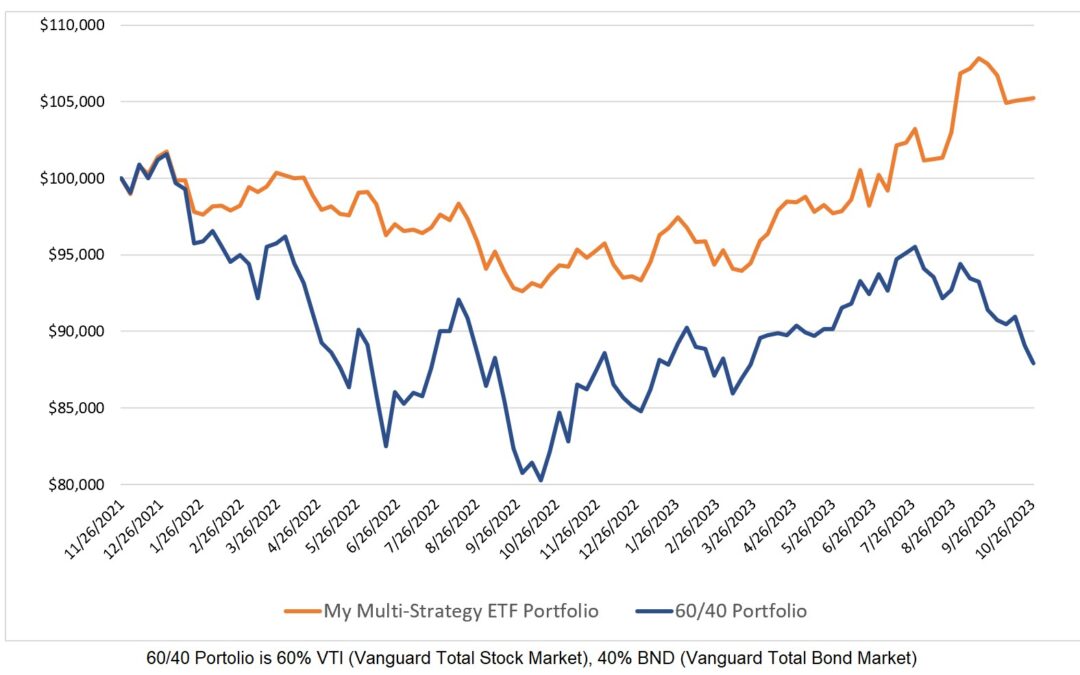

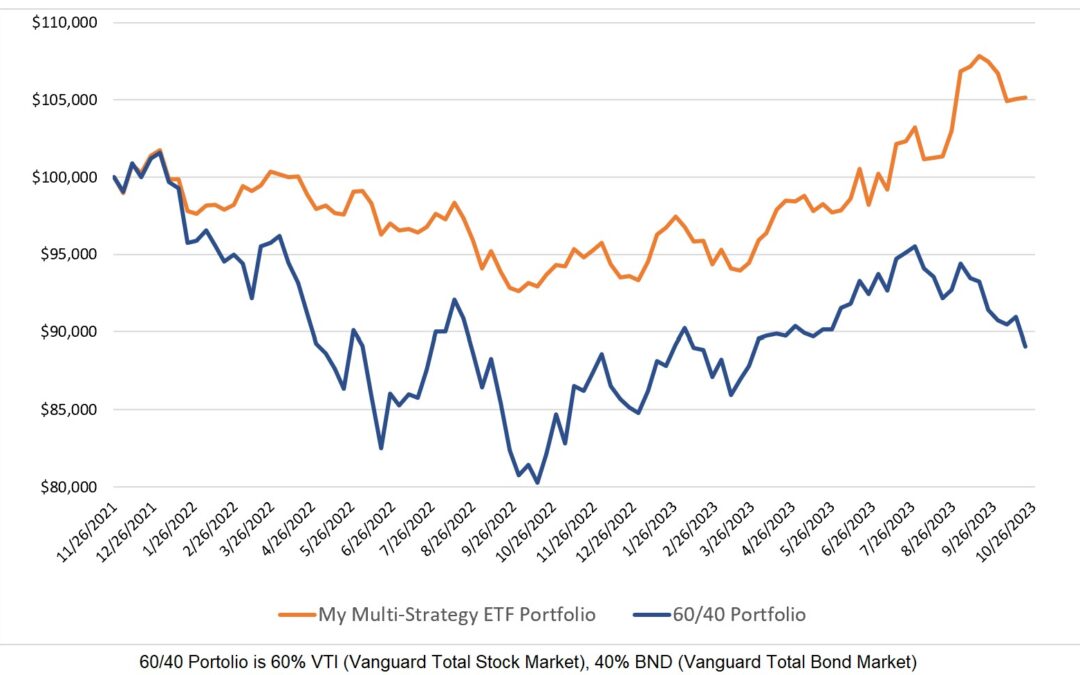

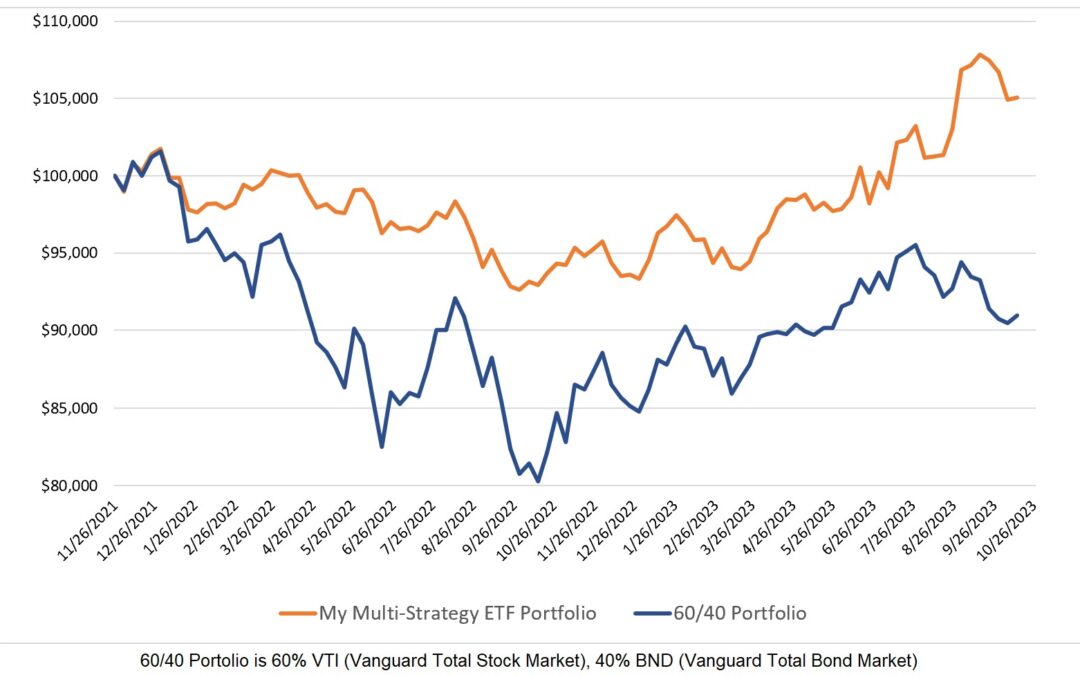

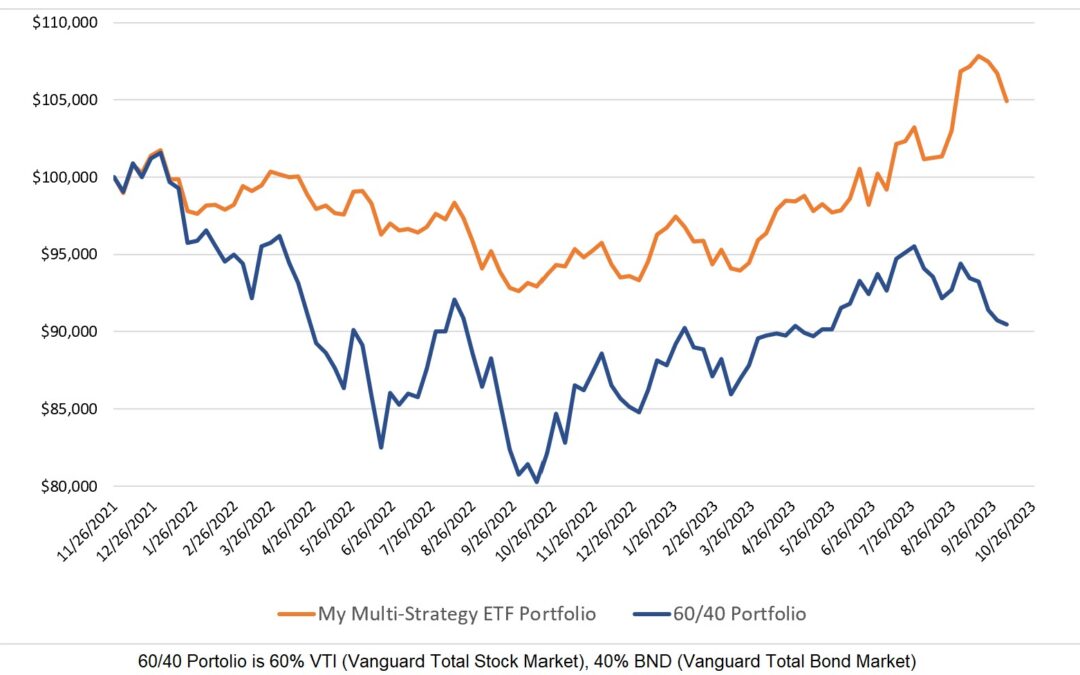

