April 18

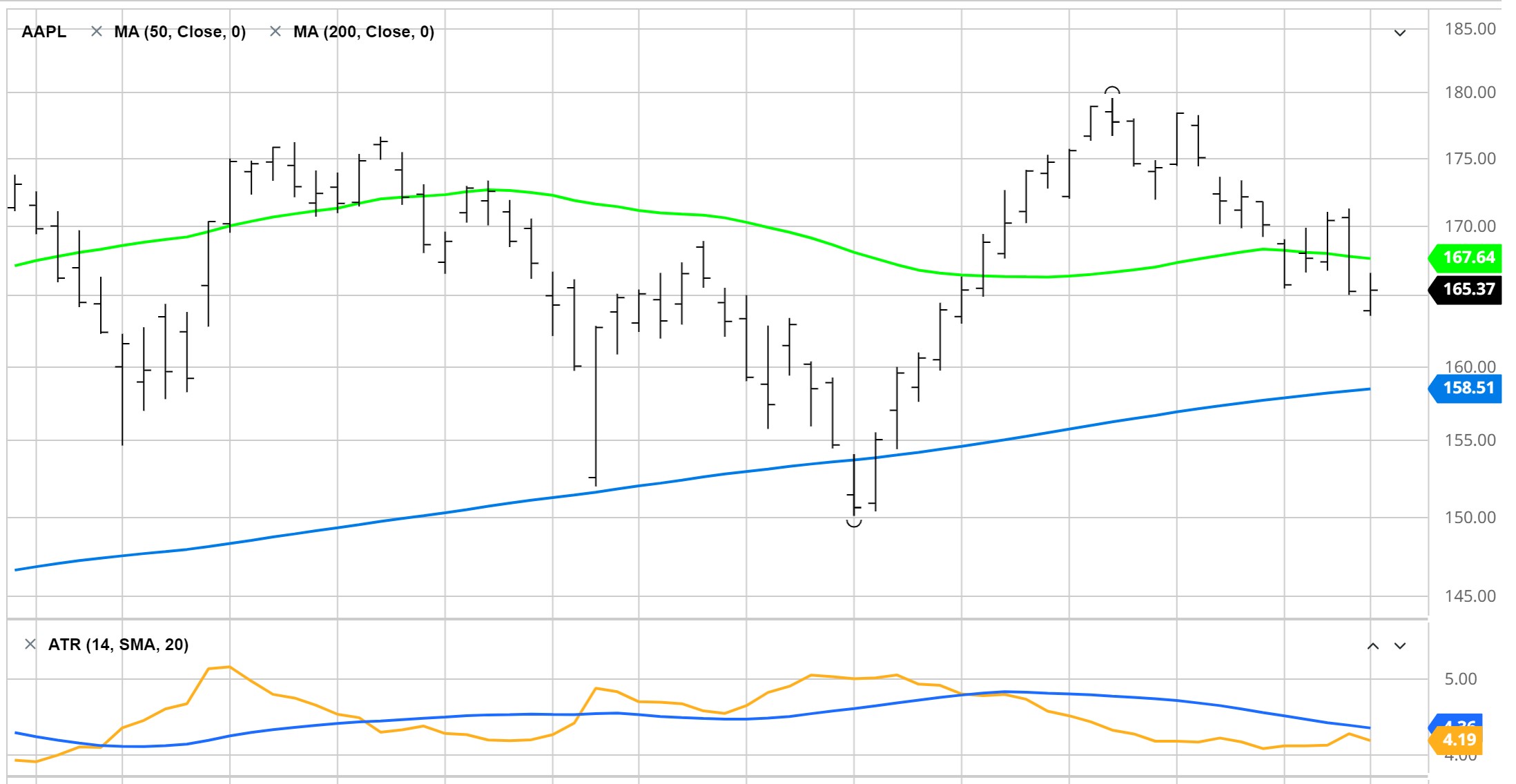

Apple (AAPL) – Shares Purchased

I purchased AAPL shares with a position size of 3.0% and then set up a 6% trailing loss. These two values combined lead to a maximum loss of 0.18% (3% x 6%) of my portfolio if the share price declines immediately after purchase and my shares are sold 6% below the purchase price.

In case you are wondering, I base my position size on past trade performance of the strategy that a stock selection is based upon. AAPL passed the weakest of three strategies that I currently use. My largest position size for a single stock will be roughly 8.0% of my portfolio and that will be used for stock selections that are generated by my best-performing strategy. It would be fantastic if my best strategy produced enough stock selections that I didn’t need two other strategies but, based on my decades of trading experience, I know that I will always have to employ several stock-selection strategies.

April 21

Pan American Silver (PAAS) – Shares Sold

I originally set my trailing stop for PAAS at 8% but after the share price ran up enough for me to have an open profit close to 10%, I tightened my stop to 6%. The stock price did retreat and my stop was triggered for a 3.6% gain in 15 days.

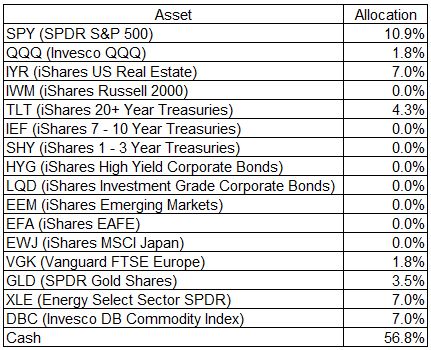

Asset Class Allocations for ETF Investing

My asset class allocation models continue to remain cautious with a relatively high allocation of 56.8% to cash.

I did hold SPY but had set a 5% trailing stop and today, as the SPY slid 2.8%, I was stopped out. As noted previously, I was stopped out of my holdings of XLE and DBC. As for TLT, I have chosen to not hold it at this point. Over the past six months or so, I noticed that TLT, even though recommended by some of my models, was taking away from overall portfolio performance so I didn’t buy it.

0 Comments