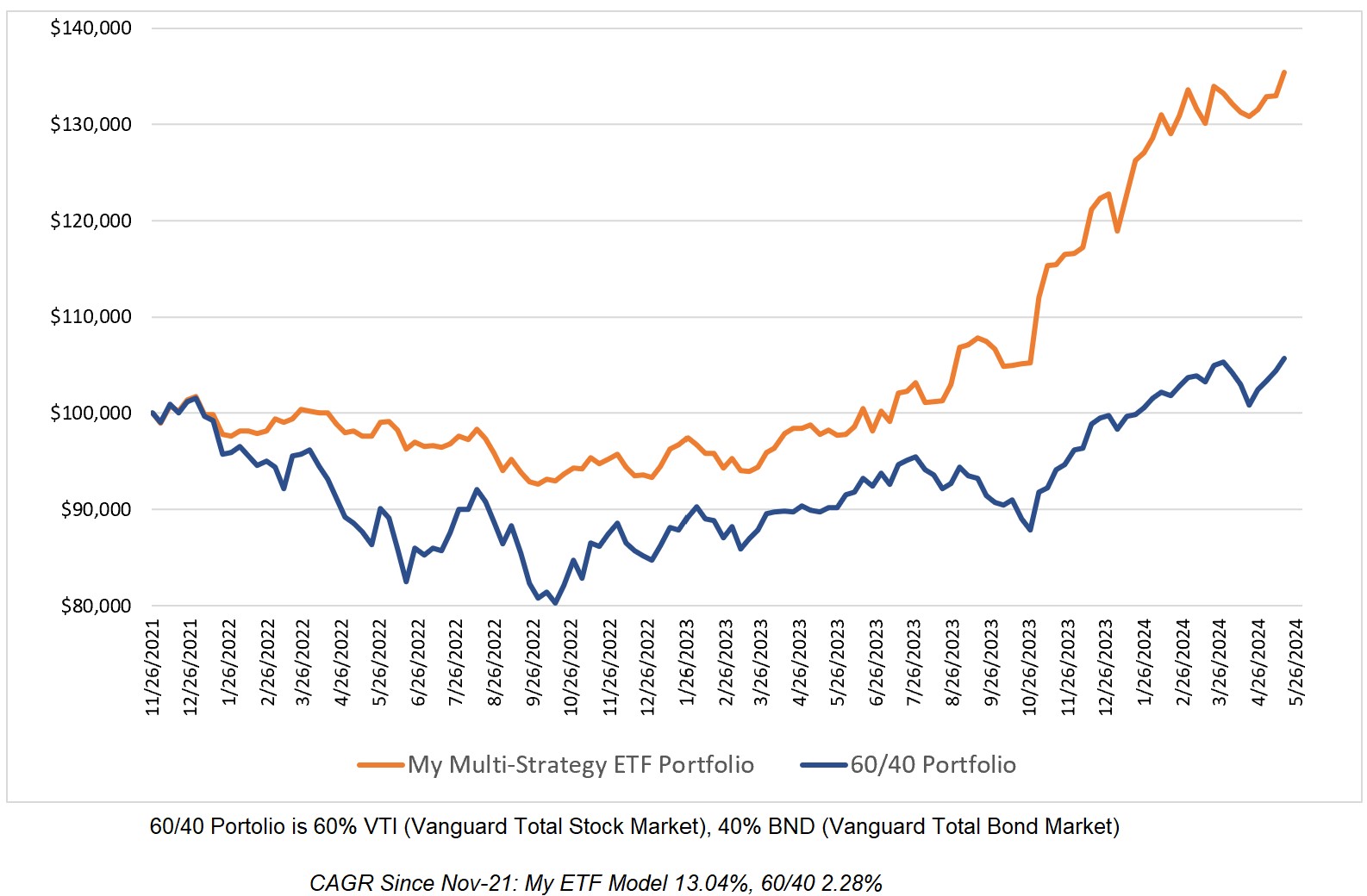

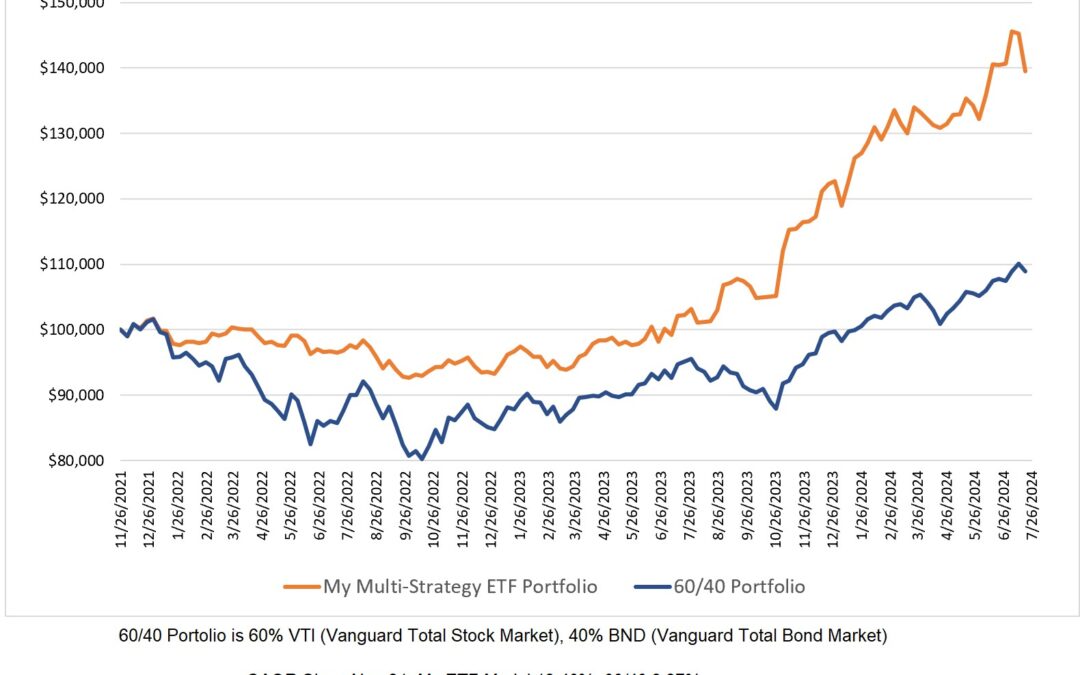

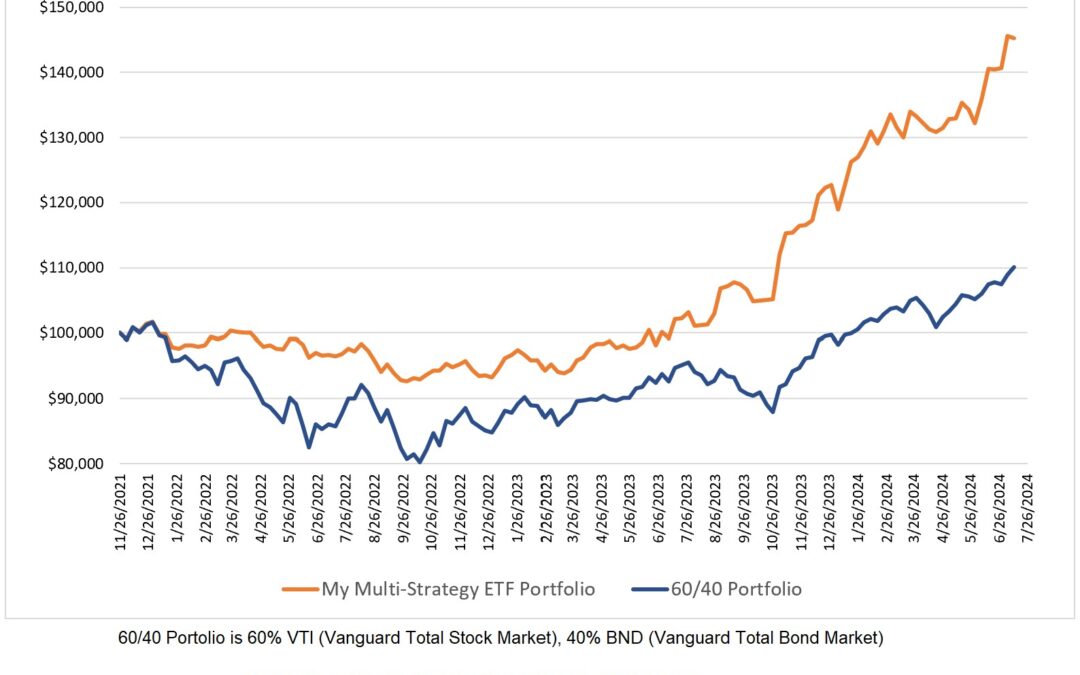

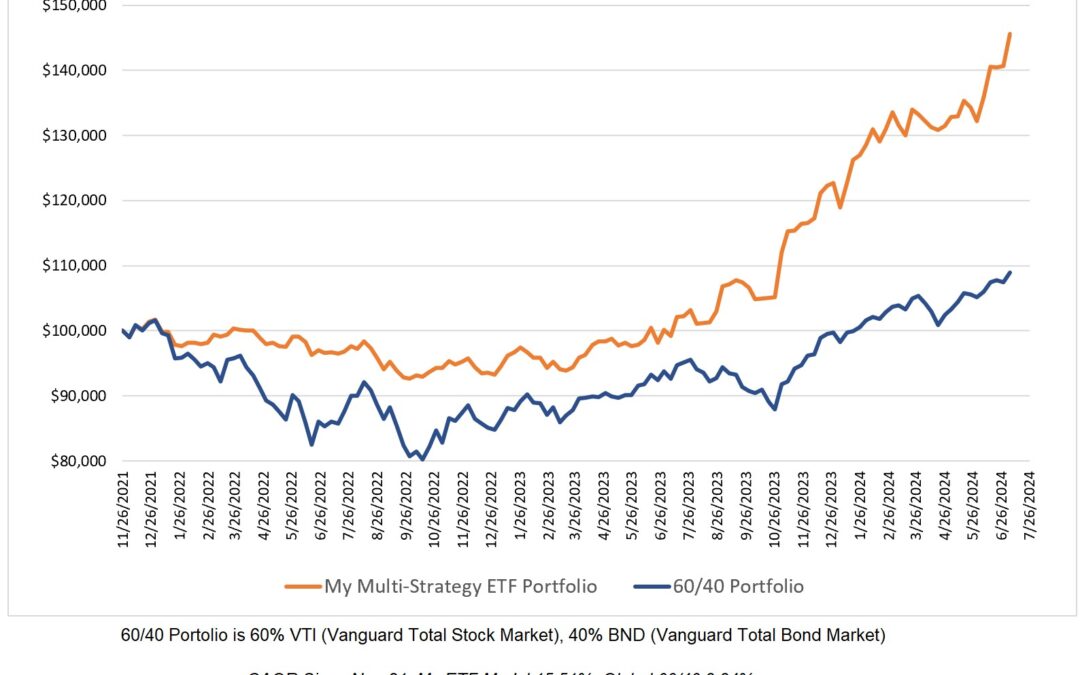

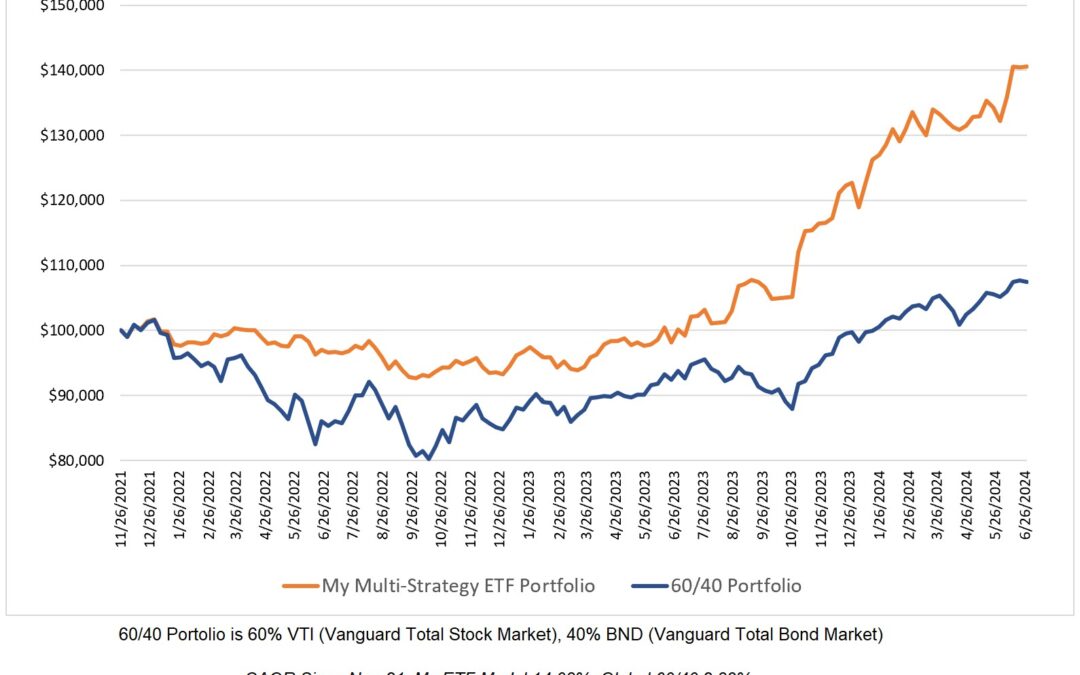