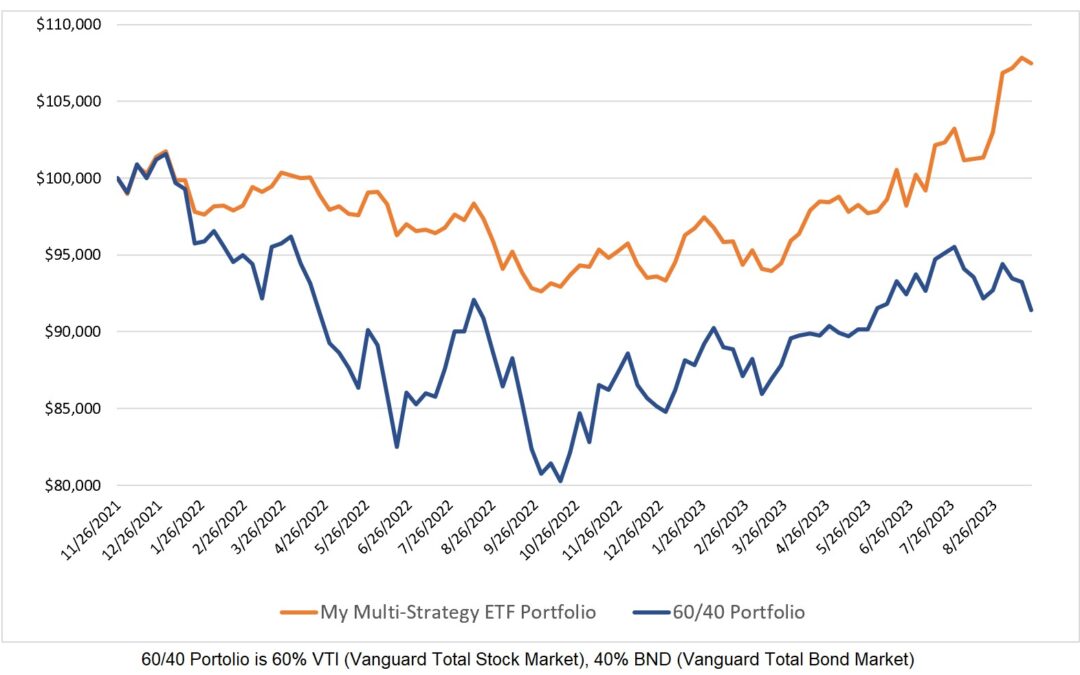

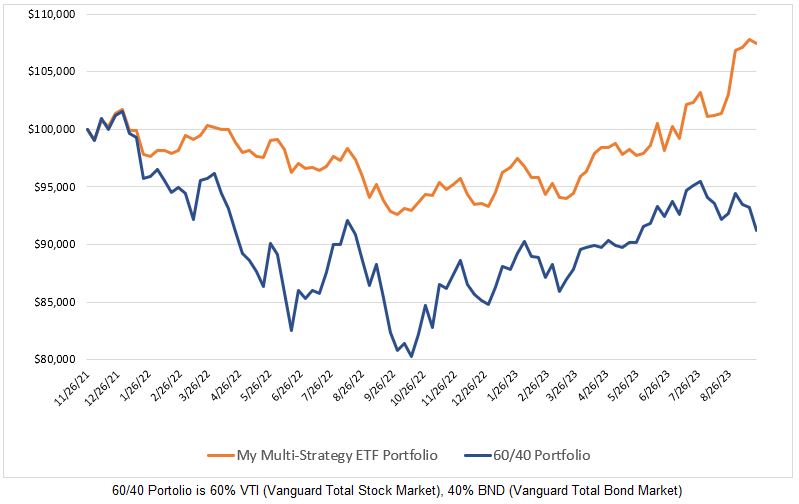

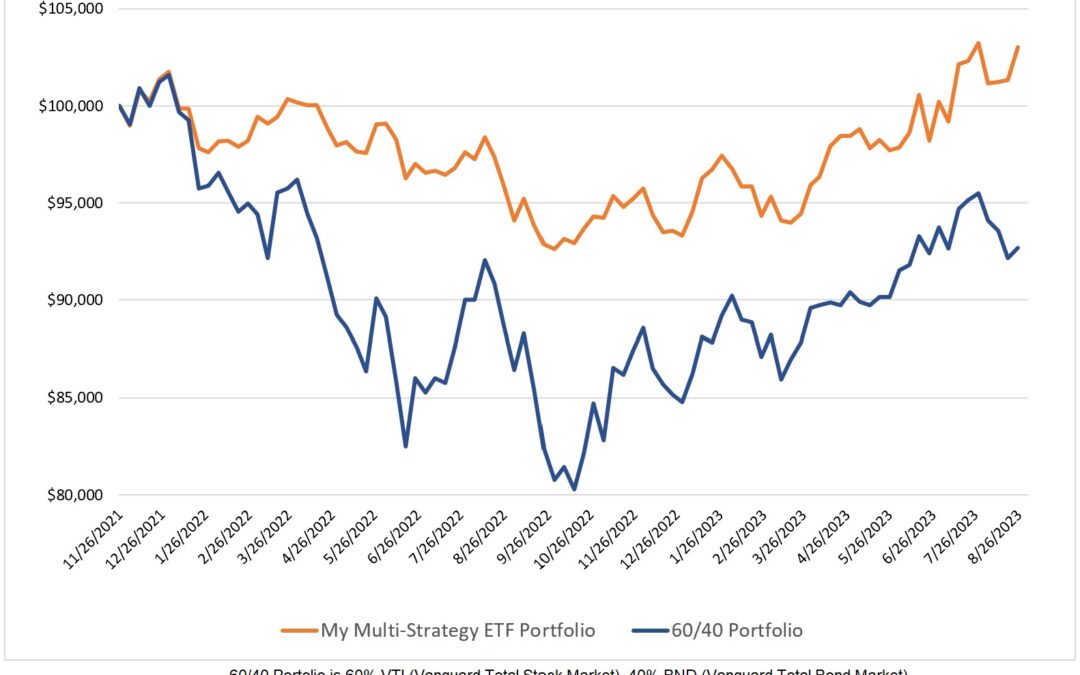

