January 23

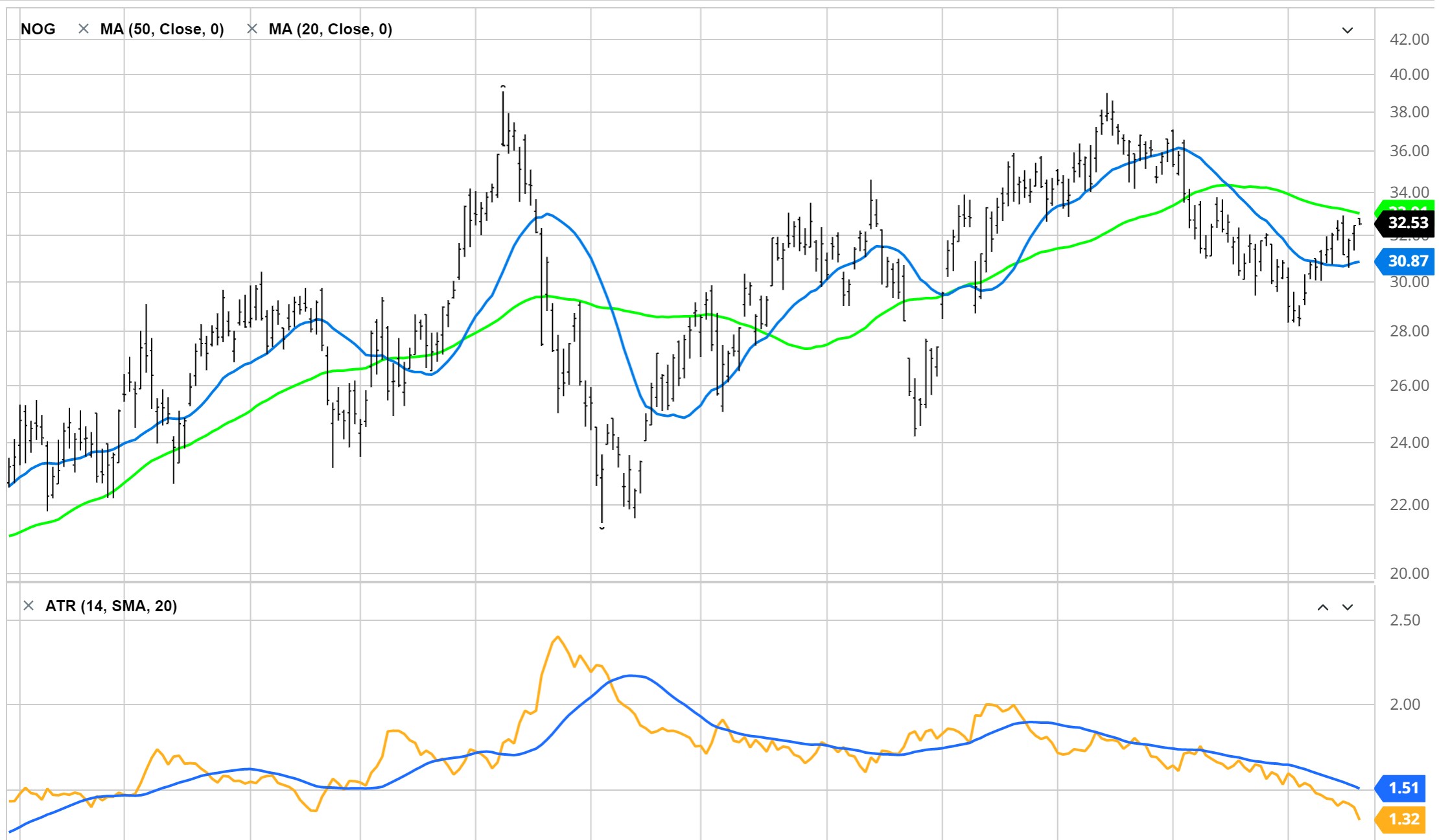

Northern Oil and Gas (NOG) – Shares Purchased

The position size entered was 4.1% of my account and I established a 9% trailing sell stop immediately after purchasing the shares.

DiamondBack Energy (FANG) – Shares Sold

I sold my FANG shares at $148.99 which resulted in an 8.3% profit over a 40-day holding period.

