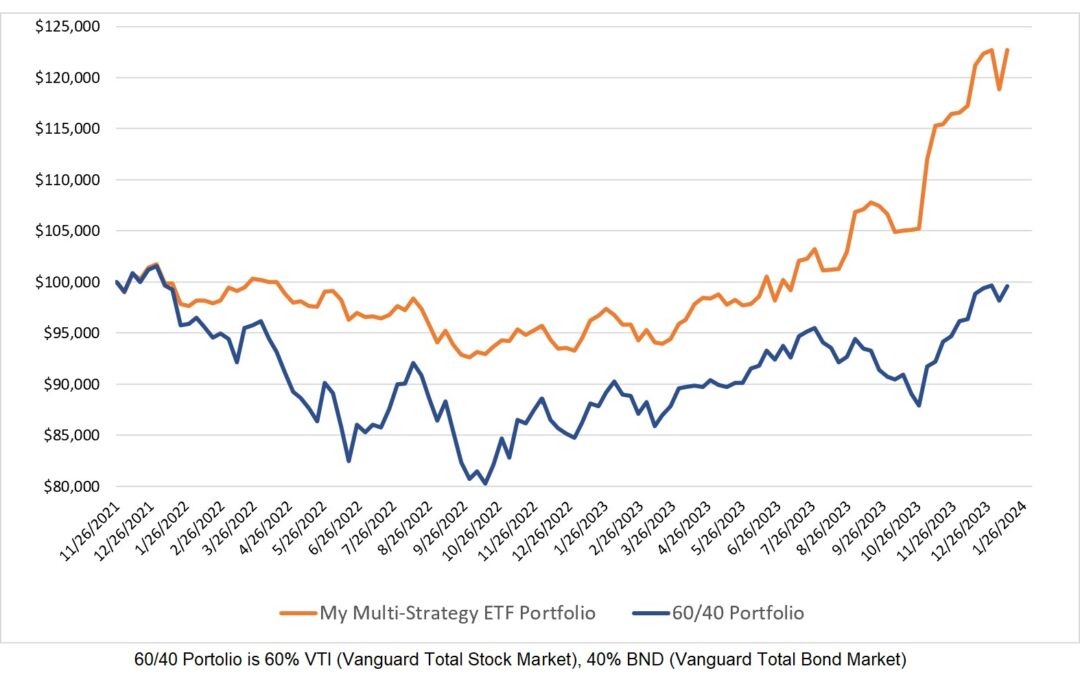

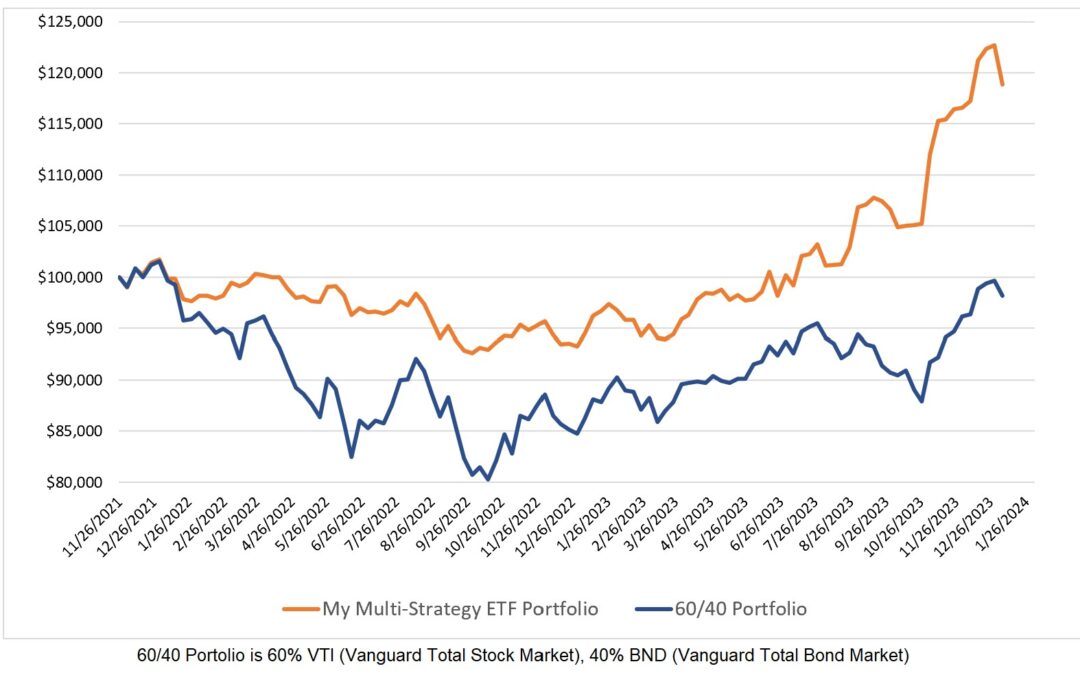

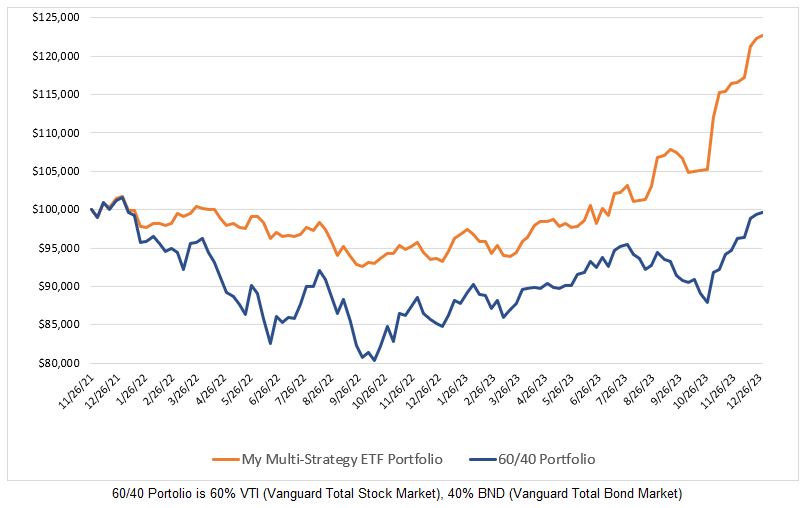

