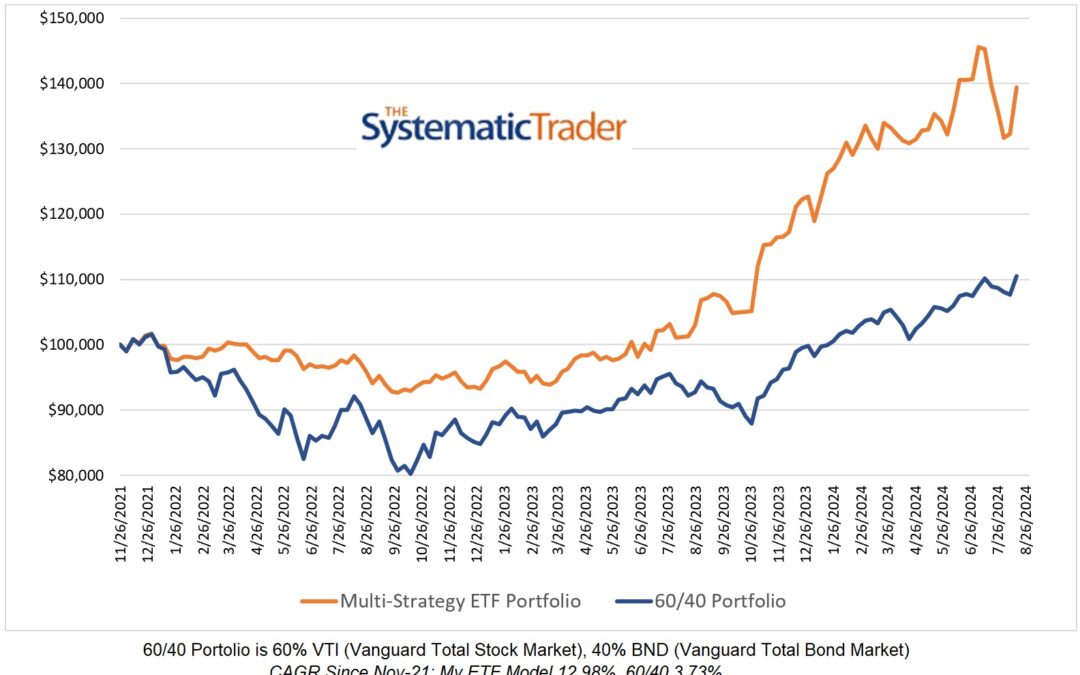

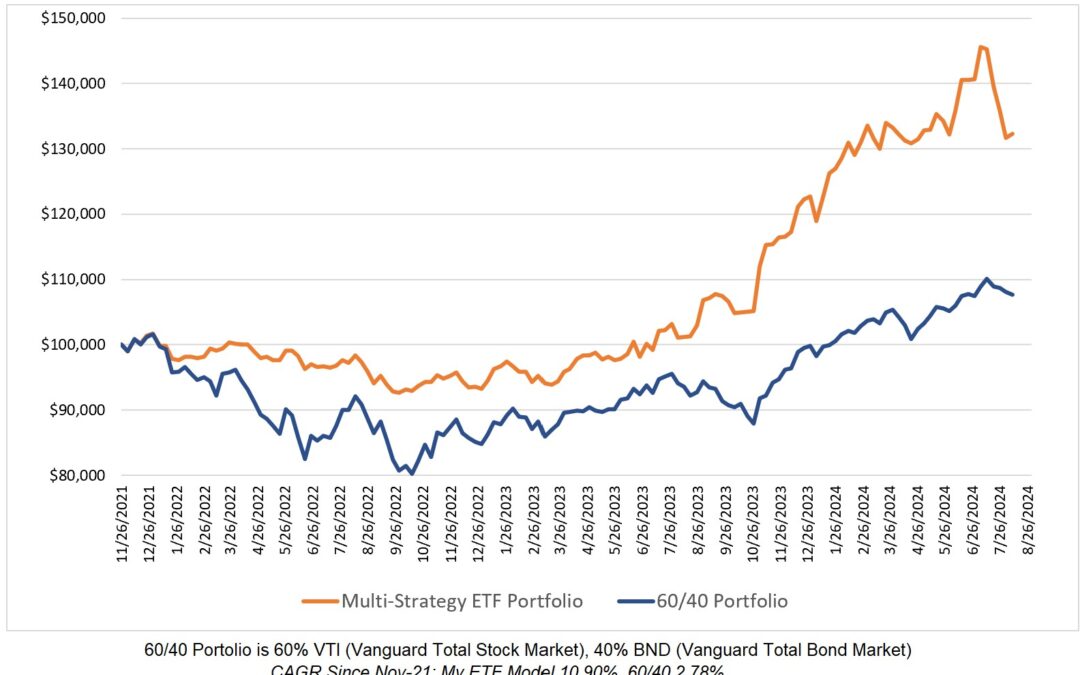

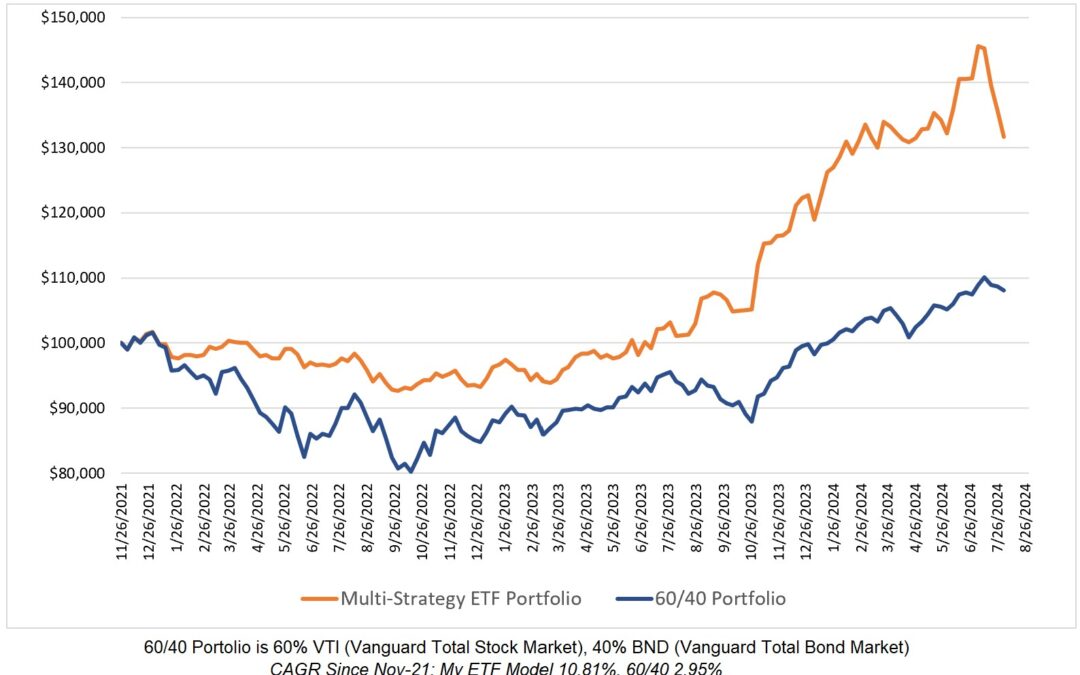