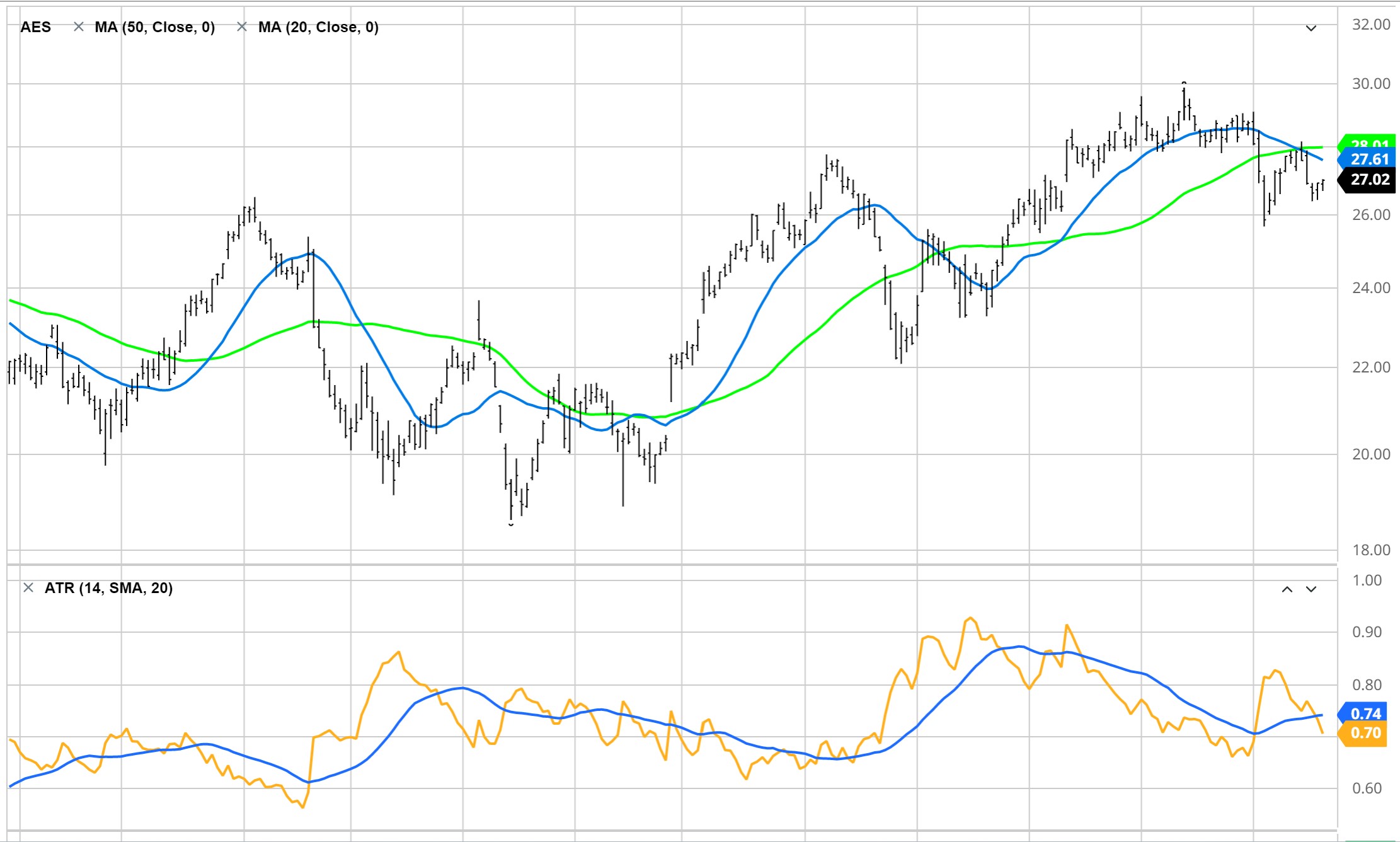

The AES Corp (AES) – Shares Purchased

The position size entered was 5.0% of my account and I established a 7% trailing sell stop immediately after purchasing the shares.