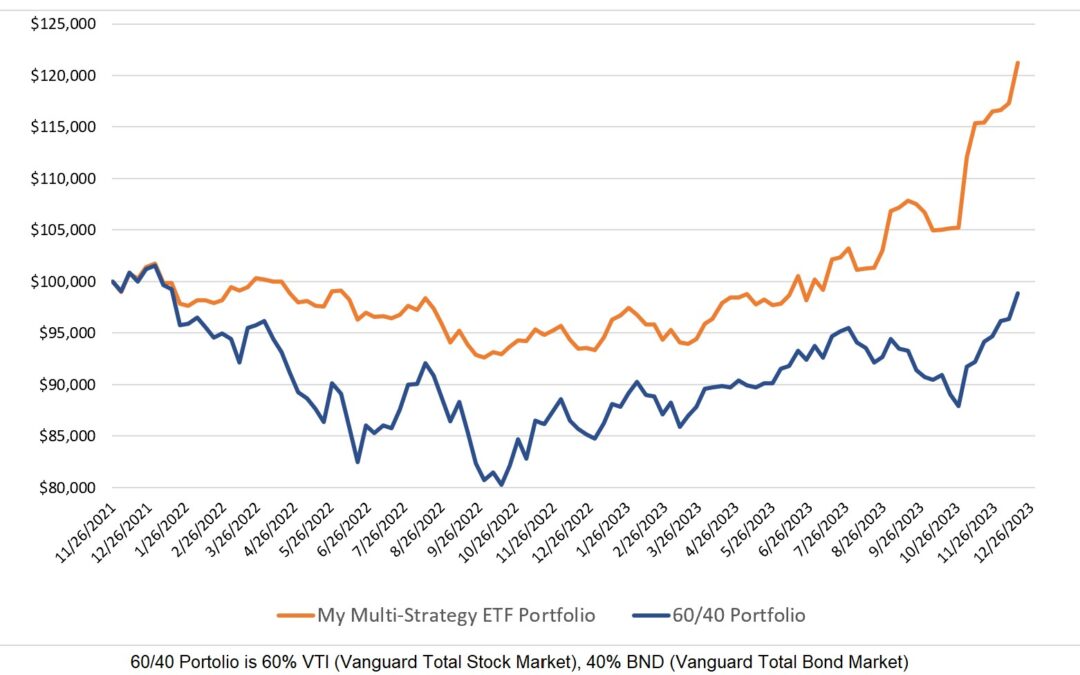

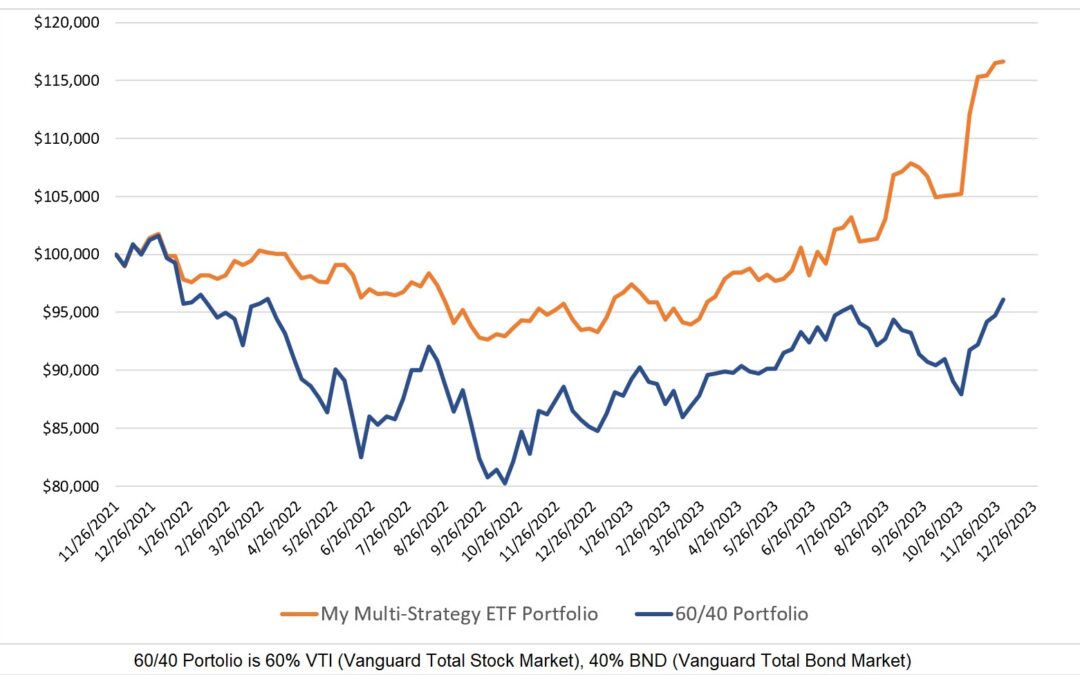

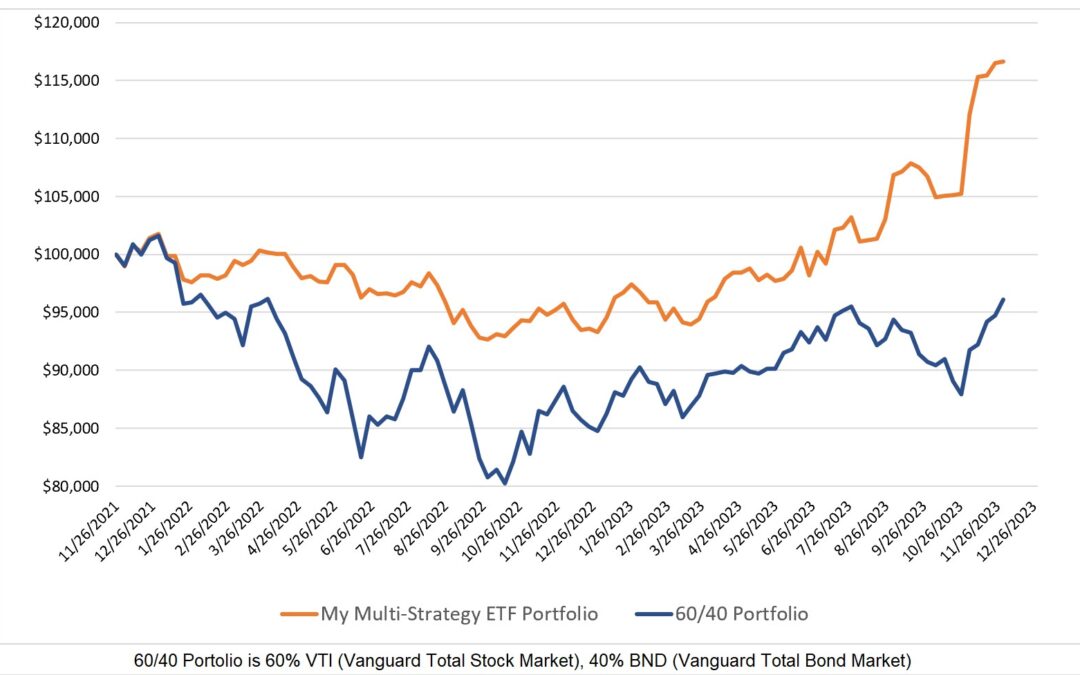

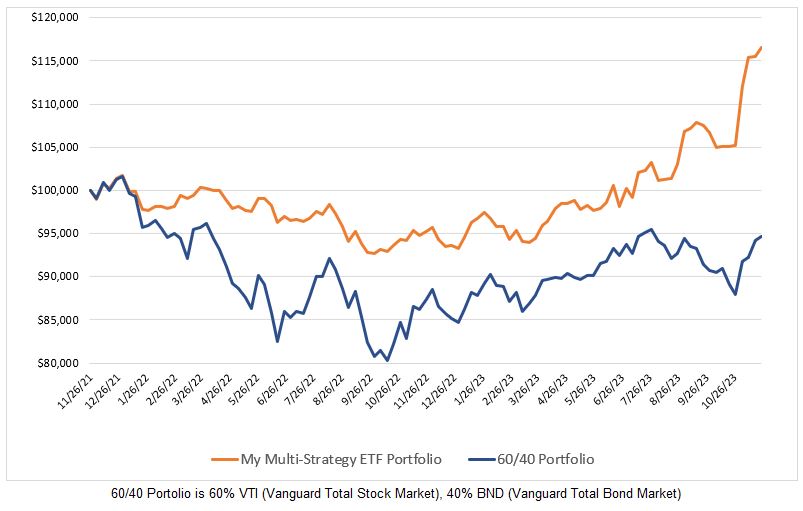

