I have nothing exciting to report. My weekly ETF strategy remains 100% allocated to BIL.

I have nothing exciting to report. My weekly ETF strategy remains 100% allocated to BIL.

It was another week in a sideways channel for my ETF trading system. My mother told me that there would be weeks like this. She just didn't tell me how many! My system is now 100% invested in BIL. May you get to enjoy some R&R with family and good friends in the...

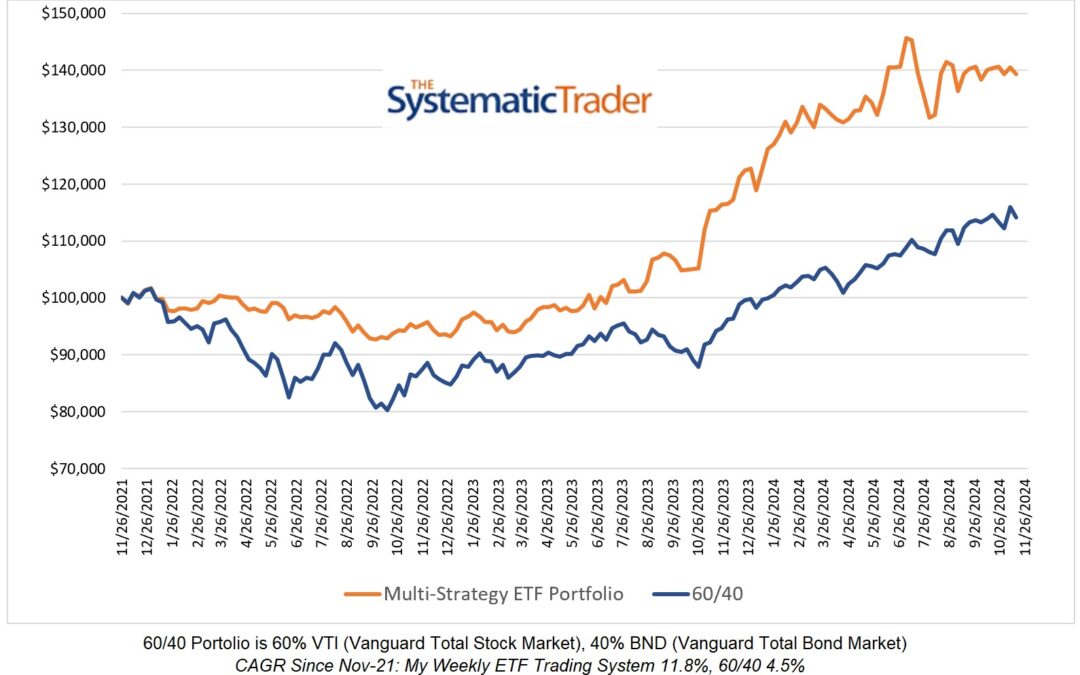

My ETF trading system gained 0.77% this week compared to a 1.07% loss for the 60/40 portfolio. There is no change in the ETF allocation this week as my model remains 100% invested in QQQ.

It was a negative week for my ETF system and a strong positive week for the 60/40 portfolio. My system is now 100% allocated to QQQ.