January 24

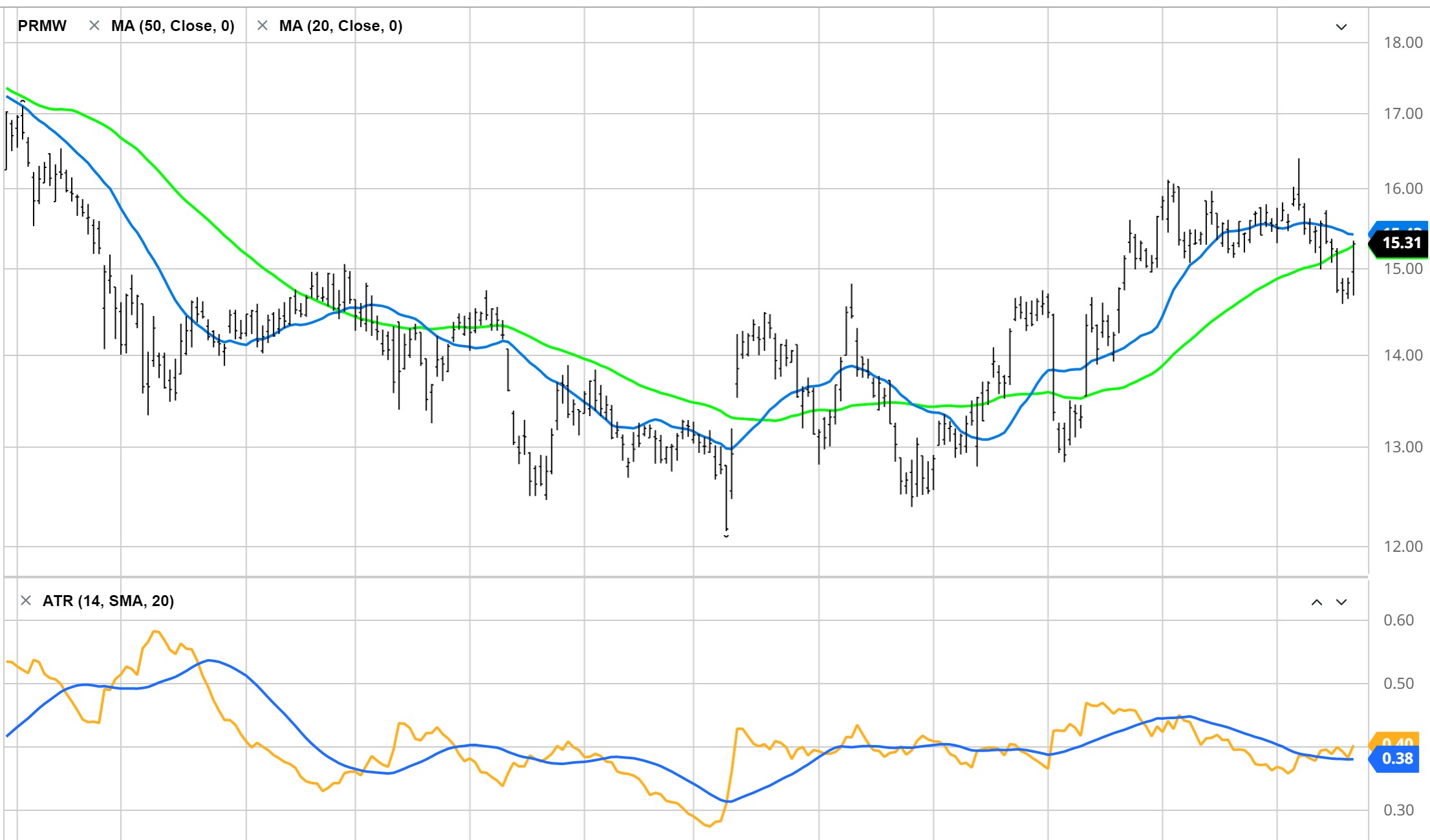

Primo Water Corp (PRMW) – Shares Purchased

The position size entered was 4.4% of my account and I established an 8% trailing sell stop immediately after purchasing the shares.

