I have many new followers on Twitter/X and a common question I get is “Why do you allocate to only one strategy at a time rather than allocate evenly across them?” In developing my weekly trading system, I formulated a method of selecting one strategy to allocate to each week that resulted in better performance than allocating to all strategies equally.

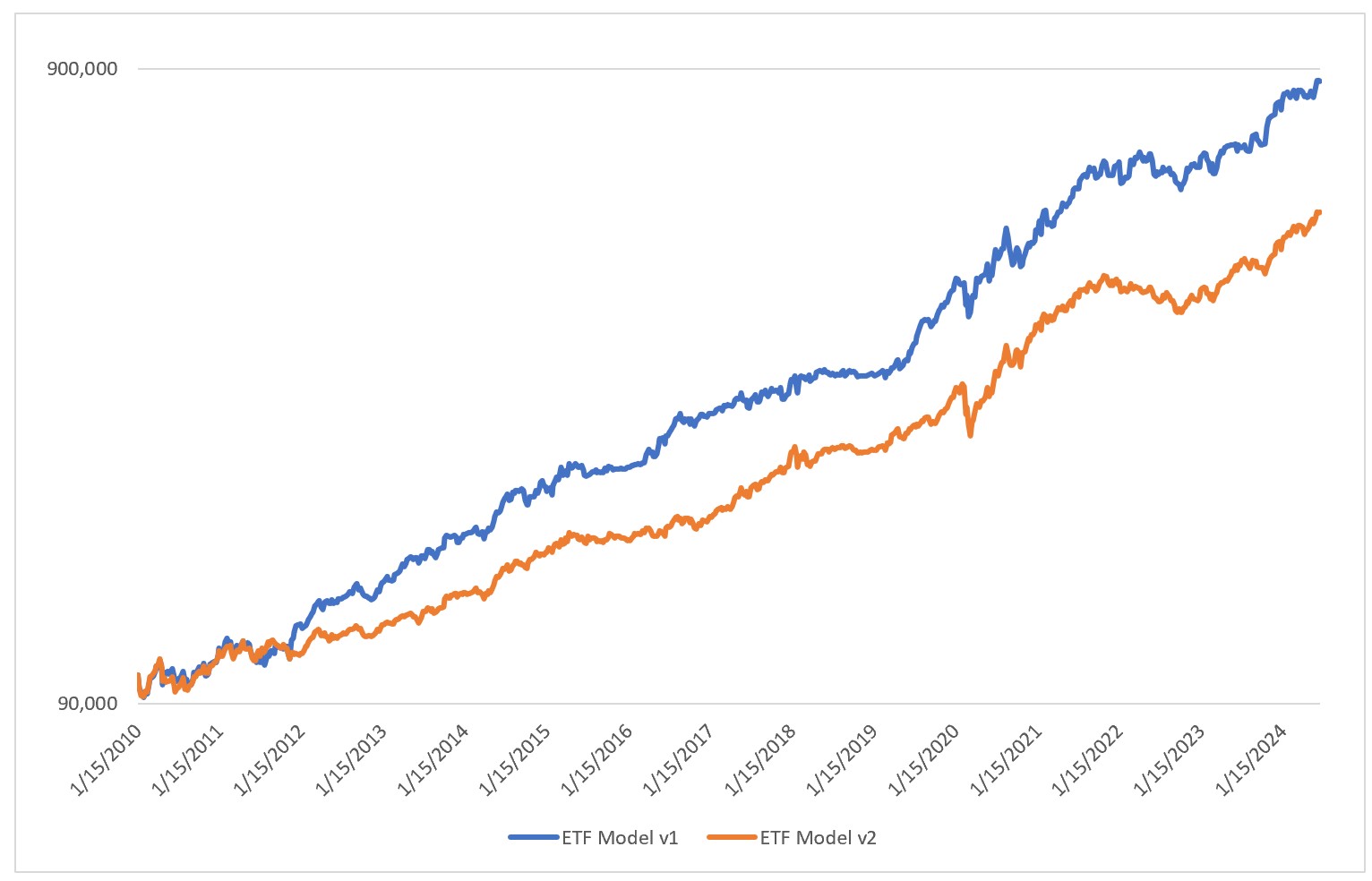

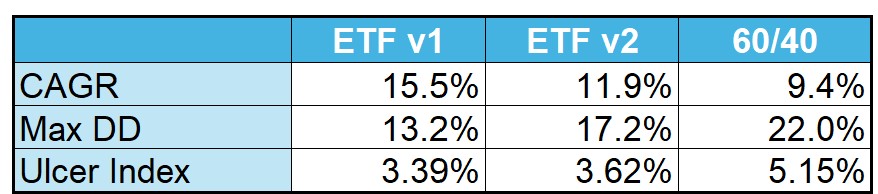

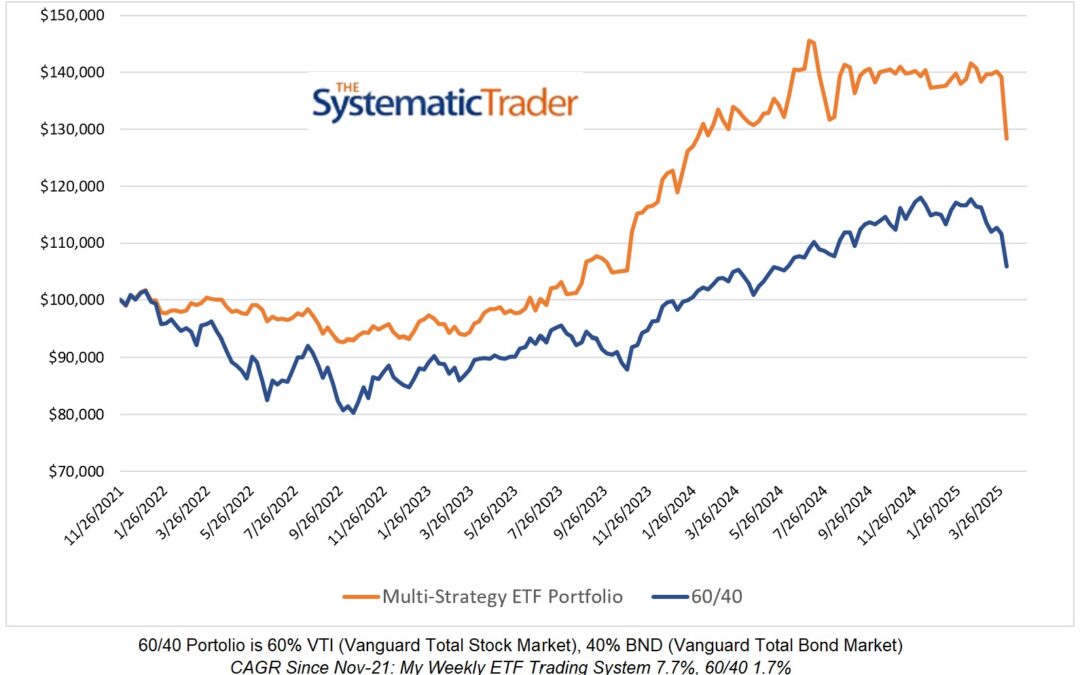

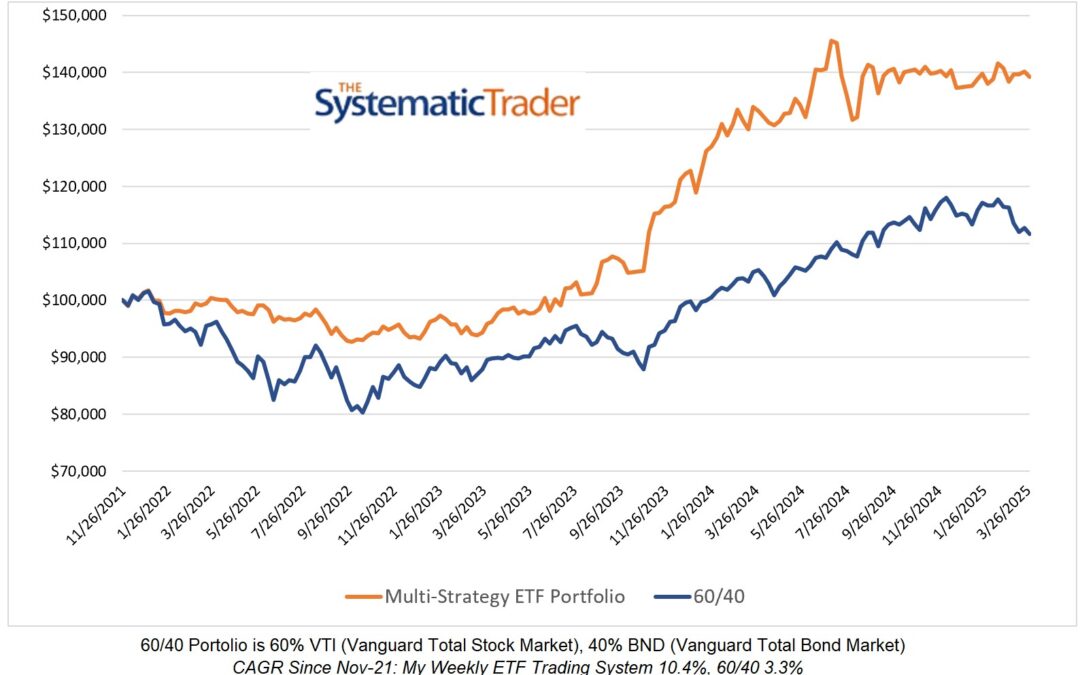

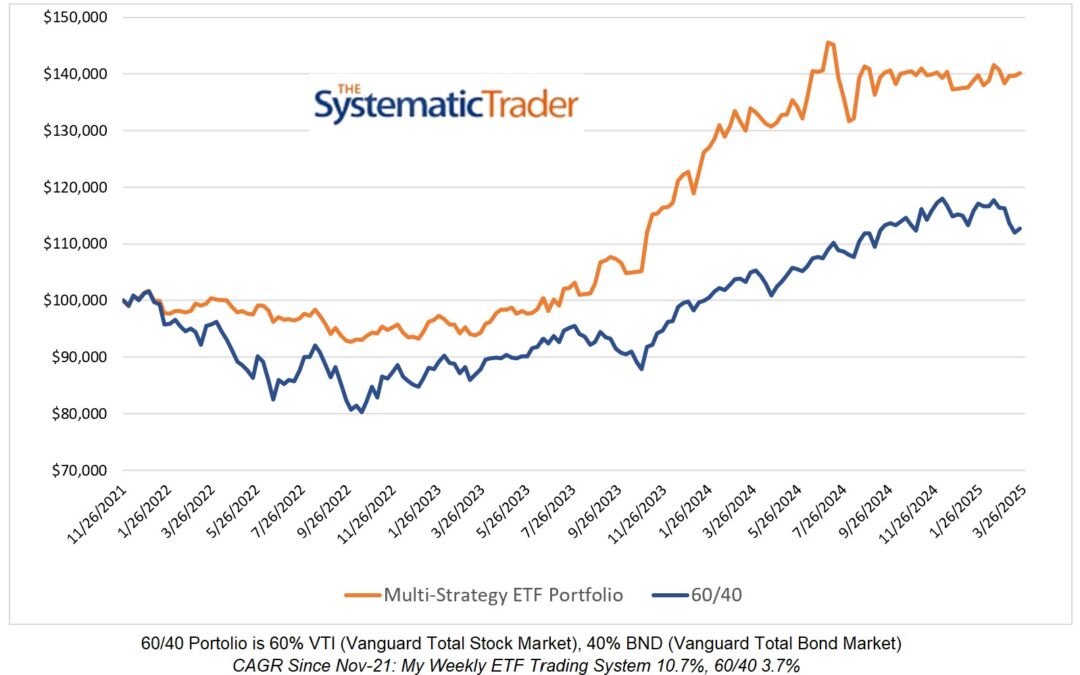

In the chart above, v1 is the system I use with only one strategy allocated at a time. v2 is a system with equal allocations to all strategies. The improvement is obvious.

The system with only one strategy allocated at a time has a higher CAGR, lower maximum drawdown, and lower Ulcer Index.

For those of you who trade a suite of strategies, I encourage you to test rules for turning underperforming strategies off and turning them back on when performance improves. It works for the trading systems (combination of strategies) I use but the rules are dependent on the combination of strategies.

Thanks for sharing. Do you implement your switching on QuantMage or Composer? Or do you track your strategies manually and then execute the trades? Thank you for continuing to share your investing journey.

I run my strategies in Excel. On Friday afternoon when there is less than an hour remaining in the trading session, I open my workbook and, with the current ETF prices automatically updated, I see if there is going to be a change in the allocations. If so, I manually execute the trades. Given that it is a weekly trading system and sometimes there is no change in the allocations for several weeks, it isn’t a big deal to execute the trades manually.