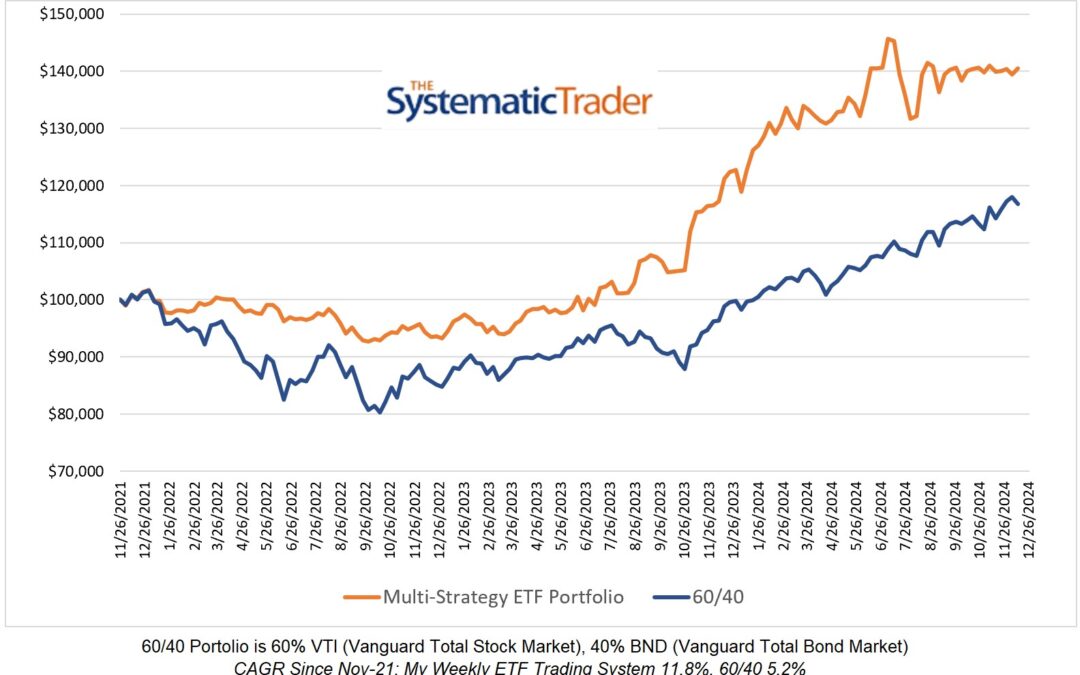

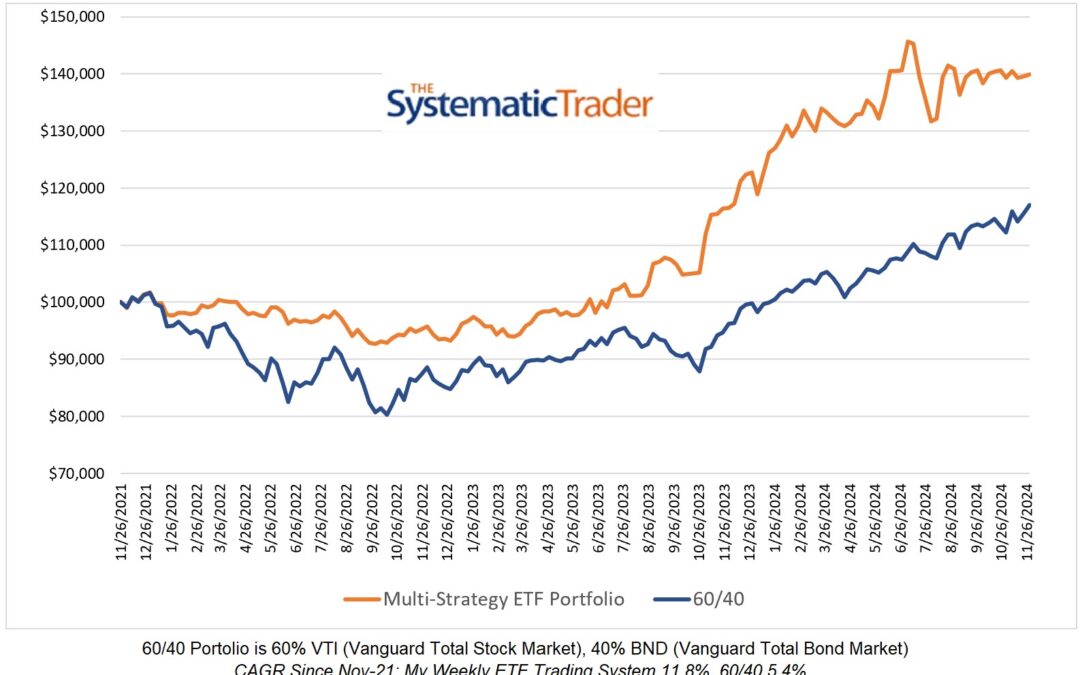

My weekly ETF system continues with its sideways action while the 60/40 portfolio continues with its upward trend. There is one change in the ETF allocations this week as HYG replaces PHYS. Now that I have been posting weekly ETF allocations for over three years (the...