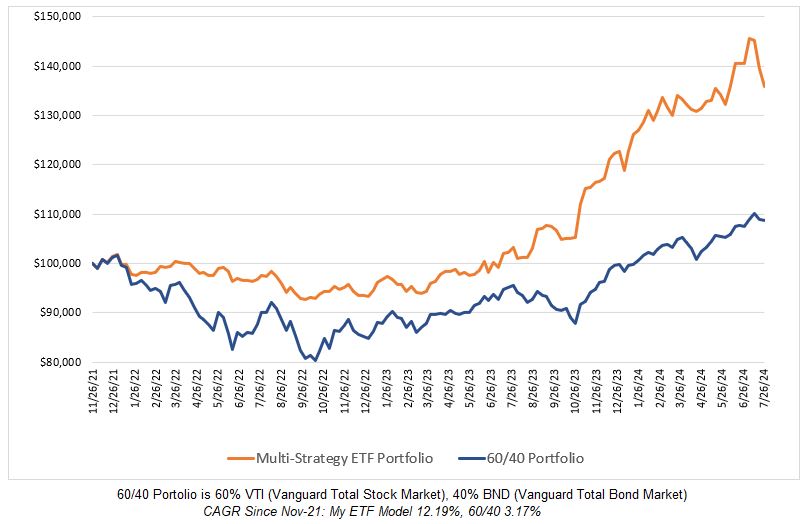

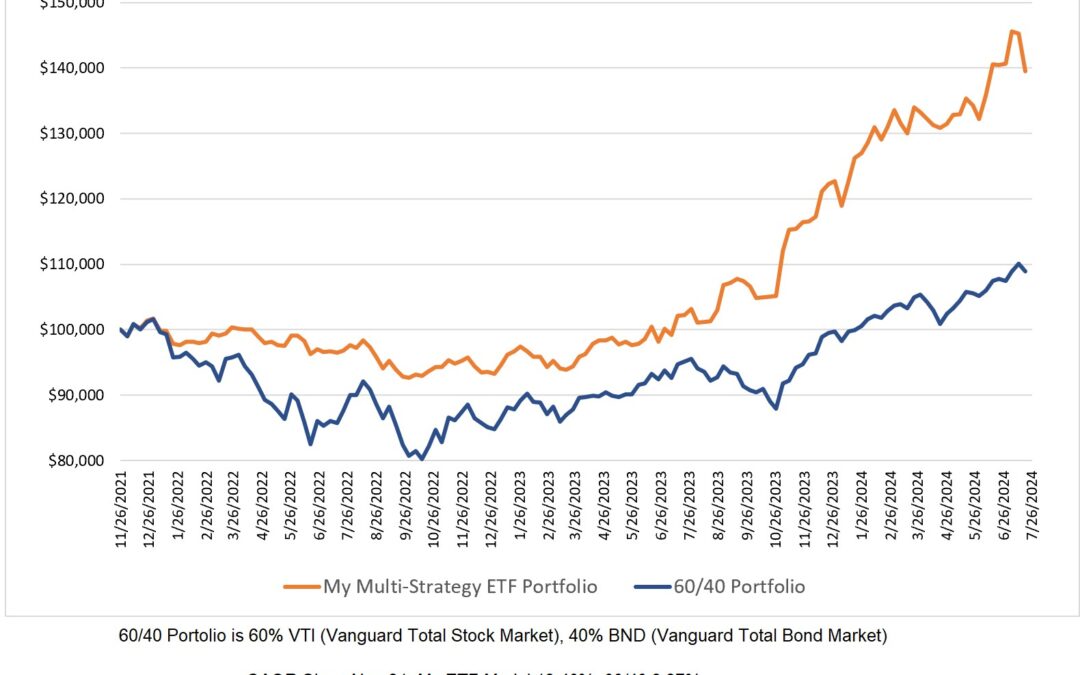

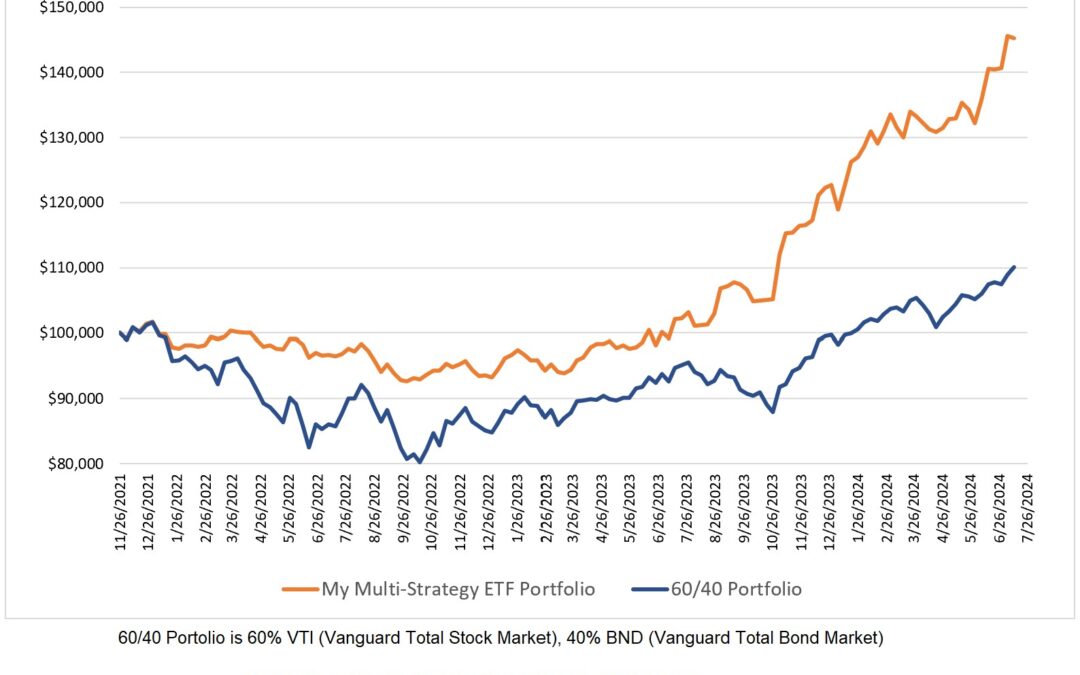

