Beating the Pros

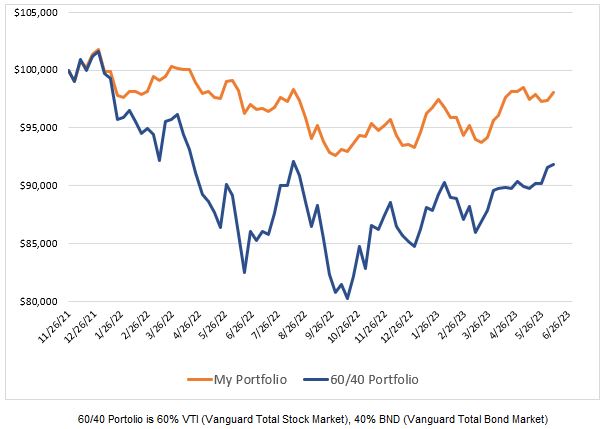

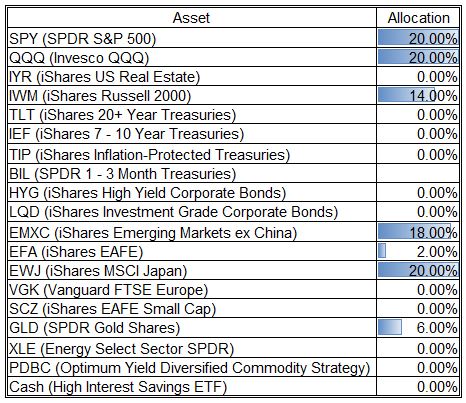

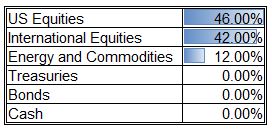

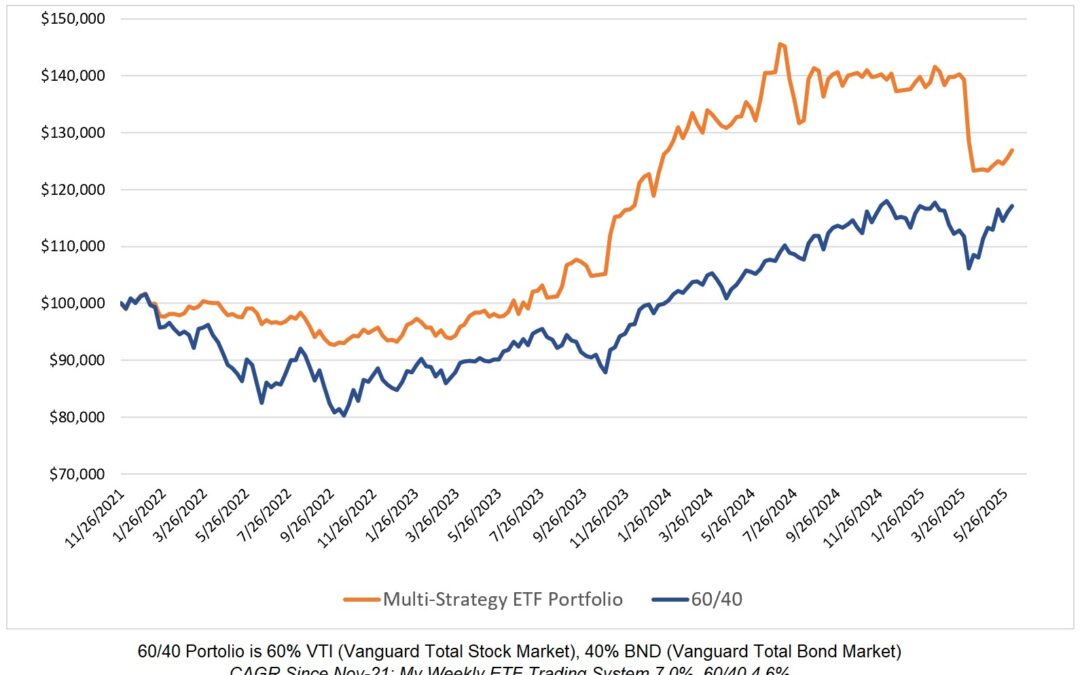

I post my personal ETF model allocations here every week so that I can compare the performance of those allocations over time against a 60/40 portfolio and alternative investment options that I would personally consider such as tactical asset allocation ETFs. If my model allocations underperform, I would have to ask myself “Why don’t I invest differently?” Of course, I don’t have to post the allocations publicly but doing so forces me to be honest with my ETF investing performance.

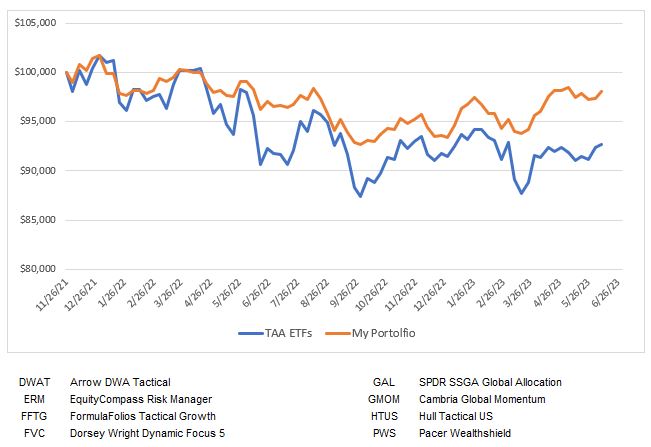

According to Barchart.com, the eight ETFs noted in the chart above have a total of about $750 million in assets under management. My portfolio is ahead of the average of those ETFs by roughly 3.5% per year. That’s a lot and we know what the effect of that difference would be over an extended period of years. On the assets managed by the ETFs, the difference is just over $26M per year. Based on an article published by a Canadian media outlet recently, there is a widespread view that a $1.7M portfolio is required for a couple to retire comfortably. A 3.5% per year improvement in investment performance on a $1.7M portfolio is $59,500 annually.

Will my portfolio of ETFs weekly adjusted continue to outperform the professionally managed ETFs by 3.5% per year? I haven’t the slightest idea if it will. It may outperform by even more or it could underperform. Different market conditions could lead to a change in relative performance. Or not.

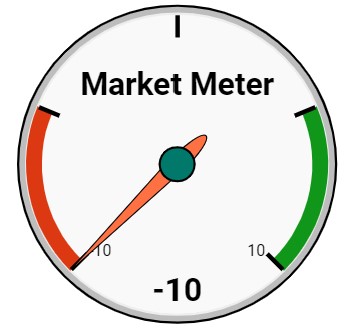

Market Meter

My market meter remains negative which suggests that now is not a good time for me to use margin.

0 Comments