January 25

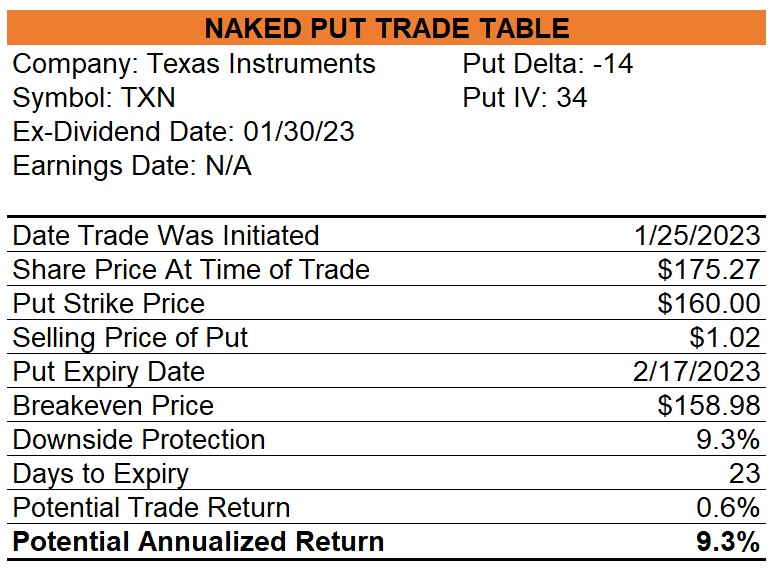

Texas Instruments (TXN) – Puts Sold

I sold Feb-17 $160.00 puts for $1.02.

