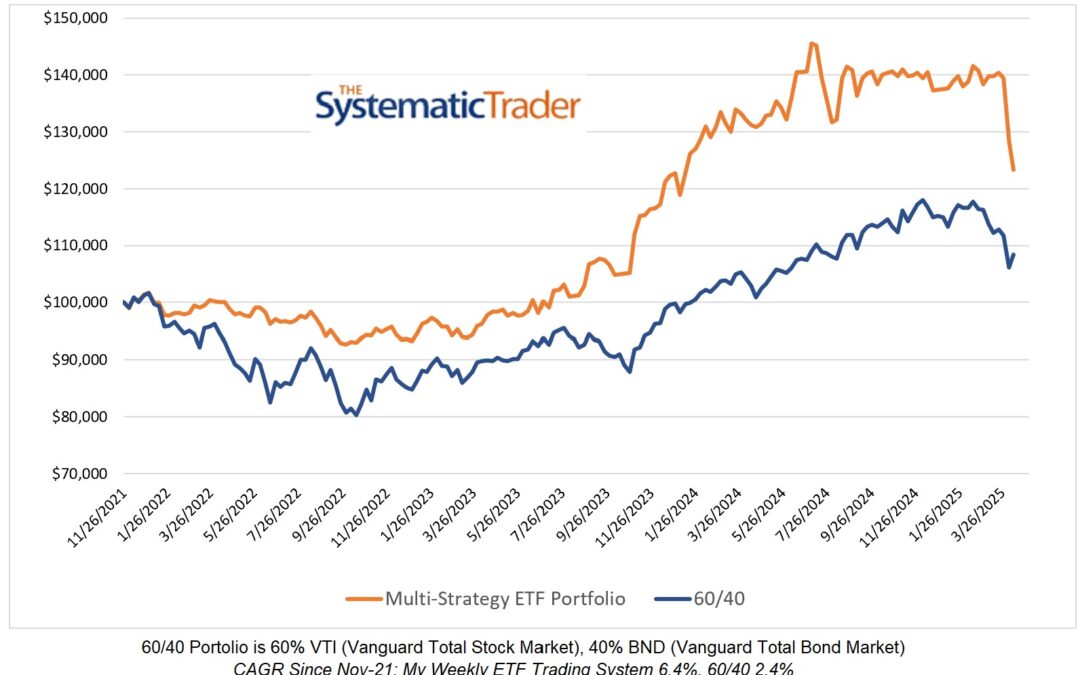

My ETF portfolio rose by 0.89% this past week versus 0.39% for the 60/40 model. From November 2021 to today, my ETF portfolio as posted here weekly has a CAGR that is 4.33% higher than that of the 60/40 model and has done so with 44% lower weekly volatility. To state the obvious, that is an extra $43,300 per year on a $1M portfolio.

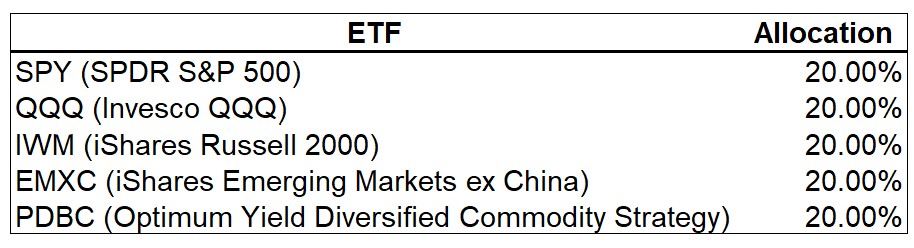

Current ETF Allocations

My allocations as of Friday’s close are listed below. It has been a long time since the commodity ETF appeared in my holdings.

0 Comments