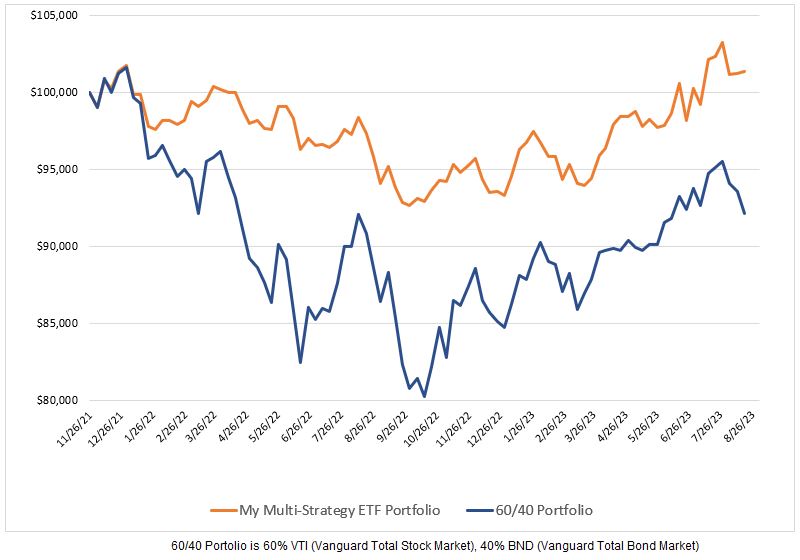

My multi-strategy ETF portfolio increased in value by 0.11% this past week compared to a 1.29% loss for the 60/40 model. Since I began posting weekly allocations on this site in November 2021, my ETF portfolio has produced a CAGR that is 9.2% higher than the 60/40...