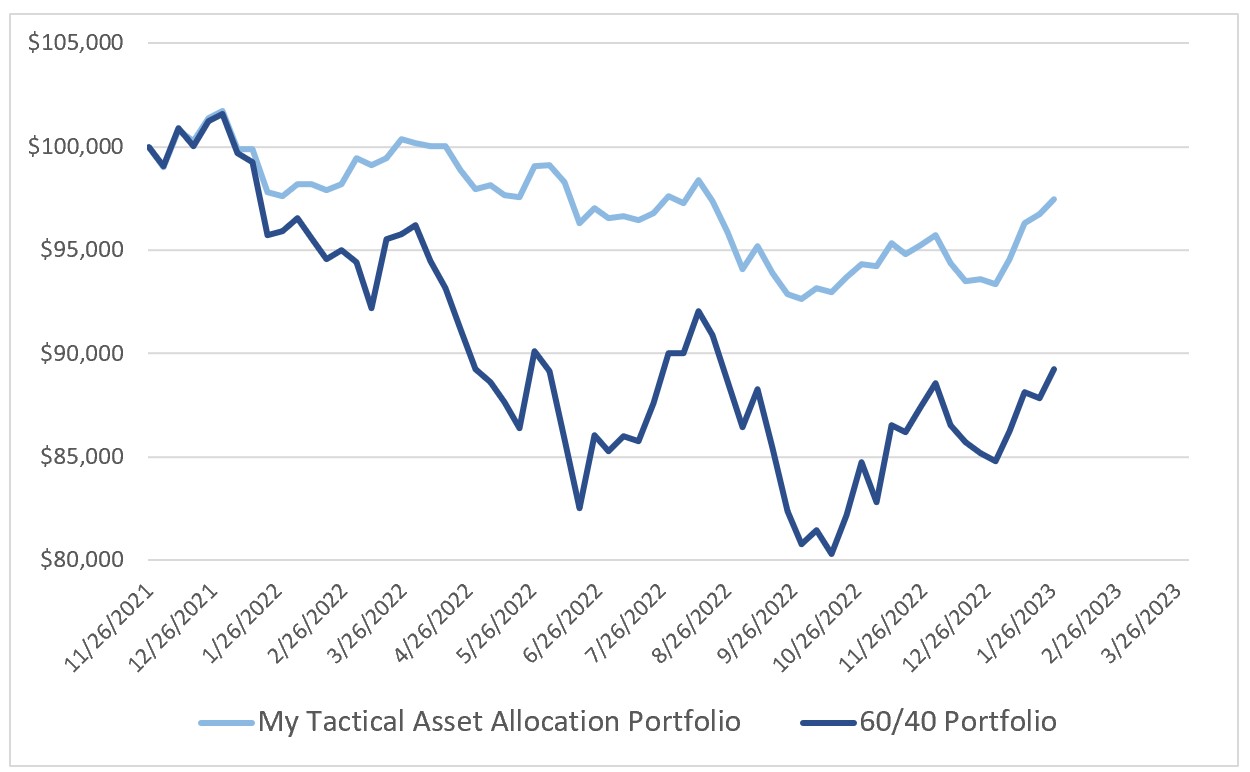

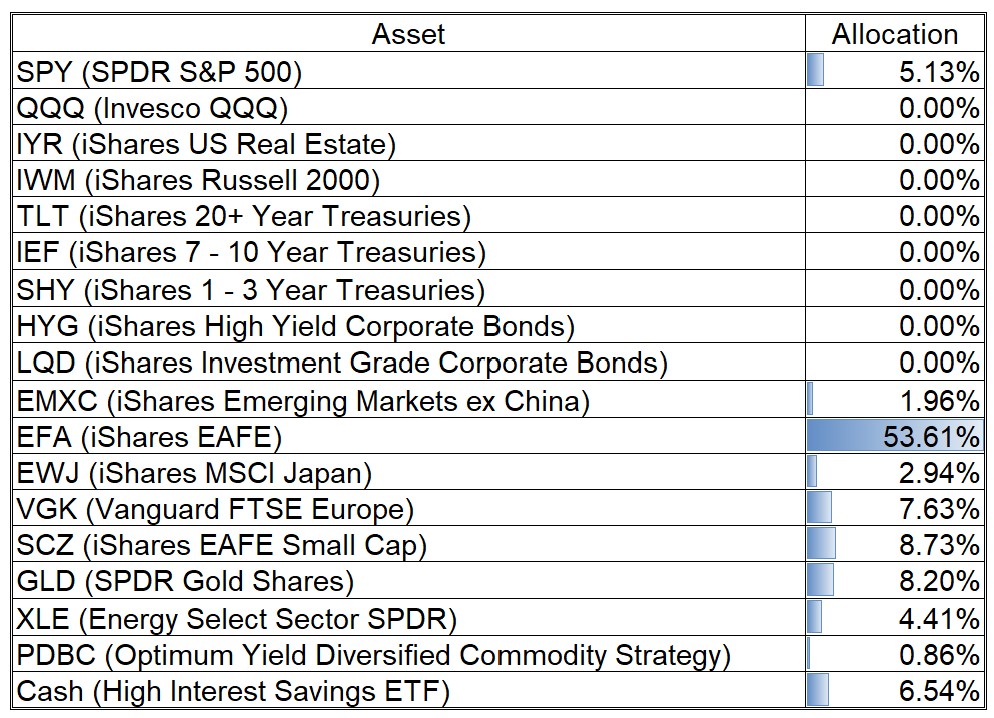

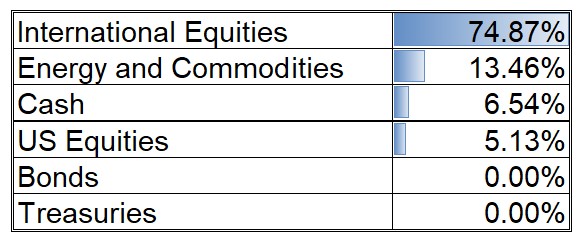

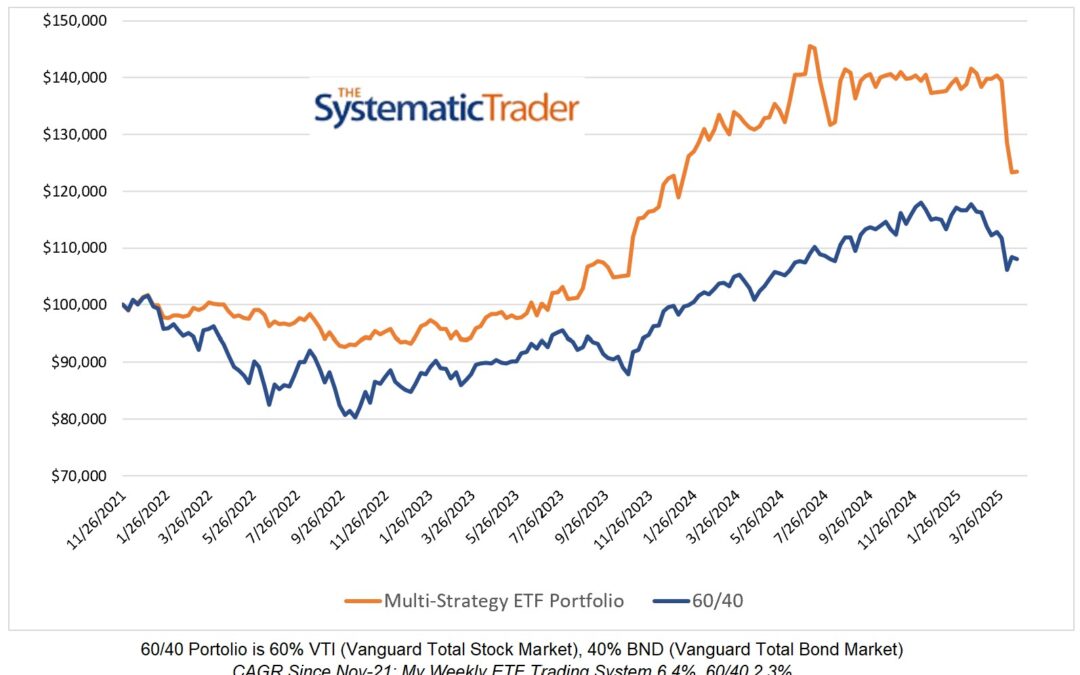

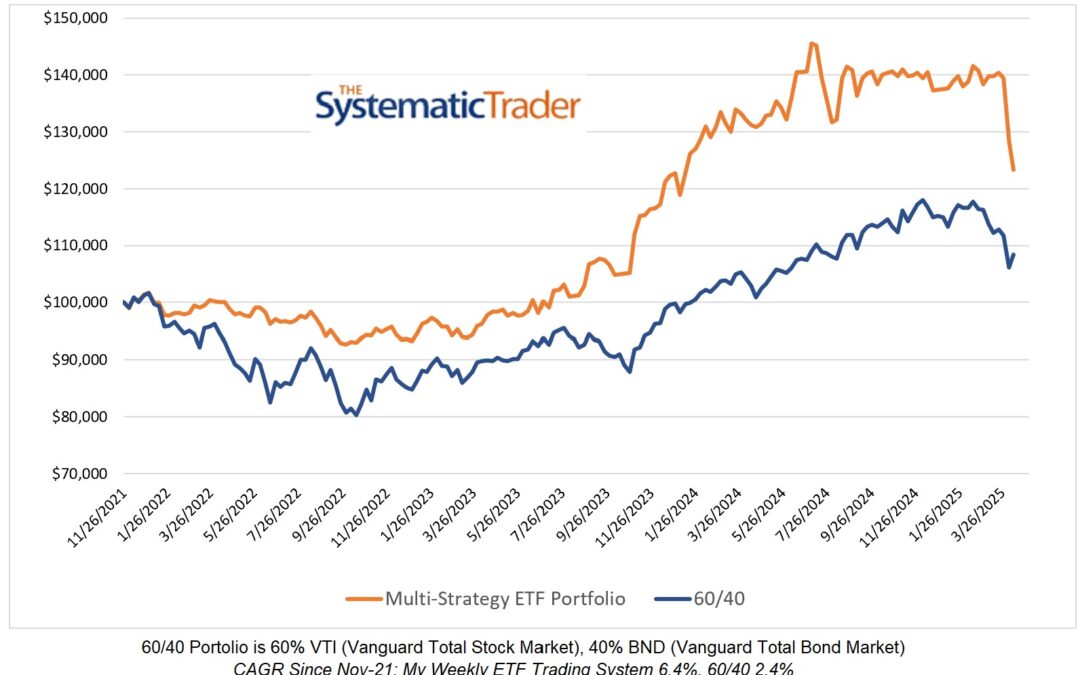