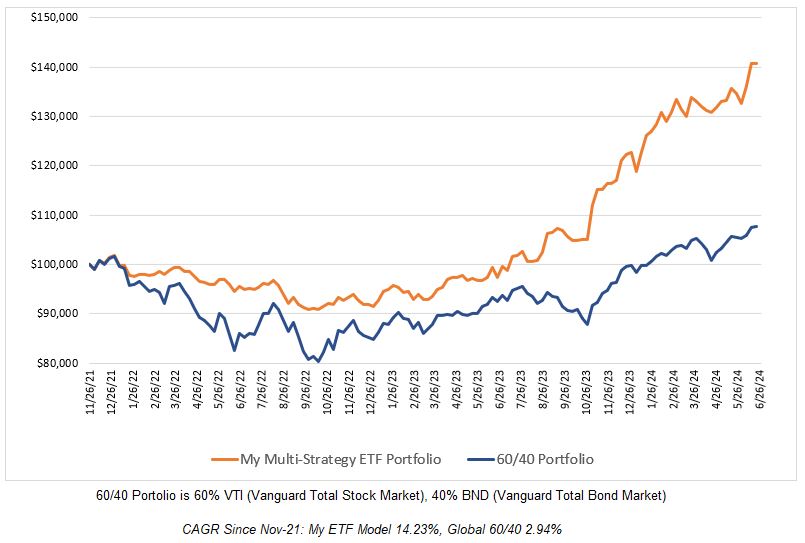

My multi-strategy ETF model hit a new equity high this week and has now produced a CAGR that is 10.76% higher than the 60/40 model since I started