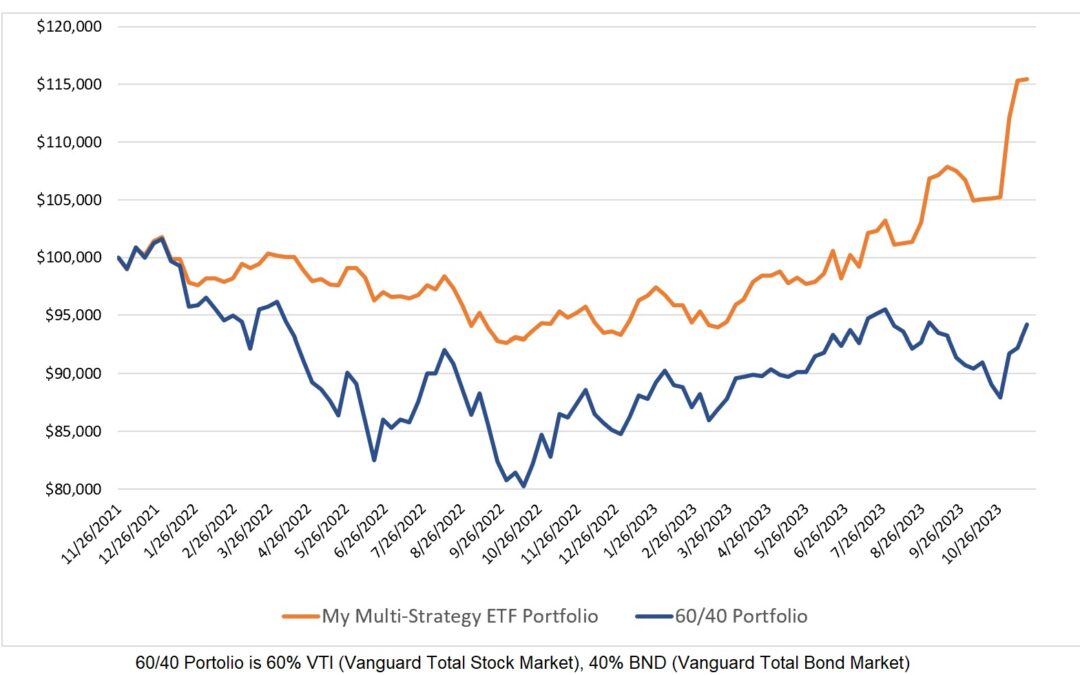

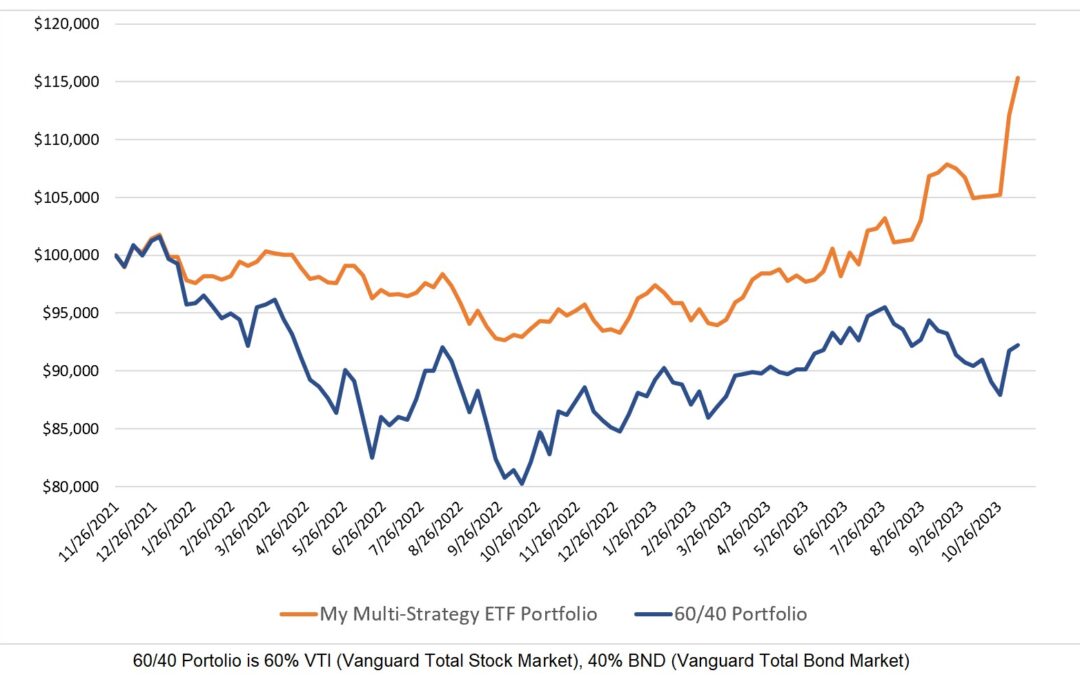

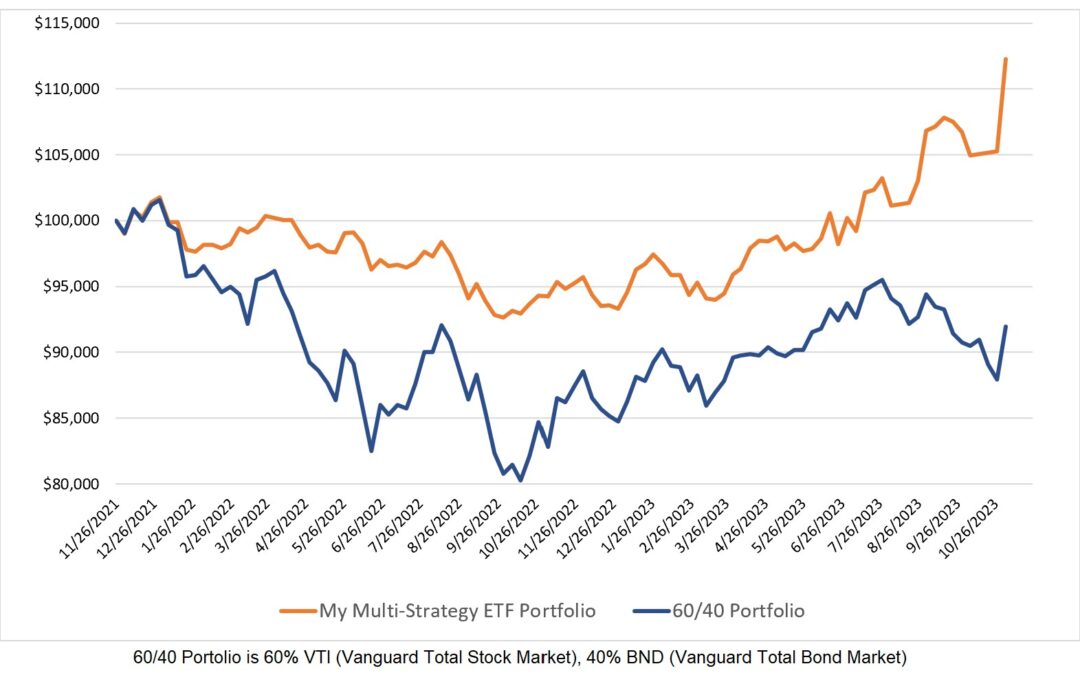

Last week's decline was followed by this week's bounce. Since I began posting weekly ETF allocations here on this site in November 2021, my multi-strategy ETF model has outperformed the 60/40 with a CAGR that is 10.3% higher. There is no change in the ETF model...