This Week’s Performance

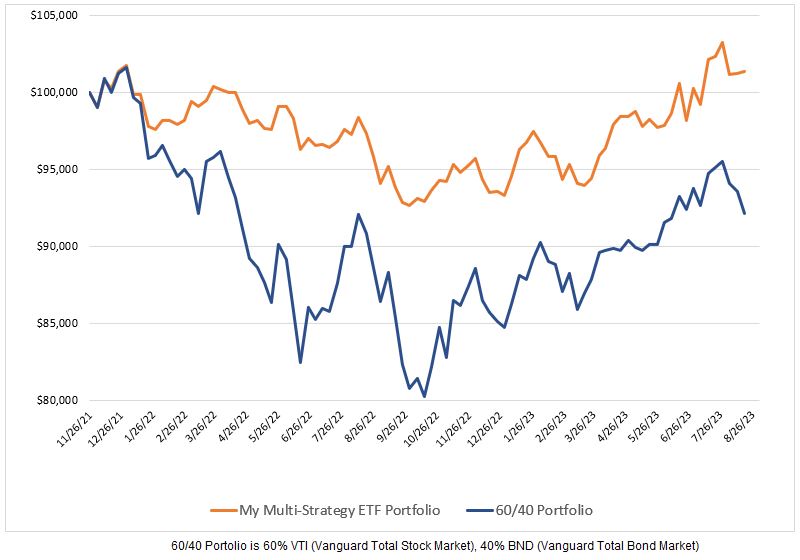

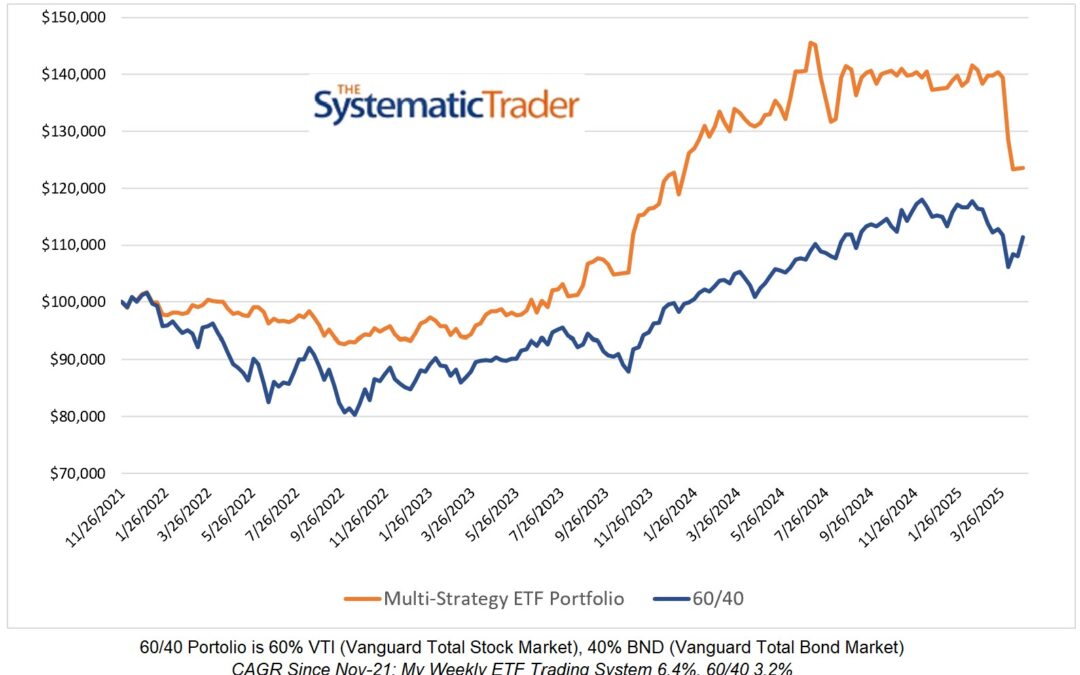

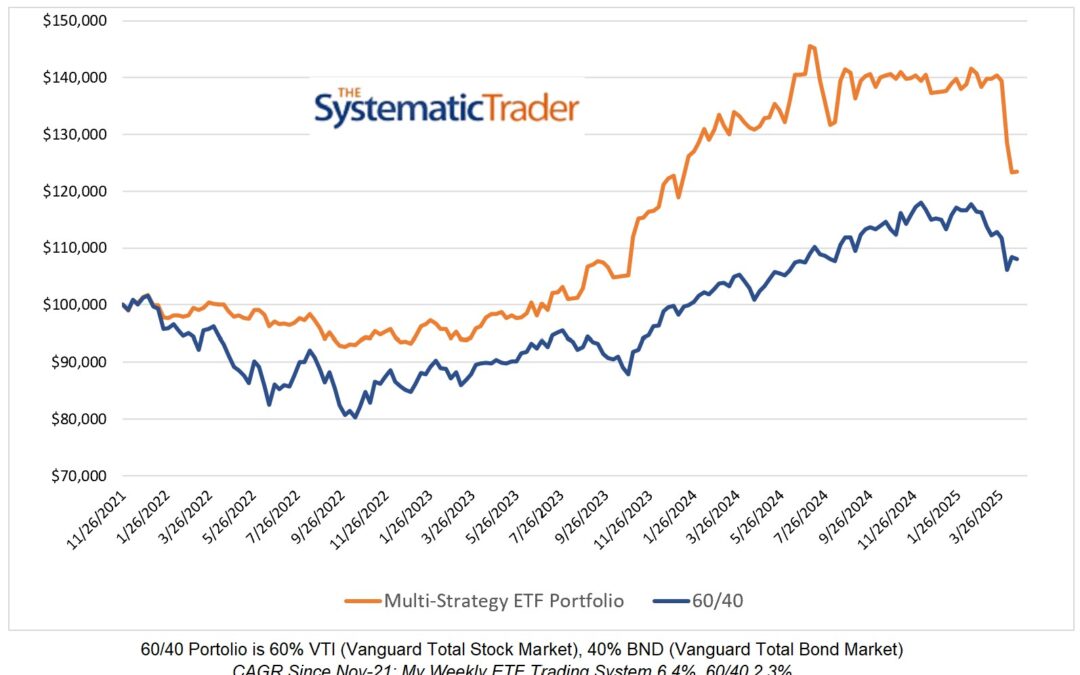

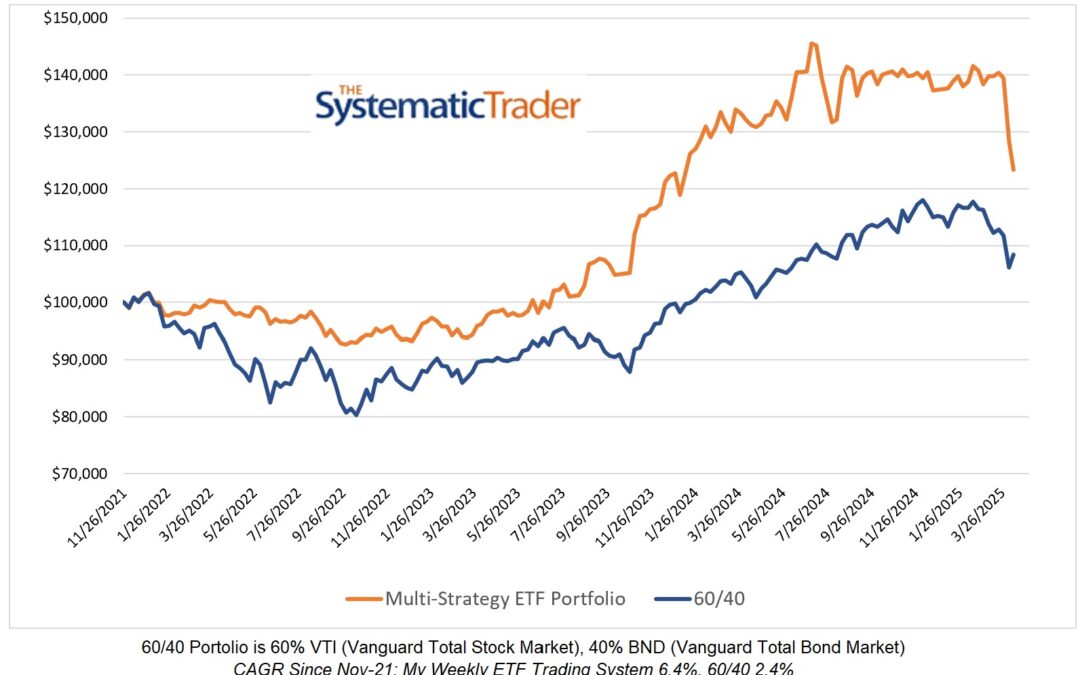

With my model 100% in BIL this past week, it rose a mere 0.10% but that was much better than the 1.5% decline experienced by the 60/40 model. This week’s performance means that my model now has a CAGR which is 5.39% higher than the 60/40 model and has 43% lower volatility (weekly).

Current Holding

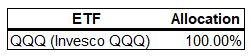

For the first time since I have been posting my ETF model holdings each week, I have a 100% allocation to QQQ. I can’t say that I am comfortable with this but I can say that with the combination of strategies I use, the backtest results are quite good and those results include the occasional 100% allocation to QQQ.

Cash Secured Puts Sold

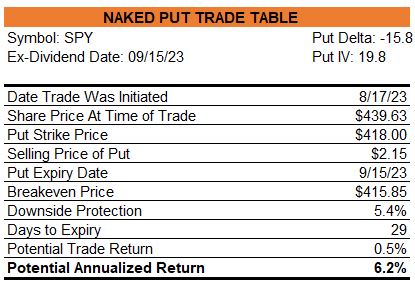

I have my own signal generator for cash-secured puts on SPY and QQQ. This past week, put signals for both ETFs fired and I sold Sep-15 $418.00 SPY puts.

0 Comments