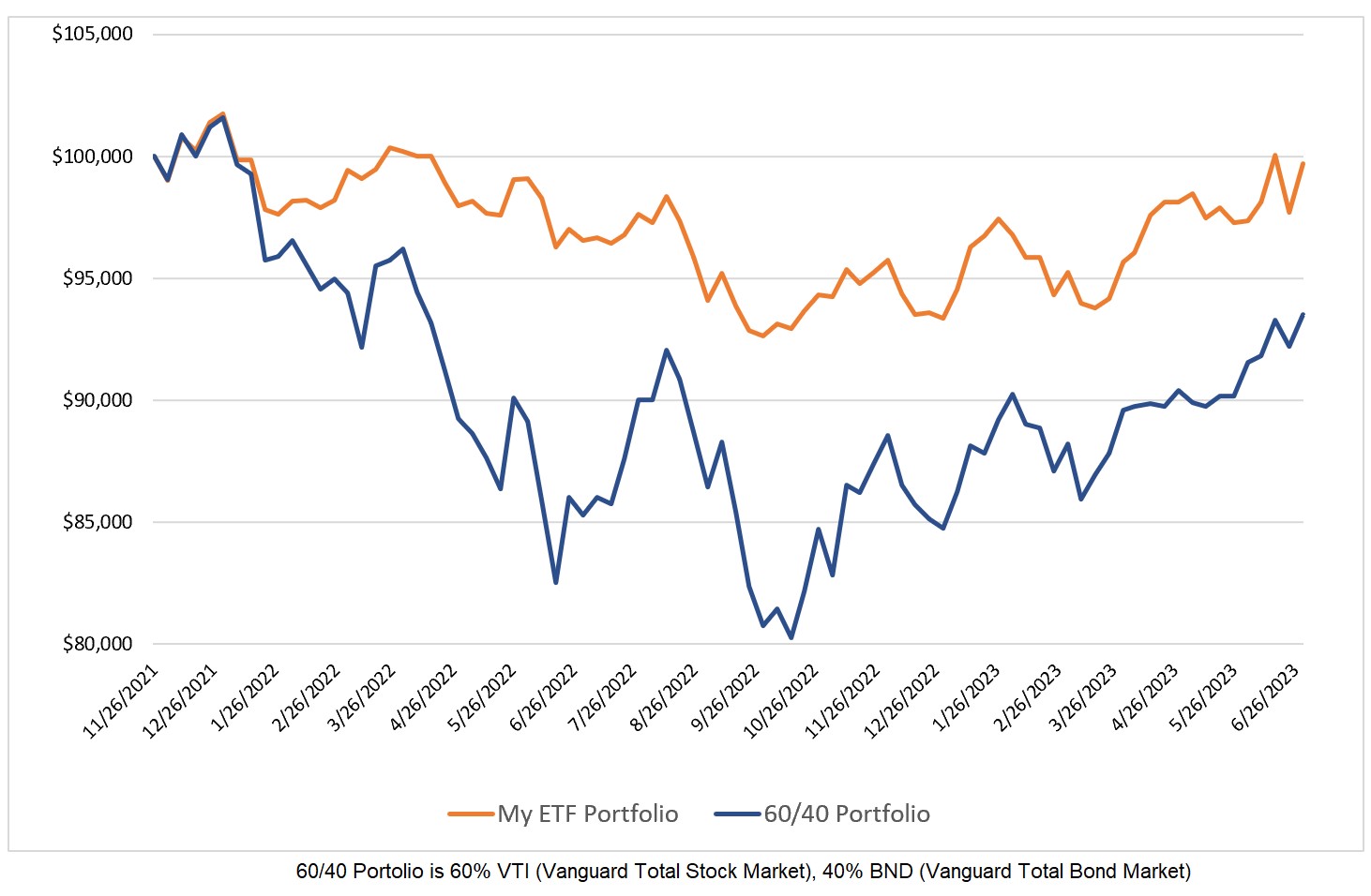

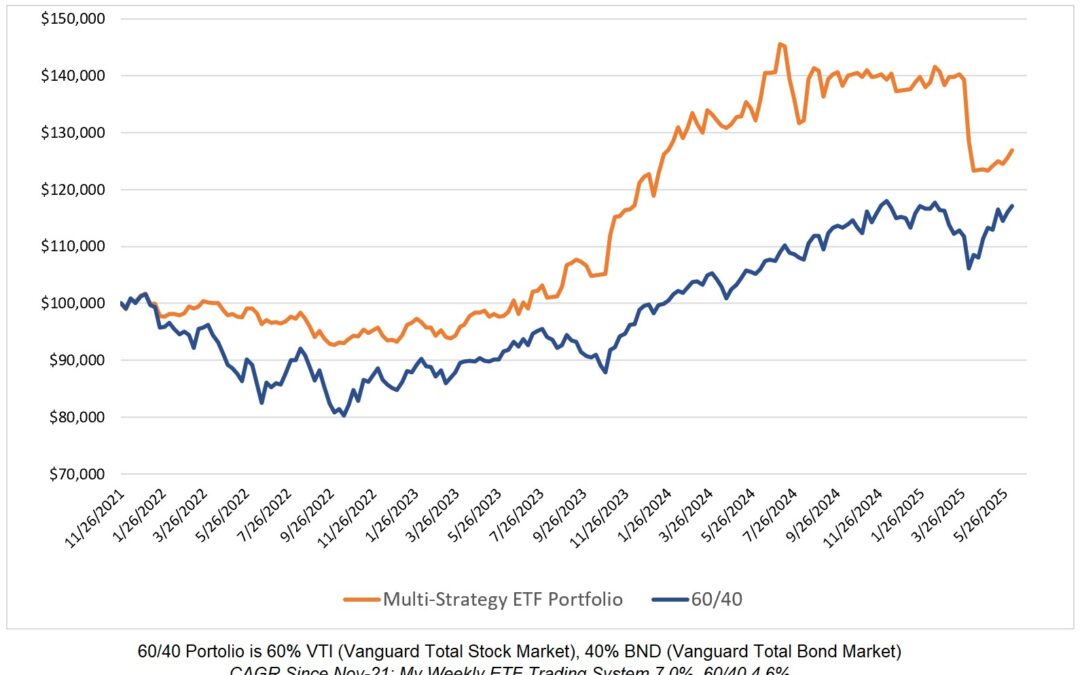

With strong performances in equities last week, my ETF model portfolio rose 2.21% and is currently outperforming the 60/40 portfolio with a 4.02% higher CAGR (compound annual growth rate).

Market Meter

My market meter which is useful for informing me whether or not I should use leverage has a neutral reading of 0.