It was a non-eventful week for my ETF trading system but the 60/40 model posted a solid 1.34% gain. My system is now off the sidelines and is fully allocated to risk-on positions.

It was a negative week as both my weekly ETF multi-strategy model and the 60/40 portfolio lost value (-0.81% vs -1.63%). My system is now as conservative as it gets with a 100% allocation to BIL (1 - 3 Month Treasuries). Sometimes successful investing is quite boring....

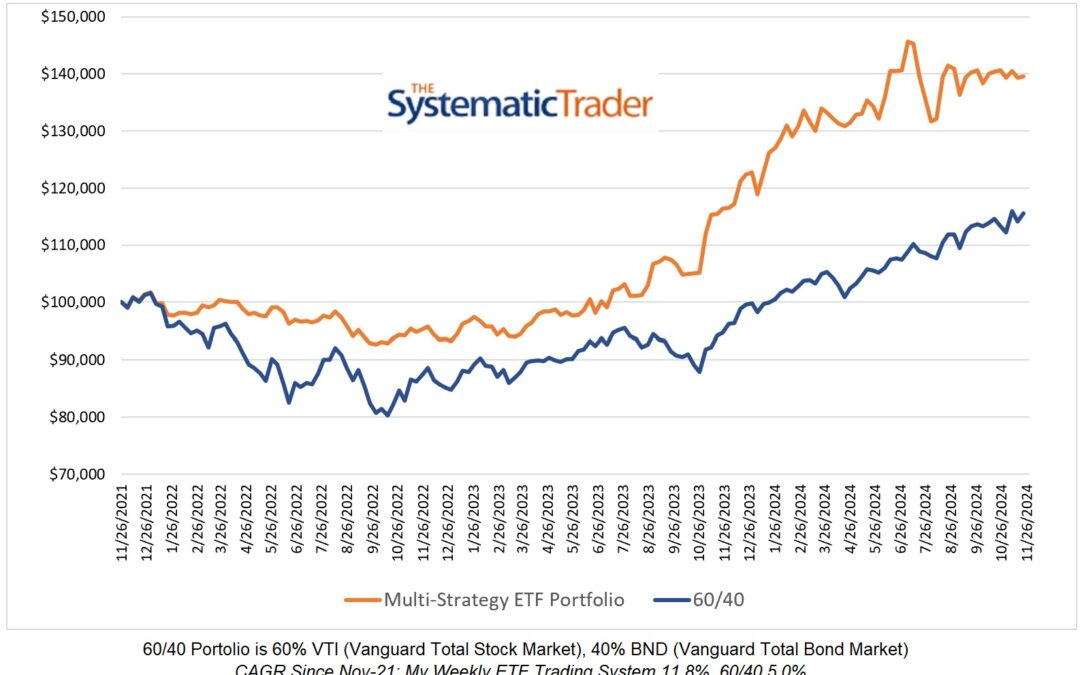

As expected for my system, it moved only modestly this past week. Fortunately, the move was a positive one. The 60/40, on the other hand, had a great week posting a 3.4% gain. I set goals for my multi-system strategy when I first began trading it. So far, so good....

Both my ETF system and the 60/40 portfolio incurred small losses this past week. There is no change to the holdings for my system which is equally allocated to BIL, LQD, and TIP.

