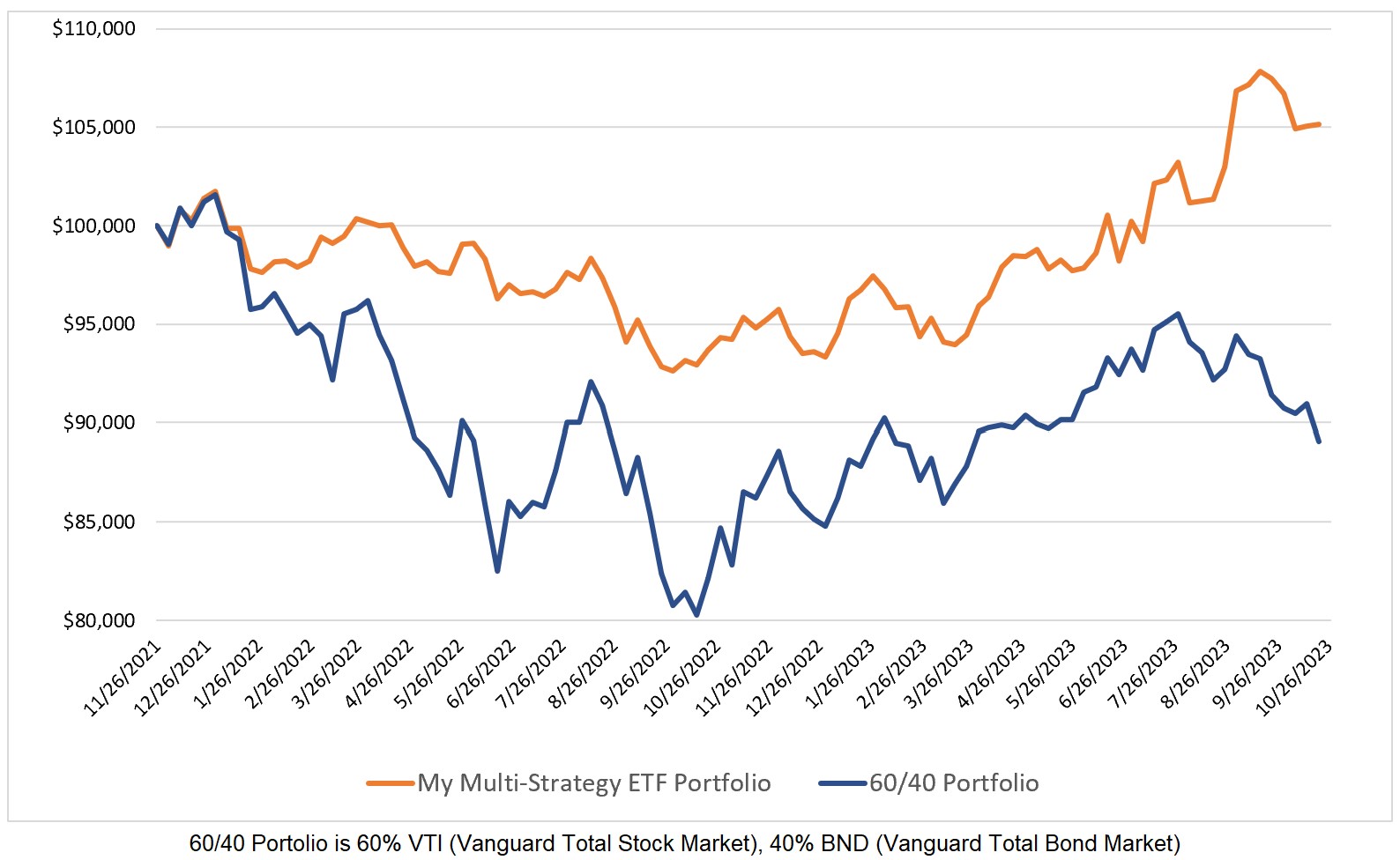

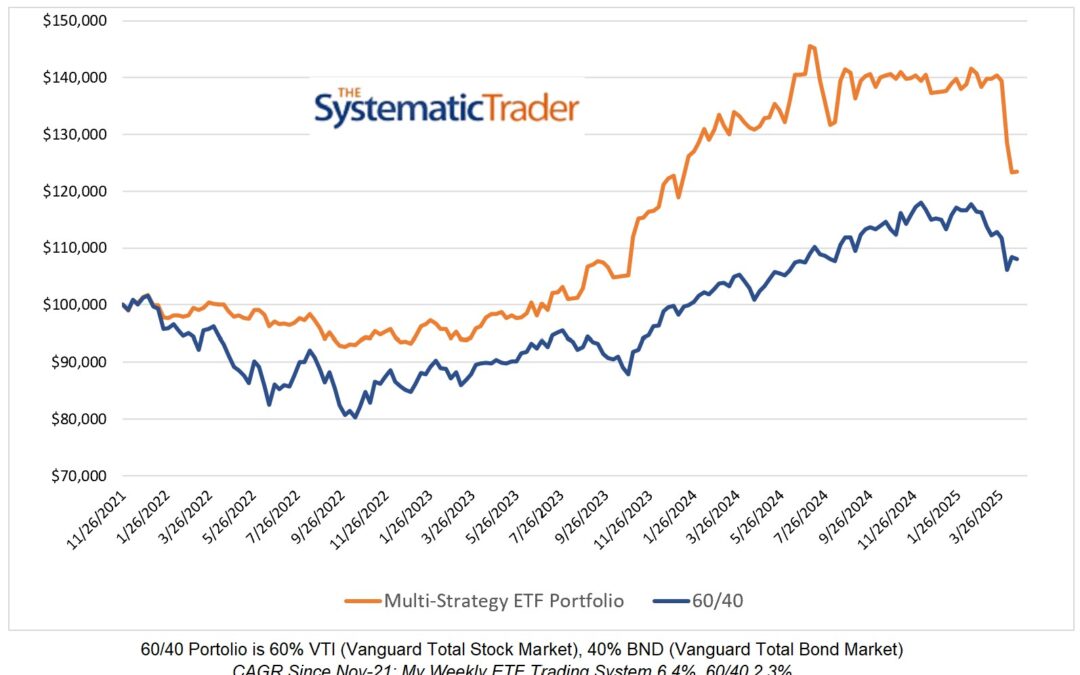

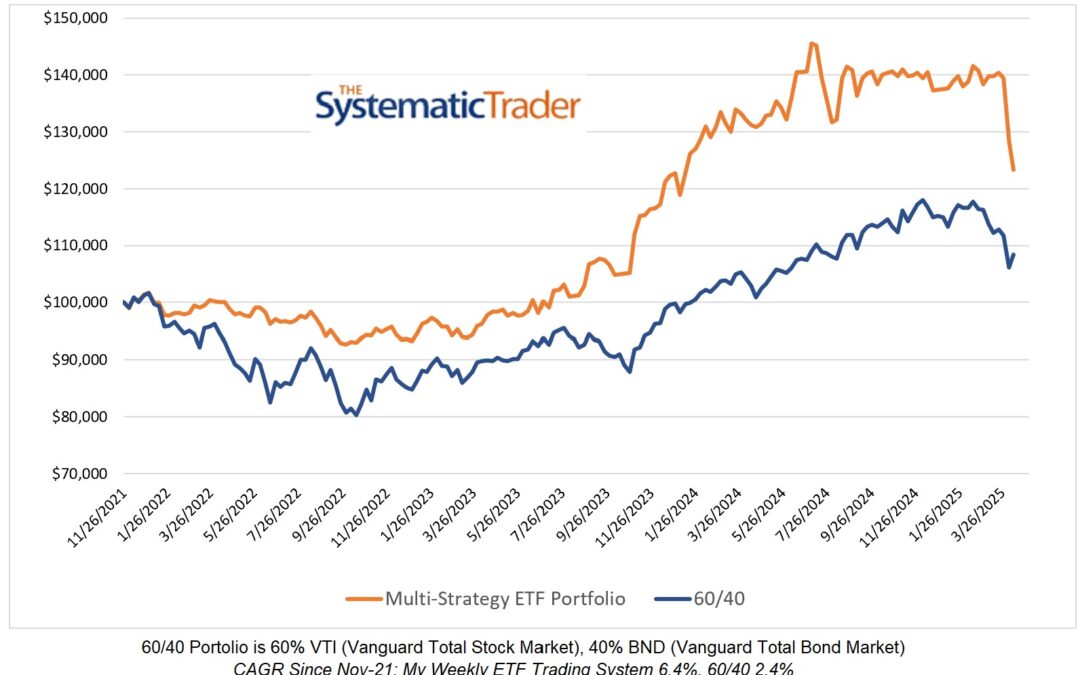

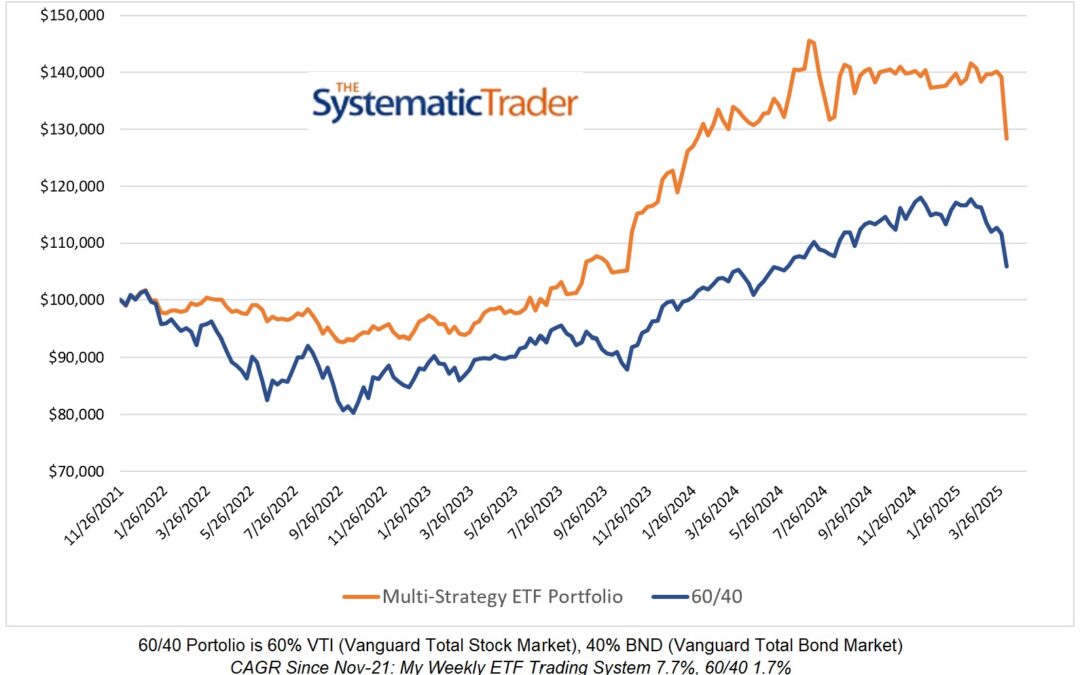

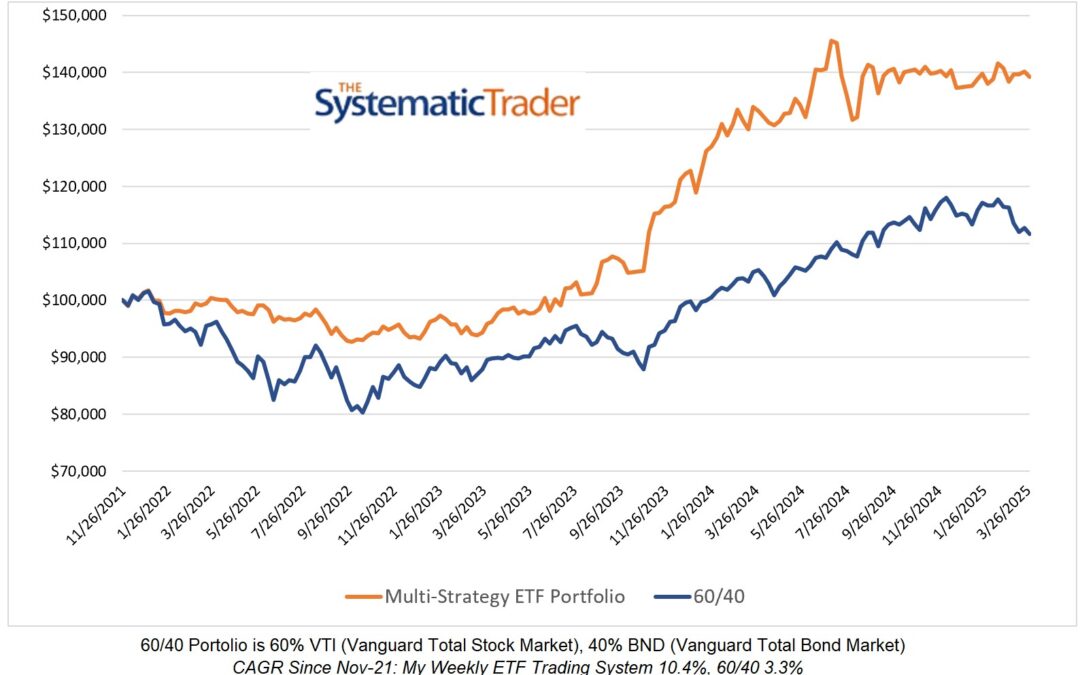

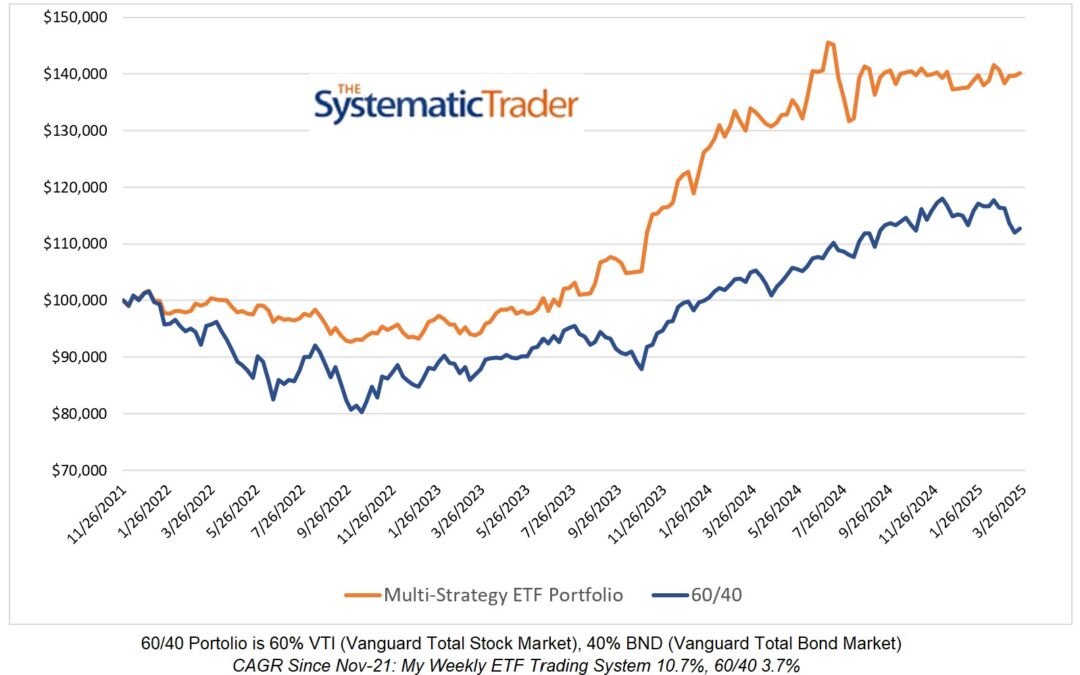

Being invested only in BIL (1 to 3 Month US Treasuries), my multi-strategy model rose a paltry 0.10% this past week but that’s a whole lot better than the 2.09% decline experienced by the classic 60/40 model. My model currently has a CAGR that is 8.6% higher than the 60/40 model and the weekly volatility is 39% lower (1.09% versus 1.80%). Higher returns and lower volatility are certainly what I aim for.

Current ETF Allocations

There is no change in my model’s allocations this week as continues to have 100% invested in BIL.

Naked Puts

The Oct-20 $415.00 SPY naked puts that I sold for $1.80 on September 21 expired worthless as SPY closed above $415.00 on Friday.

0 Comments