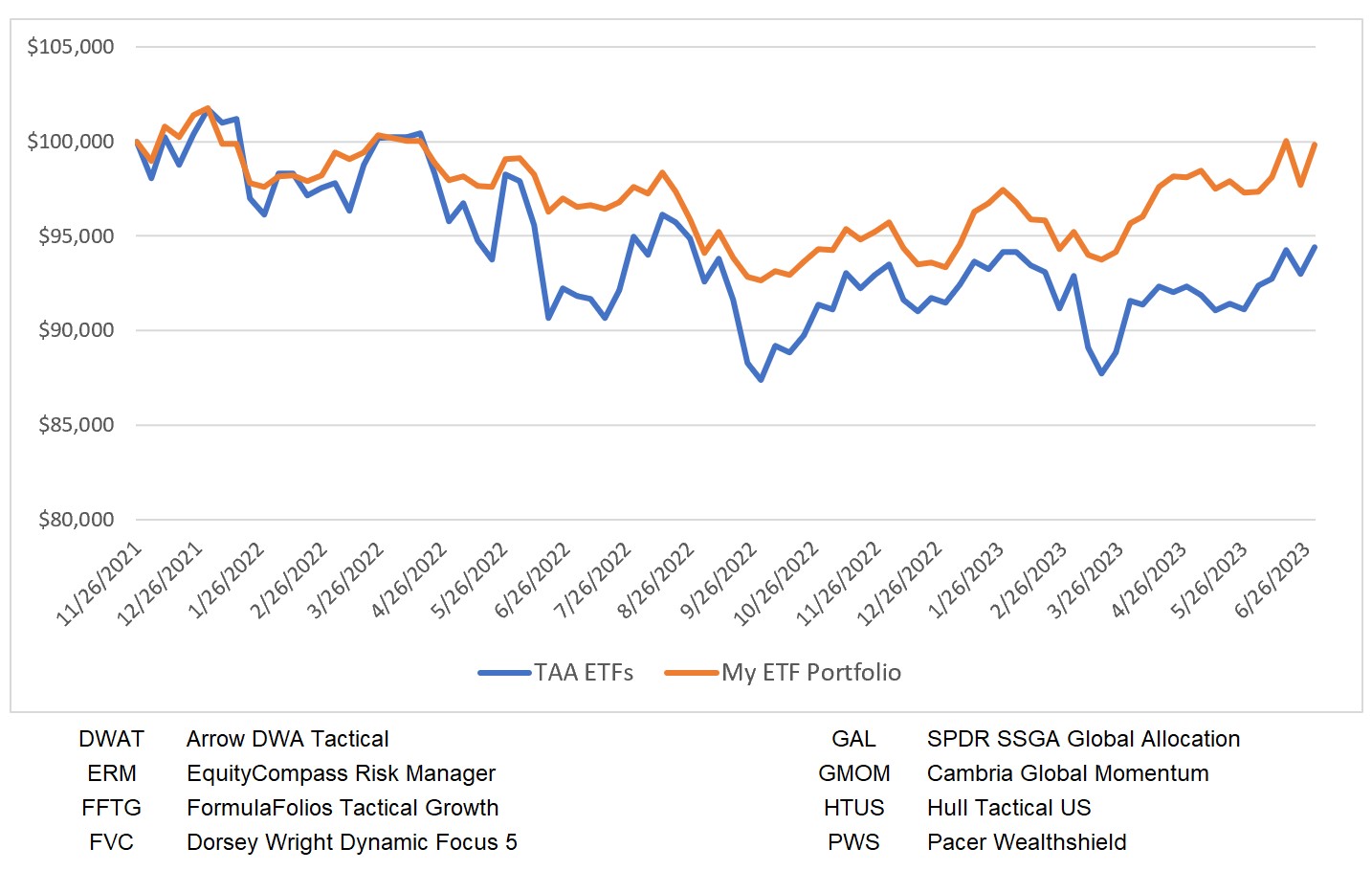

My ETF Portfolio Versus Professional Money

Since I began posting weekly ETF allocations in November 2021, my allocations have outperformed an average of eight Tactical Asset Allocation ETFs with a CAGR which is 3.45% higher. The ETFs listed below the chart have about $750M in assets under management.

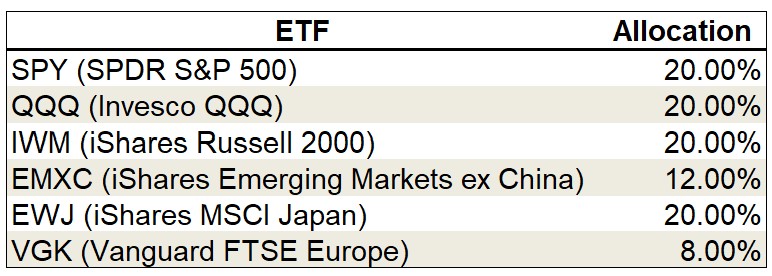

ETF Model Allocations

My current allocations are 100% to equities.

0 Comments