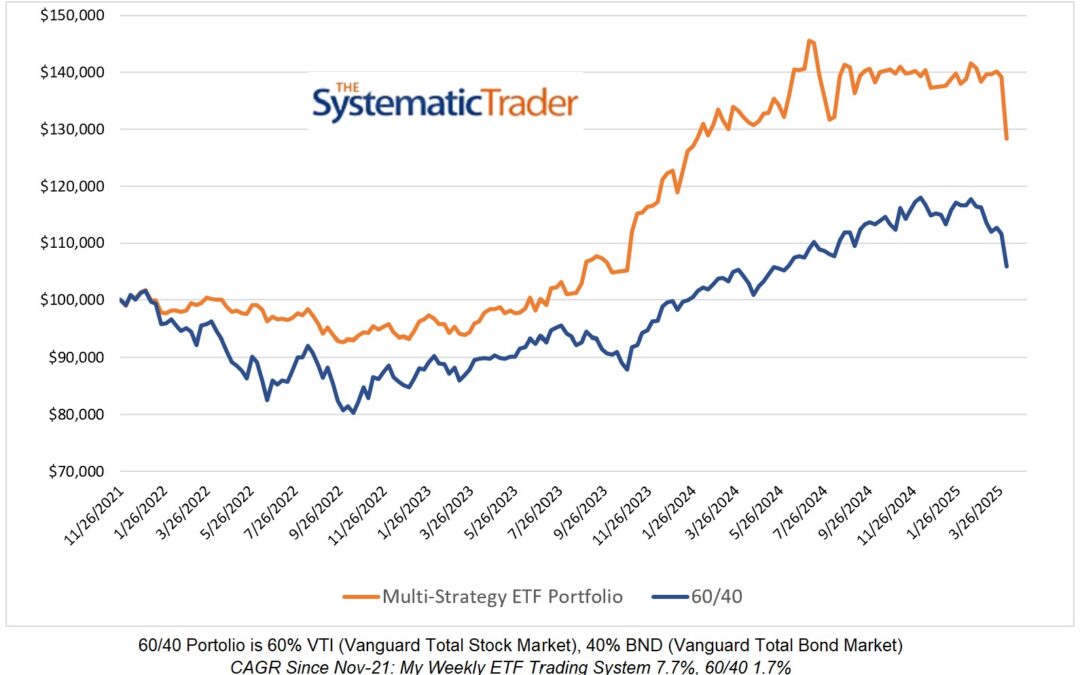

My Tactical Asset Allocations

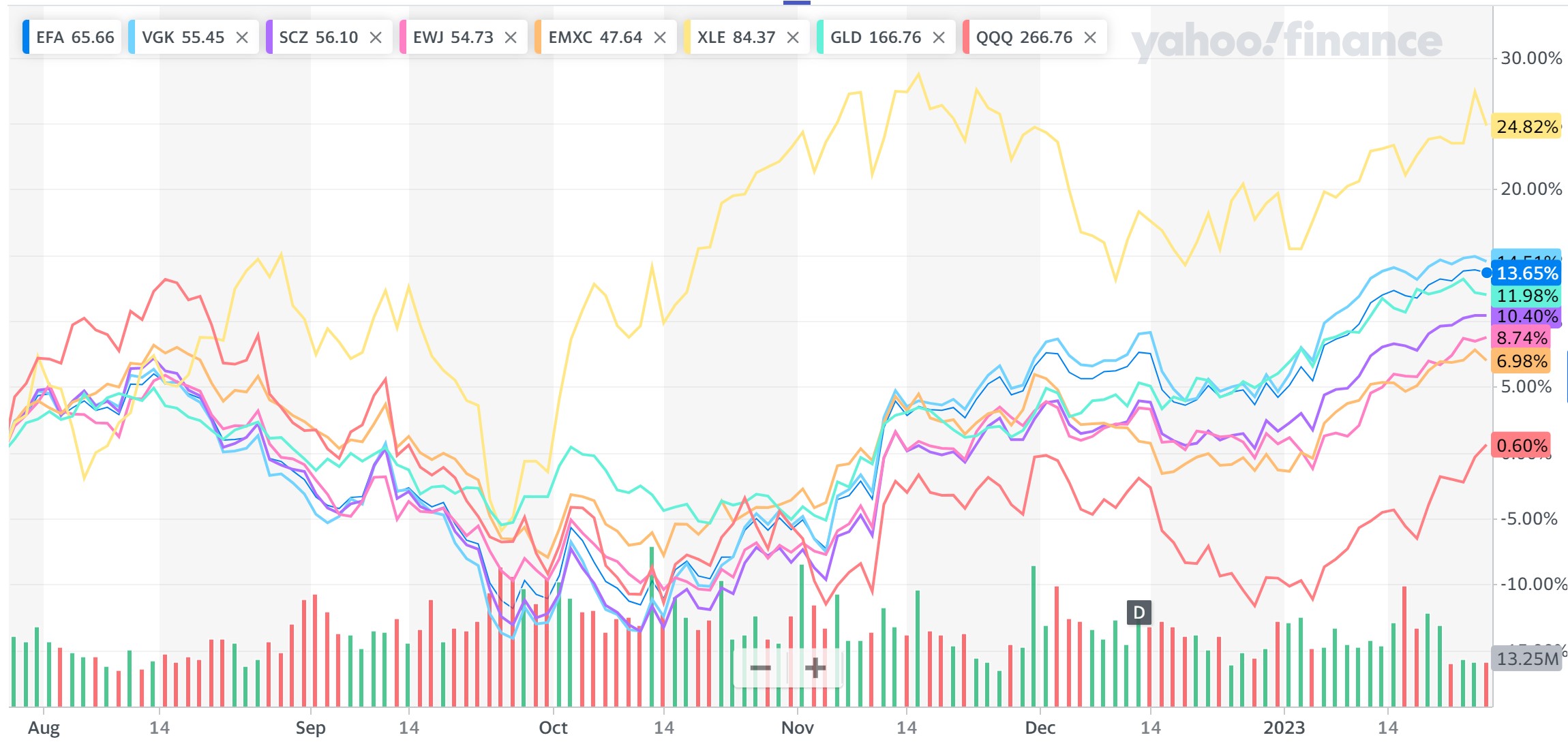

Despite all the chatter in my Twitter feed about US equities, many other