posting weekly ETF allocations here in 2021.

My model is now equally allocated to EFA (iShares EAFE), IWM (iShares Russell 2000), PHYS (Sprott Physical Gold Trust), SPY (SPDR S&P 500), QQQ (Invesco QQQ) and VGK (Vanguard FTSE Europe).

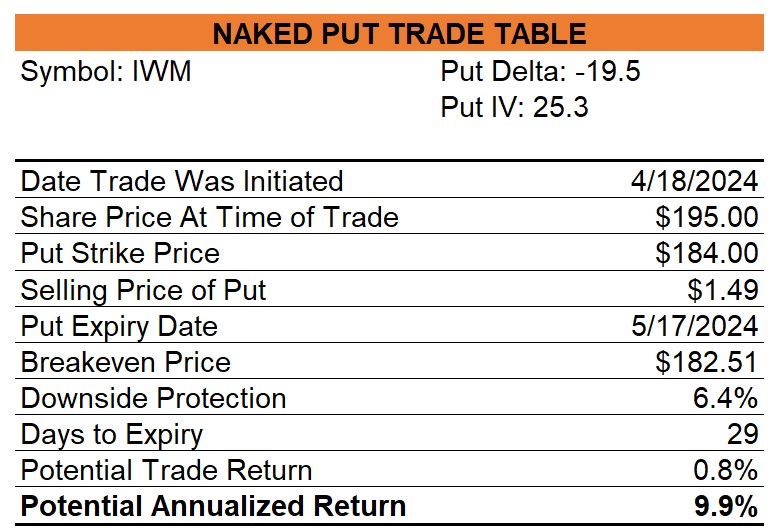

The naked IWM puts that I sold on April 18 expired worthless thereby generating a 9.9% annualized return.

0 Comments