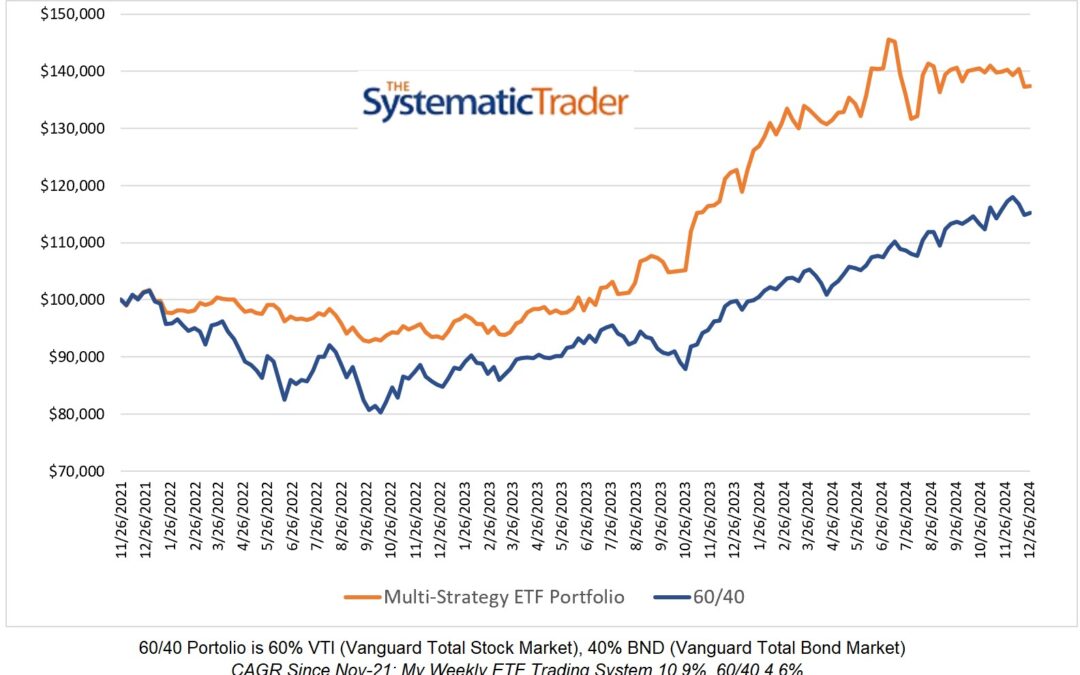

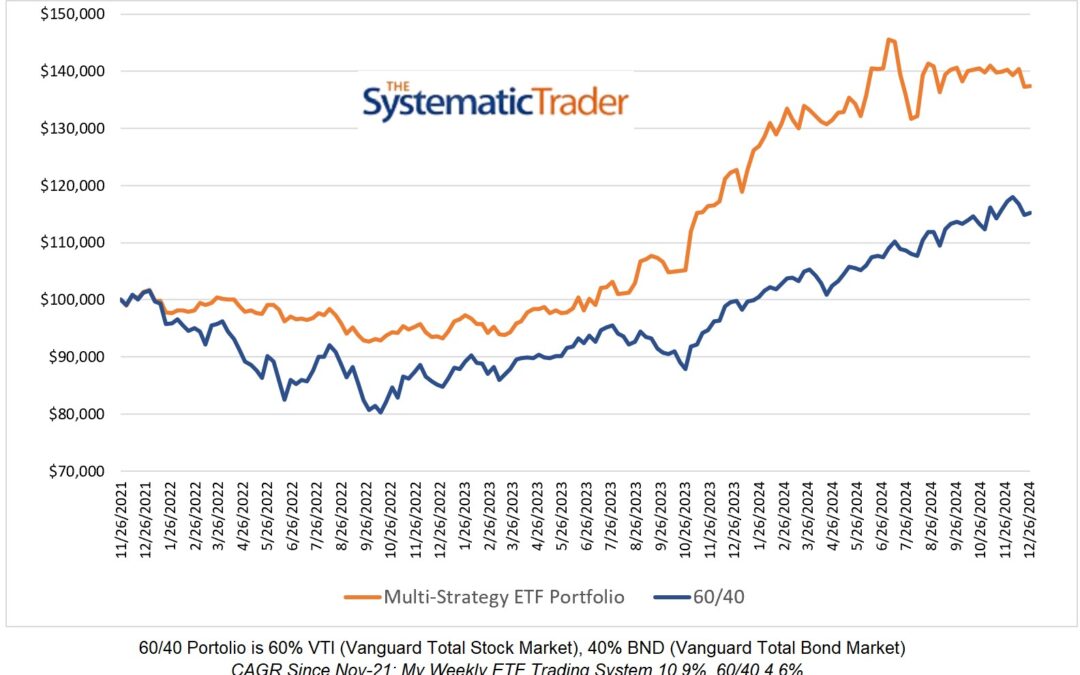

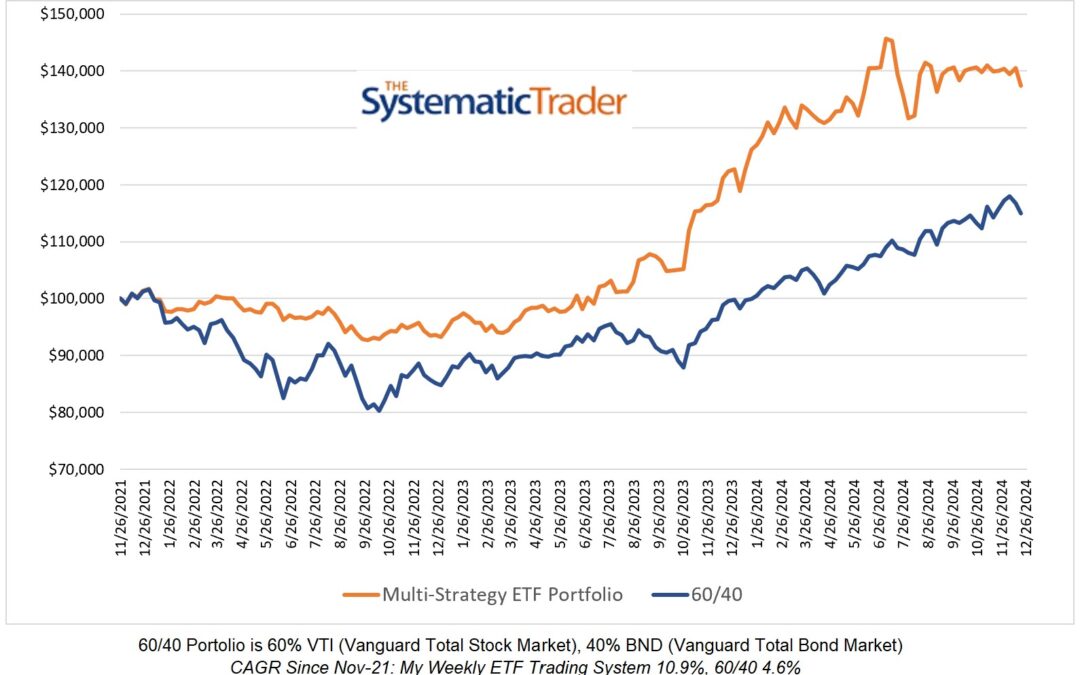