asset classes have stronger momentum and my model has a very modest allocation of only 5.1% to US stocks.

QQQ has had a strong start so far in 2023 but over the past 6 months it, like most other US stock ETFs, lags many of the other ETFs that I use.

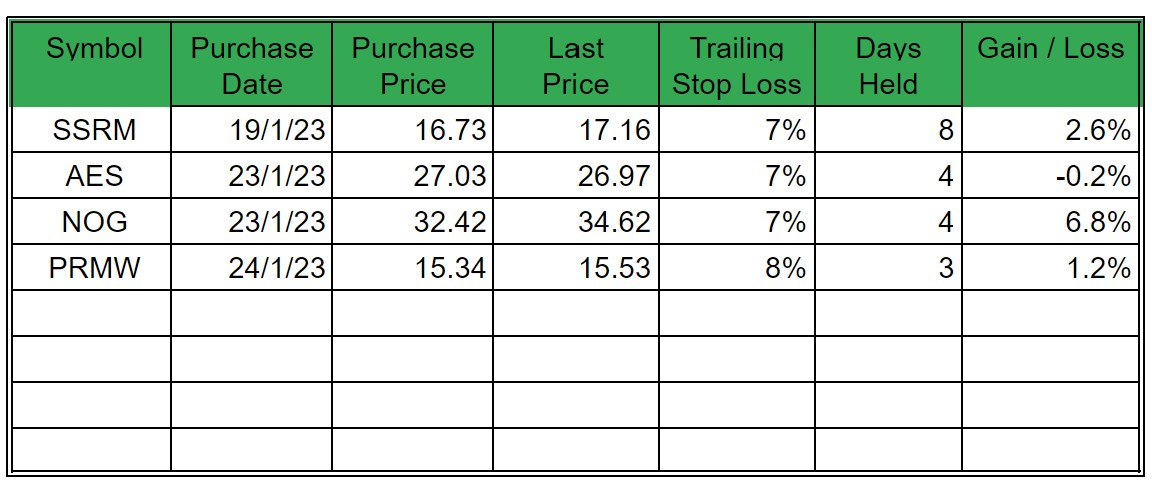

Open Positions

In addition to the TXN puts that I sold short, I am holding four US stocks.

0 Comments