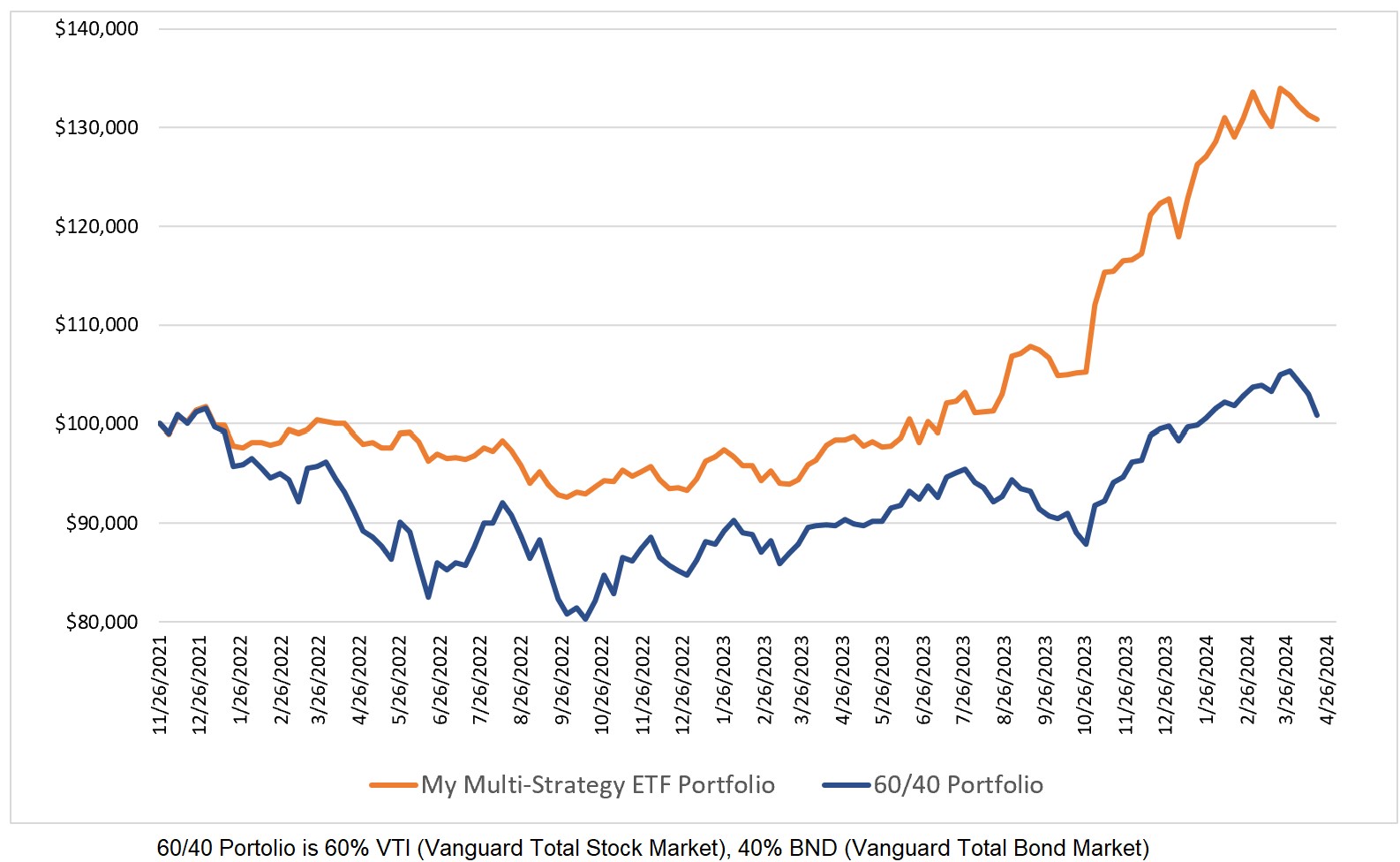

My global multi-strategy ETF model mostly side-stepped an ugly week in the markets as it lost 0.35% compared to a 2.07% loss for the 60/40 model.

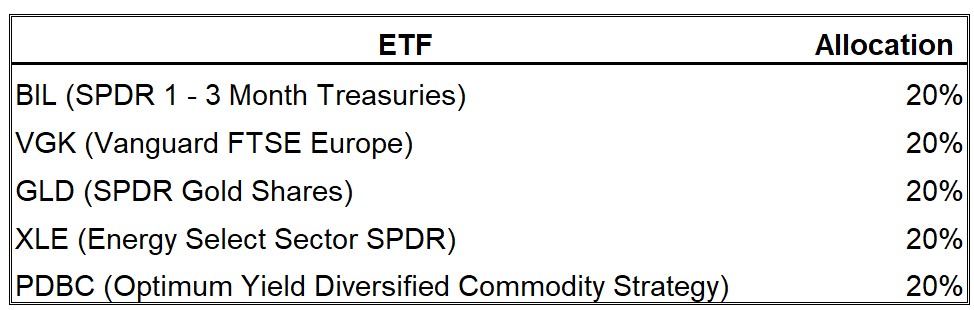

My model has new allocations as per the table below. This is the first time in months that my model did not have an allocation to SPY, QQQ nor IWM.

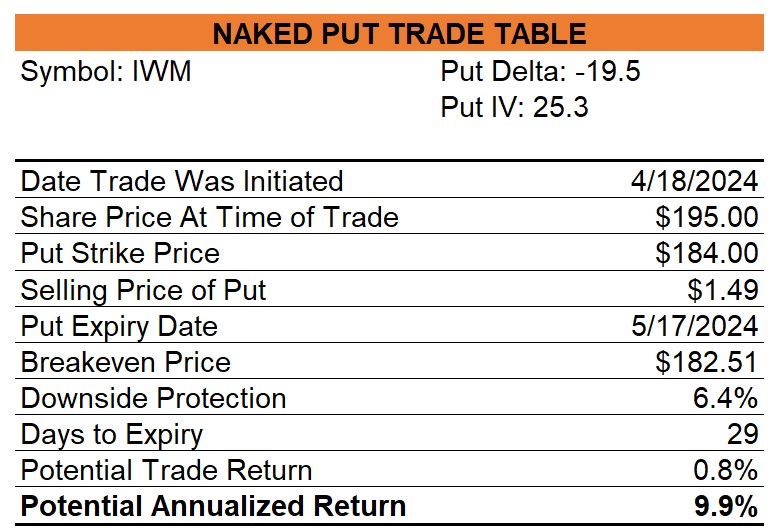

IWM Puts Sold

On April 18, I sold uncovered IWM May 17 puts with a strike price of $184.00 for $1.49/ea which will generate an annualized return of 9.9% if IWM closes above $184.00 at expiry.

0 Comments