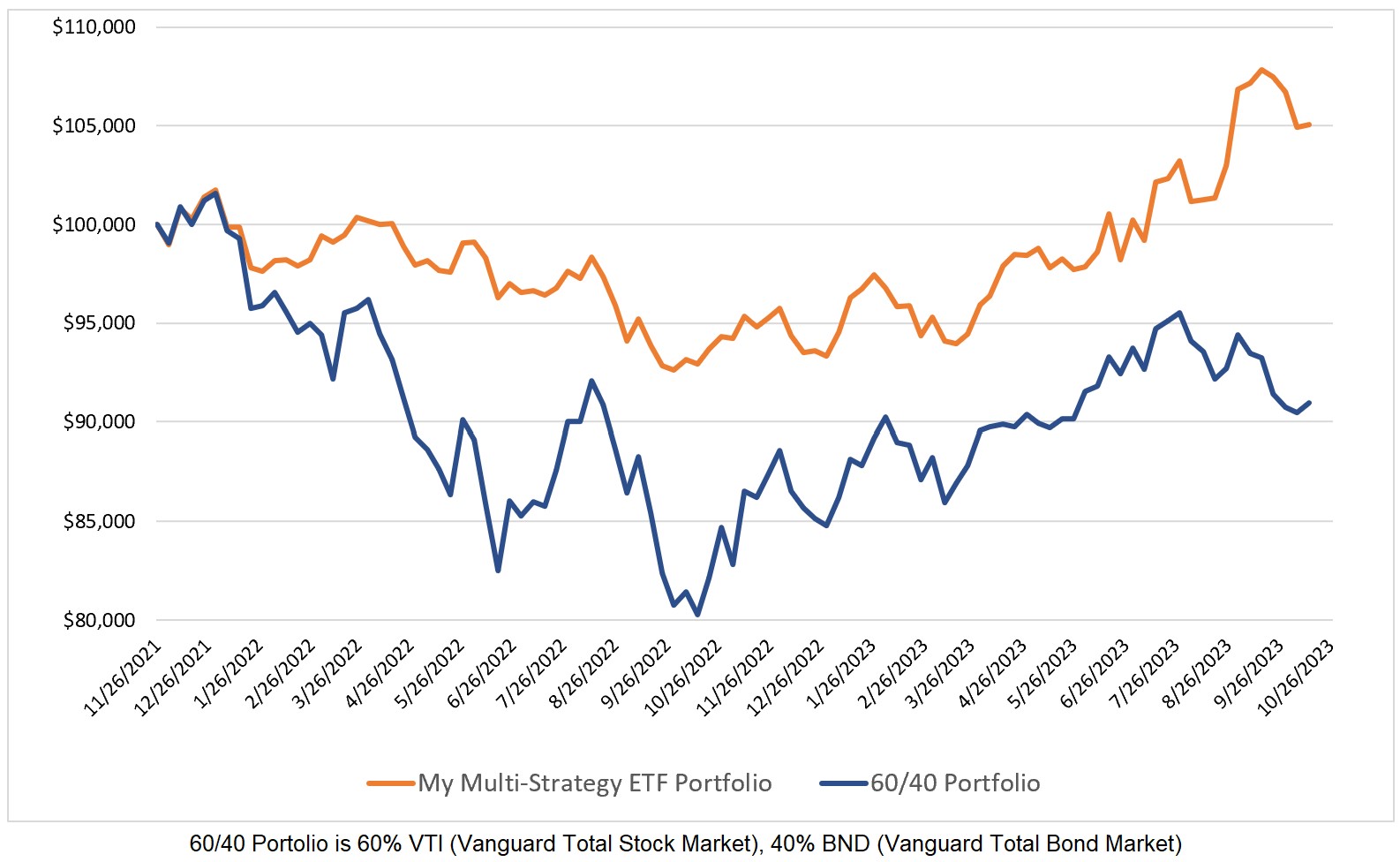

My multi-strategy ETF model rose by 0.10% this past week versus an increase of 0.55% for the 60/40 (VTI/BND) model.

Since I began posting weekly ETF allocations for my model, it has produced a CAGR that is 7.6% higher than the 60/40 model and has done so with a 39% lower weekly volatility.

There is no change in the allocation this week as my model is 100% invested in BIL.

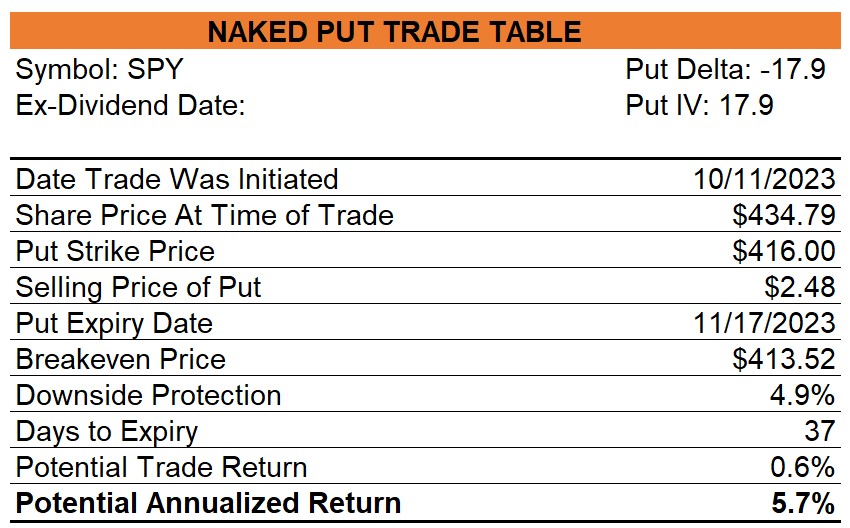

SPY Puts Sold

My signal generator for SPY naked puts continued to provide a “good to sell” signal for SPY puts throughout this past week so I sold Nov-17 $416 puts.

0 Comments