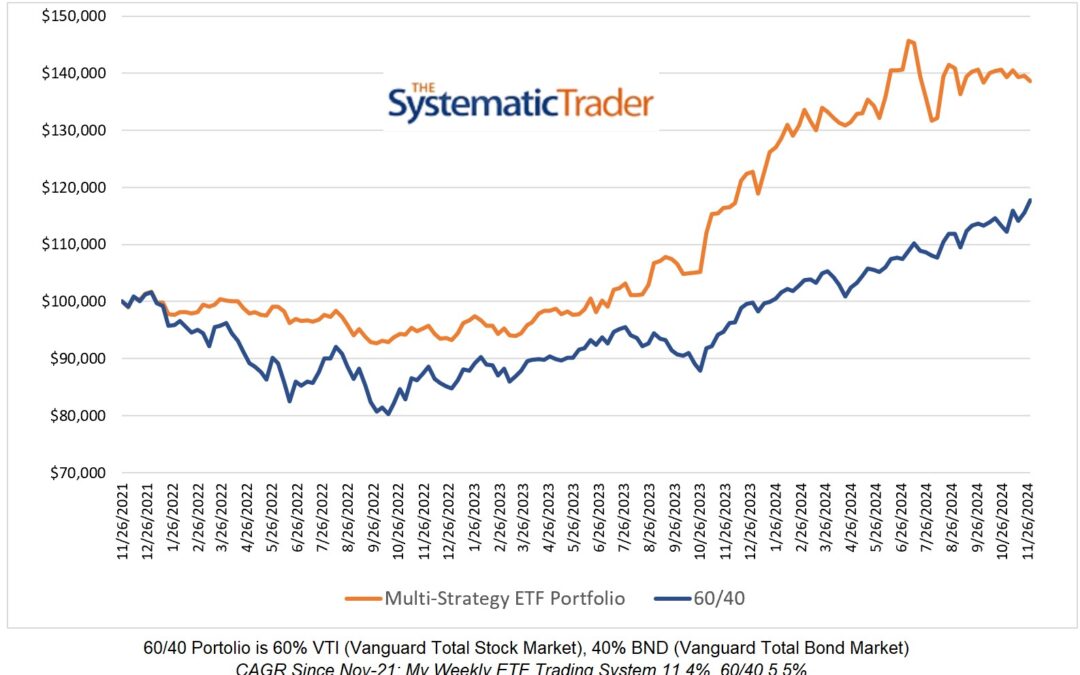

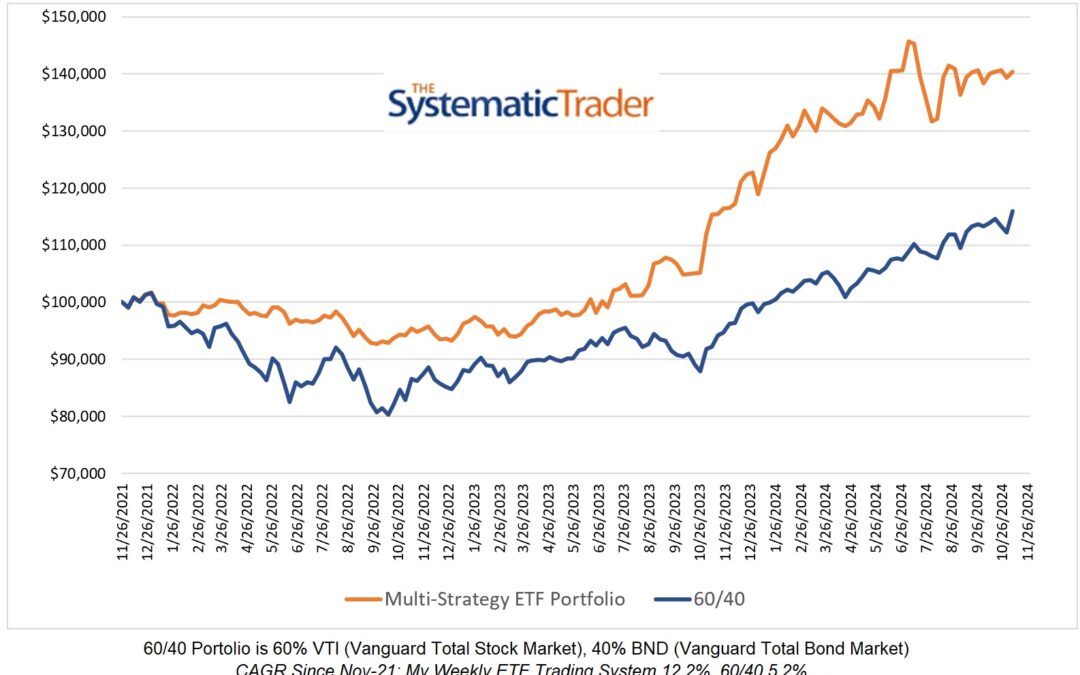

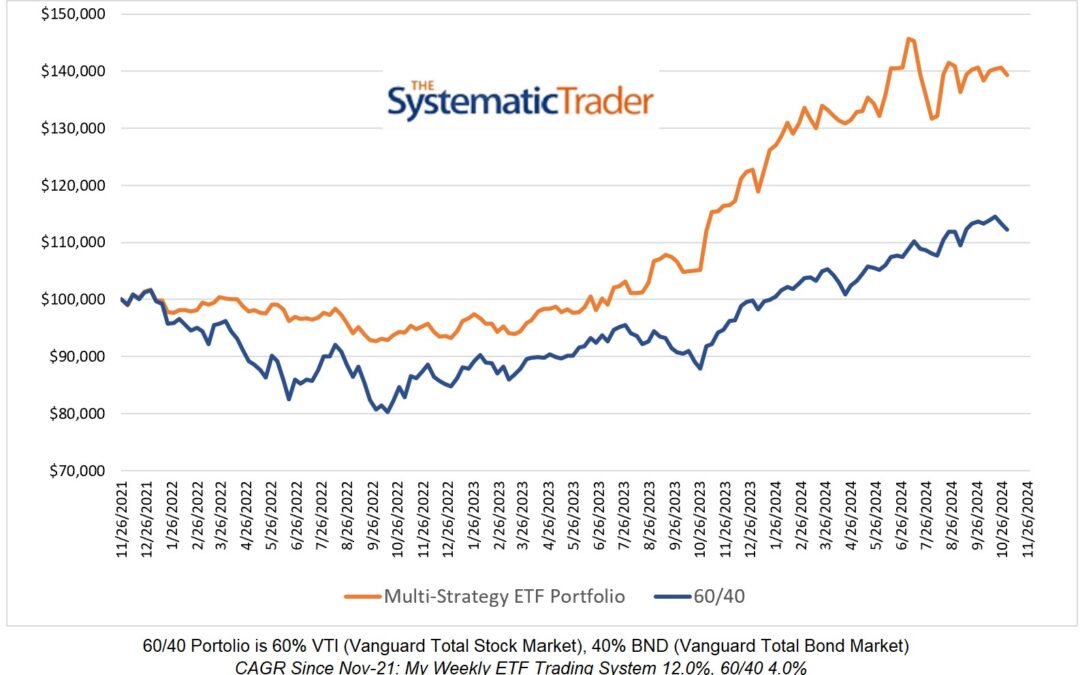

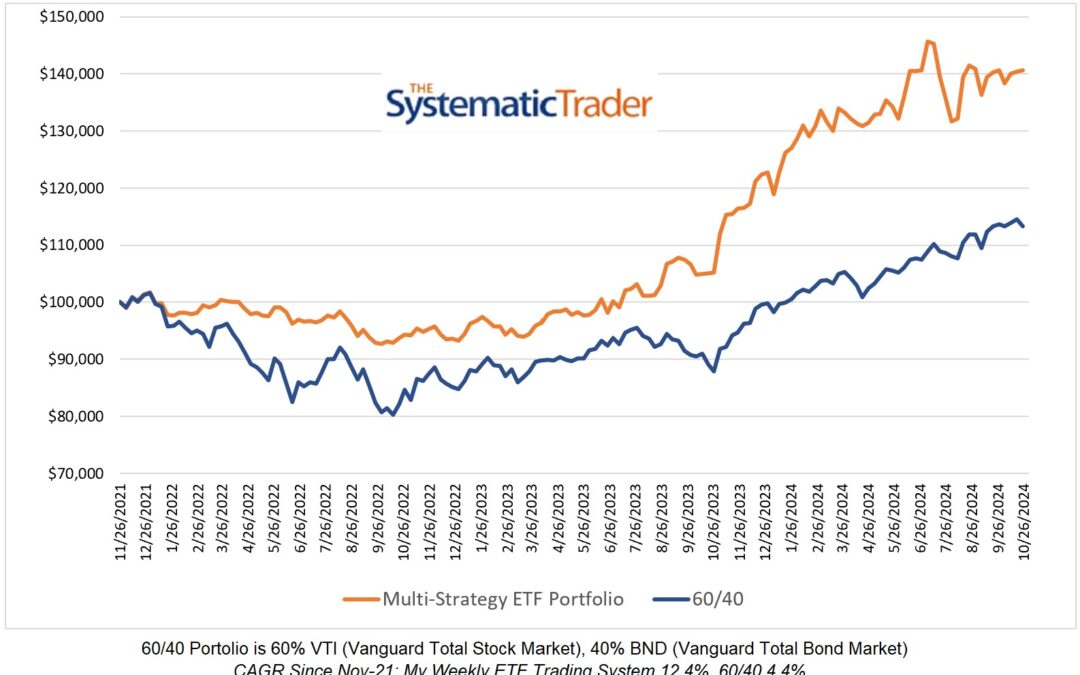

My ETF trading system was down early in the week but did finish with a gain, unlike the 60/40 portfolio which lost 1.06%. As noted in the chart, my system has generated a CAGR 8.0% higher than the 60/40 portfolio since November 2021. There is a change in allocations...