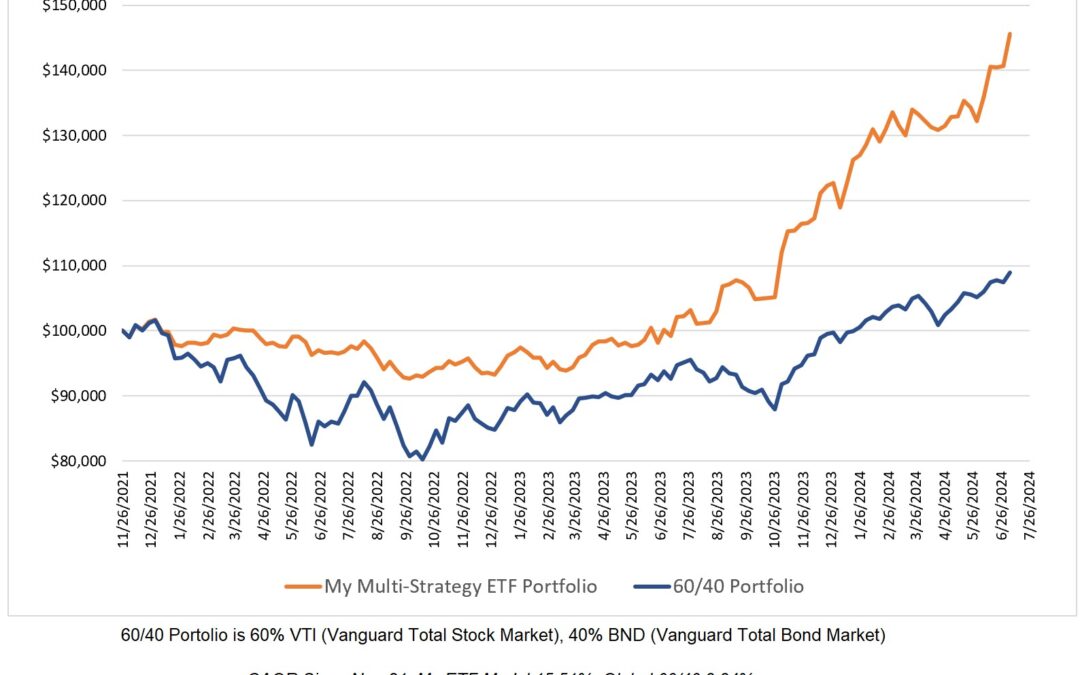

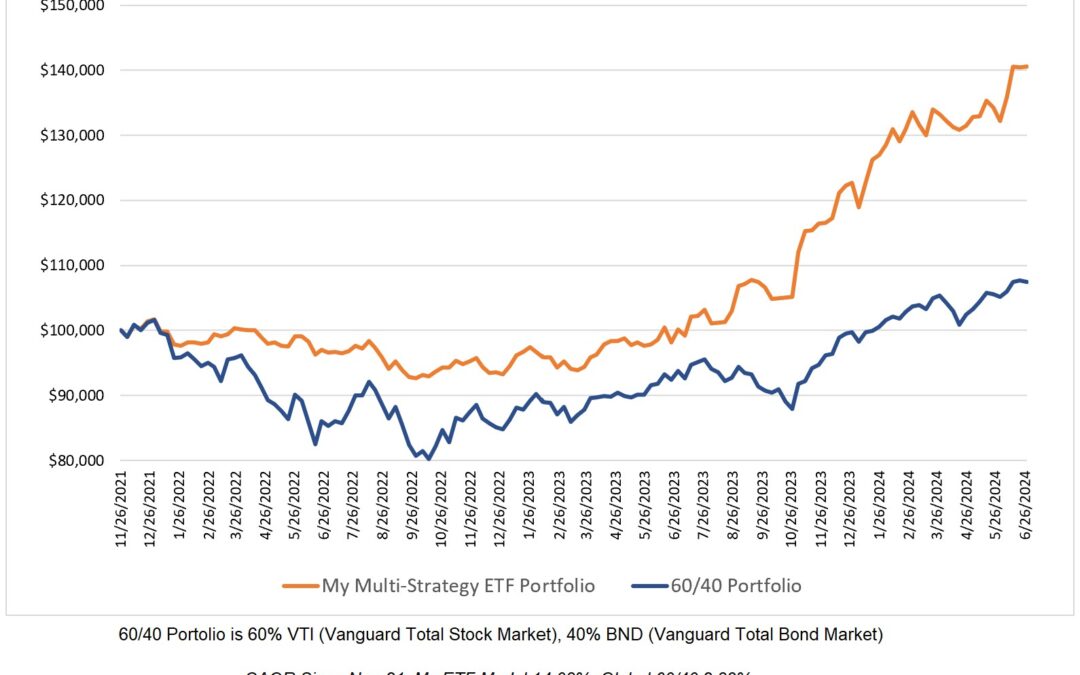

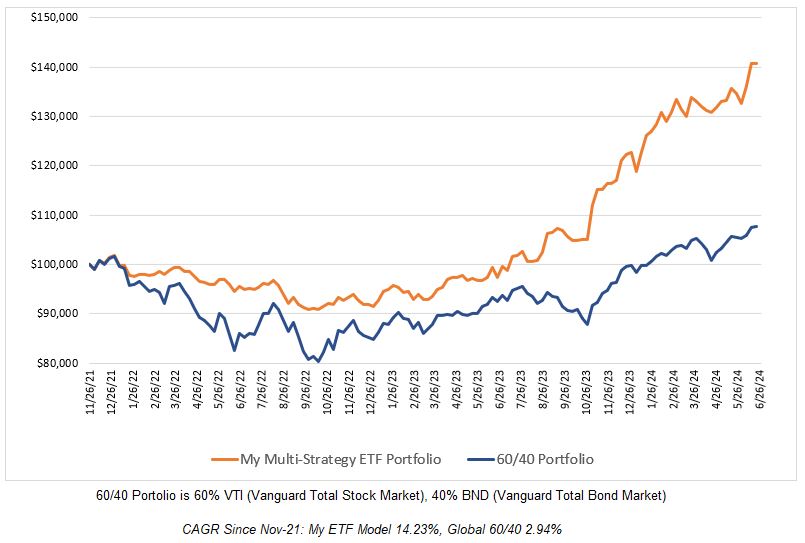

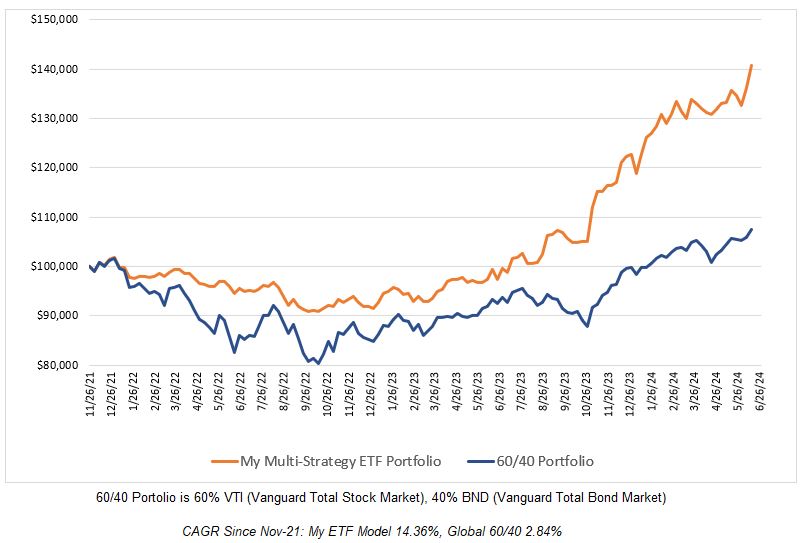

My ETF model had a solid gain this week of 5.40% which erased more than half of the recent 9.6% drawdown. My model is now equally allocated to the six ETFs listed in the table below. So far, my ETF investing strategy has performed fairly well especially...